For many years, China’s emerging companies, especially those in the internet sector, have relied on foreign capital. Alibaba and Tencent were nurtured by overseas venture capital, and were eventually listing abroad. These two companies have today become world-class giants. The market value of Alibaba was $495 billion as of late May, while Tencent’s valuation was $605 billion. This puts them among the world’s top 10 most valuable companies.

For many years, China’s emerging companies, especially those in the internet sector, have relied on foreign capital. Alibaba and Tencent were nurtured by overseas venture capital, and were eventually listing abroad. These two companies have today become world-class giants. The market value of Alibaba was $495 billion as of late May, while Tencent’s valuation was $605 billion. This puts them among the world’s top 10 most valuable companies.

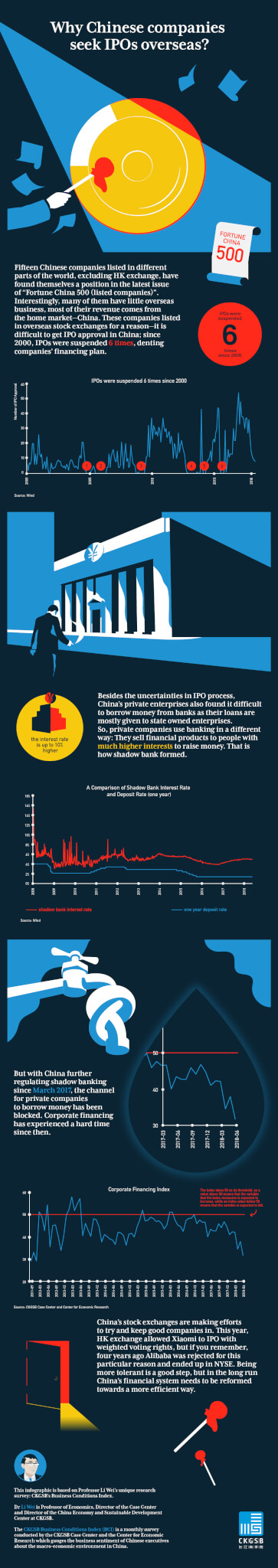

The success of China’s leading tech companies is an understandable source of pride to many in China. But for China’s policymakers, a question presents itself: why do so many outstanding Chinese companies end up going public overseas? After all, they do most of their business in China. Chinese investors are undoubtedly more familiar with their operating models, and their valuations are generally higher than others in overseas capital markets. Why don’t they list closer to home? Find out the answer in the commentary by Professor Li Wei at CKGSB.

We believe the biggest funding problem facing private small- and medium-enterprises in China is the partial state of financial reforms, and the lack of financing channels for the most efficient players in the national economy. In this commentary, we will focus on where Initial Public Offerings (IPO) reforms have got to today. The current laws and regulations force prospective A-share IPO companies to apply for approval, and go through what is essentially an authorization process.

While it is normal for a capital market to impose certain conditions on pre-IPO companies, the key lies in the details. For example, the Shanghai Stock Exchange stipulates that a company must have had net profits for the past three fiscal years, and have a total cumulative revenue of over RMB 30 million. A policy that requires companies to turn a profit before going public rides on the assumption that only profitable companies are good companies. Regulators might be doing this to provide investors with “good” investment targets, but their actions are often inconsistent with the logic of corporate development, and there are obvious side effects.

The idea is that companies meeting IPO standards should be mature companies with sound business models. They should have profitable and positive cash flows, despite the possibility that this limits their space to grow. It may also encourage companies to act unscrupulously in a rush to list. It is not uncommon to see A-share listing companies doing everything to whitewash their performance to qualify for the Chinese stock market. Freshly-listed companies many look completely different from their pre-listing incarnations.

In contrast, new companies can be in a period of rapid development, either investing to seize market share, or putting all their energy into R&D to establish a competitive edge. Such companies often make less, spend more, and have operational losses or negative cash flows. However, these companies have considerable room for growth and potentially high future profitability. A typical example of this is US-listed JD.com. From 2011 to 2017, JD.com was losing money every year, while its operating revenue grew rapidly. In 2011, it earned approximately USD 3.4 billion, and by 2017 it was earning a massive USD 55.5 billion. JD.com’s rapid revenue growth earned it the recognition of the US capital markets, leading to a successful NASDAQ listing in 2014.

For many years, China’s emerging companies, especially those in the internet sector, have relied on foreign capital. Both Alibaba and Tencent were nurtured by overseas venture capital, eventually listing abroad. These companies have become world-class giants today. On May 23, 2018, the market value of Alibaba was as much as USD 495.4 billion. Tencent’s market value was USD 605.3 billion (same day exchange rate). To put this in comparison, global leader Apple was worth USD 919.1 billion.

Why do so many outstanding Chinese companies end up going public overseas? After all, they do most of their business in China. Chinese investors are undoubtedly more familiar with their operating models, and their valuations are generally higher than others in overseas capital markets. Why don’t they list closer to home? One of the important reasons for this is that many overseas capital markets operate a registration system. As long as the information disclosed by prospective IPO companies is generally accurate, they can ultimately be qualified to list. Whether a company can finally go public depends on whether or not it can gather enough participatory investors. This means that IPO companies do not need to falsify data or whitewash their performance, as long as they can convince investors to accept their business model and can negotiate a decent IPO share price. We see significant numbers of loss-making Chinese companies listing overseas, even to the point of being highly sought after by investors.

In fact, we should also consider that listing is an expensive thing to do. It involves professional preparation by accountants, lawyers and securities companies, all of which costs money. If a company is already making good money, why would it pay such a lot to access funding from the market? Wouldn’t it be better to use their own funds if they have them? From an operating point of view, it is precisely these “loss-making” companies that are in need of financing. From this point of view, A shares demonstrate a mismatch in resource allocation.

Finance is the beating heart of the modern economy. Its role in allocating funds to the most efficient sectors helps the economy develop better and faster. If those getting funding are not the most efficient companies, and the most efficient companies lack money, then China’s capital markets are surely in need of reform.

Over the years, insightful commentators have appealed for China’s capital markets to switch from an approval to a registration system. Unfortunately we are still waiting for this to happen. According to media reports, the original schedule was for the A-share market to begin a registration system on February 28, 2018. However, on February 23, the Chairman of the Securities and Futures Commission, Liu Shiyu, suggested that implementation of the relevant reform would be delayed for two years until February 2020. On February 29, the proposal was passed by the Standing Committee of the National People’s Congress, which means that the registration system reform is no longer waiting just around the corner. In response, Wu Xiaoling, former deputy governor of the Central Bank and deputy chairman of the National People’s Congress Financial and Economic Committee, expressed her regret and view that the implementation of the IPO registration system did not need to be delayed for another two years.

We fully agree with Ms. Wu’s point of view. Everyone knows that China’s financial system needs reform. However, where there are pockets of consensus, there will also be pockets of disagreement. The change from approval to registration in the IPO system is one of the issues with the highest levels of consensus. Since we want to raise economic efficiency, get more out with less input and improve the quality of economic development, why is there such hesitation over a fairly simple registration issue? If such a small thing cannot be changed, what about more substantial reforms, such as reform of the banking system? The journey of a thousand miles begins with a single step. We very much hope that China’s decision-makers will accelerate reform of the IPO registration system, and at the very least not wait until 2020 to implement it. If they do, their commitment to its reform is just an empty phrase. The ultimate victims will be China’s outstanding companies, Chinese investors and the Chinese economy.