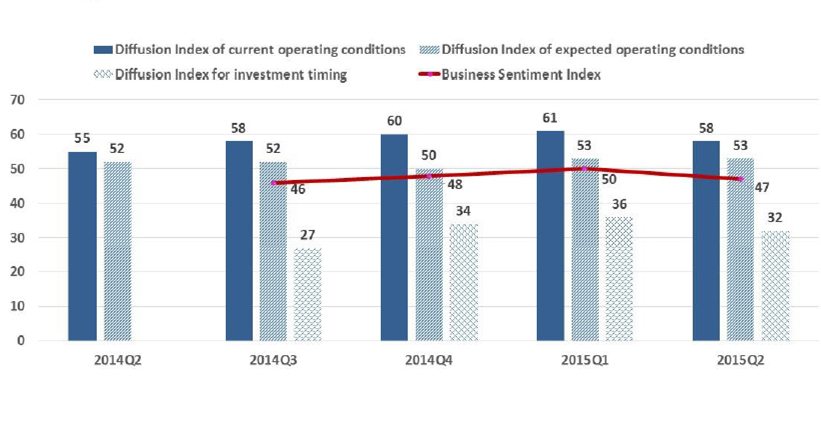

CKGSB’s Business Sentiment Index shows that China’s industrial economy hasn’t improved over the last quarter. Rather it has contracted slightly.

After stabilizing in the first quarter, China’s industrial economy did not show further improvement in the second quarter, according to the latest CKGSB survey of almost 2,000 industrial firms across the country. The Business Sentiment Index, a key indicator in the survey, stood at 47, a decline from the first quarter’s mark of 50, indicating a slight contraction. Fixed investments remained sluggish, with only 9% of firms making investments. Meanwhile, production, employment and inventory all largely stayed flat.

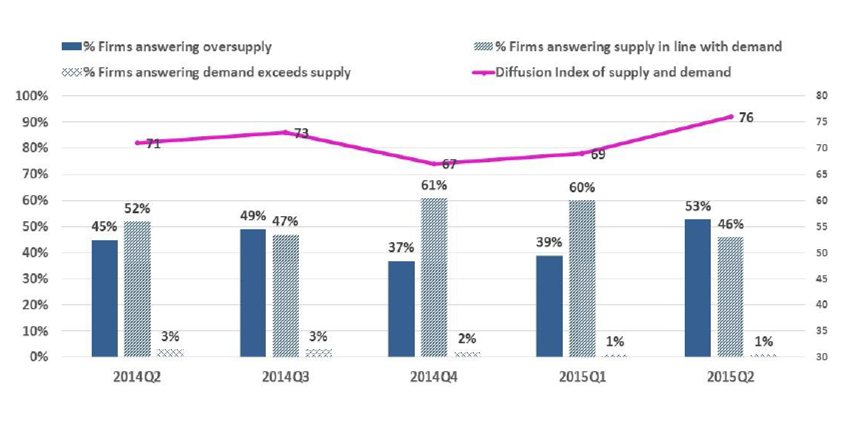

Led by Gan Jie, Professor of Finance and Director of the school’s Center on Finance and Economic Growth, the survey pointed to excess capacity as the biggest challenge facing China’s industrial economy today. As many as 53% of the firms surveyed indicated that their supply exceeded demand with a diffusion index of 76, both figures being the highest since 2014 Q2, when we started the survey. Consistent with severe overcapacity, product prices declined in the second quarter with a diffusion index of 44. Thus, the economy is facing the possibility of deflation.

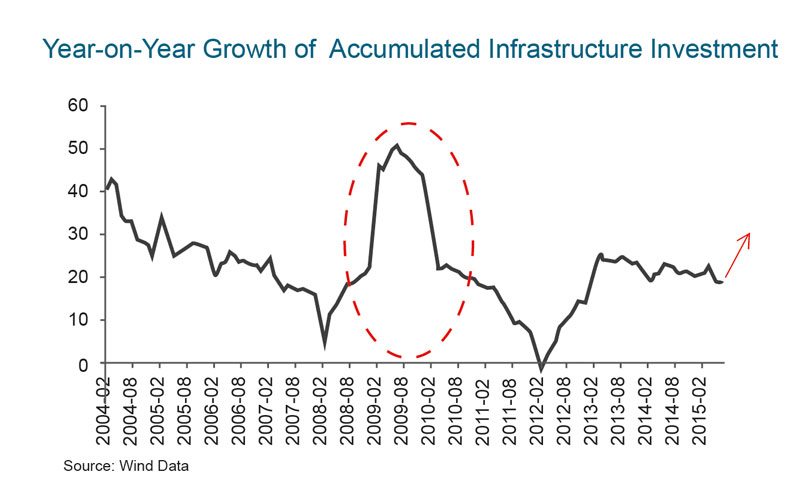

The weakest indicator in the survey was investment sentiment. When asked to what extent is now a good time to make fixed investments, only 3% considered the timing to be “good” and 40% responded “bad”, yielding a diffusion index of 32, lower than the first quarter’s 36, far below the turning point of 50. Consistent with weak investment sentiment, only 9% of firms made fixed investments in Q2, as compared to 11% in Q1. The vast majority of firms invested less than 3% of their assets—a level that roughly covers depreciation, which leaves only 3.2% (2.4% in Q1) of firms in expansion mode. The sluggish investment will not improve in the near future. Only 4% of the firms expected that they would make investment in the third quarter.

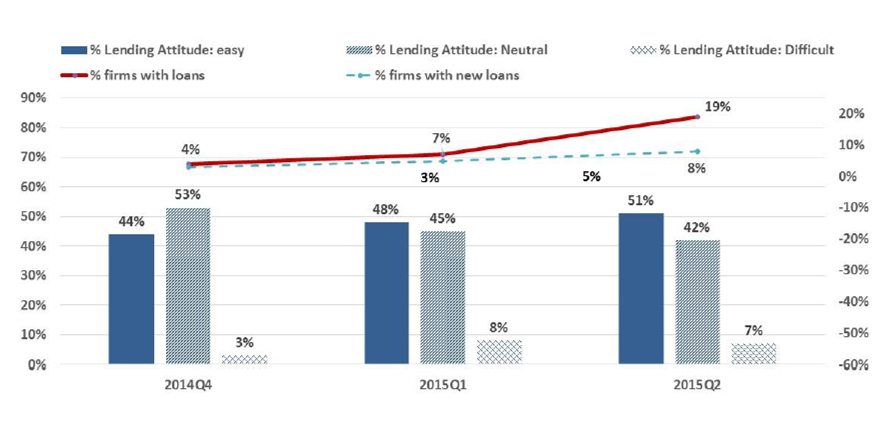

In Q2, only 3% of the firms cited financing as the constraining factor. Meanwhile, 44% of the firms reported that funds were sufficient, while only 7% reported insufficient funding. A vast majority of the firms (83%) reported insufficient funds for production, but not for expansion. Firms found the banks’ lending attitude to be generally accommodating, with only 5% reporting a “difficult” lending attitude, resulting in a diffusion index of 72. Among the firms without new loans, the vast majority (92%) reported that they did not have the need for capital.

While the finding that financing is not a bottleneck may contrast with the common wisdom, it is consistent with the central bank’s “Financial Institutions Lending Statistics” report. In 2014, new loans to industrial firms declined by, on average, 30% each quarter. While the amount of new loans went up substantially in Q1 this year, it dropped again in Q2 by 50%. Moreover, the index of loan demand dropped to 53% in 2015 Q2, the lowest on record.