The PBOC’s yuan devaluation decision wasn’t triggered by weak exports data alone, but also by the IMF’s requirements for more market-driven exchange rates.

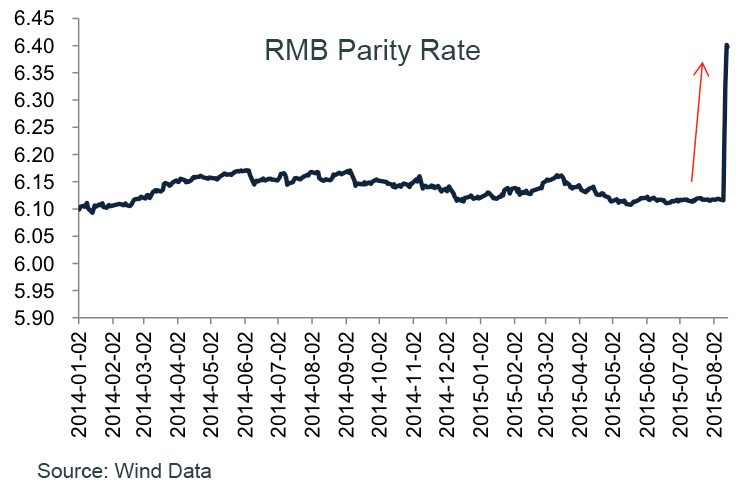

On August 11, People’s Bank of China (PBOC) announced that it would adjust the bidding system that determines the mid-point of the RMB exchange rate. It listed three principles for foreign exchange market makers to submit their bids: the previous trading day’s closing price, supply and demand of the RMB and fluctuations of other currencies’ exchange rates. As a result, the RMB parity rate fell almost 2% on the same day; it continued to drop in the following three trading days, losing 1,136, 1,008 and 704 basis points respectively.

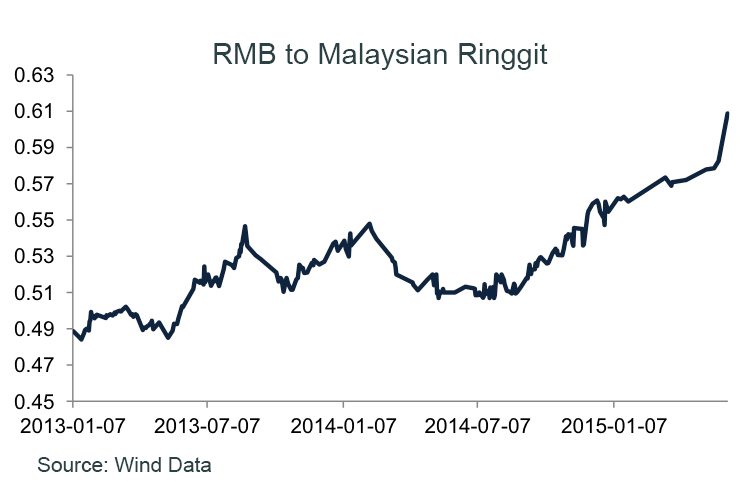

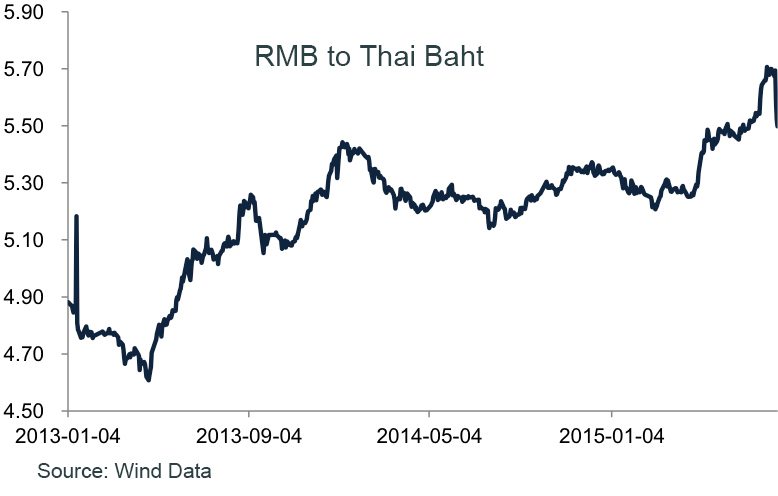

Some market observers interpreted the devaluation as a stimulus measure by the PBOC to boost the economy—a devalued Chinese currency will increase the competitiveness of Chinese exporters, which will then drive further growth of the GDP. If this is really the intention of the central bank, then this round of depreciation could just be the beginning—because in the last two years the RMB has been largely stable against the currencies of those competing exporters; it even appreciated against some of them. On the other hand, those competing currencies depreciated against the US dollar, giving exporters in those countries more cost advantages.

But judging from the message sent by the PBOC, the bank’s move is more likely a signal of market reforms. On August 12, a PBOC spokesperson told the press that there’s strong support for the exchange rate of the RMB because of five reasons: the Chinese economy is still growing relative fast; China has maintained a current account surplus for a long time; the internationalization of the RMB and China’s financial market reforms are speeding up; the market has priced-in a stronger dollar; and China has abundant foreign exchange reserves.

In addition, PBOC officials indicated that this round of devaluation had fixed the discrepancy between the mid-points and market prices; they also denied rumors that the RMB would devalue over 10% in the future to boost Chinese exports.

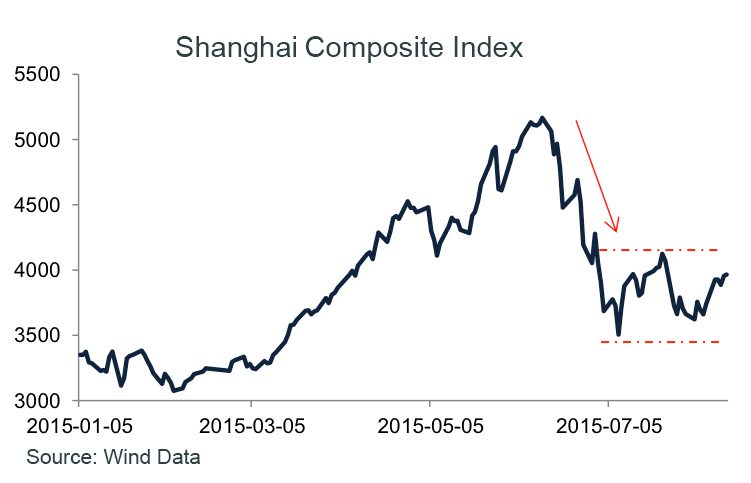

Therefore, PBOC’s action is meant to showcase its determination to push forward financial markets reforms. In the recent stock market turmoil, the Chinese government has repeatedly intervened with the “visible hand”, pumping up the market using the liquidity support by the PBOC. So far the measures have proved to be working, as the stock market has calmed down, a stark contrast from the extreme volatilities before. However, the bailout has disappointed many international investors, who tend to believe that China is moving backwards in terms of market interventions. Except for direct interventions, the suspension of IPOs has led investors to cast a doubt on the resolution of the government to carry out reforms.

Another factor behind the central bank’s move is whether the RMB can make it to the Special Drawing Rights (SDR) basket—one of the top priorities for PBOC now. Just before the RMB devaluation, the International Monetary Fund (IMF) informally pointed out that the mid-points of the RMB exchange rate deviated wildly from the market rates and thus it cannot be used as the referential price for SDR.

Since the PBOC has sent the message that China will keep pushing forward reforms, it’s unlikely that the RMB will depreciate significantly anymore. Actually, the Chinese government doesn’t want to see the RMB devaluing greatly because the instability will hurt its chance of joining the SDR.

Some investors may worry that the devaluation pressure of the RMB will overlap with the expectation that the Federal Reserve will raise interest rates, causing significant capital outflow from China. But this problem is probably not the focus of the Chinese government, as the central bank can counteract with cutting the Required Reserve Ratio (RRR) for commercial banks. PBOC officials said during a press conference on August 13 that the market has sufficient liquidity and interest rates are largely stable. Therefore, a RRR cut is more likely than an interest rate cut, especially because that China’s RRR is still at very high level.

Li Haitao is the Dean’s Distinguished Chair Professor of Finance and Associate Dean for the MBA Program at CKGSB.