Li Wei – Professor of Economics, Cheung Kong Graduate School of Business

This article is translated from the original Chinese published in FT Chinese on September 1, 2022: http://www.ftchinese.com/story/001097158?full=y&archive

According to recent reports, due to rising levels of inflation, in the last month the Biden administration has started to consider removing some of the trade barriers on Chinese goods.

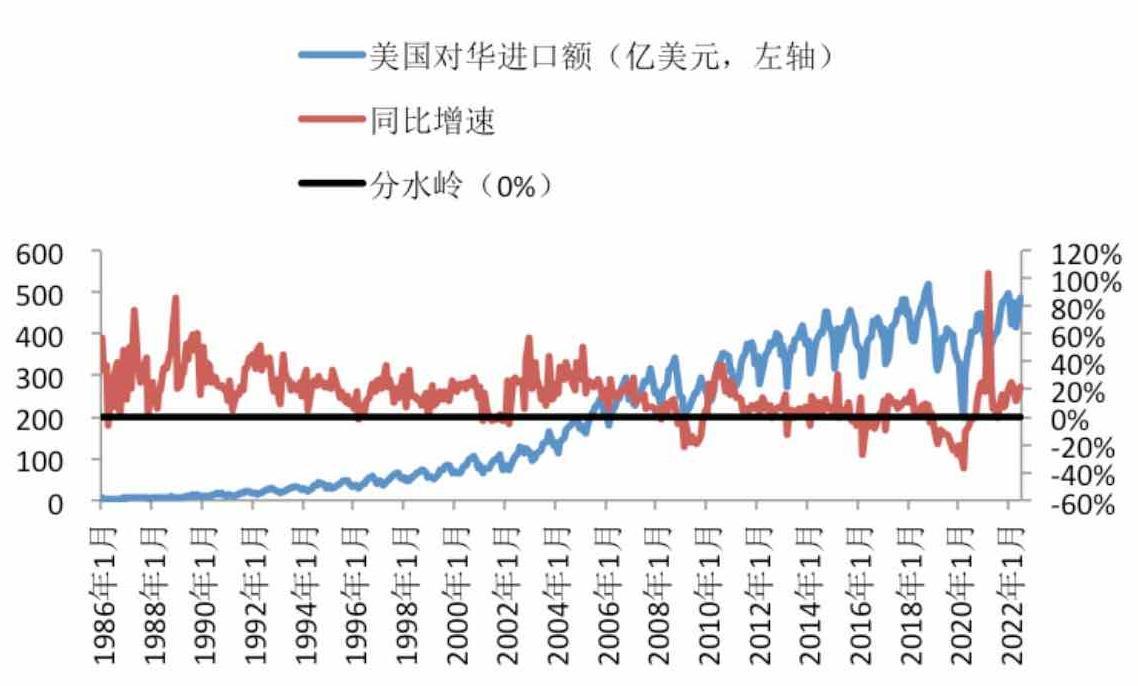

The reason for this is very simple: China is one of the most important sources for U.S. imports. Due to various reasons, the U.S. imposed various tariffs on Chinese goods during the Trump administration which resulted in trade disputes.

With inflation rising in the United States, the U.S lacks alternatives to Chinese goods. These additional tariffs are being passed on to American consumers and importers in the form of higher prices. For this reason, removing China tariffs could be a way to reduce U.S. inflation.

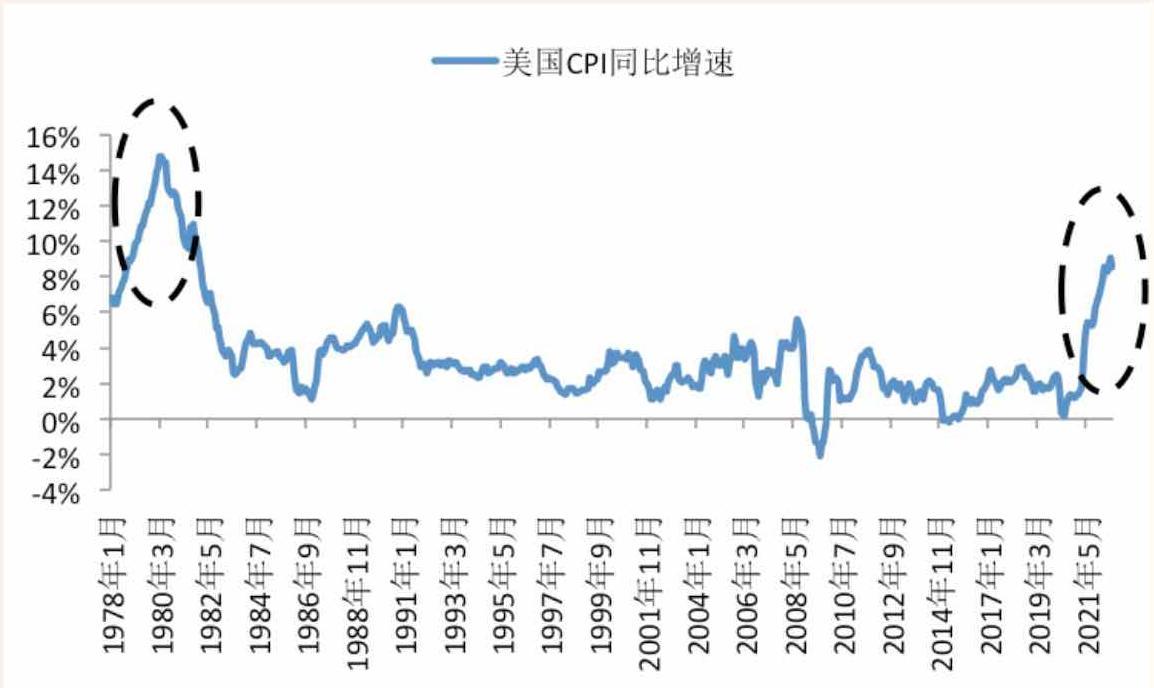

U.S. CPI growth rate

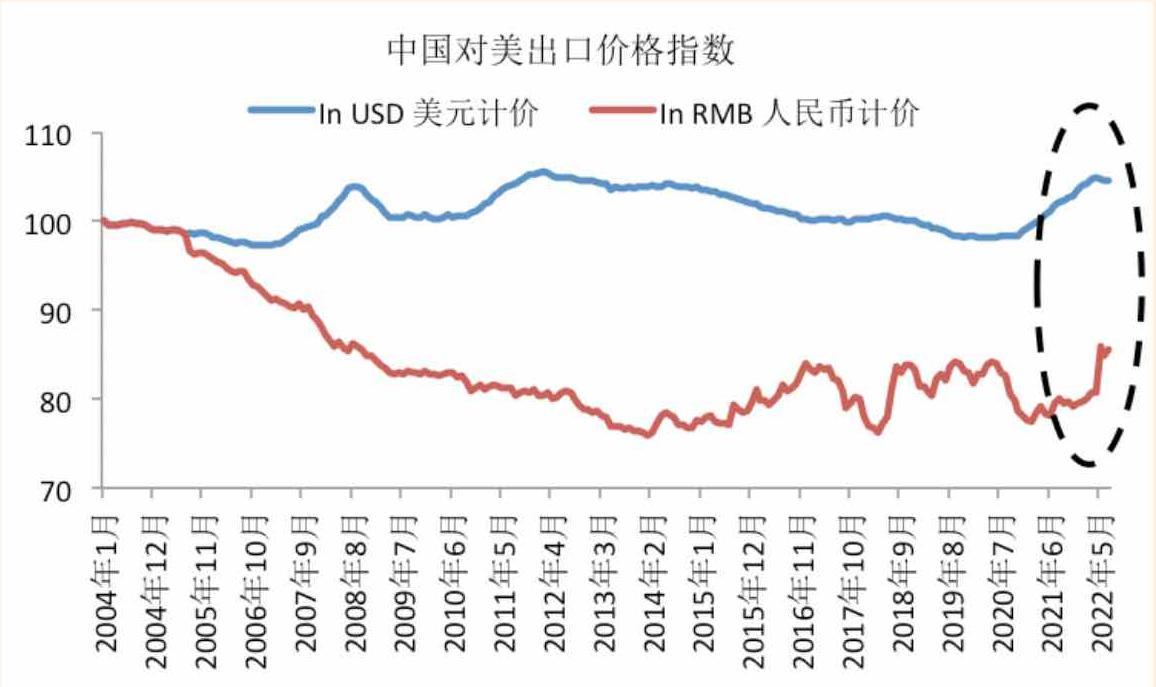

China Exports to the United States Index

Currently, inflation in the U.S. has hit a 40-year high and the market is pinning its hopes on the Fed providing an effective response; however, the recent monetary tightening comes with a big risk – an impending recession and rising levels of unemployment. Although monetary tightening can control inflation to some extent, it also puts huge pressures on the government and is often unpopular with the public.

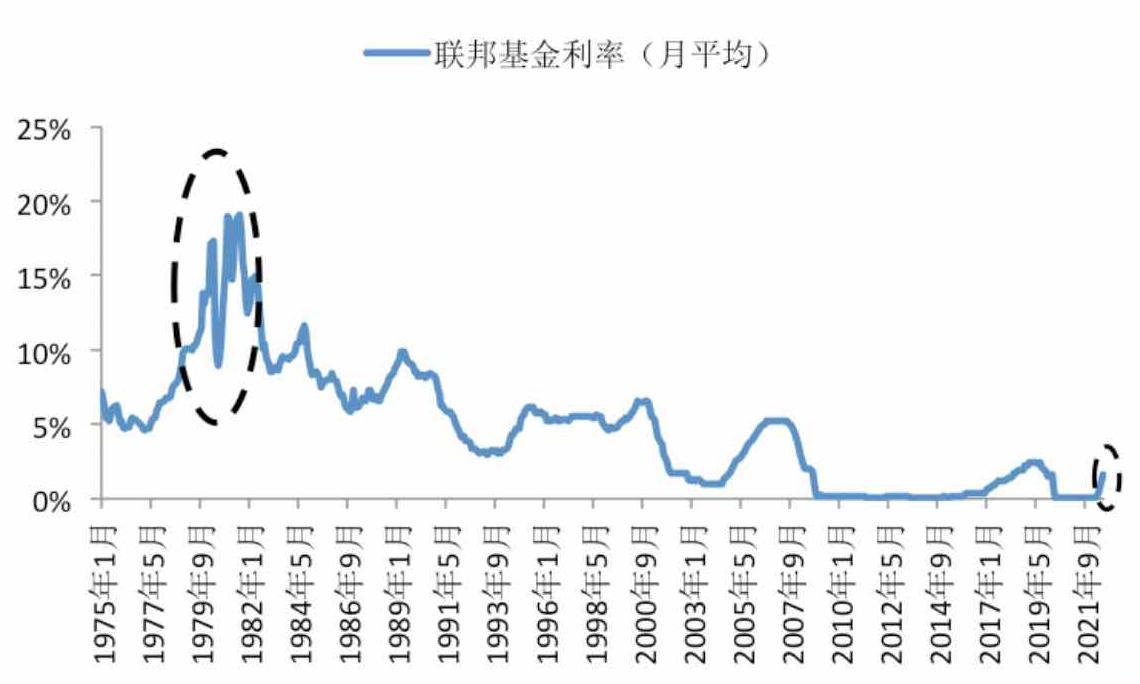

The Federal Funds Rate

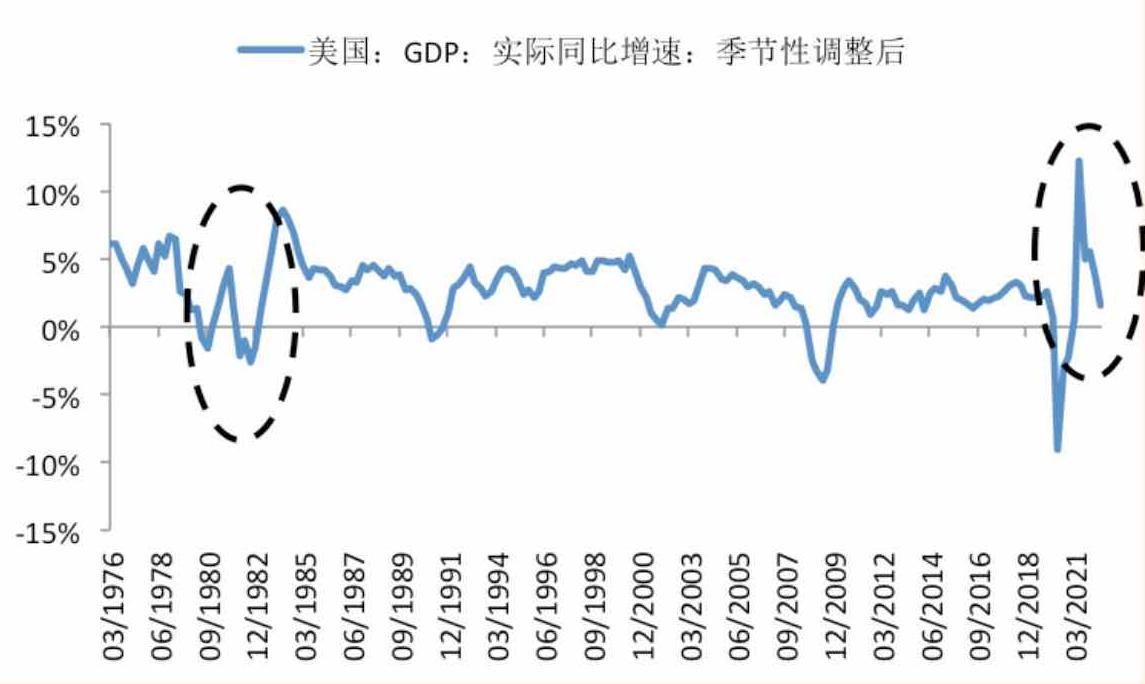

U.S. real GDP growth

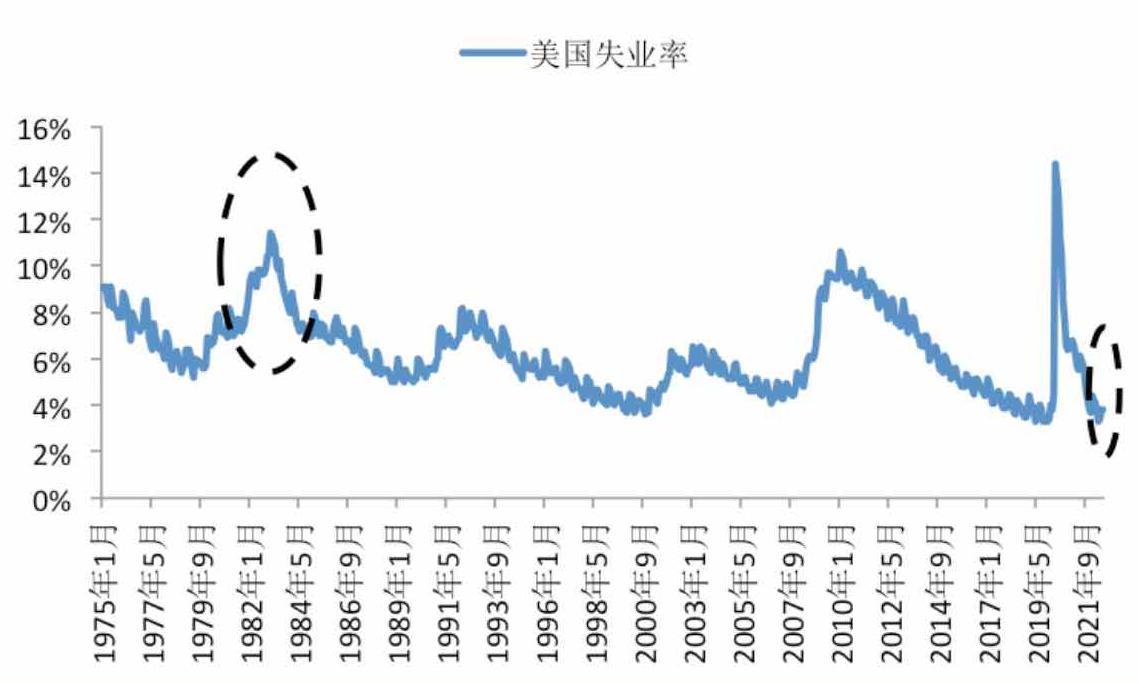

The situation today can be compared to that in the U.S. in the late 70s and early 80s. At that time there was severe stagflation (inflation plus high unemployment). The CPI growth rate in March and April 1980 reached 15%, and the year-on-year (YoY) GDP growth rates in the second and third quarter of 1980 were -0.8% and -1.6%, respectively. In response, the Federal Reserve raised rates despite the weak economic situation. In March and April 1980, the federal funds rate went above 17%, and in June and July 1981, over 19%. Although CPI eventually came down, YoY GDP dropped, and the U.S. fell into a recession. Even more substantial was that unemployment reached exponential levels.

U.S. unemployment rate

That was a classic case of monetary tightening in response to inflation, which resulted in a recession and widening inequality. Today the trend resembles that of the early 80s but this time unemployment rates has remained low. However, as the Fed imposes further hikes to interest rates, employment is likely to rise significantly.

Monetary policy is an important tool to tackle inflation, but it is not the only option. The other option is to relax, or even abandon, trade wars with China.

In March 2022, the Peterson Institute for International Economics (PIIE) published a report on this topic, titled “For inflation relief the United States should look to trade liberalisation”, written by Gary Clyde Hufbauter, Megan Hogan and Yilin Wang. They estimated that the Trump administration inflicted Americans with higher costs by imposing an additional 16% average tariffs on the USD $506 billion of imports from China – resulting in USD $81 billion worth of tariffs.

This USD $81 billion is not paid by Chinese exporters but by U.S consumer and importing businesses. In other words, Chinese goods become more expensive, and Americans have to pay more for them, which subsequently drives up inflation.

In 2021 the United States imported USD $2.8 trillion worth of goods in total. Tariffs of USD $81 billion thus make up 2.9% of U.S. total imports. They calculated that eradicating USD $81 billion in tariffs would correspond to a 0.3% reduction in CPI as a result of lowering import prices.

Eliminating additional tariffs on Chinese goods is an effective method to bring down inflation; but even more important is that competition from decreased tariffs and subsequent lower prices leads U.S. domestic firms to reduce their prices to compete with Chinese companies.

According to research published by PIIE economists Sherman Robinson and Karen Thierfelder, when there is a level playing field between domestically produced goods in the U.S. and imported goods, for every 1 percentage point decline in added tariffs, CPI would come down by 0.67 percentage points. Gary Clyde Hufbuer, Megan Hogan and Yilin Wang estimate that if Biden were to completely stop trade frictions with China, then increased competition would bring CPI down by another percentage point.

Therefore, according to the research by PIIE, ending the trade war with the United States would reduce CPI by 1.3% points in total (1.0+0.3). Considering consumer prices in August 2022 were 8.3% higher than the same period a year earlier, this reduction is quite significant.

The National Retail Federation (NRF) also calculated that additional tariffs imposed on Chinese goods since 2018 have cost U.S. importers USD $136.5 billion and U.S. consumers USD $1,200 per household, as of June 8. Moreover, according to the Tax Foundation, tariffs have cost Americans USD $80 billion, reduced GDP by 0.22%, and eliminated 173,000 full-time jobs since 2019.

Why has the United States not eased tariffs on Chinese imports?

The answer has a lot to do with politics which involves two key factors: first is the game between interest groups: although eradicating tariffs on Chinese manufacturers is beneficial to American consumers and importing companies, it can be harmful to those companies competing with Chinese companies.

Take the steel industry as an example: Under the umbrella of protectionist measures such as tariffs and import quotas, the profits of the U.S.’ five largest steel companies have soared. In 2018 when the levy was first introduced under the Trump administration, the profits of the top 5 U.S. steel enterprises combined were USD $11 billion; but by 2021 they had reached USD $31.9 billion.

U.S. steel imports in 2021 in total amounted to USD $34 billion which had an added surcharge of 25%. Suppose the U.S. government were to remove all protectionist measures on the steel industry, steel-using enterprises would save USD $8.5 billion; further lowering of steel prices would bring CPI down by 0.04 percentage points.

Although removing protectionist policies in the steel industry would be beneficial to steel-using companies these enterprises are often small and fragmented, and politically have little influence. The steel production industry in the U.S. is much smaller than the steel-using industry in terms of scale and employment, but industrial concentration is much higher, and their say in politics far greater. Through lobbying these enterprises have had a big influence on existing protectionism.

This example of the steel industry is a common phenomenon in the U.S. economy, and to a certain degree public policy has been dictated by these interest groups. Only through political reform can such problems be solved in the U.S..

Further, it is important to note that U.S. politicians have opposing views on the China tariff debate. Biden’s cabinet cannot come to an agreement: On the one hand, Janet Yellen, Secretary of the Treasury, believes the U.S. should change course and remove these tariffs; on the other side of the debate, the U.S. trade representative Katherine Chi Tai takes the view that additional tariffs are a bargaining chip in trade negotiations with China.

U.S. imports from China (left axis) (100 = USD 10 billion) and the growth rate (right axis)

All in all, Biden should remove additional tariffs on Chinese imports. Fundamental principles of economics tell us that international trade based on comparative advantage can improve the interests of all parties involved. Tariffs are not an effective bargaining chip in trade negotiations and the United States has an opportunity to prevent further inflation spikes by removing these protectionist measures. There is still time, but the U.S. should act soon.

Source: FT Chinese