From its humorous slogan “It’s like milk, but made for humans!” to its premium oat milk products, Oatly’s entry into China in 2017 was bold and calculated. Faced with unique challenges in a market saturated with non-dairy alternatives like soy milk, Oatly’s success was far from guaranteed. Yet, through clever positioning, strategic partnerships, and an innovative marketing approach, Oatly managed to carve out a thriving niche for itself in China’s rapidly growing plant-based food industry.

Tackling the Chinese Market: Challenges and Opportunities

When Oatly entered China, it encountered challenges that different from its successes in Europe and the U.S. While oat milk gained traction in the West as a dairy substitute, Chinese consumers—accustomed to affordable plant-based options like soy milk—were less impressed. Positioned alongside low-cost soy milk on supermarket shelves, Oatly initially struggled to attract attention, resulting in lackluster sales.

However, David Zhang, , Oatly’s Asia Pacific President, recognized the need for a different strategy. He identified China’s burgeoning coffee culture as the ideal entry point. By targeting urban, sustainability-conscious consumers willing to pay a premium for innovative alternatives, Zhang transformed Oatly’s potential setback into an opportunity.

A Tailored Approach:The “Three Ones” Strategy

Oatly’s breakthrough came through its “Three Ones” strategy—one city (Shanghai), one market (boutique cafés), and one product (the Barista oat drink). By aligning with the values of coffee enthusiasts, Oatly highlighted the Barista product’s superior texture and foamability, qualities that baristas found ideal for crafting coffee. This focus on quality and functionality gave Oatly an edge in the competitive café scene.

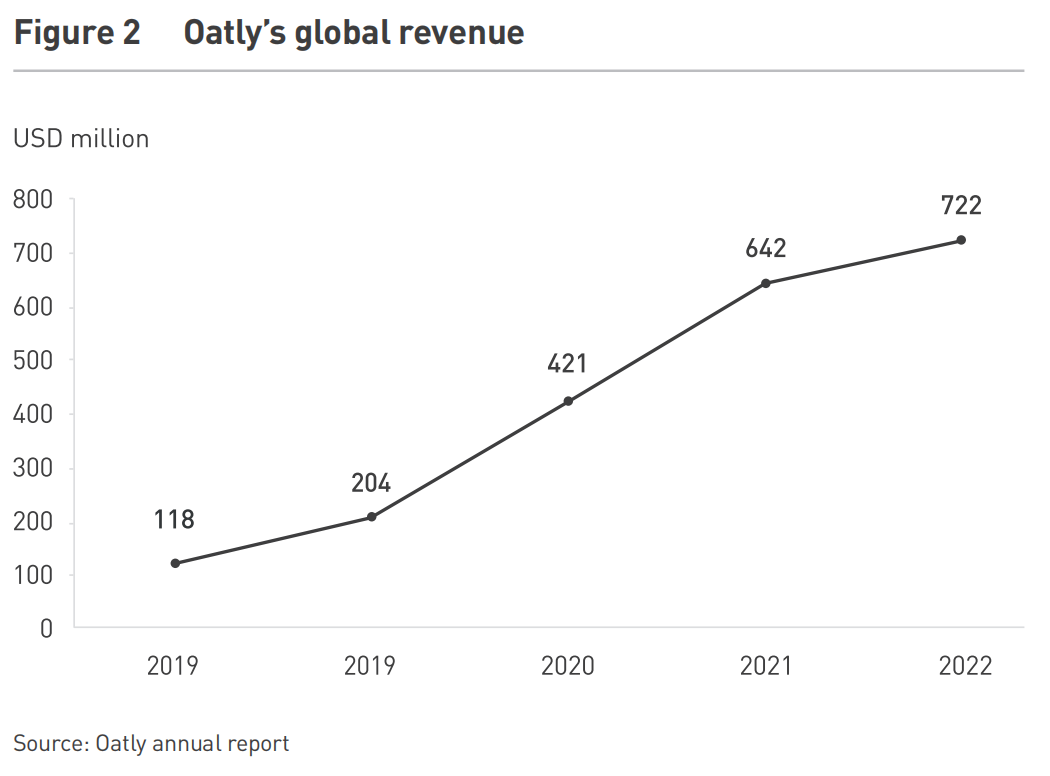

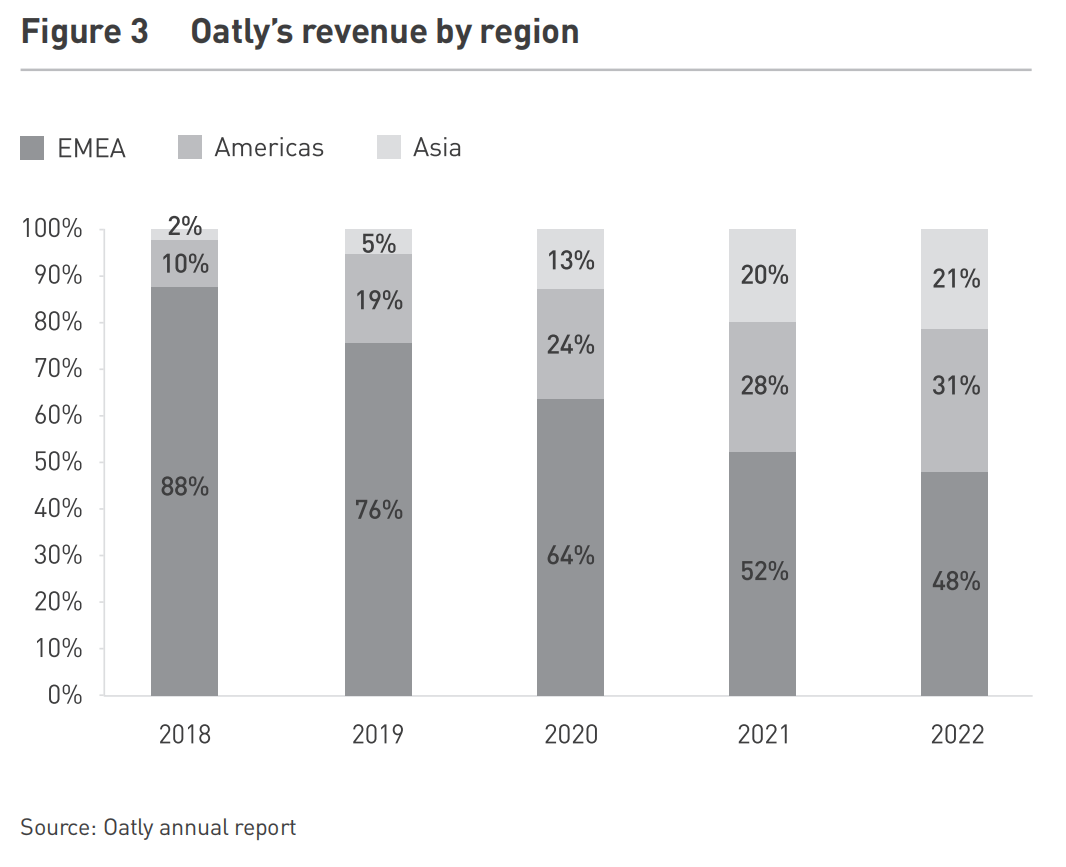

The results were striking. By the end of 2022, Asia contributed USD 152.8 million to Oatly’s global revenue of USD 722.3 million, with 88% of that amount coming from China (see Figure 2 & 3). The Barista product quickly became a favorite among boutique cafés, driving adoption and reinforcing the brand’s association with premium quality and sustainability.

Oatly further encouraged cafés to display signs promoting oat milk as a premium alternative to dairy milk. This strategy not only piqued consumer curiosity but also reinforced Oatly’s message of environmental responsibility and health benefits. Within months, hundreds of Shanghai cafés were serving Oatly-based drinks, fueling organic growth and word-of-mouth momentum that rapidly elevated the brand to national prominence.

Strategic Partnerships Fuel Growth

Oatly’s success was further accelerated by partnerships with major brands. By 2019, Oatly’s rapid rise caught the attention of leading coffee chains in China, including Starbucks. Although initial negotiations with Starbucks mainland China stalled, Zhang’s team successfully secured partnerships with Starbucks outlets in Hong Kong and Southeast Asia. This success eventually convinced Starbucks China to sign a deal in 2020, significantly boosting Oatly’s brand exposure.

Oatly’s collaborations didn’t stop there. Partnerships with KFC, McDonald’s, Pizza Hut, and Pacific Coffee further solidified its presence across China’s food and beverage sector. The increased visibility through these collaborations helped Oatly make inroads into retail channels, including supermarkets and e-commerce platforms like Tmall.

A pivotal moment came when Oatly redefined its product category. Initially confused with soy milk, Oatly proposed the creation of a “plant protein” category on Tmall. This strategic move culminated in a highly successful Singles’ Day promotion in 2018, where Oatly sold out 5,000 cartons in just 11 minutes. The success underscored the demand for plant-based alternatives in China while reinforcing Oatly’s innovative approach to market positioning.

Sustaining Success Amid Growing Competition

As China’s plant-based market flourished, competition intensified. Domestic brands like OAKIDOKI and Nongfu Spring entered the fray, and global giants such as Coca-Cola and Nestlé expanded their oat milk offerings. To maintain its edge, Oatly doubled down on sustainability initiatives, including using renewable energy and electric trucks, while diversifying its product range to include oat-based ice cream and baked goods.

To address supply chain challenges, Oatly invested in local production facilities, opening factories in eastern China and Singapore. These efforts not only reduced costs but also ensured a steady supply to meet growing demand.

The Road Ahead

Oatly’s experience in China highlights the critical role of adaptability and innovation in navigating a dynamic market. Despite encountering supply chain disruptions and intensifying competition, the brand has cemented itself as a leader in the plant-based category. With China prioritizing carbon neutrality and an increasingly eco-conscious consumer base, Oatly’s dedication offers a strong foundation for future success.

That said, the path ahead is not without hurdles. Since its 2021 stock market debut, which valued the company at USD 13 billion, ongoing supply chain challenges have weighed heavily on Oatly’s performance, eroding investor confidence and dragging down its share price. Additionally, the anticipated post-COVID-19 recovery in China has yet to materialize, adding to the pressure. To address these setbacks, Oatly has announced a strategic shift, focusing on its core foodservice business and partnering with select retail outlets in major cities, while streamlining its product portfolio.

The competitive landscape also presents risks. As domestic and global competitors vye for market share, price wars could erode profitability, and Oatly must consistently justify its premium positioning to consumers. However, as the global dairy market surpasses USD 1 trillion, opportunities for growth remain vast. Oatly’s ability to maintain its first-mover advantage, innovate, and respond to evolving market trends will be crucial to sustaining its momentum.

Oatly’s journey in China is about much more than selling oat milk. It represents a bold effort to redefine consumer preferences, create a new product category, and champion sustainability. Moving forward, Oatly’s success will hinge on its capacity to innovate, nurture brand loyalty, and optimize operations in an increasingly competitive and complex marketplace.

This article is part of the “Unleashing Innovation in China” series, which explores how companies are driving innovation and reshaping industries in one of the world’s most dynamic markets. For more insights, visit: Unleashing Innovation: Ten Cases from China on Digital Strategy and Market Expansion – CKGSB Knowledge