“Step into the future of financial inclusion with MYbank. As part of our ‘Unleashing Innovation in China’ series, this case study explores how MYbank leverages technology to solve financing challenges for micro-, small-, and medium-sized enterprises (MSMEs). Through the transformative Goose System, MYbank has redefined supply chain finance in a way that traditional banks could only imagine.”

Empowering China’s Backbone: The Rise of MYbank

MSMEs are the backbone of China’s economy, contributing more than 50% of tax revenue, more than 60% of GDP, more than 70% of technological innovations, more than 80% of urban employment and more than 90% of market entities in China. Yet, despite their critical role, these businesses face significant barriers in accessing affordable credit due to limited collateral, incomplete financial records, and risk-averse lenders.

MYbank, founded by Ant Group in 2015, has stepped in to bridge this gap with a fully digital approach. Initially serving e-commerce merchants on platforms like Taobao and Tmall, MYbank introduced its signature “310” loan system- providing loan approvals in three minutes, disbursing funds in one second, and requiring no human intervention. By 2022, MYbank had extended its services to over 50 million MSMEs across multiple sectors, including retail, catering, and logistics.

The Game-Changer: MYbank’s Goose System

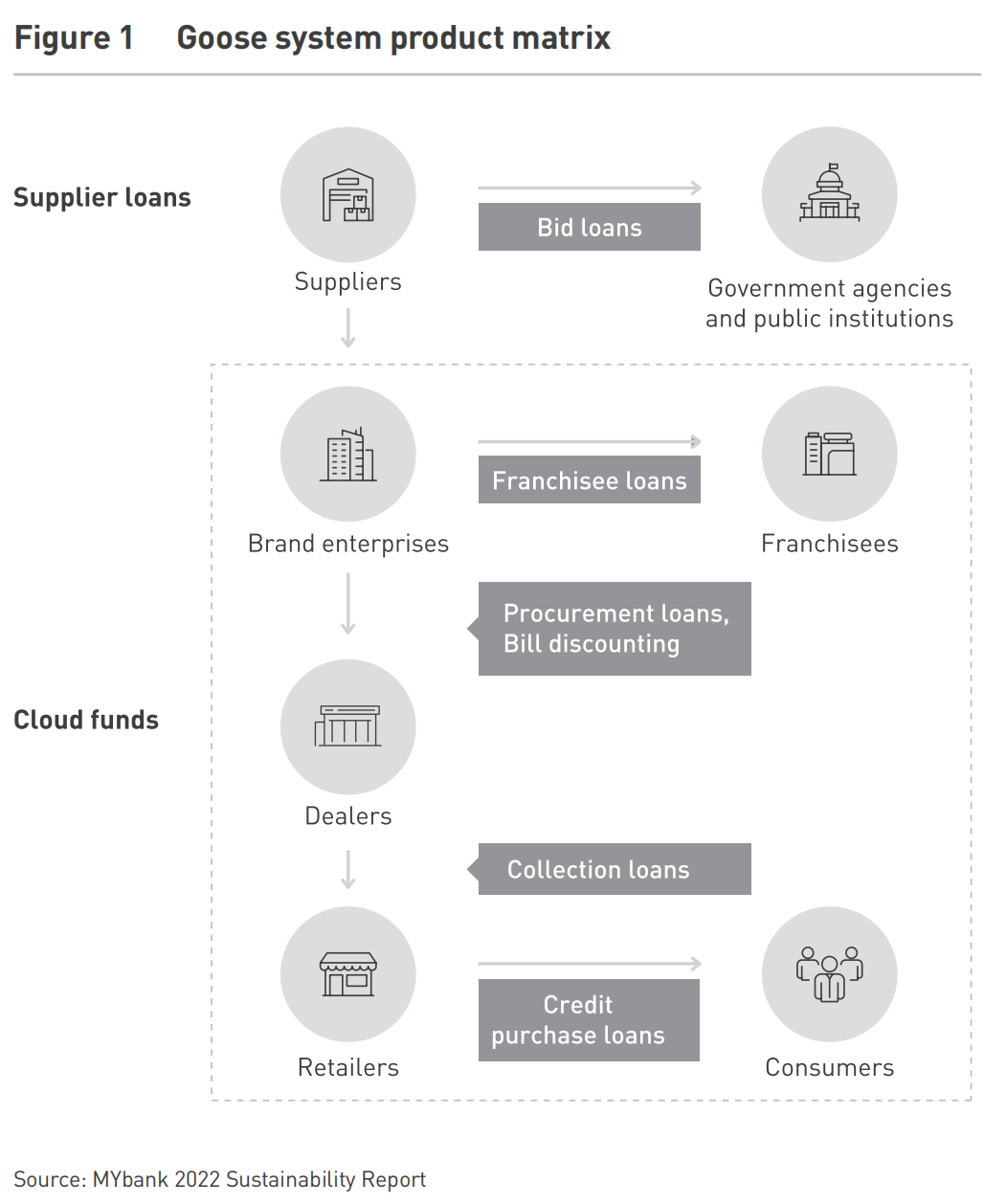

In 2018, MYbank revolutionized supply chain finance with the introduction of the Goose System, a digital platform designed to simplify and expand supply chain financing (See Figure 1).

Unlike traditional supply chain finance models that prioritize core enterprises, MYbank’s Goose System democratizes credit access for downstream MSMEs, leveraging data to assess risk and allocate loans efficiently.

The Goose System is built on three key principles:

- Data-Driven Credit Assessment: By analyzing transaction data within supply chains, the system determines creditworthiness without requiring collateral.

- Scalability and Automation: The platform eliminates manual intervention, enabling MSMEs to access loans in real time.

- Integration with Core Enterprises: Over 500 brands, including Huawei, Haier, and Mengniu, have adopted the Goose System, supporting thousands of distributors and enabling greater financial inclusion.

Innovating Supply Chain Finance: The MYbank Approach

Tackling Industry Challenges

Traditional banks often overlook the credit needs of distributors and retailers, which are essential to supply chains. MYbank’s Goose System bridges this gap by analyzing extensive data from Alibaba’s ecosystem, enabling tailored financing solutions. For instance, Mengniu’s partnership with MYbank increased loan approval rates for its distributors to 80%, driving a 22% YoY sales growth in 2020.

Transforming Fund Management

Beyond loans, MYbank offers a comprehensive suite of digital payment and settlement tools. These tools streamline operations for businesses like Happy Sweet Potato, a Chinese tea chain that increased financial efficiency by 30% after adopting the Goose System in 2021. By automating payment tracking and inventory management, MYbank enhances transparency and reduces operational costs across supply chains.

Challenges on the Horizon

MYbank faces several challenges as it scales::

- Sector-Specific Needs: Adapting the Goose System to diverse industries requires a deeper understanding of sector-specific dynamics and regional variations. To effectively serve a wide range of businesses, MYbank must embrace flexibility, tailoringits approach to meet unique industry requirementsrather than relying on a standardized, “one size fits all” model.

- Core Enterprise Digitalization: More than 80% of potential core enterprise partners lack the digital infrastructure necessary to integrate with the Goose System, creating a significant barrier to expansion. Additionally, some core enterprises have requested commissions on the financing provided to their suppliers and distributors. MYbank, however, refrains from engaging in such transactions, aiming to avoidtransferring additional financial burdens onto MSMEs, aligning with regulatory efforts to promote lower-interest credit for these businesses.

- Limited Market Presence: Unlike conventional banks with extensive networks, MYbank lacks a dedicated sales force. Instead, it partners with traditional banks to share resources and enhance operational efficiency, leveraging h its fintech expertise. This collaborative approach benefits both parties, as traditional banks close more deals while MYbank earns commissions.

To overcome these challenges, MYbank is collaborating with Ant Financial to drive digitalization among core enterprises and exploring new ways to expand its B2B business offerings.

A Bank You Can Bank On: The Future of MYbank

The COVID-19 pandemic accelerated the demand for contactless financial services, providing a clear advantage to online banks. MYbank has demonstrated its ability to adapt and innovate, leveraging technology to empower MSMEs and fuel economic growth. However, challenges remain, including data security, regulatory compliance, and expanding its market presence.

Despite a rise in its nonperforming loan ratio in 2022, – due to measures taken to help MSMEs navigate the pandemic’s impact- MYbank still posted higher profits and maintained healthy liquidity metrics. While growth in total assets slowed to 10% compared to 26% in the previous year – MYbank continues to innovate. In 2022, it launched a new product offering MSMEs a credit line of up to RMB 5 million (USD 744,000) to support working capital, capital expenditures, and other business needs.

MYbank remains a beacon of innovation in fintech and inclusive finance, championing digital solutions to bridge the gap for underserved businesses.

With its steadfast commitment to supporting MSMEs and leveraging data-driven strategies, MYbank is poised to remain a key player in China’s financial ecosystem for years to come.

Note: This article is originally published on: Unleashing Innovation: Ten Cases from China on Digital Strategy and Market Expansion – CKGSB Knowledge