ByteDance, an almost unknown Chinese company, is taking over the world. TikTok is the first Chinese app to take the world by storm, and its owner is now rubbing shoulders with the likes of YouTube and Facebook.

TikTok’s latest viral challenge has the world’s teens gluing up their top lips with eyelash adhesive to achieve a poutier look, while parents and health experts look on in dismay. Risking scarring and skin problems, depending on what adhesive is used, it is all worth it for young users eager to gain an online audience.

TikTok is a mobile app that allows users to post short videos of usually 15 seconds, contributing to what is known in the industry as “fast entertainment.” It has an impressive 500 million active monthly users, is available in 155 countries and has teenagers who have downloaded the app spending an average of 52 minutes using it every single day.

Most noteworthy of all, however, is that TikTok is the first app from a Chinese company to take the world by storm. Its owner is ByteDance which has suddenly shifted from being a top Chinese online company to a top global player, rubbing shoulders with the likes of Youtube and Facebook.

For a typical user such as South African Jaco Ludewig, the attraction of TikTok is its inconsequential nature. “I just love TikTok because I enjoy making people laugh, so it’s a cool app to do exactly that,” he says.

“TikTok democratized video content creation,” says Michael Norris, strategy and research manager at AgencyChina, a marketing and sales agency. “Just like photo-editing apps before it, TikTok made complicated video effects and transitions simple. This gave a huge range of would-be content creators the tools and freedom to make the type of video content they wanted, without the hassle of cutting, editing and re-touching.”

The app is all about providing users with an endless stream 15-second “brain bursts”—cute, pretty, weird, funny or strange video snippets that superficially stimulate and fill up time. Users compete to produce and post small videos of themselves dressing up, putting on makeup, doing outrageous things and generally trying to impress their peers.

“The social platform just makes the most of human competing and dating instincts,” says Professor Diana Derval of DervalResearch who goes on to cite the ‘chameleon effect’, the instinct of everyone, but kids especially, to want to emulate the coolest people around.

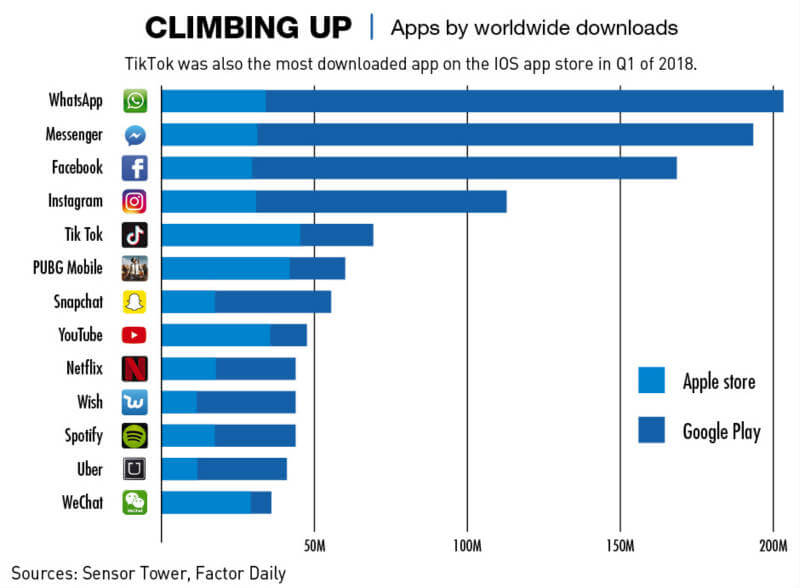

TikTok crossed 1 billion downloads on Apple’s App Store and Google Play in February 2019. Around 633 million of these downloads occurred in 2018, compared to 711 million for Facebook and Instagram’s 444 million. In August 2019, TikTok was the world’s most downloaded social media app with nearly 63 million downloads. India accounts for around a quarter of all downloads of TikTok to date, but TikTok was also the second most common non-gaming app download in the US that month with 4.2 million installs—a 54% year-on-year increase.

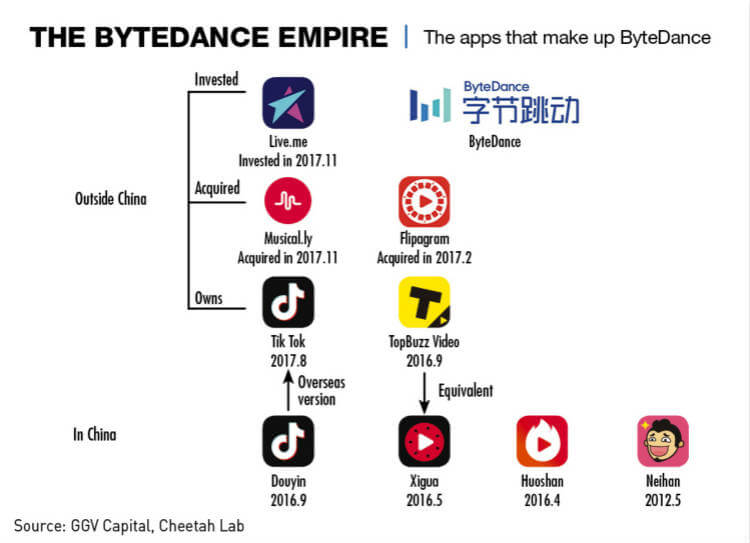

“There are two reasons why TikTok has gained great success in such a short time,” says Zhang Mengmeng, a research analyst at Counterpoint Research. “First of all, before launching TikTok, its Chinese variant Douyin, already gained wide popularity and proved to be a successful product locally. ByteDance was able to carry its experience from Douyin into TikTok. Secondly, ByteDance acquired a competing video sharing site called Musical.ly, which has most of its user base in the United States. By acquiring Musical.ly, it was able to expand its user base for TikTok quickly.”

Fandango

Former Microsoft engineer Zhang Yiming, now aged 36, founded the parent company ByteDance in 2012. The first app he launched was Jinri Toutiao, which supplies AI-curated news content personalized for users. Douyin launched in 2016 with the international version TikTok following in 2017. ByteDance really went international in 2017, after it acquired the US-founded app Musical.ly, and then merged it with TikTok in 2018.

Although ByteDance now operates in more than 100 countries, Norris says that beyond China the company concentrates on India, Japan and the United States. “Outside those three markets, it’s had a hard time converting downloads to active users. Earlier this year, it was alleged that ByteDance spent $3 million per day on existing social media platforms to encourage downloads, but these rarely resulted in loyal users,” he says.

But they are not doing at all badly. ByteDance has more than a billion monthly active users spread over eight apps. Like most China technology companies including Baidu and Tencent, its corporate structure is that of a Variable Interest Entity, which would allow it to list overseas, even though foreign investors are not allowed to own shares in such Chinese companies. But it has yet to be listed. Estimates put the value of the company at $75 billion, making it the world’s most valuable startup and it counts the likes of General Atlantic, KKR & Co., Sequoia, Softbank and Susquehanna as investors. The founder, Zhang Yiming, appears to own the majority of the shares.

“ByteDance is quite promising from a financial perspective as it generates sizable income through advertising. With a portfolio of apps with high DAU (daily active users), its monetization capabilities are strong and justify its high valuation,” says Zhang.

Breakdancing

ByteDance is one of a new wave of Chinese tech companies challenging the older and more established Chinese players, led by BAT (Baidu, Alibaba, Tencent). The founders of these new companies are all at least 10 years younger than those of BAT and are also focused on mobile rather than computer-based platforms.

“It rode the wave of mobile internet brought on by the wide adoption of smartphones as well as the rapid economic growth of the past decade in China,” says Zhang. “Other new Chinese tech companies like Didi, Kuaishou and Meituan also emerged at around the same time. These new founders are not only more ambitious but also have a better international perspective.”

With the huge popularity of TikTok globally, ByteDance is the first Chinese tech company with a serious chance when it comes to competing with the American social media giants such as Facebook and Instagram. It has been able to gain traction internationally in a way that the BAT companies so far have not.

“Seen through the lens of user experience and product design, the emergence of ByteDance—and Douyin in particular—represents a seismic shift in the Chinese startup space,” says Kendra Schaefer, Trivium China Head of Digital Research. “Alibaba, Tencent, and many of China’s other tech giants are good at creating products that meet the needs of their local market, but they started out copycatting, and then gradually employed their user data to hone those products. Douyin jumped out of the gate with a largely original interface that not only spoke to Chinese users, but had a more universal appeal.”

For many young Chinese people, Douyin is a way of killing time. “When you’re waiting for buses or the subway, you can use the app,” says Versa Yang a user of Douyin. And it seems that this, plus its ease of use and entertainment factor, are what makes it popular. While Douyin manages to appeal to a wide range of age groups in China, internationally TikTok largely appeals to young people, particularly teenagers.

Last waltz

A key feature of this kind of app is the high potential for it to fade as fast as it grows. ByteDance is not waiting around for that to happen and is spending substantial amounts on research and development.

“We already see stagnating growth for ByteDance’s Jinri Toutiao news app, with growth for Douyin also likely to hit a ceiling at some point,” says Zhang. “Therefore, ByteDance has been putting a lot into R&D to incubate the next hit product and diversify its current business.”

Despite having one of the world’s most popular apps, the company doesn’t even feature anywhere close to the top of list of global apps in revenue terms. Encouragingly, however, TikTok’s in-app purchases reached $11.7 million in July, a 290% increase from the same time a year before.

“Douyin’s foray into e-commerce is an important part of ByteDance’s monetization efforts, and I’m sure that they’re pleased with the domestic brand uptake of the integration between short video and e-commerce,” says Norris. Vine, an app similar to TikTok founded in 2012 and bought by Twitter, ceased operations in 2016 due partly to an inability to monetize its offering.

In anticipation of the ceiling and as a means of becoming even bigger, ByteDance has already set its sights on other potential areas that it can expand into.

“ByteDance is considering becoming a bigger contender in the music streaming service and strengthening its social media position by launching its own smartphone,” says Derval. “Combining hardware and AI sounds like a smart world domination plan.” The company has also tried to diversify through the purchase of two gaming companies and various smartphone patents, along with the creation of other business units such as education oriented Gogo Kid, and workplace tool Lark.

Dancing on a tightrope

In the US, TikTok has been accused of a predator problem with pedophiles allegedly using it to groom teenagers via messaging. The Federal Trade Commission fined the company a record $5.7 million in February for collecting information on children under the age of 13. The UK is currently investigating the app for similar reasons, while Indonesia banned TikTok, accusing it of blasphemy and pornography.

Many parents are worried about TikTok having too much influence over their children’s lives and that teenagers are spending too much time on the app. Another thing that parents find worrying is that the app only offers two privacy settings, either private or entirely public. There is no middle ground as on other social media platforms that allow users to share only with their friends or selected contacts.

More concerning for ByteDance is that it has come under intense scrutiny in India. Available in 15 Indian languages, TikTok has 120 million monthly active users in the country. After a wave of government employees made videos on the app, including gun-wielding SWAT teams, it caught government attention with political worries about data security as well as the apparent danger that the app posed to teenagers in the country.

Indian lawmakers said that the app was encouraging the spread of explicit content among teenagers and banned the app in April 2019. The ban only lasted for a week, but ByteDance claimed that it suffered up to $500,000 in financial losses every day that the ban was in effect. It is still unclear as to what eventually swayed the court, but ByteDance highlighted in its defense how it uses tech to keep nude content from being uploaded onto TikTok.

Later, ByteDance tried to sue online Chinese news site Huxiu over an article discussing news apps in India which included a reference to another of ByteDance’s apps, the news sharing app, Helo. Writer Elliott Zaagman compared Helo’s CEO to a drug dealer and said that fake news on Helo had influenced the Indian election.

ByteDance’s Helo is available in 14 Indian languages and uses AI to drive content to users. “It’s built on clicks and engagement rather than news,” Zaagman wrote. “The incentive system is Facebook on steroids with nowhere near the level of take downs. In order to fuel their growth, ByteDance often looks for vulnerable populations. Helo is tailored to uneducated masses who are not digitally literate and because it is based on engagement and you have cultural and political factors in India it creates dry tinder for violence.”

Byte back

Some experts see ByteDance’s massive growth as being not so much a failure of Western tech companies as indicative of China’s rise. “ByteDance’s success shows that Chinese tech companies are capable of making hit products and achieving scales on par with and sometimes even surpassing Silicon Valley companies,” says Zhang, going on to cite leadership in mobile payments and AI-based facial recognition.

The big challenge now for ByteDance is how to monetize its apps to justify its current valuation. Internationally, Zhang actually sees the popularity of TikTok amongst teens as a hindrance to this.

“ByteDance is quite promising from a financial perspective as it generates sizable income through advertising,” says Zhang. But according to Norris, much of this advertising is being poached from Baidu and ByteDance will need more revenue streams to support its multiple business units. Most of the income comes from Douyin and Jinri Toutiao, “the rest, at this point in time, is ecosystem building.”

While ByteDance may be facing challenges, it is now a major player globally. “Douyin and TikTok will remain important growth drivers for ByteDance,” says Zhang. “However, ByteDance knows that it cannot sit on its current glory and is very aggressive in overseas expansion and finding the next 100 million (user) product.”