China’s capital account liberalization and the new normal.

Strolling through Hong Kong Central district at the junction of Garden Road and Queens Road Central, passers-by may not realize that they are at the epicenter of the next big step in global finance. Aside from remnant colonial buildings the architecture is 21st century urban, with signature tower blocks and landscaped plazas, threaded with walkways and transportation links.

A closer look reveals the headquarters of all the big regional banks, transforming an anonymous cityscape into the prime arena for Chinese currency transactions, and the physical home of the internationally traded renminbi. The whole comprises a cat’s cradle of unstated hierarchies, visible and invisible, all tuned to the distant rhythms of China’s economic reform program. This is where speculation meets hard numbers, where the renminbi finds its value, and where hopes and fears become profit or loss.

On the 15th of March 2014, the People’s Bank of China (PBOC) announced that the yuan or renminbi would now be permitted to trade in a wider band, around a reference rate of exchange against the US dollar. The change—from 1% to 2% daily variation—is welcomed by Patrick Bennett, Executive Director of Macro Strategy Asia at the Canadian Imperial Bank of Commerce.

“It’s a good step. I think it was well telegraphed for some time, and I think the goal of policy makers in China is to move to a more market-oriented system,” says Bennett. “We’ve had a lot of those small steps,” he adds, reinforcing a tangible sense of progress on the long road to internationalization of China’s currency and capital account liberalization. China’s emergence as just another ‘normal’ economy in a globalized trading system is ostensibly desired by all, but placed in a wider context, doubts linger about what ‘normal’ is likely to mean when China eventually gets there.

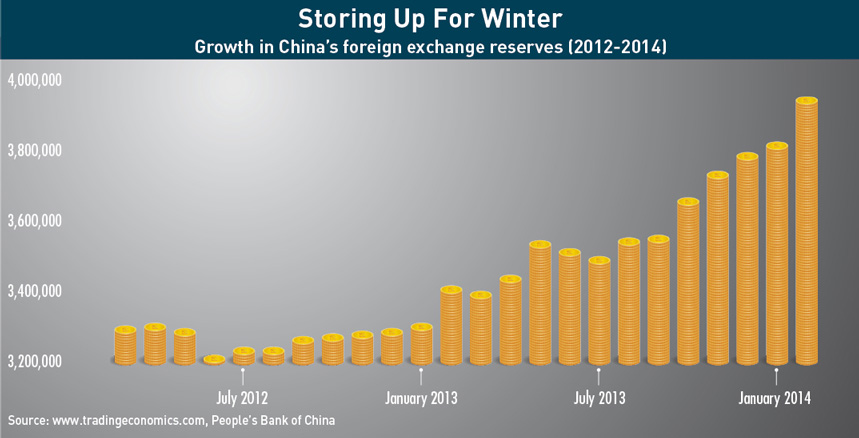

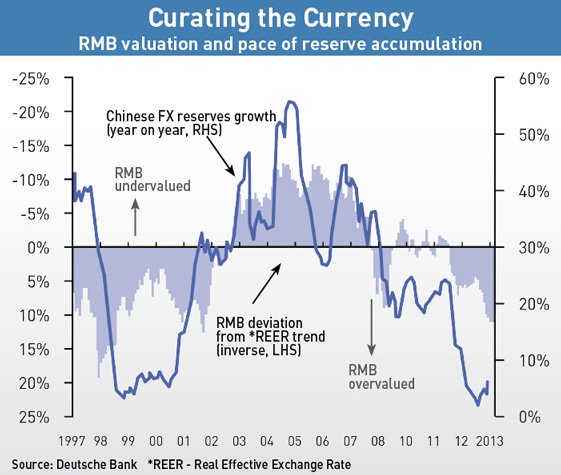

Case in point, the PBOC’s large-scale, parallel interventions in the foreign exchange market, the aim being to depreciate the value of the renminbi against the dollar. The effect of these interventions has brought the value of the renminbi down by nearly 3% so far this year, cancelling out the whole of last year’s steady appreciation, prompting a strongly worded response from the US Treasury in their April report to Congress on exchange rate policies. The renminbi remained ‘significantly undervalued’, the report declared; a reaction which highlights both that the dollar/ renminbi exchange rate rests on a very raw political nerve, and that the level at which the renminbi trades is not the same thing as the band within which it’s permitted to trade. China still maintains an exchange rate peg, and still intervenes in the foreign exchange (FX) market in pursuit of policy objectives. China may be edging closer to normal, but it’s not there yet.

On the Level?

The market view, however, remains more muted. “I think they genuinely prefer to advance this market-based reform. Widening the trading band has also helped to play down expectations for the currency as a risk-free bet on the appreciation of the renminbi,” says Song Gao, Managing Partner at PRC Macro Advisors, Beijing.

This is consistent with a broad consensus that the equilibrium value for the renminbi is probably somewhat higher against the dollar than where it’s currently pegged, but reflects little sympathy for the US Treasury view of significant undervaluation. go in than come out,” says Bennett. “The idea is to get the currency to a level which reflects supply and demand, and let the market be a better arbiter around that,” he adds. “I absolutely don’t believe the PBOC would seek to weaken the currency if exports slow down or growth weakens.”

Song and Bennett highlight that the market’s views of the PBOC’s behavior is mixed. Many traders were caught off guard by the rapid depreciation of the renminbi, and remain wary of re-entering the market.

But regardless, the move was broadly interpreted as a successful effort on the part of the PBOC to counter perceptions of a one-way appreciation that had become baked into prevailing market expectations.

“What we lost sight of was where the value of dollar/China [renminbi] was,” says Bennett. So while the renminbi has depreciated about 3% this year, the “daily fix”— which is the PBOC estimate of the current value—has only moved about 1.4%, viewed as “hardly a seismic shift”.

The Big Reveal

In addition to sending a message, the wider daily trading band gives the PBOC more latitude with its interventions. A narrow trading band renders the market extremely sensitive to even slight movements, placing greater pressure on any move by the central bank to adjust the rate. For any band, the closer the exchange rate moves towards the upper or lower limit, the greater the chance of central bank intervention, creating arbitrage opportunities that might also interfere with the functioning of the market. A wider band gives the PBOC more room to maneuver without setting the market ablaze.

Perhaps even more revealing is the implication of an important shift in the thinking of China’s leadership. “The widening of the band indicates that Beijing thinks that the renminbi has reached a reasonable equilibrium. They perceive that the value of the currency will be subject to more volatility, rather than a straight trend of appreciation or depreciation,” says Song Gao, which, according to Bennett, implies a move away from the traditional understanding that China remains an emerging market, and towards its gradual arrival as a developed economy. “Emerging markets tend to trend, developed economies are cyclical.” Of course this does not suggest that China is already a normal economy, but perhaps that normality arrives in stages.

Capital Accounting

Ahead is the much larger project of opening up China’s capital account, towards which the widening of the daily trading band is a mere baby step. In this respect, China is remarkably self-contained for the moment.

The Bank of England released a report in late 2013 estimating that although the Chinese economy accounted for approximately 10% of world GDP in 2011, it nevertheless held less than 3% of global overseas assets and liabilities (comprising cross-border direct investment, bank lending, equity ownership and central bank foreign currency reserves). The same report forecasts that China could expand from holding 3% in 2011 to holding over 30% of global overseas assets and liabilities by 2025. If the forecasts are remotely accurate, the scale of likely capital inflow and outflow raises eyebrows and regulatory pulse rates, begging the question: can China’s regulatory framework handle an internationalized currency and liberalized capital account?

A further study from the Centre for International Finance and Regulation in Australia has forecast capital outflows increasing from $250 billion to $5.5 trillion in the next 10 years, and the inflows increasing from $222 billion to a staggering $7 trillion. These transactional volumes invite some thoughts on the impact of potential dislocations, and given that the foreign exchange market will serve as one of the principal conduits for these enormous flows, it is not entirely surprising that so much attention is paid to the pace and sequencing of efforts to internationalize the currency.

Destination Normal

Fortunately, as Andrew Walter, Professor of International Relations at Melbourne University, makes clear, the rough outline of China’s progress towards full integration in the global economy, an internationalized currency and an open capital account has been agreed for years. “It was, broadly speaking, a matter of consensus among the leadership and the reformers as well, about the appropriateness of the destination, but where there was relatively little consensus, and conflicts between the IMF (International Monetary Fund) and the Chinese tended to emerge on ‘how quickly’ and ‘what sequencing of steps’ and so on.”

Unfortunately, Walter adds, “we’re seeing a lot of contradictory developments in China under the new leadership in the last 18 months.” “They are deeply split between liberal minded reformers and a number of people in the private/party sector, who are probably less sophisticated, that don’t like things like liberalized FX rates because they don’t want to deal with the consequences—exchange rate volatility and higher exchange rates—and want to continue to use the banks as primary tools of control in the political economy” Walter refers to persistent soundings from within the inner echelons of the Chinese political hierarchy: there is just too much at stake and that the program of economic liberalization—normally associated with China’s Premier Li Keqiang—must take a backseat to a program of political consolidation within China.

“Xi Jinping needs powerful allies, and a lot of powerful allies are opposed to the reform agenda,” Walter says. The possibility emerges that China’s relations with the rest of the world are perhaps more conditional than the assumption of a linear path of internationalization and liberalization might suggest. “First of all, we have to acknowledge the fact that Chinese leaders have been historically only focused on domestic issues, even in the last three decades of reform,” says Song Gao, adding, “it just happens to be the case that all of a sudden they wake up and realize that they have become the world’s second-largest economy.”

Shifting Expectations

History is also dragging down prospects for renminbi internationalization. In 2009, Zhou Xiaochuan, Governor of the PBOC, explicitly referred to the Triffin Dilemma—a paradox of conflict between a country’s national economic incentives and global economic incentives when that nation’s currency is also a reserve currency, first iterated in the 1960s by economist Robert Triffin—in criticism of the of loose US monetary policy in a world where the dollar is a reserve currency. Ironically, the same dilemma could be in store for China if the renminbi becomes a reserve currency, as it would also be subject to the pressure of appreciation as a consequence of other countries holding reserves denominated in renminbi. In that scenario, China could very well end up running a current account deficit, accumulating debt, and suffering the effects of an artificially appreciated currency.

But Walter suggests that China’s complaints are simply an exercise in flexing an “increased voice.” “[This is] primarily a negative form of influence or power, an attempt to retain autonomy to ensure that the IMF isn’t able to dictate what China chooses to do.” Walter says. In effect, China’s trying to exert its influence to institutionalize flexibility toward its anti-market behaviors. Bennett takes a more optimistic view.

“The IMF and World Bank are organizations where the Chinese do not have a great deal of—or any—influence, and I think for sure they want to have more say.”

With the widening of the daily trading band China has taken one small step in the direction of liberalization, while undercutting the move with accompanying FX market intervention. This double move has effectively raised the prospect of currency internationalization and capital account liberalization. But at the same time it has reminded the key players that the PBOC will continue to seek outcomes that suit China’s interests rather than meekly surrendering to the uncertainties that accompany market forces. China remains on the path to meet international expectations, but we can anticipate that they will exercise greater influence over how those expectations evolve.

As Bennett summarizes, “there is a push within China to become more normal, and for normal to look a bit more Chinese.”