Transsion has taken a multi-brand approach to multiple price-points in each market that it operates in

The sky at the opening ceremony for this year’s African Cup of Nations was filled with the first-ever choreographed drone show on the African continent. At points throughout the performance, the luminous drones shifted into formation, spelling out TECNO, the sponsor of the event and one of the three mobile phone brands that occupy almost half of the African market.

All three brands are owned by Transsion Holdings, the fourth biggest phone manufacturer in the world and a company that has been the guiding force in developing feature and smartphones designed to suit the growing African market over the past decade and more.

Now that the company has cemented itself in markets across the continent, it is looking to expand its global reach further. But rising competition, the growing digitalization of manufacturing and a dearth of owned patents, all pose challenges to Transsion’s continued expansion.

“What made Transsion unique was its three-brand strategy that catered to multiple consumer segments,” says Ramazan Yavuz, EMEA Director at market intelligence firm IDC. “This strategy, along with the creation of products designed for local demand allowed them to rise up the global ranks of mobile phone manufacturers.”

Dialing in

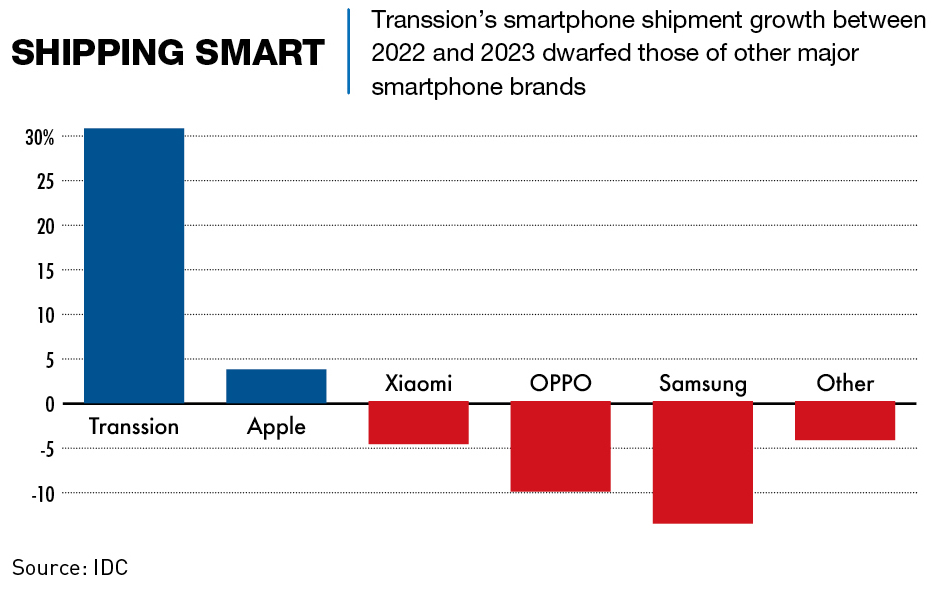

Shenzhen-based smartphone manufacturer and ancillary services provider, Transsion Holdings, was founded in 2006 by Zhu Zhaojiang as Tecno Telecom Limited. After rebranding to Transsion in 2013, the company listed on the Shanghai Stock Exchange’s STAR Market—the science and technology innovation-focused arm of the bourse—in 2019. As of August 2024, Transsion was worth ¥83.38 billion ($11.61 billion) and, according to IDC data, Transsion shipped 28.2 million smartphones in Q4 2023, making it the world’s fourth largest seller, up 68.6% year-on-year.

While much of its manufacturing and R&D takes place in China, the company operates primarily in markets across the Global South under its subsidiary brands TECNO, iTel and Infinix. Across the three brands, Transsion offers a notably large selection of products, with models available for a range of different price points and with tailored features such as extended battery life in areas with less consistent electricity access and improved camera functionality for consumers with darker skin tones.

Transsion also owns and operates brands that extend beyond the handset market. Oraimo specializes in smartphone accessories such as power banks, chargers and headphones, Syinix is a consumer electronics play, and Carlcare, which is akin to Apple Care, provides dedicated after-sales services for the three handset brands.

“The products are mostly produced in Shenzhen, but they are completely designed for Africa and other target markets,” says Tao Zhigang, Professor of Economics and Strategy at CKGSB. “They have also been quick to move into different areas such as foundations of mobile services and complementary charging technologies.”

The company has also branched out into the software space, with its music app Boomplay. “Transsion hasn’t just developed its hardware offerings, but also its software,” says Seyram Avle, associate professor of Global Digital Media at the University of Massachusetts, Amherst, Global Horizons Senior Fellow, Swedish Collegium for Advanced Study and former visiting fellow at the Harvard Center for African Studies. “Boomplay has become a well-used music app across the African continent after Transsion signed multiple deals with record companies to build up a large catalogue of music of African origin.”

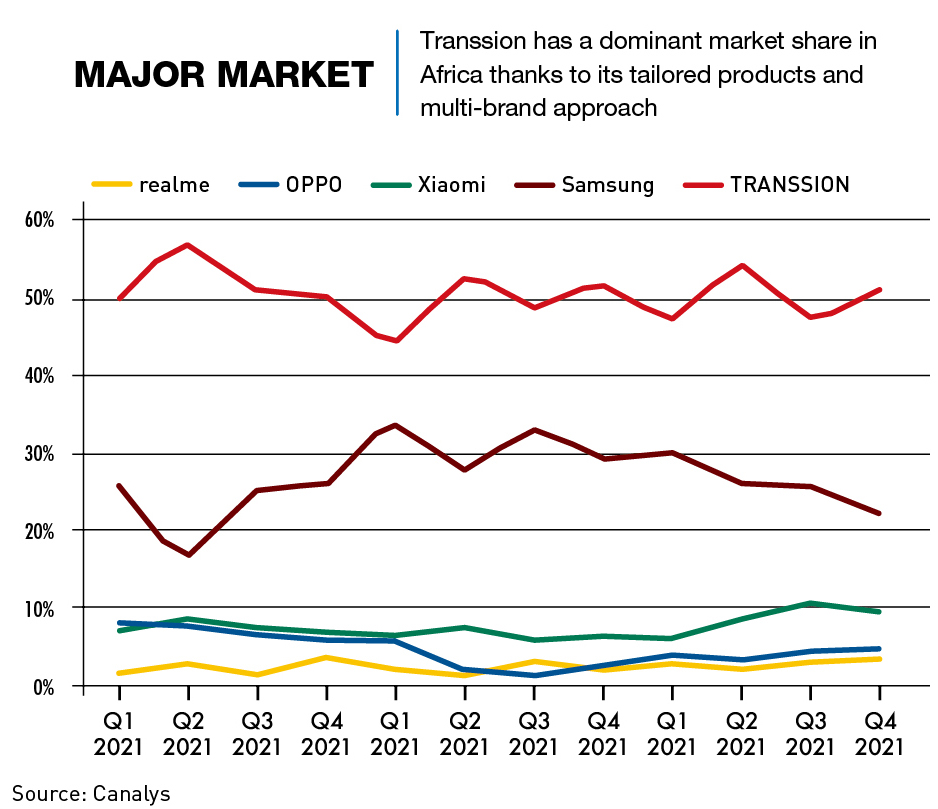

Africa was the company’s first major play, starting in 2008, and the company now holds a majority share of the mobile handset market in many of the continent’s 54 countries. According to Canalys, Transsion controlled 48% of the African market in Q3 2023, shipping 8.6 million smartphones, well above second-place Samsung at 26%.

More recently, the company has begun expanding into other markets across the globe, including several in Latin America and a number across Asia, ranging from India to Indonesia. According to IDC, in 2023, around 50% of Transsion’s operations were located in the Middle East and Africa, with 30% in APAC, 10% in Latin America and between 9-10% in Central and Eastern Europe. This is a marked change from 2015, where 88% of operations were in Africa and the Middle East and just 12% were in APAC.

“What we are seeing is a company that grew in Africa and is now expanding to all regions across the world,” says Yavuz. “After the point where they were successful in Africa they next targeted the Indian subcontinent, where they opened up local assembly companies and saw some strong growth, and right now they are growing in APAC and Latin America. But there aren’t any real signs of the company targeting markets in Western Europe, the US, Canada or Japan.”

Quality connection

The company has utilized several winning strategies to cement its dominance across Africa. One such strategy was to develop the company’s products under three distinct brand marquees. “Consumers knew about TECNO, iTel and Infinix as separate entities, but they do not really associate them with each other,” says Avle. “This helps them promote competition in the market, but also keeps it within the company to some degree.”

The segmentation also allowed them to provide products across each cost segment. iTel focuses on the low-end more affordable handsets, TECNO on the low- to mid-end segments and Infinix on the higher-end $200-$400 segments to compete with larger manufacturers such as Xiaomi, Samsung and Apple. At the same time, each brand still offers handsets for less than $100 to provide some level of affordability.

“The pricing was very suitable for African consumers at a time when the global brands were too expensive for those with a low income but a desire for a smartphone,” says Yavuz. “Also, because the company had time in a relatively niche market, they were able to establish a solid distribution strategy across big cities and rural areas. This helped gain brand awareness and reach a wider consumer base.”

It is important to understand that the African market demand is still split down the middle between feature phones—a cellphone that contains a fixed set of functions beyond voice calling and text messaging but is not as extensive as a smartphone—and the more modern smartphones. Acknowledging this was part of Transsion’s tailoring of products to market needs, something it did on a country-by-country level.

Progressing from there, the company sought to react to specific market needs and add features as required by their target demographics. For example, they were one of the first companies to offer the Amharic alphabet on the mobile phones produced in their Ethiopian factory. As a result of this approach, Transsion has offered, at times, up to 50 different handsets at once—a number far higher than the average on offer from competitors such as Apple, Huawei and Samsung, whose offerings tend to number in the low-to-middle single digits.

A particularly in-demand feature has been improved camera quality, with technology that better responds to the darker skin tones of the African consumer base. Africa is currently the youngest continent in the world, and providing cameras that help with reflecting darker complexions at night or in environments with little light emphasizes the appeal of Transsion phones in the younger ‘selfie generations,’ as well as older consumers.

“The company conducted research to find out what its consumers wanted and acted accordingly,” says Avle. “For example, the demand for better cameras came in part from studies they did with young people in African cities, particularly those that use social media often.”

Tecno’s CAMON series—short for ‘camera monster’—Infinix’s S selfie series and iTel’s S Brand are all focused on increased camera quality, particularly in the front-facing cameras of their products, and prices range from $60 to $250 for higher-end products.

Another tailored feature provides better quality battery life in markets with varying levels of access to, and reliability of, electrification sources. As with camera quality, there is a diverse range of models on sale with varying battery sizes for those who need to prioritize battery life over other types of functionality.

Transsion also offers handsets with multiple SIM card slots to help consumers better utilize the large number of telecommunications service providers on the continent. “Every country in Africa has many operators,” said Qiu Yusheng, Transsion’s former Head of Investment. “These operators have different strengths and weaknesses in signal coverage in different regions, meaning users often need to use several SIM cards to ensure signal when calling from different places.”

But the company went further, and in cooperation with Amazon, it has built up its cloud service offerings to reduce the need for multiple SIMs. “We have customized technology for mobile phone chip manufacturers to hide all SIM cards behind the cloud,” said Qiu. “As long as a Transsion mobile phone user can connect to the internet, even if there is no SIM card in the phone, the software-as-a-service (SaaS) platform can locate one and automatically develop a plan with the strongest signal and cheapest tariff for the customer.”

Transsion is also supplementing its offerings through its other subsidiaries. Accessories brand Oraimo, for example, offers a range of battery-related products, from handheld power banks to portable solar generators and home energy storage systems. For example, the PowerSolar 38 solar home lighting system provides portable solar-powered tube lights and three charging ports for phone handsets.

Transsion has also utilized a targeted approach to the needs of new markets. The company’s initial foray into India, for example, was led by iTel, strategically targeting the lowest price segment in Tier-2 and Tier-3 cities and consumers that either couldn’t afford or didn’t perceive a need for a smartphone. It has also developed unique features like oil-resistant fingerprint recognition in nations like India where it has grown as an increasingly competitive player.

Carlcare, Transsion’s dedicated after-sales care service, has also proved popular with consumers and is useful for maintaining customer satisfaction rates. It is also a useful tool when it comes to entering new markets, as it acts as an easily replicable core competency for the company.

“Product repair has always been important but Carlcare was innovative and new in Africa,” says Avle. “That sort of soft service is easily replicable in other markets, and they have introduced it in Indonesia already. There is more competition in these newer markets, so this is something that can help set them apart.”

Transsion’s presence in the manufacturing and technology innovation hub of Shenzhen has helped with the company’s diverse range of products, allowing for quick and efficient iteration based on consumer needs. “It is a perfect example of utilizing the supply chain in China to provide products for elsewhere,” says Tao.

The company also has manufacturers and designers located closer to its target markets, such as its manufacturing plant in Ethiopia and design and user interface personnel in Kenya and Nigeria.

Signal problems

Transsions growth has been impressive, but changes in the global tech environment, legal issues and increasing competition, both local and international, mean that the company faces challenges to take steps to keep up.

Competition is fierce and that results in two key considerations. Global economic conditions mean that vendors have to care about profitability more than ever, and maintaining costs at an affordable level is a challenge for all manufacturers. At the same time, advanced technologies are the key difference maker right now, whether that be through the inclusion of AI or the use of cutting-edge chips.

“Whatever market segment or country you are aiming at, you have to be a technologically advanced company to survive,” says Yavuz. “In this respect, brands like Samsung and Xiaomi have better resources to draw on globally, so Transsion has to invest to keep up while maintaining appropriate price points for consumers and for generating profit. It’s a hard balance.”

With regard to patents in particular, Transsion is struggling to keep up with its larger, better-funded rivals. Aside from some patents related to camera technologies, it is not at the cutting edge of patent creation, and this in turn has an impact on the company’s ability to woo investors.

“Transsion came into the game quite late and is reliant on existing technologies,” says Avle. “Although the products were innovative, they were not anything technologically new. Patents-wise they are behind in a big way and this is a major challenge and concern for long-term survivability.”

It has also become a legal concern, particularly in India. In 2024, both US-based chip designer Qualcomm and electronics firm Philips sued Transsion for patent infringements, and Huawei reportedly filed a lawsuit against the company in 2019 for copyright infringement. Nokia is also pressuring Transsion to start making payments for patented technologies used in the company’s phones.

Transsion has argued that some patent holders “do not own or only own a small number of patents” in some of the emerging markets where it operates, but still demand high licensing fees based on a global uniform rate without taking local factors into account.

What Transsion does have in this area, however, is what they consider a unique data set of consumers drawn from the African market. If or how they can fully monetize and use this to their advantage remains to be seen.

“They have a massive trove of data from a continent that others don’t have and there are concerns about how that data is used,” says Avle. “It’s hard to tell, but it appears, from how they pitch its value to their investors, that the long-term game is to use it to raise additional capital or stock value.”

Competition from local challengers across its operating markets is also growing. Telecom companies from Egypt, Algeria, Kenya and South Africa, among many others, have all released plans to make phones for the African market. Pan-African investment group Mara recently launched a new made-in-Rwanda smartphone aimed at primarily serving African markets. And major telecom companies Orange and MTN have also launched phones to help gain more customers and close the digital divide.

Xiao Yonghui, Transsion’s CFO was also detained by Chinese authorities in September, but the reasons behind the detention have not yet been released.

Future calls

Transsion is one of many companies helping prove that Chinese firms are no longer reliant on the size of the domestic market for success, but at the same time, it is also utilizing the power of the Chinese supply chain in building tailored products for markets overseas.

The company has a very strong baseline of market share and product development that have led to astonishing results in Africa. The innovative and personalized nature of its products has clearly met a demand that was hitherto not being met. But in an increasingly high-tech-reliant manufacturing sector, the company needs to be able to keep up to keep costs down and maintain affordability against growing local and international competition.

“Transsion has actually always been overseas, and we are convinced of this path,” says Qiu. “Chinese people are hardworking and enduring, and have their own unique insights in product understanding and supply chain construction. So as long as we find the right direction and find some like-minded partners on the way, we can continue to succeed.”