Baidu is hoping that AI success will boost the company’s growth prospects

When Baidu launched its AI chatbot in March 2023, there was an air of skepticism in the audience because the large language model (LLM) demonstration was not live, it was pre-recorded.

Despite this embarrassment, Apple and Samsung now use the AI from Baidu, China’s leading search engine provider, on many of their phones on sale in China. But, adoption aside, the AI has yet to distinguish itself from its competitors, and any level of market penetration outside the country has not been forthcoming.

Baidu is one of China’s three legacy tech giants known as BAT—Baidu, Alibaba and Tencent—and, although the smallest of the three, it still registers as a substantial tech company worldwide. The company has seen the least international success and faces several major barriers to achieving a breakthrough.

“Baidu has comfortably established itself as China’s leading search engine and one of the country’s largest tech firms,” says Tom Nunlist, Associate Director at China-focused research and consulting firm, Trivium. “The company has made it clear that it sees a future path in AI.”

But it is yet to really distinguish itself from any of its competitors. “Baidu has a history of attempting to expand into markets and failing,” says a China-based tech analyst who wished to remain anonymous. “The question really is whether it can learn from past market-entry mistakes and push itself to prominence.”

Search criteria

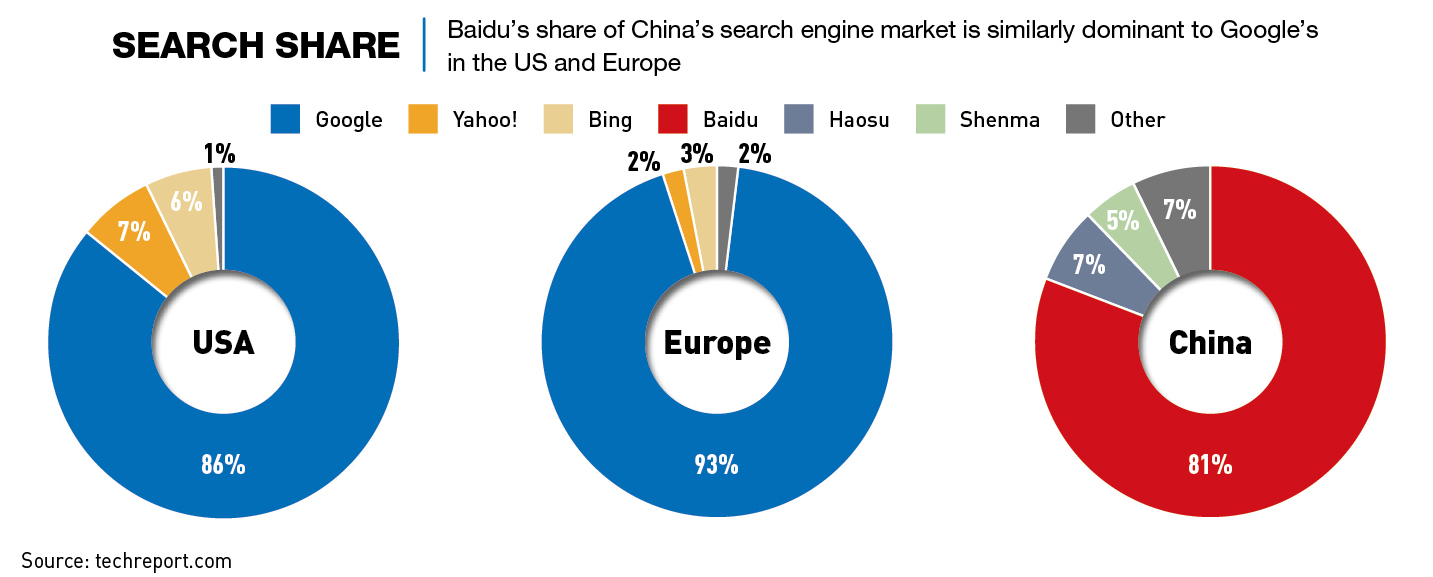

Founded in 2000 by entrepreneurs Robin Li and Eric Xu, Baidu was one of the first internet companies in China, offering search engine services to Chinese users. The company grew quickly and by 2010 had become the dominant search engine in the country by a large margin. Google meanwhile has been banned for at least the past 14 years.

As of September 2021, Baidu controlled 82.5% of the market and boasted around 580 million monthly active users, with its closest Chinese competitor Sogou managing only a 7.6% market share. By February 2024, Baidu as a whole was valued at $36 billion. For comparison, Tencent is valued at $455.53 billion and Google is worth over $2 trillion.

“The search engine has been their bread and butter since it started,” says Kai Wang, Senior Equity Analyst at Morningstar. “It is the core of their revenue, bringing in around 80-85% mostly through online advertising.”

The company also has an array of smaller product offerings. So-called Baidu Core consists of the company’s mobile ecosystem and includes applications such as the Baidu App, its AI Cloud and other AI services and short-video platform Haokan. iQIYI, which Baidu has fully owned since 2012, is an online entertainment service that is often compared to Netflix. The service offers video streaming, including the platform’s original content and other professional productions.

“There have been many examples of trying to copy a market incumbent and not really getting it right,” says the analyst. “It has tried both e-commerce and food delivery and subsequently exited them quite quickly.” The company closed its e-commerce venture Youa in May of 2024, after failing to gain traction against Alibaba’s dominant Taobao.

Baidu is increasingly focusing on various AI tools, with ERNIE Bot, the AI chatbot launched in 2023, its flagship in the sector. Company statistics show it is spending around 20-25% of its budget on R&D—although this also includes iQIYI. But as other companies make headway in the China AI race, Baidu’s stock market performance has fallen behind. At the end of June 2024, Baidu’s New York stock price had fallen around 36% over the previous year, whereas those of Microsoft and Google stocks had grown by nearly 50%.

“AI development is definitely the play for them,” says Nunlist. “But the same can be said for the other BAT companies as well as a number of smaller startups.”

Baidu’s operations are concentrated in China, but the company has established a small presence elsewhere. Baidu has a $300 million R&D center in Silicon Valley which opened in 2014, with the goal of conducting AI research, primarily in self-driving software.

b-AI-du

The importance of AI to the future of the global economy is well understood and, in Q1 2024, Baidu’s revenue for generative AI services reached ¥656 million ($90.39 million), making up just 2% of Baidu’s total revenue. The company’s most prominent AI project is ERNIE bot, and a new iteration of the LLM, ERNIE Bot 4.0, was released in October 2023, containing updates including English compatibility.

The chatbot has seen a reasonable level of success, with more than 200 million users since its initial launch. For comparison, Chat-GPT had around 627 million monthly users in June 2024. “Gross margins in Q1 2024 ticked up a bit, which is somewhat surprising, but also AI costs get lower once you can reduce the amount of data you need to pump into it,” says Wang. “At the same time, they are yet to really monetize the consumer side, so that is an option for them.”

In Q3 2023, ERNIE Bot’s enterprise client numbers jumped by over 150% year-on-year to 26,000, and the company has entered into several partnerships with major firms to boost its presence.

In March 2024, Apple, which itself is currently facing dented sales in China, announced that the Chinese versions of its iPhone 16, MacOS and iOS18 would come equipped with ERNIE Bot services, as will Samsung’s Galaxy S24 handsets. Baidu has also partnered to do the same with Lenovo laptops and tablets and smartphones will soon follow.

In terms of user experience and query results, ERNIE Bot, as with other AI models, has proved somewhat unreliable in certain areas. In some cases this can be chalked up to the language barrier—an English request for a haiku resulted in a 9-line poem, while the same instruction in Chinese returned a successful 14-syllable result—but given the need for accuracy, such mistakes are important.

There are several competitors in the China AI space, including Zhipu and Moonshot.ai which both offer similar functionality to ERNIE Bot. But none seem to stand out in terms of user experience and results.

“From anecdotal discussions with various Chinese AI users there is a wide mix of preferences,” says Wang. “Some prefer Zhipu, some Baidu and others Moonshot.ai, it’s still difficult to tell who the clear winners are yet.”

Baidu has also released other AI projects. Comate, an AI coding assistant released in 2023, has been used in the company’s own business operations accounting for 27% of the newly added codebase as of April 2024. There are around 10,000 corporate Comate users, including podcasting app Ximalaya and Shanghai Mitsubishi Elevator. There are also three smaller versions of ERNIE—Speed, Lite and Tiny—that Baidu offers for different aspects of coding assistance.

With the recent popularity of AI, the video streaming app iQIYI has also announced an interest in utilizing AI tools to improve the efficiency of its content production. Some of the tentative ideas for using AI include imitating multi-camera shots and analyzing novels that could be turned into production projects.

Baidu has also created a $145 million venture capital fund, similar to the OpenAI Startup Fund, to help generative AI startups in China, and is an investor in over 100 other companies, many focused on bolstering the company’s own AI ambitions.

The other major focus for Baidu’s AI technologies has been in navigation. The company has partnered with Tesla in China for several years, providing its mapping services for the company’s electric vehicles (EVs). In June 2024, the company announced the inclusion of Version 20 of its mapping services with Tesla models, which is likely to help bring Tesla closer to providing its Full Self-Driving system to China. Nissan has also announced that it will explore a strategic partnership with Baidu.

Baidu has also had its own go at autonomous self-driving with the Apollo project, which focuses on autonomous self-driving with robotaxis. The project began in 2017 but has been operating at a loss ever since. In Wuhan, where the robotaxis debuted, the company’s autonomous driving services only make up 1% of daily ride-hailing orders.

“Baidu’s tech is currently at L4, with L5 being fully-autonomous driving,” says the analyst. “They are close numerically, but the jump between L4 and L5 is huge and as such they are still quite a long way from autonomy.”

Baiding their time

Despite Baidu’s shift towards AI and its long-established dominance in the search engine market, domestic issues with its reputation, access to key technologies and a seemingly calcified management system, coupled with an almost total lack of international presence, mean that there are a lot of problems for the company to solve.

In terms of the company’s cash cow, its search engine business, ad revenues are currently down. “They’re depressed at the moment as they should traditionally be growing at slightly higher than GDP, but only grew around 2-3% in 2023,” says Wang.

Macroeconomic headwinds are one reason for this, but the sluggish growth is also compounded by the fact that many Chinese tech users are starting to find their information elsewhere, particularly on social media apps such as the Instagram-like Xiaohongshu.

Another reason for the reputational and reliability slip appears to be Baidu’s decision to skew towards profitability over usability. While Google faces similar issues of lower ad revenues and the diversification of app use in the rest of the world, the company has taken a more balanced approach between the two, reducing trust loss and user experience issues.

“Some users are gravitating more towards social media, such as Xiaohongshu (RED), for their information needs, partly due to usage patterns, but also because of a general drop in trust in Baidu’s results,” says Ivy Yang, Founder of Wavelet Strategy and author of Calling the Shots newsletter. “One common complaint from users is that top search results are populated from Baidu’s own ecosystem of content, rather than what would be considered the so-called ‘best’ results. Baidu’s focus on profitability at the expense of user experience has negatively impacted perception of the company.”

The company is also facing several organizational issues, in particular a recent public backlash when head of PR, Qu Jing, released videos on China’s TikTok equivalent, Douyin, glorifying China’s work-till-you-drop culture. Qu said she would not take responsibility for her staff’s wellbeing “as I’m not your mother,” as well as stating that “If you work in public relations, don’t expect weekends off.”

China’s younger workers have been increasingly vocal about their dislike of working requirements in the country’s tech industry, in particular 996—the expectation of working from 9-9 at least six days a week. And while Qu Jing has since left Baidu, her views speak to a wider calcification of the managerial approach in the company.

“Baidu has always had a problem retaining talent that it has attracted, for example Lu Qi who went on to work with Y Combinator China or Andrew Ng who also had a stint at Baidu,” says Yang. “I think the fact that Baidu has not been able to keep the high profile and top talent points to a broader culture issue in the company. There also hasn’t been any suggestion that it has changed in recent years, especially with the recent crisis within the PR department.”

Baidu is at risk of getting outmaneuvered by new AI startups that, through developing technologies, now have much more of an ability to challenge incumbents in China.

“AI is becoming more competitive as smaller companies are also entering the industry,” says Wang. “Interestingly, Zhipu just received a massive investment from Saudi Aramco, so that might be indicative of where the race is going.”

The lack of international expansion is also becoming more obviously an issue for Baidu. Other companies are now taking a different approach to enter markets including Latin America. Shein or PDD, for instance, try to distance themselves from their Chinese origins in order to avoid the reputational difficulties that come with it.

But a poor showing in international markets has not stopped the company from facing a slew of troubles. This includes a lawsuit from its US investors in 2021, which has since been dismissed. It accused Baidu of defrauding shareholders about its ability to comply with Chinese regulations governing internet content.

“They have maintained analyst relationships, but there are no longer any Western journalists that have Baidu in their beat,” says Yang. “Without these relationships their image internationally is largely negative as the only stories that get written are about the company’s issues. In turn this can impact investors’ willingness to buy into the company.”

Geopolitical headwinds are also a major challenge for Baidu and other Chinese tech companies more generally. AI software such as ERNIE are dependent upon high performance memory chips; but with increasing global restrictions on semiconductor chips, investors are concerned about how Baidu will face this issue. In addition, there have been concerns over linkages between Baidu’s research and China’s military, which have further exacerbated the issue of access to semiconductor chips as well as trust in using the product.

New generation?

Given Baidu’s history of disappointing entry into and exit from many new markets and a seemingly outdated managerial structure, there are concerns about its ability to adapt to the fast-changing tech environment in China. Baidu is throwing money at new products, particularly related to AI and autonomous driving, but there are always newer and more agile competitors doing much the same thing.

The company is likely to continue to make money in the coming years, thanks to its dominance in the search engine space. But its long-term future is not guaranteed, particularly if it repeats past mistakes and consequently fails to take a lead in the AI space.

“They have a reputation, are well known and are one of the pillars of China’s tech environment,” says Wang. “If Baidu fails in its quest to do AI then the company will likely just trade as a utility, its ad revenue will grow around the rate of GDP and the markets will follow that. But without AI, Baidu will have no catalyst for future growth.”