A revolution is underway in private online banking in China.

Teng Teng, a 29-year-old professional illustrator living in Shanghai, first began using Alibaba’s online transaction service Alipay when she was still an undergraduate student in 2009. But she says she was very slow in trusting it.

“I thought it was dangerous, somebody would take my money,” she says, explaining how she would load the account with just RMB 200 or so at a time. “But I really wanted to try it. It was new stuff.”

These days she uses Alipay, as well as Tencent’s newer WeChat transaction service, all about town. KFC, hotels, grocery stores, they all accept it. She uses it with her friends when they split the bill at a restaurant by sending each other money on WeChat. It’s even become an integral part of her freelance business.

“When I do a [freelance] job, my clients pay me on WeChat,” she says. This is the biggest reason she finally took the leap to link her card—clients demand the speed and convenience. “If I didn’t link it with my card, then I couldn’t accept many clients.”

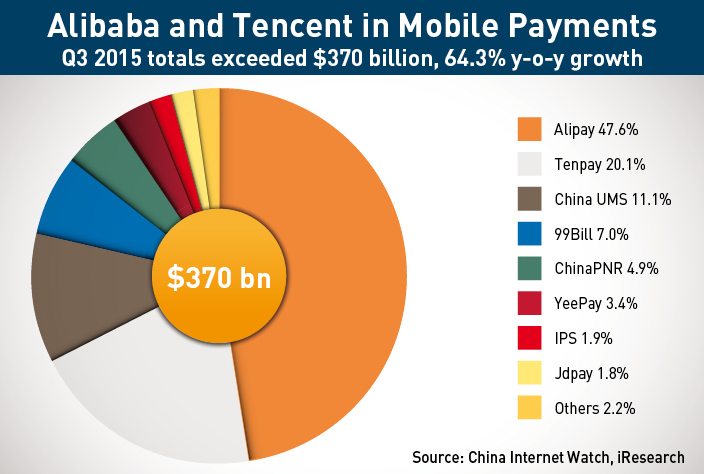

Teng Teng is one of 200 million people who have already linked their bank cards to the WeChat payment system, out of 650 million WeChat users. The WeChat mobile payment system was only launched in late 2012, and is only second place in the mobile payments marketplace with roughly a 20% share—Alipay boasts 400 million users and a 70% share.

The upsurge in mobile transaction services used through now-ubiquitous smartphones is at the heart of a sudden expansion of the online financial services industry in China. This is a diverse and dynamic marketplace with investment, small-lending companies, P2P lending, and most recently the emergence of the first online-only banks: MYbank, 30% owned by Ant Financial (founded by Alibaba), and WeBank, which is 30% owned by Tencent. The tech rivals each control the largest share of their respective banks, with the remainder divided among investment companies, conglomerates and small government stakes below 10%.

These new services provide a much-needed expansion of financial access for Chinese consumers and small and medium-sized enterprises (SMEs), that have long been underserved by the state-dominated banking system.

“[In China] we have non-banked and underbanked in some circumstances. Services cannot get to the right people,” says James McKeogh, a management consulting partner at KPMG in Hong Kong, specializing in emerging technologies. “There wouldn’t be so many [private banking and credit] organizations unless there was a real need in the market to provide lending to a populace which aren’t being served by the traditional banking establishment.”

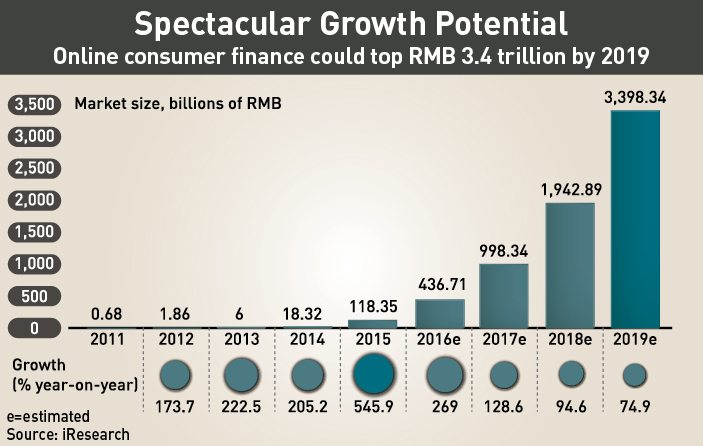

Just how many underserved people are there to be reached? Around 500 million, according to Caixin, a top business news magazine in China. The consumer finance market alone, which excludes small businesses, was estimated to amount to $4 trillion in transactions in 2015, and iResearch predicts it will reach $5.75 trillion by 2019, of which $518 billion will be online.

But it is more than just a potential market. Getting more liquidity to companies outside the state-owned sector is part of the economic transition that Beijing talks about, the demand is there, and the new online financial platforms provide new and efficient tools to do it.

“Entrepreneurship is not an issue in China, it’s more like ‘formal entrepreneurship’,” says Christophe Uzureau, a banking and investment services analyst at Gartner, a technology research and advisory firm. The need is to develop people and “move away from infrastructure investment.”

Perhaps nobody agrees with this more than the Chinese government itself—Premier Li Keqiang personally pressed the “approve” button issuing WeBank’s very first loan on January 4th, 2015. The RMB 35,000 ($5,600) loan allowed truck driver Xu Jun to buy a truck.

But there’s still much work to be done before the revolution can begin in earnest. The business model needs to be further developed, regulations need to be dealt with, and consumers need to be educated—each of which is a tall order in their own right.

A New World of Transaction

The online financial transformation began in 2004 when Alibaba launched Alipay (controversially spun off under Ant Financial Services Group in 2015), which is roughly equivalent to PayPal. By far the biggest player in China’s online and mobile transactions scene, Alipay hosts some 80 million transactions per day on average. Last November 11th on Alibaba’s record-breaking Single’s Day (China’s Black Friday) however, Alipay processed 710 million payments worth $14.3 billion, 85,900 per second at peak sales. Tencent’s Tenpay, which powers WeChat’s payment service, launched in 2005 is second with about 19.2% of the market.

The speed at which online/mobile transactions have taken hold is astounding. In 2006 when these services were just getting off the ground, transaction volume amounted to less than $1 billion. By 2014 it was $1.66 trillion, and this is just the beginning.

“Payment is only the foundation,” says Huang Chen, partner of a private financial information service company in Shanghai. Huang’s company provides loans in the RMB 10,000 range for consumers to make relatively big-ticket purchases, like computers or for dental work. “The potential [for] innovation in the financial industry is huge.”

This established base is allowing for the emergence of services beyond payments. Alibaba and Tencent, as the two biggest players, are naturally dominating here as well. Leveraging Alipay and its e-commerce business, Alibaba established Alifinance in 2011 to provide microloans to vendors on Taobao, Alibaba’s online platform for mom-and-pop shops—by mid-2014 the company had dispersed over $30 billion in loans. And in 2013 it set up Yu’e Bao, a money market fund that allows people to invest the unused balance stored on their Alipay account—the name literally means “leftover treasure.” By the end of 2015, Yu’e Bao had RMB 4.4 trillion under management, more than half the industry total. Zhao Cai Bao, launched in 2014, provides a peer-to-peer (P2P) lending service, where individuals solicit loans from other individuals, in what has become a crowded and troubled industry.

Tencent, perennial competitor of Alibaba, launched a me-too money market fund, Li Cai Tong, in January 2014 after the Yu’e Bao instant hit—in one year it gained 10 million users and RMB 100 billion in funds.

These quickly-mushrooming services are invading China’s long-neglected retail banking space that has customers starving for basic financial products—there are few places to store and invest one’s money, and it is very difficult to secure a bank loan. The money market funds were a direct shot at the state-banking system, at one time offering annual returns of over 8%, far outstripping state-bank deposit rates that can be as low as 0.35%.

AliFinance aimed to solve the credit issue among its own vendors—a move that did not require a banking license, but limits the customer base. P2P finance similarly offers a solution to the credit gap without a banking license, but is very risky and difficult to regulate.

In other words, these services can be seen as workarounds for a system that is fundamentally insufficient. Traditional banks in China generally do not provide credit service to anything but the safest bets—in other words, state-owned enterprises (SOEs) and real estate purchases where the property is the collateral for the loan.

The Need for Innovation

In rough terms, state-owned banks suffer from two related problems—lack of appetite for risk, and lack of impetus to increase profitability. It is for both of these reasons that the government is willing to encourage the development of a limited private financial system.

The banks preferentially lend to SOEs because they are required by official departments to do so and because such loans are less risky as SOEs are ultimately backed by the government. Unfortunately, this habit helps perpetuate the long-standing problem of SOE inefficiency.

“Traditional banks are quite lazy. They can just lend to state-owned companies,” says Huang. “When these companies get money, they create oversized productivity.”

Tightly wrapped up with this is the problem of insufficient measurement techniques for risk and loan performance. For example, as a development bank, it is the Agricultural Bank of China’s (ABC) job to lend to agricultural businesses first, and be profitable second. Again, loaning to SOEs helps mitigate risk, and then because profitability is not the primary mission, there’s little pressure to keep expanding the business by doing something difficult such as figuring out how to eke profit from small-time farmers that need small-time loans. Thus, without the pressure, methodology hasn’t been fully developed. This has led to a predictable contradiction.

“ABC stopped writing financial service to small village people because they don’t have any way to manage risk,” says Huang.

The net result is that big, inefficient state companies are funded at the direct expense of smaller, scrappier, hungrier players that can make a positive impact on the economy. The problem is recognized by the highest levels of government.

“The real economy is like the body, and the finance sector is like the blood,” said Premier Li Keqiang at a meeting with the presidents of major banks in April 2015. “The problem with the Chinese finance sector is not anemia, but poor circulation of the blood.”

At the same meeting, the Premier confirmed that this poor circulation is the exact reason the state supports the establishment of private banks—SMEs just cannot get the credit they need.

“At the end of the day when we look at the Chinese economy, it is driven by the SMEs,” says McKeogh. “It is the Chinese entrepreneur, it is the Chinese manufacturer, [it] is where the wealth of China has come from.”

Neither Tencent nor Alibaba took early funding from Chinese banks. But when they founded WeBank and MYbank, respectively, last year, they took aim at providing a service that they didn’t have access to, armed with the very tools that the state banks are lacking.

Data Can Save the Day

Li Keqiang’s analogy of circulation is right on the money, but solving the problem is tricky. The two-fold question is ‘who needs credit’ and more importantly, of those in need, ‘who deserves credit’—the problem of measuring creditworthiness. And one reason that state-owned banks have trouble figuring this out is that underneath the measurement problem is a data problem.

“That’s one of the challenges in the Chinese market,” says Uzureau. “You have a large pool of small-medium businesses that haven’t been tracked because there was a lack of interest from the big banks.”

Luckily, data is exactly what tech and e-commerce companies such as Alibaba and Tencent traffic in.

“The data they have is very good,” says Uzureau. “[They] have an understanding of not only the creditworthiness of those individuals, but also how they interact with clients, and even the feedback from the clients, so you get some ideas of business viability.”

Indeed, WeBank offered some of its first loans to customers pre-approved, based on user data—and that’s more than simply leveraging the payment platform. What both banks are doing is building out an ecosystem, one that is based on data, into the credit market. According to Uzureau, the key competitive advantage is being able to contextualize financial products for customers—give them products their businesses need based on knowledge about the customers.

But the reality is still very challenging, even if they do have an important edge. “You may have some very good data,” says Uzureau, “but at the end of the day it’s a market where there is still a lack of data.”

On top of that, the likely best customers, the ones with the most data on them are also probably those who have access to liquidity in some form or another. And so there is a need to go down the value chain where the risks are higher. There the rival tech companies face the danger of getting away from their core competencies where things can more easily go wrong.

When it comes to financial services, however, responsibility is not limited to the institution. But so far the regulations have been as murky as the market itself.

Haphazard Oversight

Although the government openly supports financial innovation for small-scale customers by private companies with digital tools, it is still quite apprehensive. With so many new things appearing, regulators are caught between the twin tasks of opening the market and controlling it—both for customer safety, and political need.

The recent history of the peer-to-peer lending space in China is a perfect example of this. Zennon Kapron, founder of financial technology research firm Kapronasia, points out that lending between individuals has existed for thousands of years in China—it’s only been online since about 2010, and largely free of any regulation until very recently. There’s an interesting contrast with another new digital spin on an age old financial instrument: Bitcoin.

“It is only now that we are seeing regulation [in P2P]. Why did it take so long? Bitcoin was immediate,” Kapron says. “It was because it was solving an issue within the industry. It provided funding to SMEs.” Bitcoin, on the other hand, didn’t solve such a problem, and so the government was far less willing to tolerate it.

The regulations that are finally coming down for P2P are in response to what amounts to a public crisis. Massive defaults of online platforms, of which there are surely more to come, have triggered civil unrest and mobilization of police. And although Alibaba’s Zhao Cai Bao has so far avoided its own P2P defaults, the lack of any transparency is worrisome.

Money market funds, such Yu’e Bao and Li Cai Tong, are also coming under increased scrutiny after a period of lax oversight. But the intervention here seems more geared to protecting banks than consumers. At one time Yu’e Bao offered annual returns of 8-10%, which prompted a flood of people to move money out of their low-interest bank accounts.

“Of course government won’t let [Yu’e Bao] keep doing that,” says a Chinese banker that wished to remain anonymous. The problem was people moving their money out of state-owned banks with low returns. “It was forced to reduce the accrual from 2015 [and] finally now has similar accrual with traditional banks.”

For WeBank and MYbank, the government was forthcoming with banking licenses, but appears to be hung up on the key concept of ‘online only’. With the no physical branches, the expectation is that no in-person interaction is required, but that hasn’t fully materialized.

“At the beginning of this year [regulators] allowed facial recognition to do remote account opening,” says Kapron. Facial recognition, an emerging firm of bio-identification, has been the source of significant excitement in this field. “But we think they are geographically limited.”

Kapron allows that he does not know for certain, but notes that these remote openings seem to only have been in second-tier cities, such as Hangzhou, and nowhere else.

Huang agrees the banks are hamstrung.

“The problem is the regulation of online banking is still the regulation for local banks,” she says. “They want to lend some money to people remotely, but they cannot do it. They have to have a person face-to-face sign a contract.”

Meanwhile, in the midst of these external roadblocks, internal tension has emerged between bankers and techies. When WeBank president Cao Tong resigned last September after a mere 10 months on the job, there was speculation that the former vice-president of the state-owned Import- Export Bank of China just could not handle running a disruptive internet company. The departure of vice-president Zheng Xinlin shortly thereafter further raised suspicions.

Uzureau agrees it might be an uncomfortable marriage: “One of the challenges is the concept of ‘ego management’,” he says. The high-octane tech business might not be right for the buttoned-up world of banking.

“For WeBank and MYbank to be successful, they are going to have to become a bit more traditional from a banking perspective,” says Uzureau. “It may sound boring, but it’s banking.”

How Transformative is It?

Just how long it will take to get the regulations right and egos in line is an open question, but the companies seem to believe it is worth the effort. The promise is a commanding lead in a transformed market—but there’s room for doubt.

“When they initially announced [online banking], we were very bullish. This will change the way consumers do their banking,” says Kapron. “What we have seen over the past year is that it hasn’t really changed much. The start and growth has been really limited.” By February this year, MYbank had loaned out RMB 45 billion to 800,000 borrowers—that’s about 1% of the estimated market in RMB terms, and 0.16% in terms of people.

Problems with regulations and the business model aside, it may just be the demand is smaller than expected.

“The other part seems to be the consumers themselves,” says Kapron. “There just doesn’t seem to be a real push to do it.”

He notes that money can already be easily moved between transaction platforms and traditional banks. Unless the sums are very large, more than RMB 50,000 per month, it’s not a big problem. For consumers in particular, the differentiation doesn’t seem to be that great, Kapron says.

And for those who do need the next level of service—loans—there is the issue of trust and familiarity. According to Uzureau, these two elements are essential.

“It’s not only a question of giving access to liquidity, you need to go through a process of customer [learning],” says Uzureau. “To put it simply, they still use tier-1 banks because they know they will not fail.”

Indeed, Teng Teng, who relies on online payments to work with customers, echoes that exactly: “If someday I had a lot of money and I wanted to invest… I would not use any of these services. I would go to a [traditional] bank,” she says.

Even so, Uzureau thinks the transformative potential is there because the business is more than just transfers and loans. It’s contextualizing banking services within the scope of customer business, and threading trust all the way through it. This is both the key advantage and the biggest challenge.

“It’s trying to achieve what has been done from a supply chain perspective [but in banking]. And that is extremely complex,” he says. “We have to look at how the ecosystem evolves. I think today there is too much focus on MYbank and WeBank and the distribution of loans, which is [only a] component of that ecosystem”.

But if they can pull it off, it won’t simply be picking up the slack of the state-owned banking system, but creating something that’s truly new. In that sense, what has been widely seen as slow movement in the development of these banks may really be the result of too much hoopla.

Alipay and WeChat Pay have transformed the way people pay for goods and services in just a few years. Yu’e Bao and its slightly less famous counterpart Li Cai Tong then piggybacked on those systems and have become instant blockbusters. P2P finance had a similar explosion.

WeBank and MYbank could have an even deeper impact, but given the drastically larger scope of the undertaking, it is unreasonable to expect the same speed.

“Going slowly at the beginning… is a good thing,” says Uzureau. “I think we need to give them some time to fine-tune.”