Social media is a major driver of fashion trends in China today

In 2021, a lonely user on a Chinese social media platform posted in search of makeover advice, and received a huge amount of feedback from China’s fashion-savvy netizens. In the three years since, “Classmate Xiao Ai” has become an online phenomenon and a symbol of the love of China’s youth for an entirely new approach to fashion.

Following diverse feedback ranging from his hairstyle and clothing to fitness and career, he has transformed from a nobody to heartthrob blogger. He boasts almost 300,000 followers, and in his offline life he has lost weight, developed a style and also found a wife. Soliciting fashion advice online, dubbed “tingquan” (听劝), has become a major trend, and there are even thousands of international users posting pictures holding pieces of paper bearing the Chinese characters “听劝” to get tips from Chinese netizens.

This is just one of a number of new fashion trends sweeping young people in China and the country’s youth are now drawing from domestic and external influences to define their own style.

“China’s youth is using fashion to express themselves and creating their own styles,” says Gao Liwei, a Chinese fashion blogger. “I’m sure we’ll see more excellent Chinese designers and brands rising up and having a greater impact on the fashion industry.”

Pushing boundaries

Fashion trends in China have undergone dramatic changes in past decades, spurred on by the country’s rapid social and economic development. “In the 1980s and 1990s, Chinese fashion was primarily influenced by Hong Kong, as Guangdong was the main focus of China’s reform and opening up policies, serving as a commercial trade gateway with Hong Kong,” says Wang Junjie, a freelance writer and former editor for Vogue Business.

“Hong Kong’s entertainment culture also thrived during this period. Concurrently, China’s booming economy and opening-up policies spurred a strong interest among Chinese youth in free and exaggerated styles of dressing,” he adds. “For instance, rock-style clothing like bell-bottoms, which were introduced from Hong Kong, gained significant popularity.”

After China’s accession to the WTO in 2001, fashion in the country began to develop under the influence of greater globalization. It was influenced by developed countries across the world, such as the US, Japan, South Korea and several European nations.

South Korean K-pop in particular has had a notable influence on Chinese fashion, as well as on global trends as a whole. Korean fast fashion brand Chuu opened its first store in Hangzhou in May 2021 and has since experienced almost exponential growth, reaching 73 stores across China by May 2022 and double that number by January 2023.

“Recently, brands like Chuu that emulate the style of Korean girl groups have enjoyed success in China,” says Wang. “Korean girl group members are typically very slender, and they often dress in lamei style [meaning ‘hot chicks’ in Chinese], which has become popular among Chinese youth.”

Other than international influences, the resurgence of music festivals, concerts and other performances after the lifting of COVID-related restrictions has also significantly contributed to shaping recent Chinese fashion trends. And these trends tend to be more domestically driven.

The result of this growth has been a booming fashion industry in China, consisting of international mainstays but also a huge number of local, creative and sometimes unique brands popping up across the country.

Major Chinese fashion companies are also playing a greater role in the supply of clothing and accessories to Western markets, with Shein being the key example. The company has rapidly developed into the third-largest online fashion retailer in the US by net sales, selling over $8 billion in goods in 2023, trailing just Amazon and Walmart. The company has also filed for a prospective $63.3 billion IPO in London, after a possible US IPO fell through.

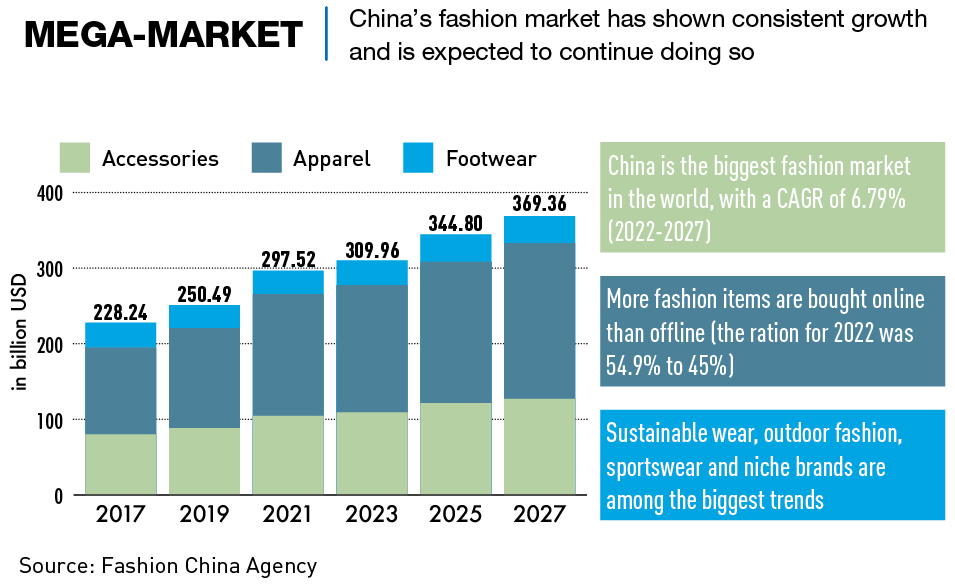

As of 2023, China was the world’s second-largest apparel market, boasting revenues of $313.82 billion, surpassed only by the US market with $351.35 billion. Both markets have grown by around $40 billion since 2018, and the gap is expected to continue to narrow, with China matching the US market size by the end of this decade.

China today

While Chinese fashion has been happy to absorb international styles and trends, there has also been a consistent interest in drawing on aspects of Chinese culture, and this has become very much more pronounced in the past few years.

A prominent example of the inclusion of Chinese culture, history, and mythology within design is Chinese designer Guo Pei, who is perhaps best known in the West for crafting Rihanna’s iconic trailing yellow gown at the 2015 Met Gala. According to Guo, the dress was inspired by her grandmother’s stories and a photo of her in a 19th Century Qing dynasty dress.

More recently there has been the launch of the Yu Prize in 2020, which is aimed at recognizing rising Chinese designers. A Yu Prize event helped kick off the 2023 Paris Fashion Week, bringing together a number of well-known Chinese designers, including Ruohan Nie, Caroline Hu and Rui, in order to showcase the growing talent from the country.

More and more young Chinese designers are also drawing inspiration from traditional Chinese clothing. They are infusing it with a modern sensibility to create the latest chapter of guochao(国潮)—‘national trend’—fashion, known as neo-Chinese style (新中式). Guochao is fueled by Chinese consumers’ growing interest in domestic brands that celebrate Chinese traditions, customs and culture.

Initially dominated by streetwear and athleisure brands such as Li-Ning, guochao has evolved to subtly incorporate Chinese elements into modern aesthetics, often complemented by dyed hair and bold makeup, regardless of gender.

“More and more Chinese people are taking pride in our culture and heritage, and are eager to showcase our traditional clothing to the world,” says Gao. Gao also acknowledges a growing trend of individuals wearing traditional hanfu and neo-Chinese attire as well as the proliferation of hanfu rental shops in cities like Xi’an and Suzhou, akin to the availability of rented kimonos in Kyoto, Japan.

Another emerging trend is urban outdoor fashion, primarily driven by domestic travel needs and consumption behaviors after the pandemic. “Individuals unable to travel during the pandemic have turned to outdoor activities, such as camping, hiking, and climbing,” says Wang. This shift has led to a flourishing outdoor economy in China, with brands like Arc’teryx gaining popularity.

“Following the acquisition of Arc’teryx’s business in China by Chinese sports brand Anta, it has adopted marketing strategies from streetwear brands like Supreme and other luxury labels, which aligns well with the interests of China’s emerging urban middle class, particularly their penchant for outdoor activities,” says Wang, referring to strategies such as using lookbooks and visual merchandising.

Post-pandemic, the concept of Citywalk has become popular, which encompasses everything from aimless wandering to hopping between foodie destinations. This laid-back and budget-friendly travel style has also spurred the rise of urban outdoor fashion.

Another company that has jumped to fill the demand gap is An Ko Rau. Established under the Chinese fashion house Zuc Zug in Shanghai in 2017, the urban athletic-wear label focuses on crafting apparel suitable for daily, casual and fashionable wear. The brand often features non-professional models in its promotions to highlight its focus on the everyday.

Social media-driven

The key driver for both fashion trends and business popularity in China is social media, with platforms such as Bilibili—akin to YouTube—and Xiaohongshu—akin to Instagram—serving as primary sources of fashion inspiration for Chinese youth.

Social media platforms not only feature users seeking advice from others, as with the tingquan trend, but also serve as key drivers of both fashion trends and sales. Brands, influencers and regular users alike leverage social media as a major, and in some cases singular, marketing tool.

Many social media platforms in China integrate e-commerce functions, and according to CBNData, nearly 40% of clothing sales in the country took place online in 2023. Among these platforms, clothing sales on Douyin, China’s TikTok, contributed to nearly 70% of the online sales increase that year.

Social media also provides a direct route to the mass market for newer brands, albeit those with enough capital to spend on endorsements from major online influencers. Founded in 2023, the outdoor brand MissWiss immediately began promoting its lifting yoga pants, known as “shark pants” in China, on Douyin, and posts featuring celebrities and influencers wearing its products, generating a gross merchandise value (GMV) of ¥130 million ($17.88 million).

Another example is the Italian athleisure brand Fila—exclusively licensed to China’s second largest sportswear brand, Anta, in the country—which collaborated with Xiaohongshu and the platform’s top influencers to pioneer ‘old money tennis outfits,’ after noting the rise in popularity of both tennis and ‘old money’ styles on the app.

As a result, within one month of the promotion, Fila’s tennis dresses became the most searched-for on Xiaohongshu, while the overall sales of its tennis skirts increased by 370% year-on-year. A key aspect of Fila’s success was the company’s online consumer research, where, through interactions with consumers on social media, they identified the celebrities and influencers that most resonated with their audience.

Trends and beyond

While trends within China always develop at a break-neck pace, the country’s fashion industry is also beginning to have an impact outside the country. Even though it can sometimes be challenging for international users to access and understand China’s subcultures and entertainment products, Chinese culture is having an increased impact on global youth culture and entertainment.

For example, fashion designer Lei Liushu, along with co-founder Jiang Yutong, runs fashion label Shushu/Tong which has grown approximately tenfold in international markets over the past few years.

Lei, who attributes the rise of K-pop and the influence of feminine designer brands to the broader recognition of his label, notes that certain China-related styles are now becoming more accepted in Western markets. “We used to receive feedback that our brand was ‘too girly’ or overly ‘Asian-oriented,’ but now we’re witnessing a greater acceptance of our style,” says Lei.

Shushu/Tong’s international success is clear, with endorsements from celebrities such as singer-songwriter Olivia Rodrigo, BLACKPINK’s Jennie, and Euphoria actress Sydney Sweeney. The brand has also attracted international collaborations, including partnerships with Estee Lauder, Charles & Keith, and Dover Street Market in London. Lei attributes much of their success to their active presence on social media.

“We’ve been managing our Instagram account since 2016, consistently sharing our designs and campaigns,” he explains. With about 200,000 followers on the platform, the Shanghai-based duo remains relevant in the global fashion market.

Although still a niche, Western luxury brands are also increasingly embracing Chinese design and culture. For instance, British luxury department store Harrods has celebrated Chinese New Year in its flagship London store for two consecutive years through an exclusive collaboration with Chinese design incubator Labelhood. During these celebrations, Harrods adorned its shop with traditional Chinese elements, presenting designs by Labelhood’s designers alongside them.

However, transferring fashion trends from China to elsewhere is not necessarily an easy process. Kevin Lee, COO of consumer insight agency China Youthology, notes that although China transitioned from manufacturing to creative capabilities long ago, there hasn’t been a surge of strong local brands that can successfully penetrate other markets.

“Chinese creatives are more focused on a narrative that speaks to Chinese consumers, and they have not emerged with ideas and narratives that break through for other markets yet,” he says.

Wang also believes that China lacks a significant advantage in pop culture, which often dictates the popularity of fashion trends. Additionally, Europe continues to have considerable influence in the fashion industry, with many Chinese designers heavily influenced by the British fashion education system and the French fashion industry.

“China’s primary advantage lies in its consumption power. The post-COVID urban outdoor trend is largely consumer-driven, but its consumption needs remain domestic-centric and have minimal impact beyond China,” says Wang. “I believe that as Chinese people increasingly embrace Chinese brands and Chinese consumers become more fashion-savvy, the Chinese fashion industry will become more locally oriented and less influenced by international trends.”

Future trends

With high domestic demand along with significant international exports, fashion creatives remain keenly focused on the domestic market and this is also leading to some innovations well beyond the ordinary.

Many Chinese designers are moving past the contemporary and exploring futuristic concepts. Xander Zhou, the first menswear fashion designer from China to participate in London Fashion Week Men’s, frequently explores futuristic themes in his collections, known for their “techno-orientalist” aesthetics. His latest collection delves into sci-fi themes and utilizes generative AI tools, envisioning a future where cyborgs and humanoids coexist seamlessly.

This is just one example of emerging Chinese designers who are exploring the fusion of fashion with cutting-edge technology. Marcela Godoy, Associate Arts Professor of Interactive Media Arts at NYU Shanghai, has observed a growing number of Chinese designers experimenting with technology and AI. The results range from creating filters and avatars for social media to designing digital garments and integrating robotics into fashion.

“In China, you see that now we use phones for everything. I think China is more futuristic than other countries, that it’s super digital,” says Godoy. “That’s why I think there’s a rise in this trend towards digital fashion, Augmented Reality (AR) and these experiments.”

During major shopping events like Singles’ Day, e-commerce platforms like Tmall incorporate AR experiences, enabling online buyers to play brand games and earn rewards through AR interactions. By blending entertainment and shopping, these AR activations attract younger Chinese consumers to luxury brands in the digital space where they then spend significant time. Interactive AR ads in China have seen triple the engagement compared to static ones.

Godoy also cites reactive 3D-printed clothing as an example—garments designed with technological elements that respond to stimuli such as movement, sound, or emotions.

“That’s something our skin does, but we tend to cover it. We’re the only animals that are covering our bodies,” says Godoy. “So how these clothes can become another skin is something that people are interested in experimenting with.”

On a practical level, Godoy also notes the emergence of wearables designed for the elderly on Taobao, China’s e-commerce giant. One item features airbags that deploy upon detecting a fall, aiming to prevent injuries.

Threading through

China’s fashion industry is thriving domestically, increasingly drawing on traditional influences while also spearheading fashion into the digital era.

“China is dictating the fashion trend, for example, Shein has become the big brand of fast fashion [low-priced but stylish clothing that moves quickly from design to retail stores to meet trends],” says Godoy. “People in China are super interested in seeing what you can do with technology. I expect they’re going to start to invest more in fashion and technology.”

While the industry has made some forays into international markets, there are still inherent challenges, such as a limit on China’s pop culture influence on the outside world and a traditionally domestic focus. However, it’s evident that the trends and culture are on an upward trajectory, and China is going to have an ever-greater impact on international fashion trends.

“Many Chinese designers are working hard to bring Chinese fashion onto the global stage, and I am very confident that Chinese trends will exert even greater influence on the world in the future,” says Gao.