There is a growing understanding that to successfully operate in the China market, foreign companies need to show a level of flexibility and responsiveness that may not be required in their home countries, and nowhere is this more true than in marketing and advertising. The industry has become highly digitalized in China in recent years and looks set to continue on that track. But just as foreign companies face challenges in China, so do the increasing number of Chinese companies looking to enter foreign markets.

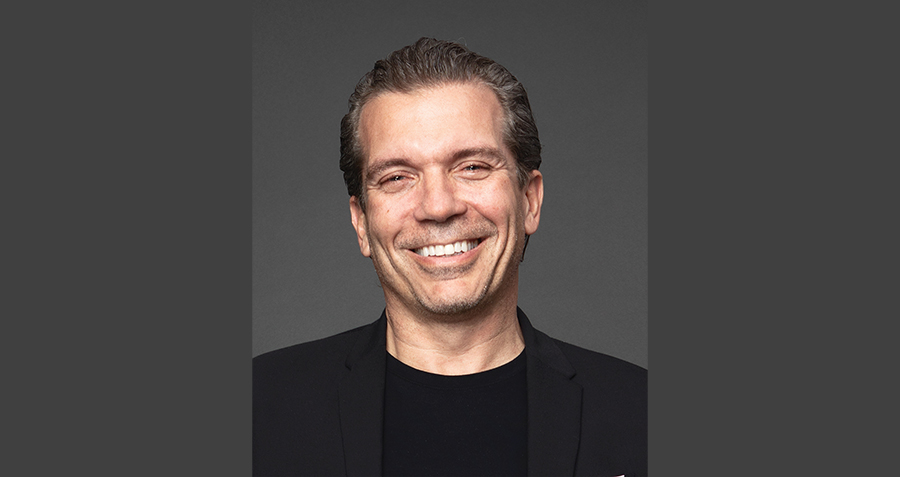

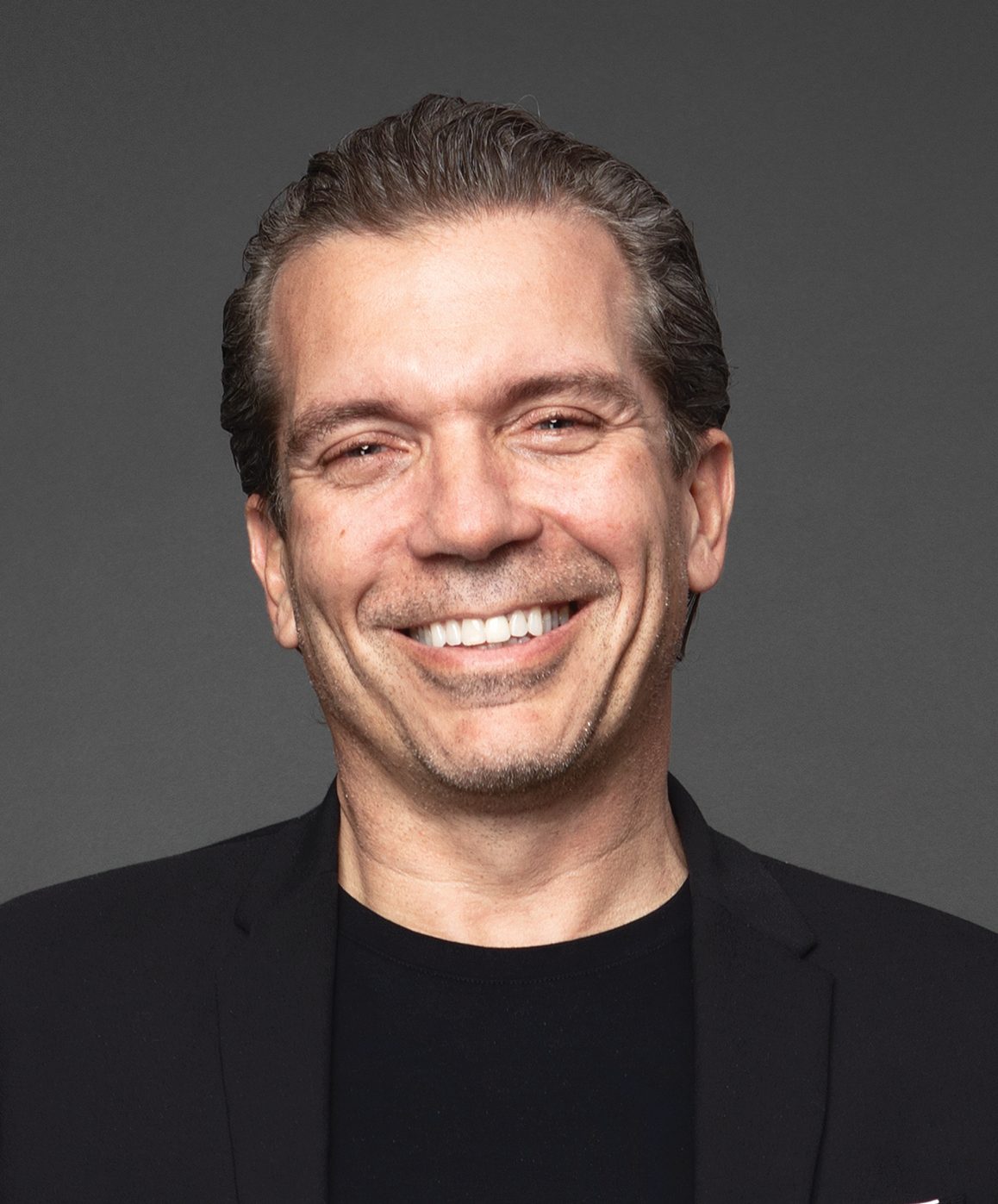

In this interview, Chris Reitermann, CEO for APAC and Greater China of Ogilvy, the full-service creative agency, discusses the advertising and marketing trends in China post-COVID, Chinese consumers’ purchasing considerations and the breakdown of different companies’ spending within the digital advertising space.

Q: What are the main advertising and marketing trends that have emerged in China’s post-COVID era?

A: It’s a very big question. Post-COVID, there are two big trends in China, one of which is changes in consumer behavior. This is more of a macro trend that is influencing a lot of what our clients do, due to the short-termism that has appeared and the uncertainties in the economy. It has been very hard for companies to build over the last three years, and also hard for us to help our clients get a clear view of how the next few years will pan out. A lot of our clients are trying to understand what consumers want and what the changes in consumption have been. But I’d also say that these issues are somewhat universal, rather than China-specific. There is a lot more cognizance of quality of life, self-indulgence and living a better life which influences a lot of our clients’ brands in the way they go to market and the way they innovate and position themselves.

The other key trend we are seeing is consumers trading down, especially when it comes to everyday-use products, where many are choosing cheaper or local brands. What traditionally used to be a big middle layer of market positioning is now struggling a lot. In response, our clients are either trying to premiumize their products or, through various different ways, trying to come up with more competitively-priced lower-end products.

Q: Imported products have for many years had a special attraction for Chinese consumers. How important is the ‘country of origin’ factor today?

A: We have done research over the years looking at how much country of origin influences purchase behavior and found that it is less of an issue for consumers than it is at a political level. When China had geopolitical issues with France or Japan, it didn’t really affect consumer behavior at all in the long-term. There are obviously some links, like people aspiring to own French luxury products or Italian fashion, but there also isn’t a general trend to buy local. But Chinese products have improved a lot and often consumers don’t really see a shift in purchasing these products from a nationalistic point of view, but more from a practical one. If it’s 30% cheaper and just as good a product, then why not buy the local one?

Also in some cases, political pressure doesn’t affect consumer behavior at all. China has tried not to encourage any kind of K-Pop growth in the country, but it still sells well. And it can even have the opposite effect and increase sales.

When you look at successful multinationals operating in China, there is a common thread that has been consistent over the last 30 years. These companies invested long-term in their China business, their brands and they produce competitive products, but they have also localized very successfully to local tastes and behaviors. In general, consumers will respond to a brand on the basis of whether it is good or bad, rather than where it comes from.

Q: To what extent is digital now the most prominent channel for advertising in China and what advice would you give in terms of balancing an advertising budget between digital and other channels?

A: It’s all digital to some extent. For most clients, spending on digital is around 70-80% of their marketing budget and the large majority of the rest is digital in some way. Even, for example, the tiny amount of money spent on radio is often done through podcasts, which are inherently digital.

People like to put things in buckets, so you get the idea of digital as a whole, but it is also split into various categories depending on a client’s objectives. I would say that if a client has $100 to spend, they spend $80 on digital and within that, about $40 is spent on e-commerce-related things. With the other $40, they put money into things like online video, which is money they would have spent on TV advertising in the past, and this is functionally a digital version of brand advertising in the traditional sense. Another large chunk of the remaining cash is spent on social and key opinion leader (KOL)-related routes. Those are the three main buckets: e-commerce, digital brand advertising and social and KOLs.

What is interesting about China is that e-commerce and social media overlap a lot, with any number of social platforms, livestreams and things like that offering ways to purchase products or promote products.

Q: What is your balance of clients between those looking to enter the China market and Chinese companies looking to expand abroad?

A: We work with very few new multinationals that are looking to enter China now. We usually work with very large companies, most of which have been here for many years. This means that a huge trend for us over the past few years has been domestic brands, where there has been a lot of growth. The pattern is often similar, with them coming to us wanting to build their brand into a significant business in China and at some point later wanting to move beyond China to become a global brand in some form.

While there are a lot of Chinese companies that sell and operate in international markets, there are still very few that we would consider as global brands in the usual sense, such as Coca-Cola or Unilever. But you can see that this will happen in the future, and with the domestic challenges in China, I believe we will see an acceleration in large domestic companies looking to move outside of China—there isn’t enough space to grow in the domestic market.

The main difference is the locality of decision-making and processes. For domestic companies, it all happens here, but for international companies, most of it comes from their headquarters and they are looking to localize their China business.

Q: What are the barriers for Chinese companies looking to expand out of China?

A: They face the same barriers that every other global company faces and I don’t think that these are uniquely Chinese. Looking at history, we have seen Korean, Japanese, American or even German companies all facing similar challenges to internationalization. I think the main difference is that the Chinese companies are still at the very beginning of that journey. It is a huge step for a company to go global because it involves overcoming massive talent, cultural and structural issues, and these things take time. Multinationals coming into China still face similar issues because they tend to be HQ-driven and that doesn’t allow for the flexibility required to be successful in China.

I think that is something where a company like Ogilvy, or WPP in general, is attractive because it has a presence in pretty much any market, meaning it can cover the practical and pragmatic issues of entering a specific market, more than the nebulous idea of ‘going global.’

Q: What are the major markets or regions that Chinese companies are looking to expand into?

A: You can definitely say that, broadly, Chinese companies tend to follow the prevailing government direction, so the US is not that popular at the moment. The same is true for Europe in some categories and less so for others. But generally speaking, Southeast Asia, the Middle East and Africa are the first places that Chinese companies would consider going. Eastern Europe and Latin America are also options. Anything that is either closer to home or more geopolitically aligned are where companies tend to go first. At the same time, for the automotive market, there is a huge push for companies entering Western Europe, because of the size of the market there, and the current political agenda of allowing open competition, so it can vary by category as well.

Q: What are your expectations with regard to the growth of the Chinese consumer market over the next decade and how do you expect Ogilvy’s market share to change over that period?

A: Looking at macro figures, demographics and any other data that’s available, you can fairly assume that growth in the next decade or so will not be the same as it was in previous years. That said, I do think that consumer confidence and consumer spending will return, maybe not immediately, but in the mid-term we should be expecting something of a rebound. Consumers become more cautious when faced with uncertainty in capital markets, but I think that the Chinese government will stabilize some of that, and hopefully incentivize companies and consumers to spend more. Also, coming from Germany where negative GDP growth is common, I always remind people that three, four or five percent growth is not bad at all. There are still opportunities for expansion and there are sectors that are doing very well indeed. It will require more strategic rigor and innovation though.

For us, compared to many other multinational agencies in China, our setup is probably a bit more sustainable because we are working with a lot of Chinese companies and this is where the growth is going to be. Chinese clients make up around 40% of our business, but when you look at it in more detail, what we do with and for them is only scratching the surface because a lot of it is still brand or advertising driven. Domestic companies are only now starting to bring us much more complex issues to solve as they mature with the market.

Q: The e-commerce revolution seemingly changed the face of marketing and advertising. What do you see as the next possible revolution?

A: AI will certainly revolutionize our business in many ways. A lot of companies are seeking more efficient ways of doing things and AI will drive huge improvements in how they do marketing, generate content, plan and buy. This will massively shift how marketing is done in the future and how agencies will operate. Beyond business efficiency, I also think that AI will open a lot of doors when it comes to creativity and will change the tools you have at our disposal for the better. If these two come together in the right way, there are a huge number of opportunities and we will see great changes.

It will be interesting to see how China’s big tech companies will evolve and develop in the coming years. I think we’ll see a few new players emerging and the likes of Alibaba and Tencent will transform to focus more on the expansion of certain existing areas and social platforms.

Interview by Patrick Body

Bio:

Chris Reitermann is Chief Executive Officer for the Ogilvy Group in APAC and Greater China, discusses changes in Chinese consumer behavior post-COVID and the massive digitalization of Chinese advertising, with responsibilities for the strategic development and daily operations of the agency across 17 markets. He is a member of Ogilvy’s Worldwide Executive Leadership Board and is also a Global Client Leader for WPP, overseeing global key client relationships across WPP.