CKGSB’s Business Conditions Index, reflecting confidence levels in China business, reveals some small signs of improvement

The BCI is directed by Li Wei, Professor of Economics at the Cheung Kong Graduate School of Business

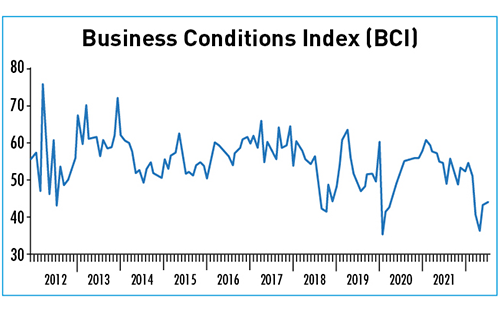

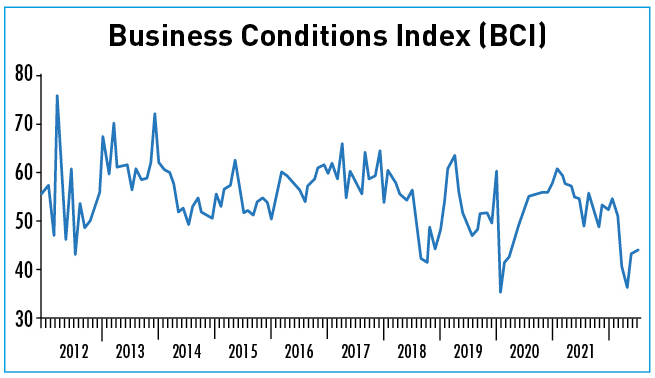

In July, the CKGSB Business Conditions Index (BCI) rose from 42.9 to 44.3, a small improvement on June’s data, but still below the confidence threshold of 50.0. This reflects higher expectations of growth in China’s business community but recovery is still weak.

It should be noted that the government’s policies to stimulate economic growth have had an immediate effect, reflecting the advantages and responsiveness of the Chinese government in focusing its efforts on major tasks. Both our data and that of the government are saying the economy is getting better, and much of this is the result of policy. However, the data also suggest that policy is having less of an impact than before, leaving China’s economy with some way to go before it returns to normal.

Introduction

In June 2011, the CKGSB Case Center and the Center for Economic Research initiated a project to gauge the business sentiment of executives regarding the macro-economic environment in China—calling it a business conditions index. Under the direction of Professor Li Wei, the two research centers designed and tested the BCI survey in July 2011. In September 2011, the first survey was carried out. 128 surveys have now been completed between May 2012 and April 2022 and 123 reports published.

The CKGSB Business Conditions Index (CKBCI) is a set of forward-looking diffusion indicators. The index takes 50 as its threshold, so a value above 50 means that the variable that the index measures is expected to increase, while a value below 50 means that the variable is expected to fall. The CKGSB BCI uses the same methodology as the PMI index.

Key Findings

- • Although it showed signs of improvement, the BCI still remains well below the confidence threshold

- • While travel restrictions remain in place, we hold muted confidence in China’s economic outlook

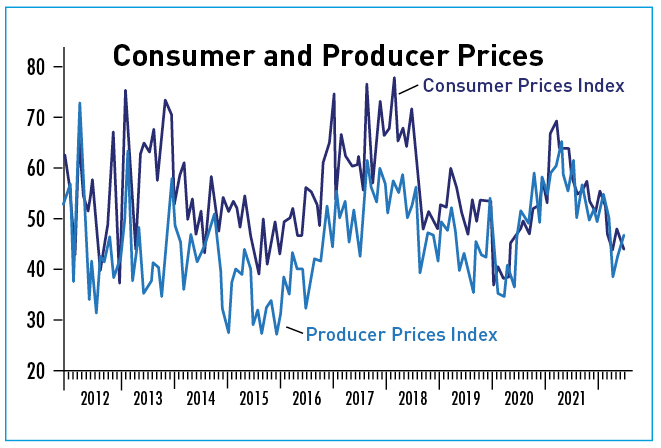

- • The consumer price index fell again after last month’s rebound, falling to 44.2

Analysis

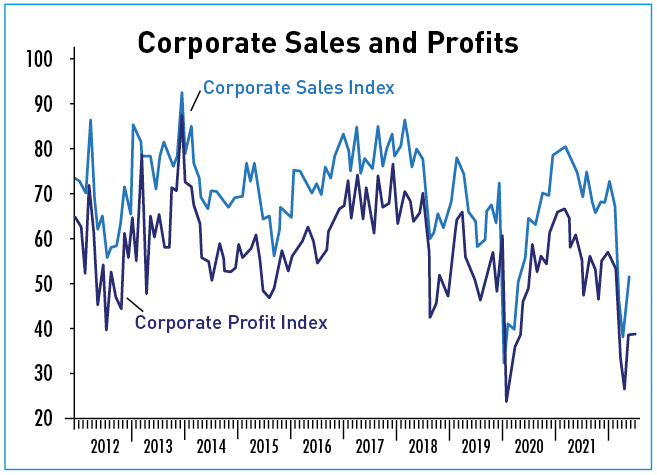

The CKGSB BCI comprises four sub-indices: corporate sales, corporate profits, corporate financing environment and inventory levels. Three measure future prospects and one, the corporate financing index, measures the current climate.

This month, two rose and two fell. The corporate sales index slipped from 50.7 to 49.0, while the corporate profit index lifted from 38.2 to 38.7.

In terms of inventory and finance, the companies in our sample have had a persistently negative outlook ever since our survey began in 2012, and this month does nothing to buck the trend.

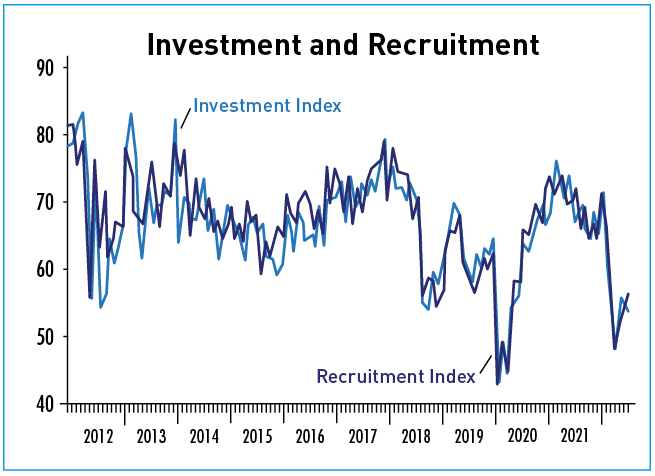

Aside from the main BCI, we also forecast costs, prices, investment and recruitment demand over the next six months. The labor cost forecast rose from 72.3 to 75.4. The overall costs forecast fell back slightly from 78.0 to 77.6.

Turning to prices, the consumer price forecast fell back from last month’s rebound, from 47.5 to 44.2 while the producer price index improved from 40.0 to 46.4.

We now turn to investment and recruitment. These indices have been consistently at the more confident end of the scale since the BCI began. In the past two months, both trended downwards, and both indices hovering at the confidence threshold this month, with confidence in investment prospects at 54.1 from 55.6 last month, and the recruitment score rising from 51.7 to 55.6 this month.

Conclusion

Many of the BCI indices have shown general downward trends over the past few months, but several have shown some form of leveling out or improvement in July. Both our data and that of the government are saying the economy is getting better, and much of this is the result of policy. However, the data also suggest that policy is having less of an impact that before, leaving China’s economy with some way to go before it returns to normal. Based on this and the continuation of China’s zero-COVID policy, we hold only muted optimism over China’s economic outlook.