Mobile wallets are taking off in China but it is too early to say what they mean for the use of cash and bank cards.

As online to offline (O2O) mobile apps take off in China, the online payments field has become a hotbed of activity. Traditional payment methods—such as cash and bank transactions—are gradually getting left behind as aggressive third-party payment channels take over. Chief among them is BAT, namely Baidu, Alibaba and Tencent, who have all developed their own online payment platforms.

A survey conducted by iResearch shows that Alibaba’s Alipay had the highest penetration rate among third-party payment methods in 2014. Over 90% of the survey respondents used Alipay in 2014, double that of Tencent-owned WeChat Payment’s 43.4%. Ranking No.3 is Tencent’s Tenpay (39.6%), followed by China Pay (27.6%), the online payment service provided by UnionPay, and Baidu Wallet (26.2%). In Q1 2015, China’s third-party mobile payment market transacted a gross merchandise volume of RMB 2 trillion, up by 39.2% compared to the same time previous year.

The report also said that in 2014, Alipay took up a dominant 82.7% market share in terms of users, while WeChat Payment and Baidu Wallet accounted for a much smaller 4.2% and 1.4% respectively.

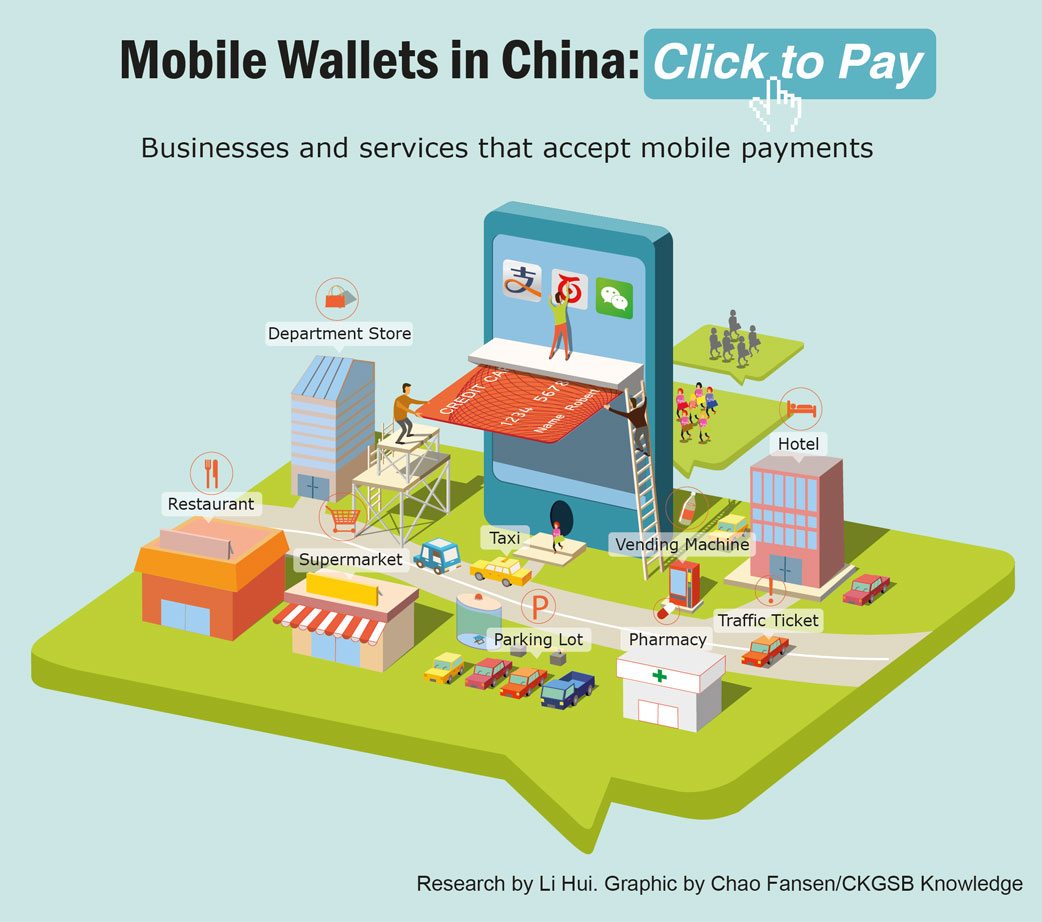

But what users care about the most is whether these payment channels make their life easier. Take WeChat Payment and Alipay for example. The two payment channels combined cover almost all daily expenses. With WeChat Payment and Alipay, customers can now check out cash-free and bankcard-free at convenience stores like 7-11, supermarkets like Carrefour, restaurants like Haidilao, pay bills at hotels, pharmacies, parking lots, vending machines, taxis, and even pay for traffic tickets in some cities. The use of Baidu Wallet, on the other hand, isn’t that widespread.

The mobile wallet trend has only just begun. But eventually, will mobile payments replace physical wallets? Remember how some years back people imagined that cash will die out because bank cards were the in-thing? It is too early to anticipate how things will pan out. But these third-party payment tools are indeed making shopping a lighter experience. Different kinds of businesses and services in China are allowing customers to pay via mobile wallets. So next time you go shopping, leave the cash at home.