There is a lack of centralized financial support for China’s local governments, so many of them are becoming creative in the production of new revenue streams

Mouth-watering images of sizzling skewered meat grilling on open charcoal dominated Chinese social media in early 2023, and they were all taken in one place—Zibo, an obscure industrial city in China’s eastern Shandong Province. Zibo is not a typical tourist destination. You could even consider it off the map, but it had suddenly become one of China’s top travel spots thanks to its cheap and delicious barbeque.

The local Zibo government capitalized on the initial social media buzz, driving the city’s newfound popularity by providing support to and promoting local businesses. It is one of a growing number of examples of local governments across China attempting to diversify their income streams in the face of growing economic headwinds.

Local governments need to come up with sustainable solutions to tackle their mounting debts and falling revenues, and boosting tourism—like in Zibo—is one solution.

“Something that was captured by one group of people and circulated online became much bigger because of a feedback loop,” says Carwyn Morris, assistant professor of Digital China at Leiden University. “That led to more people wanting to go to be a part of this event. The whole thing was intensified through online hype.”

Finding success in skewers

The Zibo barbecue example provides a good case study of a local government harnessing a trend and then the subsequent successful promotion of a local product, because maintaining a base level of business and building it into a functioning ecosystem requires more than just social media buzz.

During the 2023 Labor Day holiday, Zibo launched a high-speed train specifically to serve the massive influx of tourists, with free shuttle buses and free parking. At the same time, the local administration took measures to ensure the prices at barbecue stalls, hotels and other tourist sites were reasonable.

“In order to facilitate high-quality travel experiences for tourists, the local authority has worked really hard across a number of areas,” says Ma Liang, professor at School of Public Administration and Policy, Renmin University. “The fundamental goal for them was to build a trusting relationship with visitors which is the key to the success of the tourism and catering industry.”

Local banks also got involved to help ensure those wanting to expand their business could.

One of them, the Qishang Bank, launched a low-interest business loan of up to ¥1 million ($140,000) available to existing restaurants and suppliers in order to make sure that they were correctly equipped to deal with the surge in popularity.

According to the Zibo Evening News, passenger numbers at Zibo Railway Station shot up by 55% in 2023 over the same Labor Day holiday period in 2019, before the COVID-19 pandemic. According to data from Meituan, a food delivery and hotel booking app, accommodation bookings in Zibo, a city of 4.7 million people, also increased by 800% compared to 2019.

The craze even led to the local authorities issuing a statement telling people to stay away because the city was at full capacity. By the end of April, Zibo Business Bureau data showed that since March, the city’s barbecue business operators served an average of 135,800 people per day, and the city’s March revenues were up 4.2% year-on-year to ¥11.1 billion ($1.6 billion), compared to declines in the previous two months. It was a dramatic turn from an unknown, decaying old industrial city to a buzzing ‘Internet Famous’ city, and it happened almost overnight with the local government deftly catching the wave.

Bigger fish to fry

While the Zibo government’s success in forming a new short-term revenue stream is a positive example, there are more pressing issues for municipalities around the country that an influx of tourism is unlikely to solve.

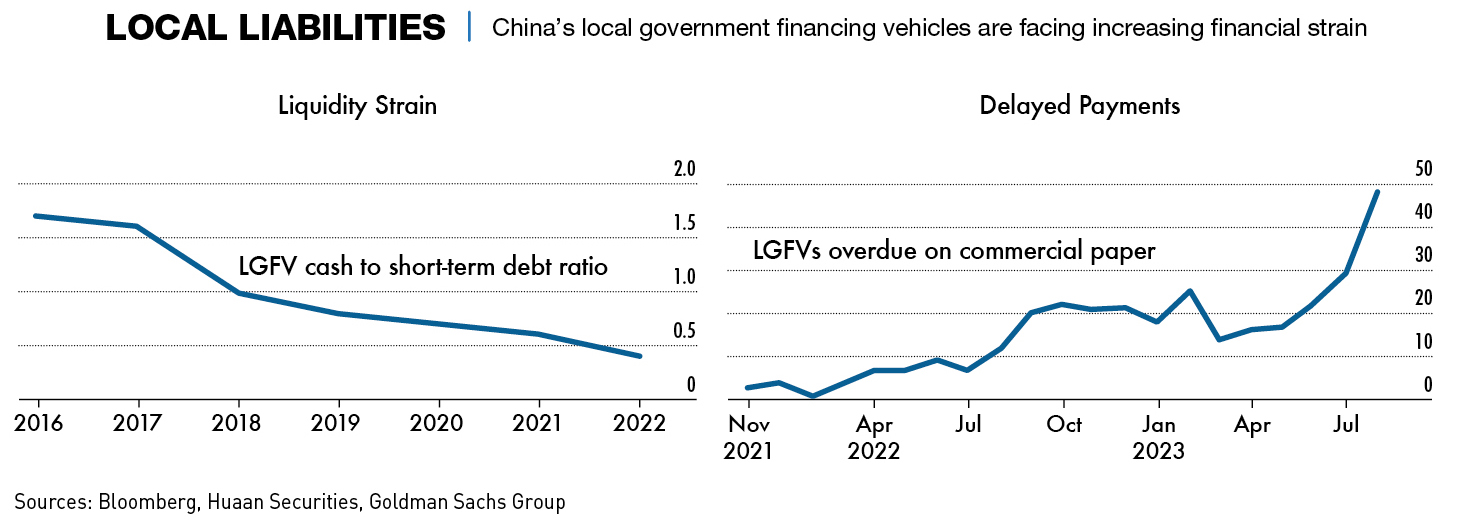

“Tourism is a partial solution for some provinces, but the real issue is that local governments are bloated,” says Alicia García-Herrero, chief economist for Asia Pacific, at Natixis. “Local governments have large amounts of debt held by local government financing vehicles (LGFVs) and then were subsequently the cushion for the central government when it came to COVID-related expenses.”

In recent years, mounting debt at all levels has become a major drag on the Chinese economy, and in April 2023, Goldman Sachs Group estimated that China’s total government debt had reached $23 trillion, or 126% of the country’s GDP.

This is a particularly pressing issue at the local level, where the Chinese Finance Ministry estimates that there were around ¥35 trillion ($4.88 trillion) in outstanding on-the-books liabilities at the end of 2022. But this number does not represent the full extent of the problem, and Rhodium Group estimates that there is also an additional off-the-books debt related to local governments of around ¥59 trillion ($8.25 trillion).

In recent decades, local governments in China have generated income through various means including land sales as well as through the use of LGFVs which usually take the form of an investment company that borrows money to finance real estate development and other local infrastructure projects.

But given the economic headwinds in China as a whole, real estate is no longer the big source of revenue that it once was—prior to the 1.3% growth in Q1 of 2023, the property sector had experienced six down quarters in a row—and it is now necessary for local governments to find new revenue streams to stay afloat and pay back their mounting debts.

“With revenues down from land sales, which made up around 40-60% of balance sheets, there really needs to be a restructuring,” says García-Herrero.

“Over the last 20 years, China allowed local governments to inflate the property bubble and use land as a tax stopgap,” says Andrew Collier, an analyst at Global Source Partners, a macroeconomic and geopolitical research firm focused on emerging markets. “This was easier than restructuring the tax system and reforming the banks and allocation of capital. Unfortunately, as with most bubbles, they come to an end. There is no easy solution at this stage.”

The problems have become more pronounced with reports from cities such as Tianjin of bus drivers failing to receive their salaries, and government officials in other areas being encouraged to purchase second, third or fourth homes to boost the property market.

One option for increasing local government income is the identification of marketable local industries including manufacturing and other products and services that can create revenue streams that can be taxed. Once an opportunity is identified, the subsequent development and promotion of business, both public and state-owned, can generate taxes as well as provide the impetus for the further development of existing infrastructure.

Beyond barbecue

Cities and provinces across China have made efforts to build upon their local points of interest to attract more visitors and derive income by developing ecosystems around them. The 2022 unearthing of cultural relics at the Sanxingdui Ruins archaeological site in Sichuan province was widely publicized with museum visits in the city skyrocketing. The success was such that the local government played a role in funding a ¥1.4 billion extension to the museum, which had a trial opening in July 2023 and includes exhibits such as a glasses-free 3D version of the ruins.

Also in 2022, the tourism bureau in the eastern city of Hangzhou distributed ¥10 million in vouchers for local tourist attractions and surrounding businesses, including hotels, in an attempt to bring in more visitors. Similarly, Guizhou Province partnered with travel website Mafengwo to promote itself as a destination, offering discounts and vouchers for travel.

But looking to tourism for extra income is not going to work everywhere, nor is it a complete solution for local government finances. Various municipalities have been working hard to attract businesses to set up production bases within their borders, with many putting on events or sending trade delegations around the country and even internationally.

The city government of Hefei, capital of Anhui province, has been trying to become an electric vehicle (EV) manufacturing powerhouse, attempting to attract both domestic and international automakers to the region. Local authorities have introduced measures to promote all forms of environmentally clean transportation, including subsidies for EV manufacturers, streamlined approval processes and infrastructure development.

Partnerships with Volkswagen, BYD and NIO have also facilitated technology transfer, accelerated research and development, and provided access to international markets, positioning Hefei as a crucial hub for EV production and innovation. The city’s EV output makes up 7.5% of China’s total.

“Technology like EVs offers some assistance in economic growth but such sectors remain too small and too competitive to fully solve the financial gap,” says Collier.

Authorities in Fujian province announced a plan to hold provincial-level events to attract business and infrastructure projects between 2023 and 2025 that should yield more than 300 contracted projects worth over ¥800 billion. Of those, 240 projects should be from Fortune Global 500 companies.

And some local governments, several cities in Guangdong Province for example, have been particularly active in sending delegates overseas to garner business interest. In November 2022, Guangzhou City sent a 160-person delegation to a beauty fair in Singapore, and in January 2023, the Shenzhen government set up the first Middle East-China cooperation fund with Saudi Arabia’s PIF, valued at $1 billion—part of Guangdong’s ¥200 billion ($29 billion) fundraising target. But these approaches have all been somewhat flawed.

“Inward investment from abroad will not solve the problem of growth,” says Collier. “Earlier FDI was aimed at generating exports, which are now weaker due to the global economic situation. Besides, foreign capital no longer trusts the economic growth or political situation in China and is less willing to make large-scale investments.”

And while local governments have shown the ability to identify and nurture profitable projects, their degree of control is limited, which can hamstring growth. “Local governments have greenlit a number of profitable plans since 2008, and their balance sheets were blooming,” says García-Herrero. “But the centralized tax system means that only a few things are actually in the hands of local governments and they have been quite constrained in their capacity to increase revenues rapidly.”

Central influence

While local governments bear the responsibility for developing local businesses, clear guidance and support from the center is often lacking, which is crucial given the highly-centralized nature of the Chinese system. Policy changes are often made nationally with local governments being given a goal to achieve with no clear roadmap to do so. Additionally, central government funding is getting harder to come by as China’s economic growth slows.

Local governments are basically left with only two options, raise tax revenues or sell bonds. Because of this, projects with a quick return on investment, or those that quickly fulfill government requirements, have become the priority for local governments. This means that short-term solutions are prized, even without a guarantee of long-term sustainability.

The situation also tends to reinforce the importance of state-owned enterprises (SOEs) over private companies, as they offer more direct income streams to the local government, even though they tend to be less efficient.

“SOEs have better access to bank loans than private firms but the misuse of capital remains a problem,” says Collier. “What local governments may do is attempt to sell off state assets to generate cash, but they will face significant political opposition among powerful state interests.”

But some areas are trying to allay these concerns. In early 2023, the southern manufacturing hub of Guangzhou put forward a draft paper that seeks to grant equal market access to private businesses.

The national government is also providing more guidance and economic incentives in some parts of the country. There are a number of special economic zones (SEZs), areas that bring together related economic activities, such as manufacturing, industry or R&D. There are seven such SEZs across the country, as well as a number of other categories of clustered business activity, such as free trade zones and high-tech industrial development zones.

Hainan, an island province on China’s south coast, also got a boost from the national government when it became a duty-free zone in an attempt to create tourism and boost domestic consumption. The scheme has been reasonably successful, particularly in the sales of luxury goods.

The concept of ‘Red Tourism’—the promotion of tourist sites with cultural links to the country’s communist history—has also been encouraged by the national government to help local areas attract more visitors to what are often poor or remote areas.

Many of the nationally-driven schemes have been successful, suggesting a need for greater central government involvement in developing local areas. But for the moment, those areas that fall into one of these categories are generally left to go it alone.

Funding for local projects can also come from loans from the large number of small- and medium-sized state banks across China. But many of these small banks, particularly in Central China, are facing insolvency issues and there are always concerns whether the longevity of new trends can become sustainable sources of business growth.

“The banks are also having to lend to sectors that they may not find appealing because the local government obliged them to,” says García-Herrero. “The exposure of local banks to small developers is much higher than the large five state commercial banks. And because the demand for loans is not growing, their balance sheets are not growing. Clearly, the model is broken.”

Flash in the pan?

For local governments, creating long-term reliable income streams is of the utmost importance given their current economic hardships and the main question raised about leaping on social media opportunities such as the Zibo barbecue, is how valuable and sustainable they will turn out to be.

“Urban development and local employment are both issues improved through tourism,” says Ma. “But again, it’s all about timescales.”

Even when Zibo’s popularity was at its peak, there were already skeptical voices questioning whether it would last, which Manya Koetse, editor-in-chief of What’s on Weibo and social media expert, sees as a natural part of the cycle. “Overall, it will maintain an elevated level of popularity compared to before,” she says. “But the main thrust of it will be transferred to the next new thing, likely somewhere else entirely. There is always an initial storm, and then it calms down.”

“The other issue is that China can’t use tourism or new technology like artificial intelligence to replace property as a driver of the economy because they are not large enough segments,” says Collier. “A short-term solution to at least ease the problems would be to allow the gig economy to grow, but the leadership seems reluctant to do that. Otherwise, the only answer for China is full-blown economic reform, to allow banks to provide capital to productive companies instead of monopolistic stateowned firms.”

Without appealing to the central government for funding that may never arrive, attracting business investment appears to be a better long-term solution for local governments to overcome income issues. It is clear that some regions have made smart moves to position themselves at the leading edge of nationally strategically important industries—Hefei being an example—but for many, there is still a long way to go to pay off their debts and not many avenues available.

“It’s about attracting talent and attracting investment,” says Ma Liang. “Local governments need to carefully assess what makes them unique and what can be developed. Despite heavy debt, there is still room to reroute spending and direct more funds to support relevant and critical areas, rather than wasting them on mindless replication in oversubscribed sectors.”