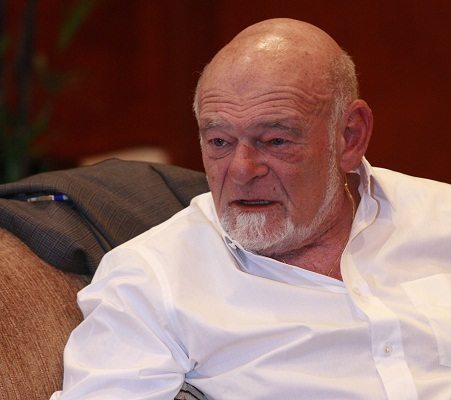

Billionaire investment czar Sam Zell shares his investing secrets in conversation with Liu Jing, CKGSB Associate Dean and Professor of Accounting and Finance

Billionaire property mogul and chairman of Equity Group Investments, Sam Zell, made his first foray into the real estate market while he was still in college. His strategy was simple: buy cheap real estate from distressed owners and sell when the price was high. This tactic earned him the epithet of the ‘Grave Dancer’. Less than two decades later, Zell made his debut on the Forbes 400, a list of the richest Americans. Today his estimated net worth is $4.9 billion, and he occupies the 68th position in Forbes‘ list of billionaires in the US and ranks 216th in the list of the world’s billionaires.

Zell’s investments range from prime real estate across the US to media. He also has interests in finance, energy, transportation and communication. Zell is also the chairman of Equity Residential, Equity LifeStyle Properties, Capital Trust, Covanta Holding Corporation, Anixter and the Tribune Company (publisher of the Chicago Tribune and Los Angeles Times). He created three of the largest real estate investment trusts (REITs) in history. Zell is betting big on emerging markets and has been investing in countries like Brazil, China, Egypt and Mexico.

In late June, Zell flew down to Beijing to attend CKGSB’s Investment Forum the theme of which was ‘Challenging the Odds: Successful Investment in Adverse Markets’. In a lively exchange with Liu Jing, Associate Dean and Professor of Accounting and Finance at CKGSB, Zell shared his investment philosophy.

Excerpts from the conversation:

Liu Jing: We are very interested in you both as an investor and also personally. What factors helped you to become today’s Sam Zell?

Sam Zell: I think, as a starting point, my philosophy is that any time you don’t sell, you buy. So if we had chosen not to sell Equity Office [to Blackstone] for $39 billion, we would be buying Equity Office for $39 billion. My point being that at all times, we are keenly aware of what our exposure is. As a result we are much more of a Benjamin Graham kind of investor. We are very focused on what the liquidation value is. I think it was Bernard Baruch, who was a very famous financier in 1920s, who said nobody ever went broke taking a profit. In the same manner, I have never suffered from any transaction turning out to be “too good”. The real issue is “what is the downside”, and more than anything else, at every point in our process, we address the question of “what is the downside” so that we know the risk we are taking.

For example in 1993, I bought what at that time was one of the largest department store companies in the US. They had 79 stores in malls around the western part of the US. Before we made the investment, I sent my team out and I basically said to them, “I want you to liquidate the entire company on paper. I want you to tell (me) what the inventory’s worth. I want you to tell (me) what we can get by selling the leases. I want you to tell me all of the elements of value. And then come back to me.” They spent three weeks on the road. They came back and said that their liquidation value was worth 80% of what we were paying. What that did for me is it identified the risk. That was that 20%. And then I could then decide, with that exposure, whether I was getting a sufficient return for the risk undertaken. Interestingly enough, that transaction did not work out well. We suffered through earthquakes, and fires and race riots and all kinds of terrible stuff. The deal did not work out well. We ultimately sold the deal and got out. What did we get out for? Eighty percent. So, although we lost our 20%, the key to the investment from a philosophy point of view was to quantify the risk in terms of dollars. What percent of the total of an investment is basically non-risk and where is the exposure? And focusing on that is an incredibly important part of investment discipline.

LJ: In terms of career development, what got you to start investing in real estate and distressed assets?

SZ: We have been most famous for the ability to see around the corner. It is all about both recognizing change and being able to execute accordingly. There have been many, many examples in my career where a change occurred and we had the ability to recognize the change and execute a plan accordingly. In 1995, we invested $50 million in an over-leveraged radio station company. At that time, under the law, you were only allowed to own 17 stations. A year and a half later the government changed the law and allowed you to own as many the stations as you wanted to, but you couldn’t own more than a 40% share in any market. I looked at that change in the law and I said, “This is it.” So I called in the management and I said I want you to go out and buy every radio station in America that you can, and somehow I will figure out how to finance it. We went from 17 stations to 234 in two years, and we sold the company to Clear Channel Communications for $6.4 billion. So again, (this was about) recognizing the opportunity, executing accordingly, and then recognizing when it was time to exit.

LJ: The question is, is any of this teachable? For those who want to be the next Sam Zell, what would you advise them?

SZ: You start by saying, “What is an entrepreneur and what is entrepreneurship?” Is it an art or is it a science? I think everyone has varying degrees of entrepreneurship capability, and just like everything else, there are extremes. I seem to have an extreme version thereof.

It is all about how you think. Entrepreneurs basically not only see the opportunities, but also see the solutions. There is a lot of opportunity in a country that is growing as fast as this one to exercise entrepreneurial talents. If you are an entrepreneur, the word “failure” is not in your lexicon. Maybe it didn’t work out, but you never failed. Therefore, you can get up and play the game again.

LJ: So to be a great investor you’ve got be a great entrepreneur, right?

SZ: And you have to be a thinker. I think that’s a critical element to a successful entrepreneur–he or she thinks in themes, not in single events. Operating on philosophy and operating on those pieces that are critical, in their opinion, to go from here to there.

LJ: Our students have identified the major factors in your investment thinking. One is value, the other one is liquidity, (and) the third one is leverage. Do you agree with the assessment?

SZ: I think that is one of those least understood issues, and that is you can have all of the assets in the world you want, but if you have no liquidity, it doesn’t matter. In 1990, which was one of the toughest (years for the) real estate markets in the history of the US, I was worth well over a billion dollars and I was worried about making payroll on Friday because I had a huge asset collection but insufficient cash flow. The problem with leverage is that you have to pay it back. And an awful lot of people have taken a lot of leverage without focusing on how to pay it back. I think the biggest measure of success or failure is how entrepreneurs address and deal with leverage. I think if you are in the real estate business without leverage, that’s like being a boxer in the ring without a glove.

LJ: Liquidity seems to be quite elusive for a lot of people. How would you judge leverage?

SZ: Liquidity has never been more important than it is today. People talk today about the fact that interest rates, and therefore, the cost of the capital is very cheap. The truth of the matter is that the cost of capital today is very expensive. If you’re investment grade, you can get all the money you want at below the inflation rate. If you are non-investment grade, money is very expensive. And yet because we have a significant worldwide shortage of liquidity, that is why the cost of capital, despite the apparent cheapness, is very expensive.

LJ: So you are basically referring to the liquidity of risky assets.

SZ: I think that very un-risky assets are very over-leveraged. We have office buildings in New York that are no different than single family houses where the debt is significantly higher than the value. And yet the asset itself is terrific. The General Motors building was over-leveraged at one point. It is still probably the best office building in America, but it was over-leveraged. It is not whether it is a risky property or not. It is really a question of: give me the cash flow, tell me what the debt is, tell me where the debt service is, tell me how I am going to pay it off, and then I can deal with the leverage. I do believe that over the next four or five years, we, as a world, have got to de-leverage. It is just too much debt relative to the income flows, particularly in real estate.

LJ: But that seems to be more of a problem for the developed market, right? For example, in China the leverage issue is kind of manageable if you use the international standard.

SZ: Well, I think the answer is there is different leverage in different places. In Brazil the leverage level is very low, much lower than here. And yet the availability of capital in Brazil is much less than it is here. So half the leverage in a scenario where availability of capital is limited is perhaps more difficult than twice the amount of leverage in a different market. That is why in the developed world such as Western Europe, the US and Japan, there is very high leverage. In Brazil, China and other developing markets there is significantly lower leverage because the flow of capital and availability of capital is diminished and therefore, you have to have even less leverage to operate in that environment.

LJ: In the year 2007 you did two really big deals: the sale of Equity Office and buying the Chicago Tribune. Was there some conflict in your thinking, if you think the market was overvalued at that time?

SZ: As far as Equity Office was concerned, as with all of our REITs (real estate investment trusts), we did the NAV (Net Asset Value) analysis every 90 days. So every 90 days we had an opinion as to what the asset values of Equity Office were and what the liquidation value was. When Blackstone came along and basically gave us an offer of $48.50 when our internal NAV was $41. So from our perspective that was such a premium over what we thought the values were that we had to pay attention. The key to that transaction, and maybe the most difficult negotiation with Blackstone, was over the break-up fee. Blackstone wanted a huge break-up fee to discourage any other players and I, of course, wanted no break-up fee and we settled our break-up fee at $200 million on a $35 billion transaction. That attracted Vornado Realty Trust which started to come out of the woods and making noise. We went back to Blackstone and got them to increase the price to $55.50 per share or $39 billion, and then we increased the break-up fee to $700 million. The net effect of which was as the price increased, so too did the barrier against anybody else interfering in the transaction.

LJ: What about margin of safety? It seems that you are very confident about your own evaluation. But there might be a gray area where you say, “I am not totally sure”, right?

SZ: I am a lot of things, but “not sure” is (not one of them). The answer is I controlled the situation, and I didn’t get lost in the $39 billion number. I just looked at it as a very simple transaction, and I had to keep control of it if I was going to get the maximum value. Now going back to the Tribune, what I would tell you is there was no connection between the two transactions. And in the case of the Tribune, I recognized when I did the transaction that it was a very highly leveraged transaction. However, the risk-reward ratio was extraordinary. My investment was $300 million. If it worked, and if it worked without taking any extraordinary risk, we would have the opportunity to make 20 to 40 times our money. So risk and reward was there. During that five-year period (prior to our purchase) the revenue of the Tribune went down by 3% each year. We, in turn, underwrote the deal with a revenue suppression of 6% and felt that would protect us from the erosion of the newspaper business. The first month we owned the Tribune, revenue was down 30%. That was the equivalent of a black swan. Nobody had ever seen a 30% reduction. We obviously couldn’t have underwritten it. We lost. So be it, next. If the circumstances were identical, there is no doubt I would do the Tribune again today even though I know it didn’t work. But the risk-reward ratio is what it is all about. And measuring and gauging that all the time is the biggest safety issue every investor has.

LJ: In the US you are often called the ‘father of the modern American REITs industry’. In China there is no offspring, because we have no REITs. Should we develop a REITs industry?

SZ: The REIT industry in the US was created by a passage of a law in the end of 1960. The goal of the original REIT legislation was to provide an opportunity for the little investor to basically buy pieces of very high-quality commercial real estate. The concept was terrific. The problem was that, during that 30-year period of time, the private market was so much more attractive than the public market. Then in 1990 all forms of real estate financing disappeared and the only access to capital was the public markets. I began, along with a number of other people over a 3 or 4-year period, converting most of the commercial real estate market from private to public. To give you a frame of reference, today the REIT market is about $500 billion. So from 1960 to 1990 it grew from zero to $6 billion and from 1993 to 2000 it grew from $6 billion to $500 billion. So, obviously, it fulfilled the need and demand from the investment community for income and a piece of the action. It also did tremendous things for the commercial real estate market by creating dramatic amounts of additional new liquidity that didn’t exist.

LJ: So is that a good idea for China?

SZ: I think it’s a good idea for every country in the world because it basically results in taking massive amounts of holdings that are generally very concentrated and spreading them out through out the population.

LJ: Here in China investing in real estate is a very big thing for many investors. What is your advice to them?

SZ: Wouldn’t a Chinese investor be better off owning liquid stock with a dividend than owning an apartment in some complex that needs to be taken care of and that has no liquidity by definition? The real reason China should have REITs is that China needs to provide its population with appropriate investment vehicles. And the investment opportunities in this country are very closed with a relatively small group of people. And, in effect, you’re democratizing real estate when you create REITs.

LJ: Before the government introduces REITs, what should the investors do? What do you see actually in today’s Chinese real estate market and is your advice to investors who are interested in Chinese properties?

SZ: What I would say to you is that 10 years ago China had very little capital. If you had the opportunity to buy real estate here, you benefited from the fact that there was a shortage of capital. Today there is no shortage of capital, so I would suggest that the real estate market here is probably overvalued simply because there are so few other opportunities for people to invest that you end up with real estate taking on a much bigger part of the investment scenario. Here it is 50% or 60% real estate while in the US it’s probably institutionally 6-8%, and in the end, that might be a healthy environment.

About Liu Jing: Liu Jing is Associate Dean and Professor of Accounting and Finance at CKGSB. He formerly served as a tenured faculty member at the Anderson School of Management at the University of California at Los Angeles (UCLA-Anderson). He is an internationally recognized expert on capital markets, equity valuation and securities analysis. He holds a Ph.D. from Columbia University.