China’s emerging humanoid robotics space has never been short of surprises. In one recent jaw-dropping stunt, IRON, a full-size humanoid robot from electric-vehicle startup Xpeng, walked on stage with a distinct human-like gait at the carmaker’s 2025 AI Day.

The scene was so surreal that it sparked skepticism as to whether a human was hidden beneath the robot’s soft skin. In response, Xpeng founder He Xiaopeng unzipped IRON to prove it was truly a machine.

Although the rollout of IRON and other similar, life-size humanoids suggests we are edging closer to a sci-fi era of robotics, the sector has been overshadowed by the same old question: What practical things can they do to make our lives better?

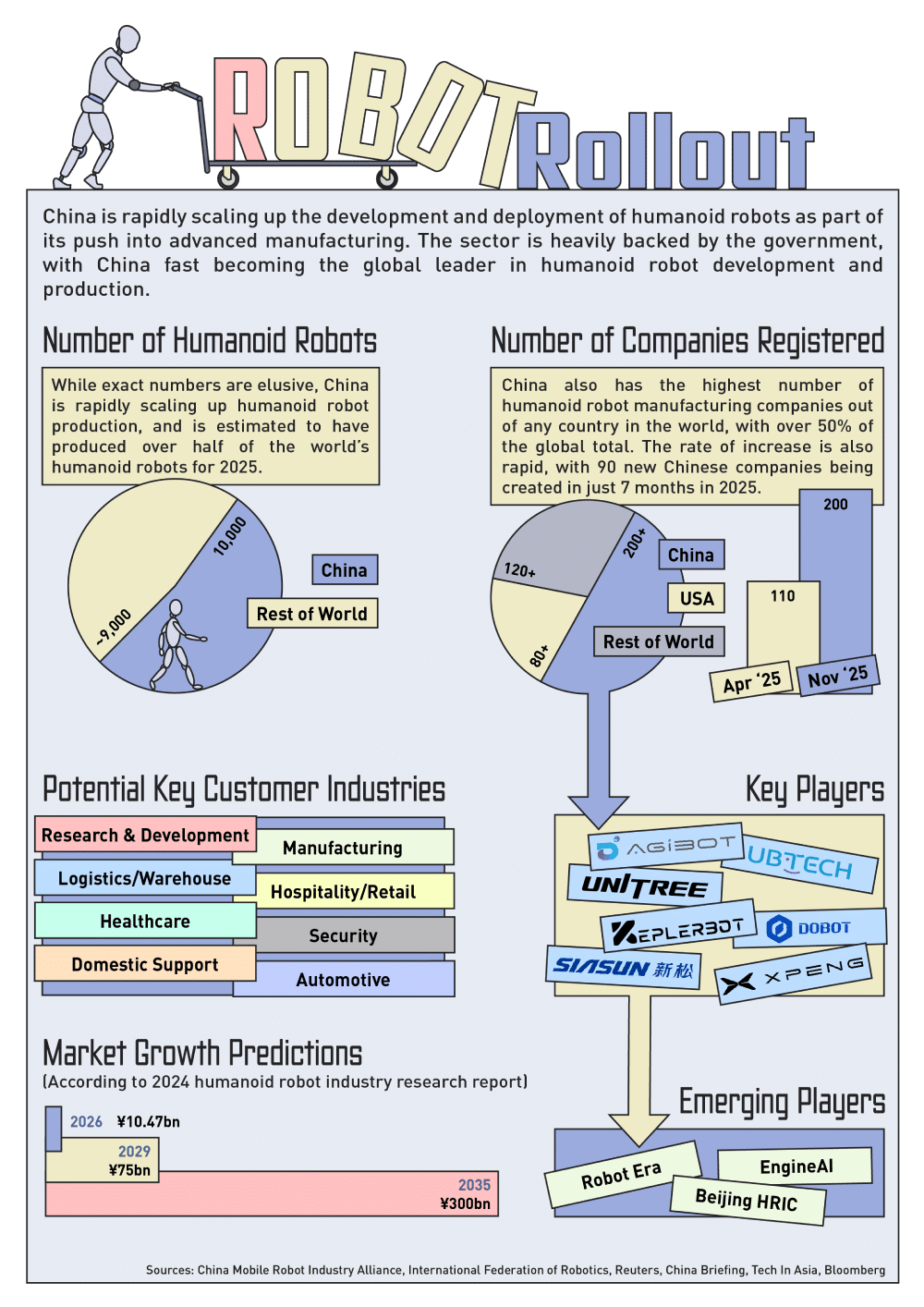

And this stands true particularly in China. While the country is emerging as a leader in humanoid robotics development, it is still behind the US in terms of the capabilities of its robots.

According to Xi Yue, co-founder and president of Beijing-based Robot Era, a leading humanoid robot startup, the sector’s momentum in the last 12 to 18 months has been driven largely by three factors. “A supportive policy climate and abundant capital, a mature hardware supply chain, and increasingly intelligent software have combined to inject momentum into the sector and lifted it to a level unseen before,” Xi says.

Chinese leader Xi Jinping has repeatedly stated the importance of robotics to the country’s future, calling them “one of the most important future industrial tracks.”

The biggest challenge for China to catch up, or even overtake, the US, is in the foundational software and AI autonomy of its robots. Restricted access to AI chips and other advanced technologies are slowing progress towards having humanoid robots with real practical uses.

The history of robotics

Humanoid robotics has a longer history than many realize. As early as 1973, researchers at Japan’s Waseda University introduced the world’s first humanoid prototype WABOT-1—a skeletal, metal-built contraption that needed 45 seconds to take a single step. Progress remained slow for decades.

A milestone came in 2000 with Honda’s Asimo, which achieved bipedal walking, albeit wobbly. Continued advances in motor joints and algorithms culminated in Boston Dynamics’ Atlas—launched in 2016—a hydraulically driven humanoid renowned for its dynamic feats from somersaults to parkour.

In the last few years, Chinese humanoid developers have exploded onto the scene. Their rapid ascent has taken some observers by surprise, given China’s historically modest footing in robotics.

“China’s rise looks sudden from the outside, but it’s really the result of years of coordinated investment, talent and manpower,” says Jack Hallewell, co-founder of Humanoid Robotics Technology, an industry website. “To me, the ‘surprise’ says less about China coming from behind, and more about the West underestimating how powerful that combination becomes once the technical barriers start to fall.”

If video demonstrations are to be believed, an invasion of robot companions or co-workers into homes and factories appears imminent. Robots now appear to display agility rivaling—or even surpassing—humans, acting as floor-sweeping cleaners, cocktail-pouring bartenders and kickboxing bodyguards.

Yet a vast chasm lies between these often scripted, pre-trained movements and truly generalized capabilities in an unpredictable and unstructured physical environment. People are starting to ridicule moments when supposedly dexterous humanoids fail at simple tasks like pouring water without spilling.

The fact is that today’s humanoids are still technically far from the omnipotent creatures we envision. “Adaptability to a diverse range of use cases without advanced fine-tuning is still impossible at this stage. Every scene and action need to be fine-tuned using extensive specific data,” says Lian Jye Su, chief analyst at Omdia, a tech consulting firm.

Beyond performances and delivery to STEM researchers, currently the practical use cases are mainly concentrated in structured settings like manufacturing and logistics. Humanoids are currently best at pick-and-place tasks on factory floors, as their hands and underlying AI systems have yet to match the nimbleness of skilled workers.

“Our assessment is that highly precise assembly tasks are a bit difficult for humanoid robots to excel in. Industries requiring less delicate actions, or those where fine precision is less critical, are likely to be the first to adopt them or see progress,” says Robot Era’s Xi.

In one case the Tiangong, a humanoid robot developed by Embodied AI Robotics Innovation Center, is being used in a warehouse to pick and place items. Yet these machines are still at the stage of carrying out menial tasks, and do not yet possess social or advanced cognitive abilities.

Yet the technical bottlenecks haven’t deterred a wave of entrepreneurs. The humanoid landscape is now crowded with Chinese companies like Unitree, Robot Era, and UBTech, alongside mostly US players such as Tesla, Boston Dynamics, Figure, and Agility Robotics. Tech giants like Huawei and Alibaba are exploring related opportunities and throwing their weight behind the recent boom with capital infusion.

Strong hardware, but not enough

Humanoids are composed of hardware, including motor joints, wirings, drives, actuators, gearboxes, and most crucially, chips. Sitting atop an extensive EV parts supply network—many of which overlap with those used in a robot—China enjoys a cost advantage in building humanoids at scale.

“China’s strongest advantage is obviously the tight integration between its hardware supply chain, research institutes and emerging robotics companies…” says Hallewell. “That lets teams prototype quickly, test aggressively and bring full-stack electromechanical systems to maturity far faster than we typically see in the US or Europe.”

Meanwhile, software, especially the AI “brain” that analyzes sensor data and translates it into actionable commands, is increasingly seen as the true game-changer. ChatGPT in 2023, followed by more advanced intelligence models, offered powerful new tools for roboticists who once relied upon primitive control methods.

“AI algorithms such as vision language model (VLM) and vision language action model (VLA) allow the humanoid robots to demonstrate highly accurate and ultra low latency actions, ” Omdia’s Su says. “While AI infrastructure powered by AI training chipset, hyper-scale computing clusters, and high fidelity physics rendering and simulation engine allow developers to train and fine-tune the robots to perform humanlike motions and actions.”

But even with these improvements, robots struggle to navigate within strict safety perimeters, especially when interacting with vulnerable groups like the elderly or children. Battery life poses another constraint. Often lasting no more than a few hours, it casts doubt over how they can be of real help.

China’s strengths as a manufacturing powerhouse, however, do not offset its deficiencies in key technologies. Its Achilles heel remains access to advanced AI chips and simulation software stacks from companies like Nvidia.

The US currently holds the advantage in AI-driven robotic capability. Companies such as Tesla and Boston Dynamics still hold the world’s most advanced humanoid robots in terms of advanced perception, simulation, and higher-level autonomy.

“A key factor has been the strength of the US AI ecosystem, where companies are able to tightly integrate robotics with leading AI platforms and simulation environments,” Hallewell says. “Nvidia’s role in providing widely adopted compute, simulation, and robotics frameworks has helped accelerate development cycles and standardise tooling across many advanced robotic programmes.”

Without access to the most advanced chips, China’s robots will struggle to catch up or overtake their US counterparts.

Building a viable business model

Over time, humanoid robots are poised to impact multiple sectors, with certain industries likely to see early adoption. Manufacturing and logistics stand out as primary opportunities. Since last year, UBTech, Agibot and a few other players have raced to run trials, often in car factories to test their robots.

Healthcare represents another potential frontier, with companies such as Fourier branching out from medical equipment into humanoids. Its latest GR-3 model is designed, among other purposes, as a care-giver deployable in rehabilitation hospitals and nursing homes.

Household applications such as robot butlers and nannies have yet to gain traction, as they demand stringent safety protocols and more sophisticated designs.

A much-touted benefit of humanoids is boosting productivity in an aging society, a rationale that resonates in China amid demographic decline and labor shortages.

While factor work is already being done to some extent by non-humanoid robots, one of the most crucial areas in which robots could replace humans would be in their ability to take on tasks which would put a human life in danger. Picture a humanoid robot entering a building fire or compromised structure about to collapse to rescue a trapped person, or carrying out tasks in some sort of inhospitable environment, such as deep sea or space.

Asked about the economic driver for adoption, Robot Era’s Xi points out that return on investment (ROI) is key, with many operators willing if deployment costs can be recouped within two to three years.

“If a blue-collar salary is ¥100,000 ($14,202) per year, manufacturers can accept around ¥200,000–¥300,000 ($28,405–$42,608),” Xi says, noting that labor-intensive, sometimes unsafe industries are naturally inclined to endorse humanoid robotics.

Business models also affect adoption. To lower high upfront investments, companies are turning to rental-like RaaS, or robot-as-a-service. In sale-only models, tiered pricing is favored, based on the number of robots purchased. A few firms also charge a one-time development fee, plus per-unit licensing.

“However, the last model is still uncommon at this point. Most humanoid companies now mainly focus on selling hardware rather than providing full or tailored solutions for specific industries or customer needs,” Xi says.

The road map from L1-L3+

Widespread humanoid deployment remains a gradual process, with skepticism lingering around “stage-managed” demonstrations. Most current systems sit at level 0–1, meaning they can only perform scripted or teleoperated tasks.

Level 2 robots function with a higher degree of autonomy, but only in tightly supervised environments. True level 3+ autonomy promises general-purpose, flexible operation, but, like fully autonomous driving, it remains a distant goal.

The rollout of humanoids is expected to mirror the staged evolution of self-driving cars, with short-term pilots in manufacturing and logistics, tentatively staggering into new roles along production lines.

The mid-term (3–7 years) could see expansion into service roles and basic household assistance, akin to limited deployments of autonomous vehicles. Only in the long term (10 years and beyond) might general-purpose humanoids emerge, capable of navigating complex, unstructured environments.

According to Omdia’s Su, the best way to distinguish between staged demonstrations and genuinely field-ready humanoid systems is an eye-test. “We need to start seeing humanoid robot working alongside humans in a normal production site before we can qualify the robots to be ready for commercial deployment and scale-up,” he says.

Barriers to scale-up are familiar. Even as pioneers such as Unitree have sharply slashed prices, a humanoid robot—once add-ons and advanced features are included—can still cost ¥500,000 ($71,013). Beyond the price tag, other major hurdles include massive data requirements, security concerns, and persistent public scrutiny over potential risks to humans.

For Chinese companies looking to sell abroad, Hallewell states they have to take issues like data security and reliability very seriously.

“Chinese players can succeed in the West, but the path will be narrower because Western markets impose far stricter requirements around safety certification, data handling, compliance and long-term serviceability,” he says.

Childhood dreams

For many, childhood memories of Transformers or C-3P0 in Star Wars inspire many to dream of a world filled with robots that look somewhat like us. That vision is beginning to materialize, but current advances are just the start of a long march toward general-purpose robots. Contrary to some claims, the industry is nowhere near a “smartphone moment.”

Despite periodic disappointment over slower-than-hyped advances, the industry continues to propel forward and China, with its industrial capacity, talent pool and government support, enjoys a head start in this race.

However, it’s one thing to produce humanoid robots which can walk like a human, and another to produce ones capable of carrying out practical tasks autonomously.

“At the moment, the latest models and dataset that the humanoid robots trained on are sufficient for specialized tasks, but remain insufficient to perform daily tasks handled by highly skilled workers or the complex household work handled by a housekeeper in a highly complex environment with constant interference from human beings and other moving objects,” says Su.