Chinese companies are joining the driverless bandwagon

In April, Chongqing Changan Automobile Company deployed a self-driving car on a 2,000-km road trip from its headquarters in Chongqing to Beijing. The car completed the journey in six days, employing self-drive technologies that Changan says are comparable to those of Tesla models already available. The company says it expects to launch a self-driving car commercially within three years.

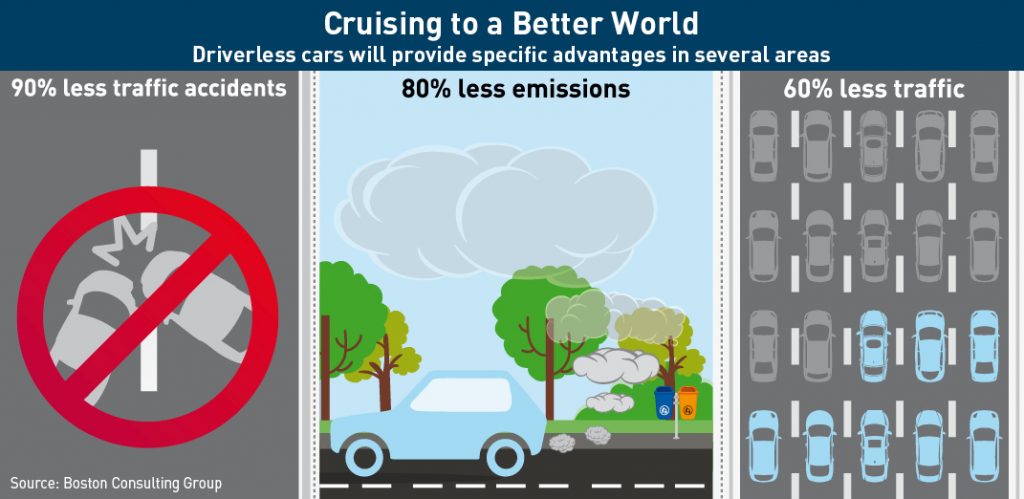

China is keen to deploy self-driving cars for the same reasons as everyone else is: Autonomous vehicles are tipped to significantly improve traffic and environmental conditions. According to research by the Boston Consulting Group (BCG) and the World Economic Forum, widespread adoption of automated vehicles could reduce automobiles on city streets by 60%, vehicle emissions by 80% and traffic accidents by 90%.

The Chinese authorities also intend autonomous vehicles to help drive the country’s transition into advanced manufacturing.

“The ‘Made in China 2025’ roadmap has made self-driving cars a key priority,” says Tzeng Chiau-ling, an analyst at Taiwan’s government-backed Market Intelligence & Consulting Institute (MIC). “China is poised to set up a connected car development platform which will have support from the Ministry of Information and Industry Technology (MIIT).”

Some experts believe Beijing’s top-down control capabilities could even give China an edge over the US and Europe in the race to develop self-driving cars. While the West has superior technology, its governments lack the authority to swiftly implement massive infrastructure projects and a large part of taking self-driving cars mainstream will involve refitting existing transportation infrastructure.

With that in mind, China’s success with high-speed rail could augur a bright future for the nation in terms of driverless vehicles. China easily boasts the world’s largest high-speed rail network: 19,000 km, or 60% of the world’s total, most of which was built in the past decade.

Will driverless vehicles arrive in China equally fast? They will, if Baidu and the city of Wuhu (about 200 km west of Shanghai in Anhui province) have anything to say about it. The Chinese search giant is deploying autonomous vehicle technology in the city in support of a bold bid by Wuhu to become the first city in the world to go totally driverless by 2025. It is a fast track that has to bypass a fair number of roadblocks to succeed, but it is clearly a goal worth aiming for.

Driving Conditions

The most obvious reason for China to go driverless is to make its hazardous roads safer. According to the World Health Organization (WHO), more than 250,000 people die on China’s roads annually. Pedestrians, cyclists and people on motorcycles comprise 60% of the deaths.

The WTO estimates there are 18.8 traffic-related deaths in China per 100,000 people per year, about average for middle-income nations but more than double the rate in developed countries.

“Countries cannot develop sustainably when this many people are dying and being injured on the world’s roads, as they go about their daily lives,” Bernard Schwartländer, the head of the WTO’s China office, said in a May statement. “Road crashes impoverish families, ruin livelihoods, and impose a heavy burden on countries’ health systems, societies and economies.”

Most experts believe it will take China decades to reduce auto accidents and develop a less combative driving culture, but driverless cars may speed things up. And the benefits of self-driving cars may go far beyond improved safety to relieving congestion and air pollution.

“Congestion has become severe in Chinese cities,” observes Anderson Chan, global communications manager at Ford Motor Company in Detroit. “There is a shortage of parking spaces; the public is increasingly aware of air pollution.” Self-driving cars combined with car sharing and automatic parking could enhance the efficacy of car use, he says, “reducing accidents caused by human error, enabling drivers to better use their travel time, and meeting the huge demand for quality mobility services in China.”

It would seem that just about everybody is on board. A survey conducted by BCG in July found Chinese consumers were enthusiastic about self-driving cars: 81% were willing to ride in one, compared to 75% a year ago, suggesting that the recent crash of a Tesla vehicle in the US has not dampened the enthusiasm of Chinese consumers for automated vehicles.

Juliet Wang, a marketing director at an educational institution in Shanghai, looks forward to self-driving cars arriving on China’s roads. “Many Chinese people drive recklessly, so automated cars will make China’s roads safer,” she says, adding that automated vehicles will save people’s time. “You won’t need to bother getting a driver’s license anymore,” she points out.

Off to a Fast Start

Auto brands and tech companies alike are racing to tap China’s nascent automated vehicle field, and Germany’s BMW has been one of the most active automakers. In late 2014, the German automaker entered into a partnership with Internet giant Baidu, known for its data mapping and artificial intelligence acumen. In an email to CKGSB Knowledge, BMW China’s corporate affairs department said a demo car based on a BMW 3 Series GT successfully demonstrated Highly Automated Driving (HAD) technologies including Automatic Lane Change on a Chengdu highway in June. “BMW became the first premium car brand to apply this function in actual road conditions in China,” they said.

Roger Sheng, a director at research firm Gartner in Shanghai, reckons the superior technology of foreign auto brands gives them an edge in China’s self-driving car market. “Telsa is taking leadership in providing ADAS (Advanced Driver Assistance Systems), while BMW is more active than other luxury auto brands in automated vehicles,” he says. “If Tesla can manufacture vehicles in China, I expect it will be a strong player. Chinese automakers are more likely to be followers in this market.”

Ford’s Chan says, “China is one of the most important markets for Ford not only in regards to our core business but also for mobility opportunities. We are proactively working on bringing the most advanced Driver Assist Technologies to Ford and Lincoln products.”

Among Chinese technology brands, Sheng says Baidu is best positioned to make inroads in self-driving cars. “It is the most aggressive investor [in automated vehicles] among Chinese tech companies now,” he says.

In April, Baidu announced it had formed a self-driving car research team based in Silicon Valley that it plans to expand to 100 people by the end of the year. The team will be part of Baidu’s newly-created Autonomous Driving Unit (ADU). In a statement, Wang Jing, senior vice president of Baidu’s ADU, said: “Baidu is fully committed to making self-driving cars a reality. Autonomous vehicles will save lives and make transportation more efficient.”

At The Wall Street Journal’s Converge technology conference in June, Wang told the audience that Baidu intends to launch its self-driving cars globally by 2021. He noted that the company is already testing its model on public roads in Beijing and Anhui, as well as in “a closed testing area in Shanghai.” Wang said he hopes Baidu’s car can eventually be tested in 10 cities across the country.

“Baidu has been devoted to developing artificial intelligence technology for a long time and its self-driving car has reached a leading international level in terms of deep learning and high-resolution mapping capacity,” Wang told CKGSB Knowledge.

Beijing Takes the Wheel

While the Chinese market looks ripe for self-driving cars, government support will be integral to widespread adoption of automated vehicles. “Compared to other countries, the Chinese government’s support will be a main driver to develop self-driving cars as the level of complexity in vehicle regulations is relatively high in China and the Chinese government plays a key role in verifying which technical standards are optimal for China’s driving environment,” says Tzeng of MIC.

He notes that in June, China set up its first national test site for connected and self-driving cars in Shanghai, which aims to facilitate R&D, standard studies and policy formulation, and test and certify connected car technology. At the Shanghai base, test cars will initially be put through 29 different driving simulation programs, such as vehicle collision, brake alert and pedestrian crossing alert. The government plans to expand the number of testing programs to 100 by late 2017.

As part of the launch of the demo base, General Motors unveiled its newest connected vehicle (V2X) technology. Wide deployment of the technology could eliminate 81% of “non-impaired” light-vehicle crashes, according to the US National Highway Traffic Safety Administration (NHTSA). “The newly-opened Demo Base provides an excellent location to carry on our research on intelligent and connected vehicles in China,” said John Du, director of the GM China Science Lab, in a statement.

From 2018-2019, 5,000 automated vehicles will be deployed in an expanded testing area of 100 square kilometers. Testing will also be done in the Shanghai suburb of Jiading, at the Auto Expo Park and Tongji University’s Jiading campus. And then in 2020, China plans to launch a self-driving vehicle demonstration city near Shanghai.

Some industry experts have been encouraged by Beijing’s approach to automated vehicles. “The Chinese government is taking a ‘top-to-down’ approach to push hard on self-driving cars, and the attitudes are generally positive so far,” notes Ford’s Chan.

Meanwhile, a draft roadmap for autonomous vehicles backed by the MIIT is in progress. The plan is expected to call for deploying self-driving cars within three to five years on highways and for urban driving by 2025. Observers say the roadmap will likely outline technical standards, infrastructure and regulations. Such a uniform framework for managing the introduction of automated vehicles would be a significant departure from the US’s fragmented laws and standards, which vary by state.

A Long Road Ahead

Market observers are generally bullish on self-driving cars in China, but a few caveats remain, one of which is consumer attitudes. In contrast to the highly encouraging BCG survey, a J.D. Power/Tencent survey of 5,000 consumers in China conducted in the spring of 2016 found that only 9% were very positive on the prospects of unmanned mobility.

“Driving in China is still a novelty and serves as a kind of socio-economic status symbol of having arrived,” JD Power Vice-President and Asia-Pacific general manager of automobile operations Geoff Broderick said in a statement. “As the market matures, consumers in China are rapidly becoming exceptionally discerning and are seeking value when considering technology and other features. This creates a unique set of preferences that are important for manufacturers to understand.”

Gerald Fu, a Shanghai-based media sales manager and owner of a BMW 3 Series car, told CKGSB Knowledge that automated vehicles do not interest him. “Driving is fun,” he says. “I don’t want an automated vehicle. People should be the ones in control of machines, not the other way around.”

Indeed, the appetite of Chinese consumers for motoring remains healthy. From January to June, retail sales of cars, sport utility vehicles and multipurpose vehicles increased 9.5% to 10.8 million units, up from 8.4% a year ago, according to the China Passenger Car Association. There remains plenty of room to grow as well. Vehicle ownership per thousand people in China was just 110 in 2015, compared with 800 in the US and 500-600 in Europe, according to data compiled by Ford.

Ford’s Chan suggests that “more studies should be done regarding consumer attitudes of self-driving cars in China” to get a more accurate reading of the true situation.

He cites regulatory ambiguity as a potential obstacle to the development of self-driving cars in China. “There is at present no clear regulations on self-driving cars in China,” he says noting inconsistent definitions of automation levels as well as accident obligations. Additionally, he observes China “has not developed technical advantages in self-driving vehicles yet, compared to Europe or the US” All of those factors “will potentially become big barriers for the development of self-driving cars in China.”

Meanwhile, following the fatal crash of a Tesla Model S car in Florida in May, China’s auto industry regulator She Weizhen told automakers in July not to test their self-driving vehicles on highways before relevant regulations are released. Then in August, another Tesla Model S was involved in a minor collision on a Beijing highway while the driver had ‘autopilot’ mode engaged. Tesla responded by stating the mode was for driving assistance, and subsequently changed the language on its Chinese site from “self-driving” to “self-assisted driving” (in translation).

Research firm IHS predicts it will take China twenty years to become a global leader in autonomous vehicles. But by 2035, IHS forecasts, China will have deployed 5.7 million vehicles on its roads “with some level of autonomy,” more than any other country in the world. High sales volume and robust consumer demand for new technologies will drive growth of the automated vehicle sector in China, IHS said in a June press release.

Gartner’s Sheng agrees it will be a long time before self-driving cars are the norm on Chinese roads. “Most Chinese automakers do not think they will be available in the short term due to the absence of regulation and complexity of China’s transportation conditions,” he says. “There could be some progress in the next five years but the commercialization challenges remain significant.”