Going Down

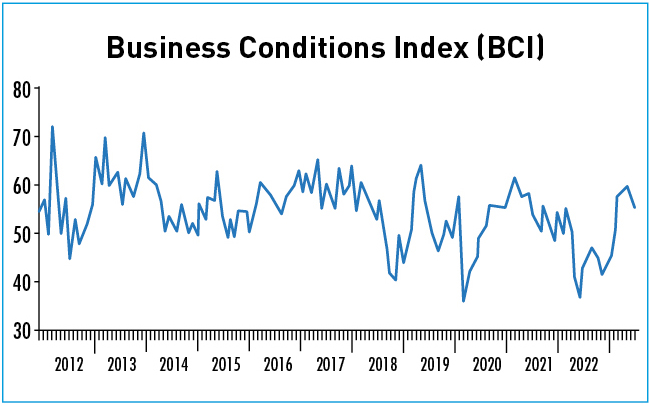

The CKGSB Business Conditions Index (BCI) registered 55.0 in May 2023, sliding from April’s score of 58.8, but remaining above the confidence threshold of 50.0. All of the indicators in this month’s BCI also fell.

Introduction

The CKGSB Business Conditions Index (CKBCI) is a set of forward-looking diffusion indicators. The index takes 50 as its threshold, so a value above 50 means that the variable that the index measures is expected to increase, while a value below 50 means that the variable is expected to fall. The CKGSB BCI uses the same methodology as the PMI index.

Key Findings

- All of the BCI sub-indices fell in May 2023

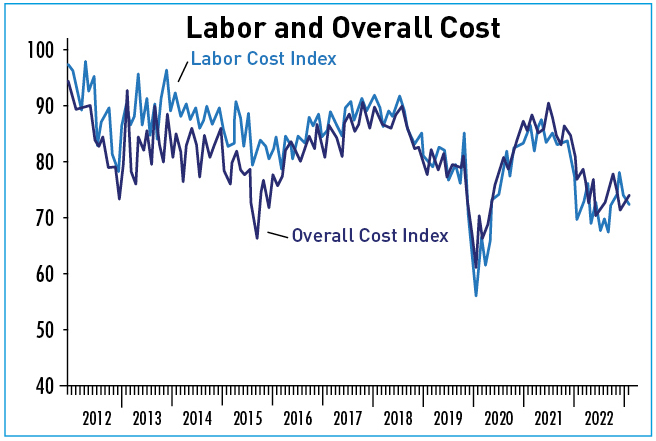

- Overall cost expectations was the only forecast to rise this month

- While there were drops all round, many indicators remained over the confidence threshold

Analysis

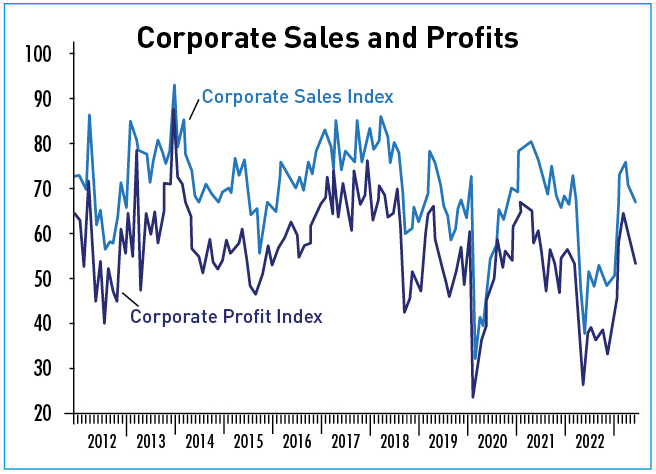

The CKGSB BCI comprises four sub-indices: sales, profit, financing environment and inventory. Three measure prospects and one, the corporate financing index, measures current conditions.

The corporate sales index continued to drop, from 70.4 to 67.4, while the corporate profit index fell again from 59.6 to 53.9.

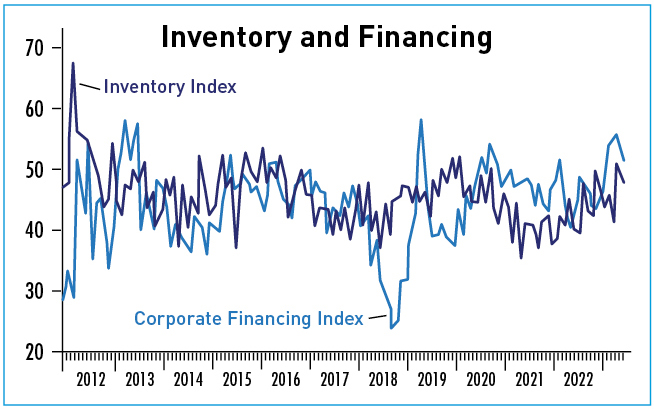

Corporate financing prospects fell slightly from 55.9 to 51.7, staying above the confidence threshold. The index for inventory fell back to 47.6 from 50.5, falling below the confidence line of 50.0 again.

While for the other sub-indices—sales and profit—a positive trajectory indicates growth, when it comes to inventory, a positive trajectory indicates falling numbers of goods held in warehouses and a falling index suggests goods are not being shifted as fast as companies would like.

Aside from the main BCI, we also forecast costs, prices, investment and recruitment demand over the next six months. This month, labor cost expectations fell from 74.4 to 72.9. The overall costs index rose slightly, from 71.9 to 73.8 this month. The rise in overall cost expectations is the only rise across the BCI this month. Although rising labor and overall costs increase pressure on companies’ bottom lines, they do not necessarily mean a deterioration of business conditions in China over the next six months. It could also mean the economy is improving, as companies are pushed to spend more as demand warms up. When the economy is improving, the output or sales of enterprises increase, and more people and materials need to be invested in production, which may mean that the operating conditions of enterprises improve. It is when the unit costs of production or sales rise that companies feel the impact of worsening business conditions.

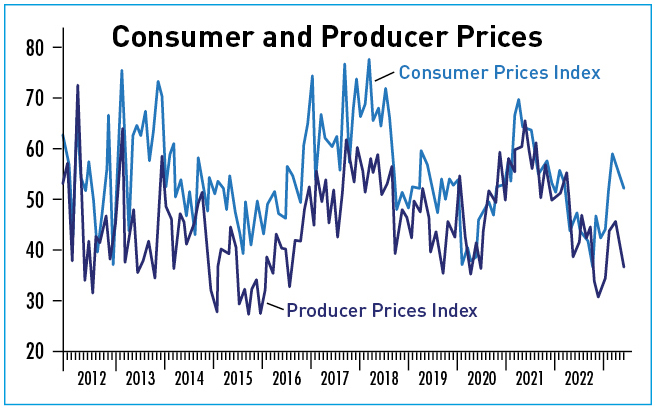

Turning to prices, consumer price expectations fell from 56.5 to 52.3. The producer price forecast fell from 43.0 to 36.5.

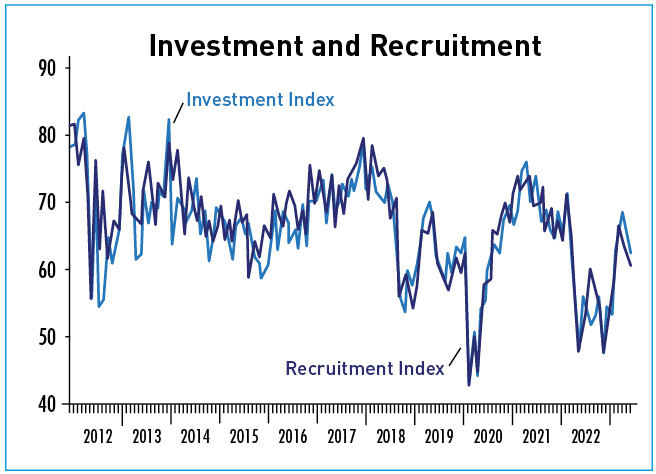

We now turn to investment and recruitment. These indices have both been at the more confident end of the scale since the BCI began. In the past few months, they have trended downwards. This month both fell, yet they remain above 60.0. Since the Chinese economy is largely investment-driven, and investment has a strong link with job recruitment, they are important to follow. In other words, these two indicators look at plans for expansion in China’s business world. The index for investment fell sharply this month, to 62.7 from 68.2 last month; the index for employment fell slower, to 61.6 this month from 64.6 last month.

Conclusion

While there has been an all-round drop in the BCI, sub-indices and forecasts many of the indicators remain above the confidence threshold.

The BCI is directed by Li Wei, Professor of Economics at the Cheung Kong Graduate School of Business