Chinese tech companies own stakes in a large number of international game publishers and developers

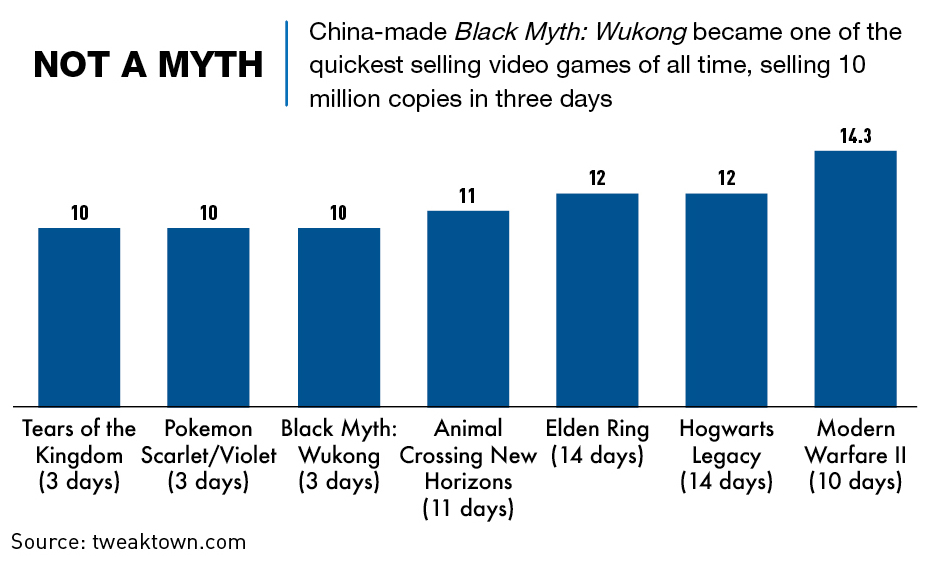

Just 83 hours after the August release of Black Myth: Wukong, the game sold its 10 millionth copy, becoming one of the fastest-selling debuts in video game history. The game, produced by Tencent-backed Game Science, also broke records for peak concurrent users on both PC and PlayStation platforms. It marked a major breakthrough for Chinese games in the international market and the Chinese gaming industry as a whole.

For a long time, the Chinese video game industry produced local copies of international best sellers, but it is now the world’s largest with widespread appeal across diverse swathes of the population. It was not easy to get to this point for the country’s publishers, developers or even the gamers themselves, given the many regulatory challenges.

“China has gone from gaming novice to global powerhouse,” says Joost van Dreunen, CEO of intelligence firm ALDORA and games professor at NYU Stern. “The Chinese video game industry has experienced significant growth and transformation over the past decade, becoming the world’s largest mobile gaming market.”

Logging in

The global video games market, which includes the games, the hardware they are played on and esports—professional players competing against one another in an organized format—was valued at $217.06 billion in 2022, according to research firm Grand View Research, with an expected revenue forecast of $583.69 billion by 2030.

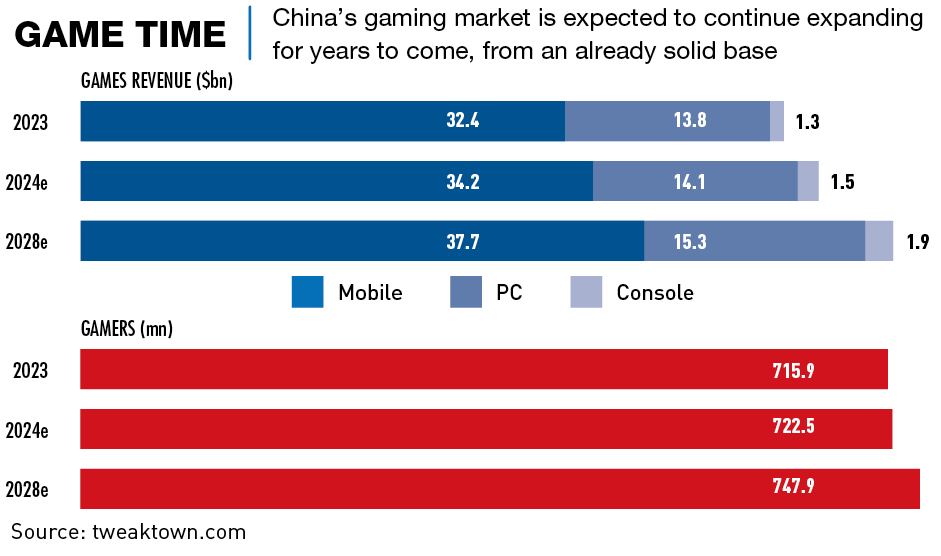

China makes up about 20% of the global market, with domestic sales revenue exceeding ¥300 billion ($42.1 billion) for the first time in 2023, a 13.95% year-on-year increase, according to the China Audio-Video and Digital Publishing Association (CAVCA). Growth is expected to continue, with one estimate indicating an increase in market size to $95.51 billion by 2029.

Around 46% of the Chinese population engages with video games, lower than the 61% of the US population, according to the Entertainment Software Association, but due to population size, the number of individual users is significantly higher. Around 46% of gamers are women in both countries, and China and the US also have a similar average age, at 35 and 36, respectively.

Users play games across three main platforms—mobile, console and PC. In China, mobile gaming has seen the largest growth in recent years and, in 2023, it accounted for 66% of the country’s total gaming expenditure and 74.88% of actual sales revenue, according to CAVCA. Console use in China is low in comparison to other markets, at just 15%—compared to 36% in the US—due in part to historical and current regulations limiting console access and content, but also due to the costs in comparison to a mobile phone.

“Consoles are expensive in China, and this can be prohibitive for some prospective gamers,” says Ivan Su, Senior Equity Analyst for Morningstar Asia. “You also need peripherals, such as TVs, to use consoles so they can add to the costs as well.”

Video games provide a number of income streams, ranging from sales of physical or digital copies of games, to themed or esports events and merchandise. But one key trend in recent years has been the use of microtransactions—in-game purchases, for real currency, of items such as equipment, characters or skins.

Microtransactions usually appear in free-to-play (F2P) games, which means they can be downloaded for no upfront cost but often have stunted gameplay speeds or minimal customizability to encourage in-game purchases, and have proven incredibly lucrative.

Major Players

Gaming in China is dominated by the almost-duopoly of Tencent and NetEase. In 2022, they together represented 61% of the total share of domestic computer and mobile games revenue. Their combined market share has decreased slightly in recent years, but they are still well ahead of the rest of the pack.

Tencent is the largest gaming company in the world, in part by virtue of it being one of the world’s largest internet firms. For its gaming operations, the company historically had a reputation for being a copycat, taking international gaming IP, then reproducing and publishing it.

The company has since published internationally developed games in the Chinese market through licensing deals. It has also seen success with self-developed games such as the mobile Multiplayer Online Battle Arena (MOBA) game Honor of Kings (although this is a copy of internationally famous MOBAs DotA and League of Legends (LoL). Tencent also owns the US publisher of LoL, RIOT Games.

The real key to Tencent’s dominance, however, is its investments, such as in the developer that created Black Myth: Wukong. “They have acquired or invested in studios and publishers across the world like nobody else over the last half-decade,” says Daniel Camilo, a China-based games consultant. “They did so before, but it has really ramped up recently.”

NetEase began by producing its own online games as early as 2001, and has released several hit games. But the real breakthrough for the company came when it signed agreements with US-based Blizzard to be the Chinese publisher for a number of games, including the hugely popular massively multiplayer online role-playing game (MMORPG) World of Warcraft. The partnership between the two companies ended in 2022, due to disagreements, but has since been reinstated.

“NetEase has a different strategy to Tencent and is fundamentally a gaming company,” says Camilo. “Although NetEase has also been investing and making acquisitions outside of China, it is much more active on the development side.”

While Tencent and NetEase dominate, there are many other successful developers in the country. These include miHoYo, Perfect World, 37 Interactive Entertainment, iDreamSky, Giant Network and Kingsoft, as well as established internet companies ByteDance and Alibaba.

“These companies also dominate the market through a combination of self-developed titles, strategic partnerships and investments in smaller studios,” says van Dreunen.

miHoYo’s growth has been of particular note in recent years. The company developed a number of mobile games prior to 2020, to varying levels of success, but with the release that year of Genshin Impact, a Japanese-inspired gacha game—a type of game that utilizes loot boxes to encourage in-game spending—miHoYo experienced massive success both at home and internationally.

Leveling up

While the Chinese game market is much like those elsewhere, there are key differences. “Major trends in the Chinese video game market include a mobile-first approach, prevalence of free-to-play models, deep social integration, a developed esports ecosystem, rapid game iteration and increasing AI integration,” says van Dreunen. “Compared to international markets, these trends differ in their intensity and speed of adoption, often driven by China’s unique regulatory environment and tech ecosystem.”

One example of the mobile-first, social integration approach has been a rapid proliferation of mini-games embedded within mobile apps such as Tencent’s ubiquitous WeChat. “These games tend to be quite simple, but offer social engagement and easy accessibility through the platforms they are hosted on,” says Su. “This access has been a large contributor to China’s gaming industry growth.”

The rapid growth and acceptance of esports in China are also of note. Professional gaming as a career has been growing in legitimacy in recent years, and the salaries can often be eye-wateringly high. In 2020, LoL professional Yu “JackeyLove” Wenbo joined Chinese team Top Esports, for a rumored signing fee of RMB 480 million ($6.9 million).

Public perception of esports, especially among millennials and younger generations, has become increasingly positive, but there is also a lot of support for the scene from the Chinese government.

“The government has been providing a lot of esports funding to build esports cities and recognize esports as a sport,” says Xiaofeng Zeng, Vice President at Asian games market intelligence firm Niko Partners. “Esports players representing China have won medals at the Hangzhou Asian Games and other global events. The huge push from the government, and China’s international esports success, will encourage more parents to accept the legitimacy of their children participating in esports.”

The widespread availability of cloud infrastructure has also revolutionized the gaming landscape by offering scalable and cost-effective computing resources. As a result, gaming services stand out as one of the fastest-growing sectors for cloud computing in China.

There has also been a lot of talk of AI and its impact on the gaming world, but the changes have mostly been seen in the development of smaller games for younger audiences. “AI hasn’t really changed that much for AAA games [games with large budgets released by major developers],” says Alex Xu, Chairman and CEO of game and animation studio MultiMetaverse. “Lots of companies are claiming they see lots of cost savings, but it feels more like the bosses are pushing the narrative, rather than companies truly benefitting from it.”

Chinese developers have also increasingly focused on the localization of themes and content., Games such as the role-playing game (RPG) Wuthering Waves are heavily centered around Chinese culture. Black Myth: Wukong is another example that seems to have produced positive results.

“It has really made a name for itself compared to other big names like Elden Ring, Sekiro and the Dark Souls series,” says Daniel Meharry, a 28-year-old from Glasgow. “The world design and gameplay drew me in. The fact that it was developed in China isn’t really relevant for me; it’s more that it is just a good quality game.”

But Black Myth: Wukong, as the first AAA game produced in China, is an outlier, and the fundamental building blocks of most China-produced games are still largely drawn from foreign influences.

Gamification of other services has also seen major growth in the Chinese market, with notable examples including ecommerce platforms such as Taobao using virtual personas and AI-led marketing in China to engage with customers. Brands such as Coca-Cola are collaborating with platforms like Tencent Music Entertainment Group to create virtual personas that enable users to immerse themselves in a cyberpunk meta-universe for shopping and entertainment activities.

“Gamification is more pervasive and sophisticated in China compared to many other markets,” says van Dreunen. “It is often integrated into daily life through super-apps and widespread mobile adoption.”

No cheat codes

Regulatory barriers have also slowed the development of the Chinese market for years, and although there have been some positive moves recently, there is an unpredictability that may hamper future growth.

“The Chinese government has implemented significant regulations on the video game market, including strict gaming time limits for minors, content approval processes, anti-addiction systems, real-name registration requirements and monetization restrictions,” says van Dreunen. “These regulations are more extensive and stringent compared to most other countries, significantly shaping the development and operation of games in China.”

Licensing restrictions, in particular, are a key problem. Games published in China go through a licensing and approval process. Over the past few years there has been a slowdown, and several complete halts, in application approvals. But for Xu, recent months have seen a positive trend with regard to licensing approvals.

“Domestic licenses are getting back to normal, and more applications are approved every month,” says Xu. “For domestic development, this is encouraging, as it will mean more companies are willing to put in the time and effort to develop games.”

Press X to join

Expanding overseas is now a hot topic for Chinese developers after seeing an increasing number of successes in the international market. Chinese game studios already dominate the global mobile gaming market, capturing 47% of the revenue share worldwide. Of the top 100 global mobile game publishers, 38 are based in China.

“The barriers to going worldwide have gone for a lot of developers,” says Xu. “ One example is Beijing-based S-GAME, where the leadership was mostly educated in the US and had a large familiarity with Western art styles and trends. Seeing one of their trailers at a recent SONY expo highlights the breakthrough for companies like this, even if they are only small 20-30 person teams.”

Chinese companies have also become major players in shaping international gaming trends and practices, with increased investments in game markets in Southeast Asia, India, and other regions. The percentage of Chinese video game-related deals involving overseas companies reached 41.3% and 37.7% in 2022 and 2023, respectively, up from just 10.5% in 2016, according to Niko Partners.

But for international gaming companies looking at the China market, many barriers still remain to be overcome. Regulation limits access, and, as has happened in the past in other industries, foreign firms are required to partner with local video game publishers to publish their games in the country.

“The main barriers are to know what the real needs of gamers and their local cultures are, and then balance it within the bounds of the regulations,” says Zeng. “For global game companies to successfully enter the market, they must understand and comply with these layers of regulations. This is the first step to entering the market. Effective game localization is another key success factor in China.”

Final boss

Aside from the unpredictable regulatory barriers, the sector is on a clear upward trajectory. Technologically, Chinese video game developers are near the cutting edge and demand in the country is high and growing.

In addition, the proven success of Chinese games internationally, especially now that this has spilled over into the major AAA games with Black Myth: Wukong, indicates that massive growth is available.

“We understand live service very well, have proven success with box sale games and we’ve been doing microtransaction games for years,” says Xu. “We, as Chinese developers, have almost unlimited power to unleash in the future. So much more is coming.”