For Elena Xiong, working for a foreign firm in her hometown of Shanghai was always the goal. Still, since returning to China after studying in the US, she has found it harder than expected to land one of these coveted jobs.

“I have been applying consistently for around a year now, but there are fewer jobs available and there is more competition than before for those roles,” she says. “I’ve been working for a Chinese company for two years now. Even though I’m still looking for something at a foreign company, I’m not sure if it’s going to happen.”

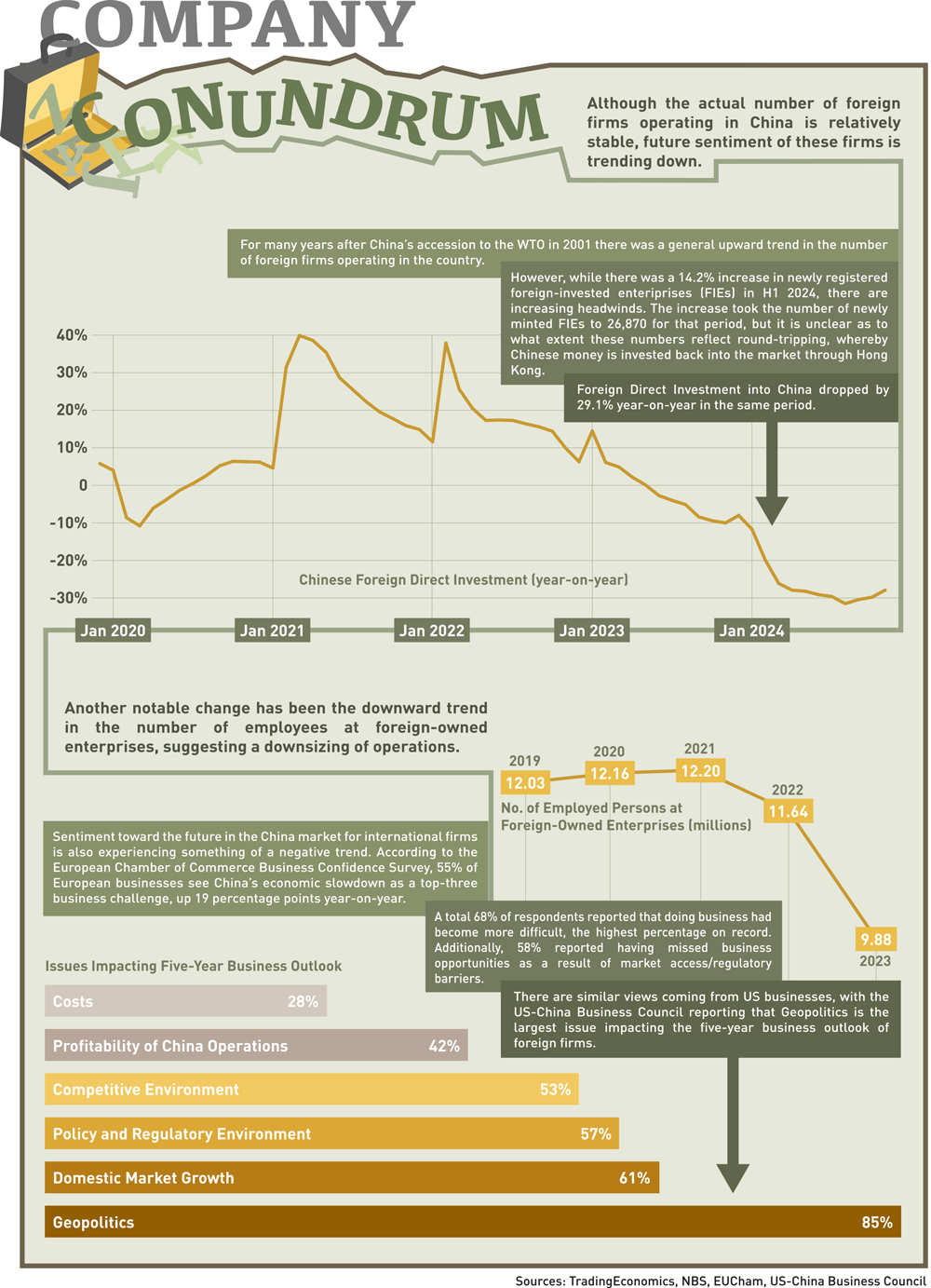

In 2023, the number of people employed by foreign companies in China fell below 10 million for the first time since 2009. While roles in these firms remain attractive to Chinese people, the overall reconsideration of China by foreign firms would have been unimaginable a decade ago.

After China joined the WTO in 2001, international business considered the country and its market the future, but the future now seems less certain, and the risk/reward ratio for doing business in the country is shifting.

“Companies used to come here to grow rapidly and expand their market share,” says Adam Dunnett, Secretary General of the European Chamber of Commerce in China. “Increasingly investment is defensive in nature now, with companies looking to secure their market share, gain market intelligence, acquire better understanding of their competitors or fill unique market niches.”

Foreign Investment Trends: A Mixed Economic Picture

Statistics from China’s Ministry of Commerce present a mixed picture of foreign firms in the country amid a two-speed economy where domestic demand is low but exports are growing rapidly. In 2023, foreign direct investment (FDI) into China dropped to $163 billion, a 13.7% fall from 2022 to its lowest level in 30 years. But at the same time, during the first half of 2024, the number of newly registered Foreign-Invested Enterprises (FIEs) rose to 26,870, up 14.2% year-on-year.

Some of the increase in investment represented in these FIEs can be attributed to a round-tripping process, whereby Chinese money is invested back into the market through Hong Kong. But European Chamber of Commerce statistics also suggest little change.

“The number of member firms we have operating in China has remained relatively consistent over the years, and remains so,” says Dunnett. “The big difference is the number of foreign nationals employed by these firms. We have yet to see an uptick since the COVID restrictions have been lifted.” The number of people employed by FIEs overall dropped from 12.2 million in 2021, to just 9.88 million in 2023.

Corporate Restructuring: Global Firms Reassessing China Operations

A number of firms have shut up shop altogether. US law firms in China have seen a sharp downsizing, with at least 10 prominent firms bidding farewell to their Greater China offices since June 2023. Many attribute this to shifting client demands or a consolidation of work to other Asian teams.

In July 2024, Microsoft asked as many as 800 of its R&D employees to consider relocating outside of China. In August, IBM shut down two major R&D units which together employed more than 1,500 people, pulling the operations out of China. And in October, Fidelity International announced plans to cut 500 jobs at one of its tech and operation centers in the northern Chinese city of Dalian.

But there are also examples of firms, such as BASF and HSBC, doubling down on their commitment to the China market. VW is another such firm. In April 2024, the company announced a €2.5 billion ($2.68 billion) investment to build out its R&D segment in China’s eastern Anhui province.

“The fastest-growing foreign enterprises in China are concentrated in high-tech industries, the service sector (particularly areas such as R&D, design and technical, business and information services) and manufacturing,” says Wang Dong, Executive Director of Peking University’s Institute for Global Cooperation and Understanding.

Economic Impact: International Companies Shaping China’s Market

The influence of foreign firms in the Chinese economy has been enormous, with international companies playing a major role in helping Chinese firms reach their current level of competitiveness on the global stage. Aside from increasing access to international products, policies that required companies entering the China market to become part of a joint venture (JV) with a local firm have helped the local partners gain IP and related expertise that expedited their growth.

And it has not simply been a one-way street, with the size and scope of the China market offering incredibly lucrative opportunities for international businesses. The concentrated supply chains and huge demand have meant that China was a target for any firm that wanted to see rapid growth.

Starbucks, McDonald’s and KFC all now have a vast presence across the country’s F&B industry, and many luxury brands found the China market amenable to their high-end products and the prestige they bring.

Navigating Policy and Geopolitical Complexities

In recent years there has been a change in the approach of foreign enterprises to the China market for a number of reasons, in particular the fact that China’s economy is facing a number of headwinds. “Strategic adjustments made by MNCs have been influenced by the changing competitive landscape, market changes and industrial renewal and the impacts of the COVID-19 pandemic,” says Wang.

There is a property market slowdown playing into a lack of consumer demand and consumer confidence, and a growing threat of overcapacity in key industries such as the auto market, as well as a potential faltering of China’s booming export industry on the horizon with US President-elect Donald Trump due to return to office early in 2025. As a result, the reward aspect of the risk/reward ratio that was once so attractive for foreign firms seems to have shifted further toward the former.

Another reason is policy changes that make operating in China more difficult, including cross-border data transfer laws that are hard for companies to understand and satisfy.

“If you can’t export your own data from China in a timely fashion and leverage your global data network, it risks becoming a barrier for your own innovation,” says Dunnett. “The same goes for homegrown technologies. If you are required to transfer technology or reveal source codes or algorithms, you are unlikely to bring them to China. In turn if you have to use the older or local IP of a third party, you lose any competitive advantage you might have otherwise had.”

“There have been significant improvements in intellectual property laws in China, but for half of our members, the enforcement of said laws still doesn’t meet their expectations,” he adds, suggesting there is still room for improvement.

The global geopolitical landscape has also become more difficult to traverse in recent years, with semiconductors being a key battleground. “The tensions in the US-China relationship have an impact on companies’ long-term planning and operational decisions,” says Wang. “For example, US export controls on China’s high-tech sector have made it more difficult for companies to operate.”

“Everybody talks about the importance of globalization, open markets and avoiding protectionism, but the reality is that there is a lot more focus from countries around the world on economic security, which runs the risk of turning into protectionism,” says Dunnett. “Our members have faced a number of unfavorable policies such as those focused on self-reliance, localization and dual-circulation, among others, for some time now. But as there has been a rise in security-related policies around the world China is likely to feel largely vindicated for having introduced such policies and is therefore unlikely to change it any time soon. That’s a real challenge for businesses operating here that we don’t expect will change soon.”

Another difficulty for businesses is moving money out of China. The RMB lacks full convertibility and it is therefore often quite a complicated process to get capital out of the country once it is within the system.

General business, compliance and labor costs are also a rising concern for businesses, with 10% of the respondents in the US-China Business Council 2024 Member survey citing these rises as the primary constraint to increased profitability in China.

Future Strategy: Adaptability in a Dynamic Market

Despite the present difficulties, cause for optimism still exists in the market. Greater localization of operations in China will help offset the difficulties caused by cultural barriers, as well as issues like data transfer. In addition, taking a longer-term perspective on the market may provide more stability. China is no longer the quick route to making money that it once was, and approaching it by building solid foundations along with a country-specific strategy is necessary for success.

Companies looking to enter the China market should be proactive in defending their interests in the setup of JVs in industries where they are required, considering the breakdown of issues such as voting rights, profit distribution, commitments and inputs from each partner and non-competition clauses to stop partners starting similar local businesses.

One competitive advantage that many international firms do have is their creativity and R&D prowess. For example, HSBC offers international market access in a way that other major banks in China do not, and it is arguably for this reason that they have decided to stick it out in the China market and take a longer-term approach to building the company here.

“Flexibility is also critical in a dynamic market like China’s,” says Wang. “Companies need to be prepared to adapt to rapid market changes and policy shifts.”

Shaking hands The certainty that China was the future for many global firms is fading somewhat and there is a general negative trend among these businesses in attitudes and sentiment towards the country’s market. But while the current economic and geopolitical headwinds are sizable, opportunities remain for businesses that are willing to take the time and tailor their approach to the world’s second-largest economy.

“While opportunities for growth and expansion exist, the future of foreign businesses in China may be complicated by market dynamics, global politics and domestic policy changes,” says Wang. “For foreign firms to thrive in this changing environment, they must remain flexible, innovative, and deeply engaged in the local market.”