The government money is there, the producers are capable, so what is stopping electric cars in China from taking off?

The government money is there, the producers are capable, so what is stopping electric cars in China from taking off?

If official lip service and subsidies could affect on-the-ground change in China, the worldʼs largest car buyer and maker would be at the forefront of global electric car adoption. But Chinese consumers have bought into luxury, not ecology—at times, there is little distinction between the two in terms of price—and a gaping lack of alternative fuel infrastructure in China isnʼt helping. A stroll through a popular shopping district in downtown Shanghai tells the story: not an electric car in sight, not even in proximity to public charging stations which largely stand derelict and unused. The publicized rollout of electric cars seems little more than hot air.

Unfazed, an enterprising Tesla owner, Zong Yi, recently built an entire network of charging stations from Beijing to Guangzhou on his own dime, a feat that only highlights the glaring failure of Chinaʼs electric vehicle (EV) policy.

But it isnʼt for want of trying. Leading by example, a host of state agencies headed by the National Development and Reform Commission released an order in July that mandated at least 30% of all government vehicles purchased in the next two years be electric, plug-in or hybrid.

Since 2001, the countryʼs leaders have demonstrated a keen awareness that battery-powered vehicles were inevitable. With battery costs falling, experts project electric cars to be price-competitive against gasoline-guzzling sedans a decade from now.

Looking to form its own green car industry, China exhausted an unparalleled set of measures from 2009 to increase the sales of homegrown new energy vehicles (NEVs), a category which consists of battery electric vehicles (BEVs) and plug-in hybrids (PHEVs). From sizable subsidies to relaxed license restrictions, the government has done much to prop up this nascent sector, short of handing them out for free.

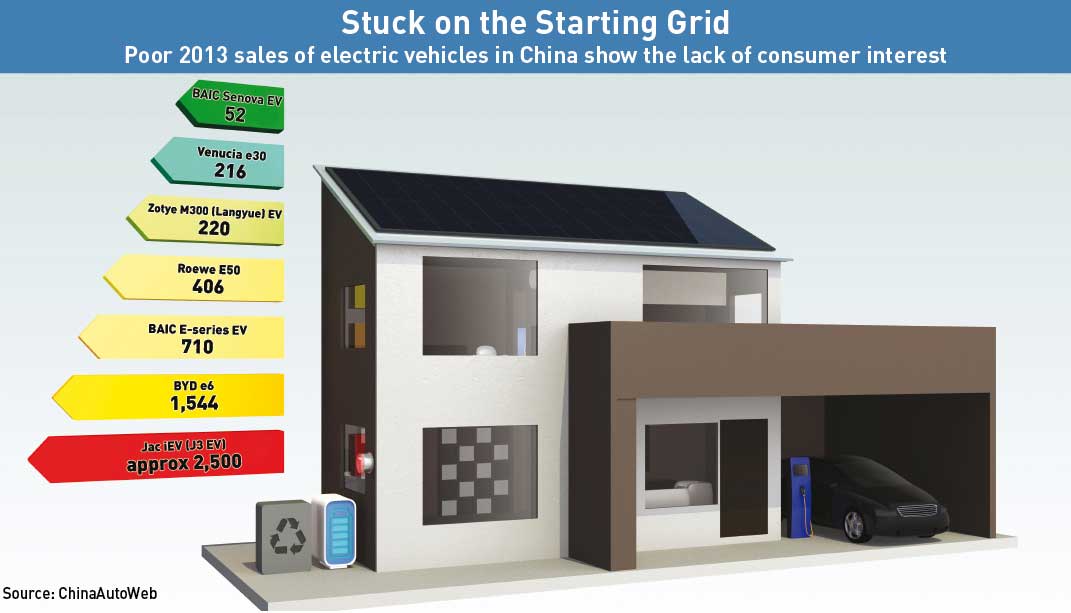

So far, Chinaʼs program to encourage EV adoption has met serious headwinds. “The actual progress and sales performance of BEVs and PHEVS so far has been very disappointing,” says Ashvin Chotai an auto analyst at Stone Mountain Capital. In 2008, the Ten Cities, Thousand Vehicles Program, which later expanded to 25 cities, set the lofty target to have 500,000 electric cars on Chinese roads by 2015; the current number is closer to 70,000, most of it from sales to taxi fleets and local governments.

Solidiance, an Asia-Pacific consultancy, estimated that only 18% of electric cars sold in China during 2013 were for private consumption. The average Chinese driver is no closer to riding a battery-powered car now than 10 years ago.

National Champion, Again?

“Battery electric vehicles are a huge opportunity for China and Chinese companies to leapfrog global automakers and hence build up a significant global competitive advantage,” says Chotai.

From the dais, the stakes are high. Reduced reliance on foreign oil and a fall in tailpipe and carbon emissions are chief incentives. There would also be serious global kudos in store if China can get out in front of the global e-car race, particularly given the countryʼs failure to self-actualize in the traditional auto sector.

Foreign auto manufacturers like Toyota and Volkswagen control the market for hybrids and internal combustion engine (ICE) cars, but plug-in hybrids and battery electric vehicles remain unexplored territories.

In an attempt to seize the opportunity, China has doggedly pushed domestic car companies to manufacture electric cars for the last five years—encouraging domestic car brands to develop and manufacture battery electric vehicles in the hopes of leap frogging global automakers. “Electric vehicles are the future battleground for 21st century innovation,” says Bill Russo, President of Synergistics, a Shanghai-based consultancy.

But China is wary of repeating mistakes made in previous efforts to develop the domestic auto industry over the last two decades. Chinese automakers remain bound to the technical expertise of foreign car brands, and even today, Chinese companies donʼt exactly stand toe-to-toe with German and American competitors.

Nevertheless, analysts feel that Beijingʼs laudable intentions have only shown the limits of what can be achieved by government fiat. Scott Laprise, an auto analyst from CLSA, says Beijing had thought “if it threw enough money at the problem, it would solve everything”.

Beijing can either suck it up and open the e-car market to foreign companies in order to immediately address the ecological impact of gas-powered vehicles, or it can continue to hold onto the hope of fostering a global leader while exhaust plumes coat Chinaʼs atmosphere with growing potency.

E-tours

Chief among the unresolved obstacles to a healthy NEV market is range anxiety. A limited driving range, inadequate charging infrastructure, a long charging time and few parking spaces with installed sockets mean the possibility of being stranded in heavy traffic is a real. A BYD Qin, a Chinese plugin hybrid, can only drive up to 50 miles on its battery before it must start running on gasoline. In comparison, a gasoline-run car can go four to five times the distance.

To solve the issue of limited mileage, the government has directly funneled large amounts of R&D investment into battery technology and EVs. But according to Russo, much of this investment and the burden of innovation have fallen on domestic car manufacturers, many of whom have no interest in giving up their hard earned profits from foreign joint ventures, and investing them in unproven technology with little market demand to back it up.

It doesnʼt help that each municipal government is pushing for its own charging standard. Much like how China advanced its own mobile telecoms standard at the expense of international standards to encourage indigenous innovation, each city has developed individual power standards for charging stations in favor of its own auto state-owned enterprises (SOEs). If you buy an electric car in Beijing you cannot recharge it in a charging station in Shanghai. Russo says, “As national policy on EV cars is delegated to regional state governments, which try to compete against each other, there is little coordination on that level.”

This infighting appears in other areas as well. Power utilities and electric car companies are fighting each other to determine if electric vehicles should use battery-swapping stations or battery-charging stations. With State Grid, which has a virtual monopoly on the national power grid that it is unwilling to yield, China has fallen far behind the targeted goal of 2,000 charging stations by 2015. “Considering the current market realities, infrastructure players are also pessimistic that the target of 2,000 charging stations by 2015 can be met as they do not see any immediate shift in demand within the next 2-3 years,” said a Solidiance report. Moreover, most of the charging stations have fallen into disrepair after years of being unused. Without electric cars stopping to top up their batteries, charging stations are a drag on power utilityʼs profits, each of which can cause millions of renminbi in losses. State Grid last year cut its annual investment in electric car projects to less than RMB 1 billion after spending about RMB 3 billion in 2010 and 2011, according to an anonymous source quoted in a Caixin article out earlier this year.

Consumers Ain’t Buyin’ It

Amid Chinaʼs grand plans and ambitious policies, bureaucrats have lost sight of the fact that consumers retain the final say over the purchase of an electric car. Wang Tao, a resident scholar from the Carnegie Endowment, says the policy of setting arbitrarily high targets has been counter-productive and “not very sensible”. He says the policy of sales targets have produced misaligned incentives whereby government officials try to fill their EV sales quota by encouraging purchases and not by encouraging the usage of electric vehicles.

The provision of subsidies to electric cars is one way that the government has misunderstood consumers. Although the high price of electric vehicles is a barrier to consumers, Scott Laprise says that “making vehicles cheaper would not change consumerʼs minds”. The sizable RMB 120,000 subsidy each Chinese electric car receives does little to change what remains an unattractive purchase. Laprise feels domestic original equipment manufacturers (OEMs) have struggled, at least at that price range, to produce an electric vehicle that can compete against the foreign gas-powered competition. A BYD e6, including subsidies, costs RMB 369,800, much more than the price of an Audi A3 at up to RMB 280,000. Teslaʼs Model S is even more expensive at roughly RMB 371,000 before subsidies, though Tesla maintains that the model is intended as a luxury car. Still, customers have to wonder, for that kind of money what are they really getting?

Safety risks for one. Laprise recalls when BYD launched its F3DM plug-in electric hybrid in China to much fanfare in 2008, more shrewd industry watchers noticed Chinese consumers had little interest in purchasing an expensive, domestic car installed with unproven, and some say dangerous, technology. Last year, two electric BYD taxis crashed and burst into flames, leaving their occupants dead. This prompted suspicions that electric vehicles are fundamentally unsafe. US consumers on the other hand have welcomed the marketʼs leading plugin, the Nissan Leaf, with June 2014 sales showing a year-on-year increase of 5.5% reaching 2,347 units.

Greg Anderson, author of the book Designated Drivers: How China Plans to Dominate the Global Auto Industry, points out that unlike the US and Europe, there is no “cachet” to owning a green car in Chinaʼs lower-end market, even with air pollution being one of the most important issues of concern today for the Chinese people. Many “first time car drivers want to ride on the open roads”, rather than being hemmed in by short-range limits, he wrote.

These innumerable barriers have cast doubt over whether domestic electric vehicles will be viable in China. Even senior officials have questioned the philosophy of putting so much emphasis on battery electric vehicles, says Chotai. As a result, China has now started concentrating on producing PHEVs for private consumption and BEVs for public fleet use.

There is evidence in other economies that shows electric cars are commercially viable. Even though government support in Europe and US lags behind that of China, car sales of plug-in electric vehicles in those countries far outstrip Chinaʼs. Navigant Research forecasted that overall global sales of plug-in electric vehicles were projected to grow 18% annually.

Europe and the US rarely use subsidies, a crucial difference from China. They instead incentivize the purchase of electric vehicles through tax credits. Norway, the country with the highest number of EVs per capita, exempts electric cars from public parking fees, toll payments and also grants them the ability to use less crowded bus lanes. These policies have yielded rapid growth in these two markets.

Course Correction

Despite the impressive announcements of the countryʼs ambitious economic targets, selective Chinese government policy, in an ironic twist, has sometimes stifled the rate of electric car adoption, such as lackluster support for hybrid vehicles.

Auto analysts agree hybrid vehicles are an effective bridging technology that could pave the way eventually for battery-powered cars. Hybrid cars are not hobbled by limited charging infrastructure, and could raise awareness and familiarity of eco-friendly cars. With years of development, hybrid vehicles like the Toyota Prius are more than a match for their counterparts with internal combustion engines.

But the central governmentʼs subsidies for hybrid vehicles are a paltry RMB 3,000; a miniscule sum when compared to the RMB 30,000 allocated to plug-in hybrid vehicles. Plus, most hybrid vehicles are manufactured offshore and thus subject to costly import tariffs. Last year, only 1,400 Toyota Priuses were sold in China out of the 315,000 sold globally.

But with hybrids being primarily dominated by Japan, China was naturally “unwilling to subsidize foreign industry”, says Chotai. Beijing would be swallowing a bitter pill to resort back to the strategy of importing foreign car—in this case green car—technology through joint ventures. It is only recently that Chinese carmakers have partnered with foreign auto brands to develop new battery electric vehicles.

Russo of Synergistics also says that Chinaʼs green car adoption program could have advanced much more quickly if it had imported foreign know-how in the form of lighter car bodies, engines and battery technology.

That is not to say Chinaʼs government does not have a part to play in the upcoming rollout of electric cars. Russo says China is responsible for ensuring the proper charging network infrastructure exists, but that would entail it “going down the value chain”, a role Beijing would be unwilling to undertake after investing heavily into fostering battery electric vehicle innovation.

Russo adds that Chinaʼs government could exercise a key advantage over other countries. Chinese officials are able to align the incentives between local governments and auto companies and force them into adhering to a national strategy for EVs.

Luckily, recent regulatory moves suggest officials are slowly resolving bottlenecks in EV adoption. In May, Beijing set up a special commission with the mandate of solving bottlenecks in Chinaʼs EV program, according to Namrita Chow, an analyst from IHS Automotives.

This has already yielded results. State Grid has agreed to allow private companies to use their own charging standards instead of submitting to a national one. This should give the sector a boost, increasing the number of electric charging stations and speeding up the deployment of new electric vehicle models. Furthermore it provides opportunities for companies like Tesla which also sell charging stations.

Though foreign original equipment manufacturers hold the final key to unlocking rapid growth in Chinaʼs EV market and infrastructure, Beijingʼs continued desire to promote domestic electric cars leaves it in a “tricky policy dilemma”, says Russo.

Unless government intransigence gives way to a more begrudging pragmatism, the eventual rollout of electric cars in China may be indefinitely postponed.