Operating behind the scenes, Geek+ robots aren’t widely-known, but they are an integral part of supply chains that many of us use

During peak season for George.com, the clothing brand of UK supermarket chain Asda, the company’s returns center needs to handle 360,000 units coming in and then the same number back out per day. The issue is that there is only space for 70,000 units in the warehouse at any one time. The solution? A fast-moving logistics system featuring the Geek+ P-800 autonomous mobile robot (AMR).

As just a handful of warehouse workers stand by, towers of shelves wind their way towards them, filled to the brim with goods bound for various destinations and accessible from four different sides—a feature unique to Geek+ solutions. Underneath the shelves is the P-800, which looks similar to a largish Roomba, the famous robot vacuum cleaner. The AMRs have revolutionized George.com, and Asda’s, logistics operations across the UK, allowing for the processing of goods without sorting and decreasing the time it takes to get each unit back on sale.

Geek+, valued at $2 billion in August 2022 and headquartered in Beijing, is the Chinese tech unicorn you’ve likely never heard of, but thanks to their ever-growing number of partnerships with companies like Decathlon, Walmart and Nike it is quite likely you’ve reaped the benefits of their backend solutions. And as e-commerce grows worldwide and supply chains increase in complexity, robots like the P-800 will keep everything moving.

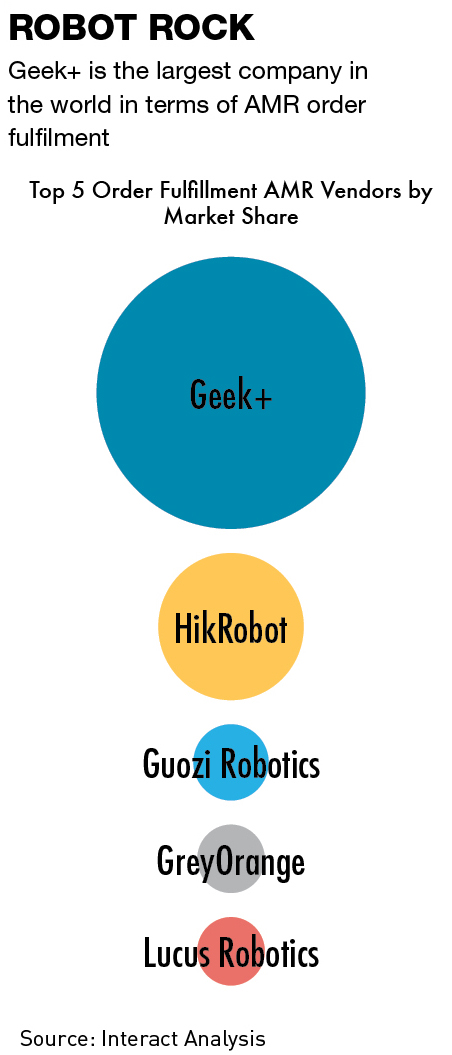

In 2021, market intelligence firm Interact Analysis not only named Geek+ as the AMR market share leader for the fourth year running, but also for the first time the global leader in mobile robots. This highlights the growing importance of the AMR market versus the older automated guided vehicle (AGV) systems that have dominated warehouses over the last few decades.

“Geek+ first developed its flagship goods-to-person solution of mobile robots carrying racks to help meet demand during peak times around the 11/11 Singles’ Day sales holiday in China,” says Marie Peterson, Geek+ International Business Development and Marketing Vice President. “Today, we have offices around the world to serve a growing global client base of over 700 customers.”

Geek squad

Even though the company’s CEO Zheng Yong only founded Geek+ in 2015, it has already become the world’s largest AMR producer by market share, according to Interact Analysis. The company is still privately held, having raised around $540 million in total from backers including big-name tech firms such as Intel Capital and Alibaba.

While no plans for an IPO have been announced, most companies look to go public after three rounds of fundraising, and having recently gone through its fifth, Geek+ could well be looking for a listing over the next year.

AMRs are the most visible part of the Geek+ product catalogue, but the company offers a range of services to solve customers’ storage issues and provide a way to efficiently get items to where they are needed. For example, its PopPick goods-to-person system increases storage density by up to four times over standard storage systems and uses movable shelves to get goods to where they are needed.

“Products and services include myriad robotic solutions aimed towards flexible picking, high-density storage handling, moving, forklifting and sorting,” says Kevin Firouzian, Technical Director at, Ruigu Robotics. “Their hardware offerings go hand-in-hand with their self-developed flexible robot management system (RMS), intelligent warehouse execution system (WES), and intelligent warehouse management systems (iWMS).”

In 2019, Geek+ opened a factory in Nanjing capable of producing 10,000 AMR units a year. Furthermore, the company provides full-service solutions to customers including the option of Robots-as-a-Service which reduces the initial costs of implementing a new system by providing the option of renting robots and even operating and management support.

“Because different clients usually have varying requirements, and the requirements are usually domain-specific and highly relevant to their business, the competition is not on the robots themselves, but rather on the overall system and service,” says Yuji Dong, assistant professor at the School of Internet of Things, Xi’an Jiaotong-Liverpool University Entrepreneur College (Taicang). “Geek+ benefits from its internal tools and platforms for fast delivery.”

According to market research firm Grand Review Research, the AMR market was valued at $2.52 billion in 2021 and is projected to reach $10.66 billion by 2030. The outlook seems bright for Geek+ and it is already starting to profit from the growing market. According to a company statement, Geek+ received $300 million worth of orders in 2021 and by the middle of the year had sold over 20,000 individual robot units worldwide. The company experienced 100% year-on-year growth in order numbers in H1 2022 and was expected to continue that pace of growth through the end of 2022.

By far the largest company producing and using AMRs globally is Amazon Robotics, with a massive 520,000 units in operation. However, they are solely confined to the Amazon ecosystem and therefore it is not in competition for market share with Geek+ and other providers. There are a number of global competitors, including Japanese startup Mujin and industry veteran Daifuku, while in China there is Quicktron, used by Alibaba’s distribution arm Cainiao, and Hai Robotics.

But according to Peterson, Geek+ has no direct competitors because it covers all requirements unlike any other players. “We see a variety of players on the market depending on the projects, from traditional automation to warehouse robotics,” she says. “But we are the full package.”

Firouzian agrees, “I would argue that based on the scale of the company, its global outreach and acceptance of product and services in China and abroad, there are few strong competitors.”

More than just robots

Geek+ differs from most Chinese companies because it does more business in international markets than domestically. For example, as well as producing the UK’s first national sorting system using AMRs for Asda, Geek+ has also provided logistics solutions for sporting goods brand Decathlon in France, where it has increased storage capacity by up to 30% thanks to the streamlined nature of the AMRs, as well as working at three times the efficiency of the previous manual operations.

It is its geographical dispersion, along with the company’s broad range of solutions and wide-ranging partnerships that have allowed them to develop so quickly into a major AMR player.

Geek+’s early AMRs were reliant on vSLAM technology—“visual simultaneous localization and mapping”—and QR codes for navigation around warehouses and factories. This system essentially used cameras and light signals to put itself on a map. The company has since collaborated with Bosch Rexroth to upgrade robots to use Lidar—laser imaging, detection and ranging—technology, now the industry standard, which enables the units to operate far more autonomously and avoid collisions, albeit at a much more expensive purchase cost. The first Geek+ robots started to use the system in 2017, making them one of the first cohort of companies to do so.

“Geek+ did not always have the best solutions but their adaptive management style allowed them to catch up on technologies and business practices, which is encouraging for their future growth,” says Professor Diana Derval, Chief Investigator at DervalResearch, which uses biosciences to decode people’s behavior and preferences for leading brands from all industries from food to electronics.

Behind the physical robots, Geek+ is also developing a number of software solutions to increase the accuracy, maneuverability and efficiency of its logistics systems. Including a Robot Management System, Intelligent Warehouse Management System and an ever-expanding Data Platform that accumulates and provides real-time data, these systems are mostly cloud-based and allow for complete control over deployed robots.

Geek+ also has a Simulation Platform that clients can use to help find the best plan and configuration of robots before a project even starts.

The company was also an early adopter of Robots-as-a-Service (RaaS). Especially suitable for use by small- and medium-sized companies, it allows users to implement an AMR solution appropriate to their needs with less capital cost. RaaS is more than just the rental of robot units, it also incorporates the software systems and AI algorithms which allow for the robots to be deployed according to fluctuating business needs.

ABI Research predicts that there will be 1.3 million RaaS installations across the smart warehousing industry by 2026, generating $34 billion in revenue. Geek+ is not alone in offering RaaS, Mujin for example also offers the service, but the Chinese company’s early adoption of the model should help it grab a substantial portion of that future growth.

Partner proliferation

Partnerships such as the one with Bosch Rexroth have been a key factor in helping Geek+ to develop and set it apart from competitors. On the physical product side, cooperation with technology partners such as Intel, Microsoft, SAP and Bosch Rexroth have helped to give the company an edge.

Geek+’s logistics solution for George.com and Asda is also in partnership with AMH, a British material handling systems company. While Geek+ provides the AMRs and the systems that allow them to function properly in-situ, AMH provides the conveyor belts and sortation/storage systems that the AMRs facilitate. The companies work closely with clients to design highly-tailored and often unique solutions.

For Asda’s South Elmsall depot, the Geek+ AMRs work within a large open space in the center of the facility, around the edges are multiple conveyor inputs and output areas sorted by product or destination. The inputs and outputs, produced by AMH, are serviced by S-series Geek+ robots fitted with a rotating conveyor belt on top, that can be used to move the product in any direction. Because the robots work within an open space, the solution’s capacity is essentially infinitely expandable, only limited by the size of the warehouse itself.

In 2018, Geek+ entered into a global strategic partnership with the German company Körber Supply Chain. “I would argue that this partnership has had the biggest impact on Geek+’s business development,” says Firouzian. “After joining hands in 2018, the two companies have worked very closely together to assist companies worldwide to streamline their operations using smart AMR solutions and establish themselves as market leaders.” Working with an established player has helped the relatively new company gain a foothold in projects internationally.

Geek+ has also used its cooperation with Körber to increase its knowledge base and experience in particular industry areas. The company’s technology spans robotics, software and algorithms, which are offered to the market in clearly defined product lines.

“The partnerships yield more case studies to bolster an already impressive portfolio of successful projects and deliver valuable knowledge on how to further shape and adapt their products for the growing and ever-changing demand for warehouse automation,” says Firouzian.

The company aims to offer tailored solutions to clients based on the specific requirements of particular industries. “Business competition in this area is not on the robots themselves, but rather the overall system and service provision,” says Dong. “Clients have different requirements, and the requirements are usually domain-specific and highly relevant to their business, so Geek+ benefits from its internal tools and continuous platform development.”

It’s the economy, stupid

Through advanced R&D, knowledge accumulation and early adoption in some areas, Geek+ has largely set itself apart from competitors, and the real threats to the company’s future lie in the health of the global economy and bubbling geopolitical issues.

The domestic market has faced a general slowdown in recent years, thanks to regulatory crackdowns on a number of industries as well as the knock-on effects of COVID-related restrictions. Recent policy changes have signaled the end of zero-COVID, but the economy is still some way from a full recovery and is also unlikely to reach the high GDP growth numbers of previous years. Outside of the China market, many countries are also trying to come to grips with the impacts of geopolitical turmoil such as the war in Ukraine.

While these issues may cause companies in any number of industries to delay new investments, they may represent an opportunity for Geek+ thanks to the improved efficiency and reduction in long-term costs that the company can provide.

“The Chinese government is very interested in further developing the manufacturing sector in the coming years and the concepts of AMR and warehouse automation solutions are actively being promoted,” says Firouzian. “Geek+ clearly benefitted from the Made in China Industrial Plan, for example.”

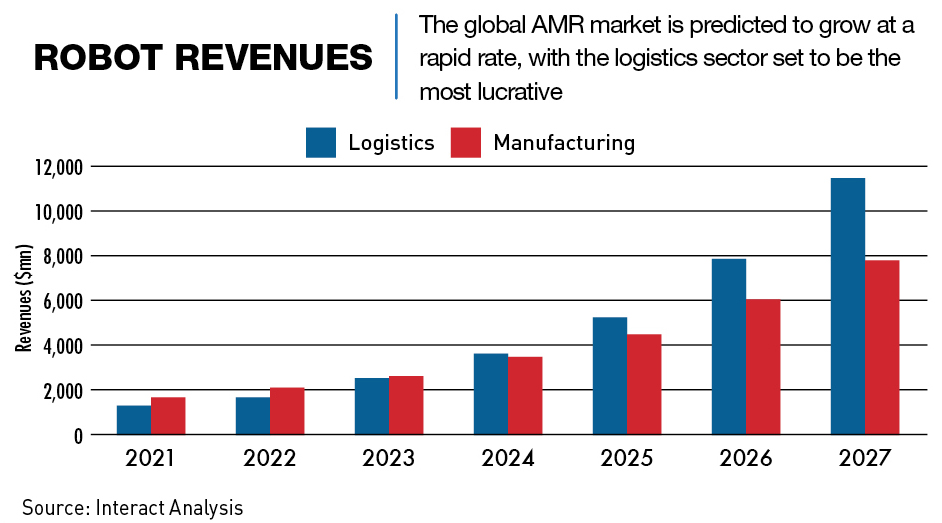

That the structural changes currently being made to the Chinese economy should offer opportunities for Geek+ is a view echoed by Dong. “With the increasing labor cost and exchange rate, the traditional labor-intensive logistics sector is facing higher pressure than ever,” he says. Interact Analysis predicts that the logistics industry will top manufacturing as the main source of mobile robots sales and revenues by 2024, and logistics’ share of the market will continue to grow until 2027. With Geek+’s strength lying more in the logistics area, this is a bullish case for the company.

Inflation over the past year in many markets has put similar pressures on many industries, and stronger players are likely to invest more in automated solutions, gaining the upper hand over less well-capitalized competitors. “Wise companies will invest in automation, digitalization and ‘intelligentization’,” says Dong. “Geek+ can benefit from this kind of investment if they can continue to deliver quality products that help meet these needs.”

While there are geopolitical risks that could threaten its expansion, Geek+ already has a broad geographical footprint and it is not too dependent on any one market. It has also clearly positioned itself as an international player rather than simply a Chinese company. And although there are obvious perception issues that come with being a Chinese tech company, the nature of the company’s tech and the benefits from it are likely to shield Geek+, to some extent, from related issues.

And with some manufacturing moving away from China, the international image of the company presents opportunities. “Given the relocations of industries toward Europe or other Asian countries like Vietnam, AMRs can help mitigate the rising cost of labor in China and make firms more competitive,” says Derval.

And while Geek+’s prospects appear to be good, there is a need to continue considering partnerships for the future. Increasingly in the warehousing logistics sector, there is a need for interoperability between machines from different companies, and perhaps the days where one company can go in and impose their branded solution on everything are numbered.

“The warehouse automation market is slowly moving towards holistic automation adaptation,” says Firouzian. “The challenge there is to combine and integrate a large cluster of hardware and software and incrementally move away from any traditional warehouse handling and management procedures.”

“But I think they’re more than up to the challenge,” he adds.

A packaged future

With current economic conditions likely to push more companies to invest in solutions such as those offered by Geek+, the company’s current level of success may well be the tip of the iceberg. “Warehouse applications are growing exponentially year over year with more and bigger warehouses being installed each year to meet e-commerce growth,” says David Cheskis, senior director at TriEye, which manufactures automated sensory technology. “We are at the early stages of robotics in warehouses with very low penetration rates currently, and there are opportunities in both new and existing facilities.”

As Derval succinctly puts it, “reliable yet affordable sensors and collision avoidance algorithms that minimize idle time are the sinews of war in AMRs.”

Going forward, the battle will be on sensors and integration. AMRs are still at a relatively early stage using first-generation 3D sensing solutions, which are costly and not always very reliable. Geek+ is no doubt working on creating solutions through partnerships with technology companies and by its own R&D. With increasing automation, there will likely be more problems with how to get machines working together in an optimized manner and not colliding with or holding each other up. Here Geek+, which offers a holistic solution alongside its partners, has an obvious advantage over its competitors.

Growing labor shortages in China and other key markets will also be key drivers for further automation, along with the desire to boost efficiency and decrease costs. Geek+ with its solutions covering many industries, proven track record and partnerships, looks set to benefit. “We expect an increasing number of businesses to make the transition to flexible automation and smart technologies, meaning that we will be quite busy for the foreseeable future,” says Peterson.