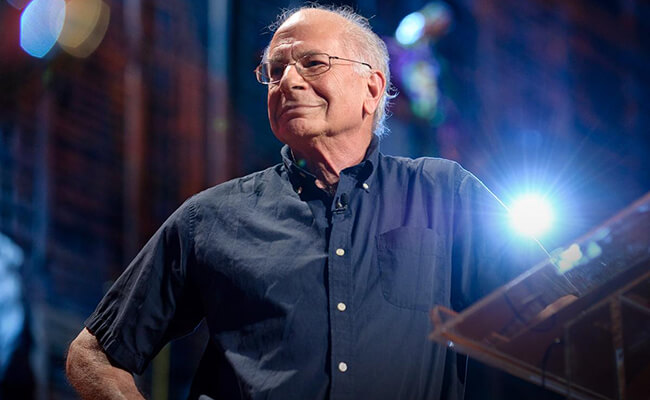

Daniel Kahneman, grandfather of behavioral economics, talks about how the field came to be and the impact it has had

Traditionally, the field of economics assumes individuals in markets to be rational—that is, always inclined to act out of their own self-interest to maximize personal gain. Reality, of course, is a bit more complex and thanks to biases, emotion and blindspots, people sometimes make decisions that appear to be quite counter to their own interests. In recent decades, a new way of approaching economics, one which tries to take these realities into account, has emerged: behavioral economics.

The field has become very popular and its influence has spread to the world of government and policy, which attempt to use the insights into our less-than-perfect decision-making approach to influence (or “nudge”) people into doing what they wouldn’t necessarily have chosen to do.

Psychologist Daniel Kahneman, with his research partner Amos Tversky, helped pioneer the ideas that became behavioral economics. In 2002, he was awarded the Nobel Memorial Prize in Economic Sciences for the wide-reaching impact of his work. In this interview, Kahneman talks about the history of his research, how psychology came to be a part of economics and the impact it has had on the world.

Q. Together with Amos Tversky and Richard Thaler, you invented the field of behavioral economics. When you were first doing your work in the 1970s, did you have a sense that what you were doing was revolutionary?

A. Absolutely not. However, I should correct your statement. Amos Tversky and I certainly did not invent behavioral economics. If anybody invented behavioral economics it is Richard Thaler. At most [Tversky and I] were the grandfathers or godfathers, as both of us were psychologists, not economists. Richard Thaler is an economist, and he really introduced our ideas into economics.

Q. So then what were your thoughts when these ideas were being introduced into economics?

A. In the first place, we were not primarily interested in influencing economics. We were psychologists. We published our main article, the most important one it turns out, in Econometrica, which is an economics journal. The reason we published it there was not to influence economics, but because at the time this was the most prestigious journal in decision theory. We had a decision theory paper, so we sent it to the best journal available. That made our work visible to respectable economists. It made a very big difference because if we had published exactly the same article in a psychology journal, it would not have had nearly the same influence on economics that it had.

Q. Was the impact immediate, or was it more of a gradual growth?

A. It was quite a slow process. There were a few landmarks along the way that I could mention. One important early figure was Eric Wanner. In 1983, he was working at the Alfred P. Sloan Foundation, and he was interested in bridging psychology and economics. The first grant that he gave was to Richard Thaler to spend a year with me in Vancouver. That year was very important, I think, to the development of behavioral economics. I collaborated with Richard and with another economist. I learned a lot of economics, and our publications during that year were in economics journals. We published about the endowment effect, which has become very important, and we published about fairness. These eventually had a significant impact.

Then I think the most important thing, and one that few people know about, was the role of Nobel laureate Joseph Stiglitz—he was not a Nobel laureate at the time. In the 1990s, he was the editor of the Journal of Economic Perspectives, which every member of the American Economic Association receives as part of their subscription package. Joe Stiglitz invited Richard Thaler to write a regular column. They ran under the title “Anomalies,” and they were all challenges to established economic theory—Richard Thaler wrote them brilliantly. He always had a co-author who was a respected person in the field, and the articles were highly readable and almost invariably funny because Richard has an excellent sense of humor. They were read by everybody. I think that it was primarily those columns that made people in economics aware of behavioral economics, aware of Richard Thaler and aware that something useful was going on that was a challenge to standard economics.

Q. How does challenging the idea that people are rational challenge economic theory in its entirety?

A. The assumption of rationality is essential if you are going to do economics, and the reason is the following: economics is really about markets, but markets consist of individual buyers and sellers. The way economics works is it predicts the behavior of individuals in a market situation. The assumption of rationality simply means that every one of those individuals follows his or her best interest, and if they find an opportunity, they use it. This makes economics able to predict human behavior, because all you need to do then is to define the market in terms of the opportunities that it provides to the individual agent, and then you assume that each agent will use all the opportunities available to them to the maximum. You can then ask how will the market behave if everyone behaves in that way.

The moment you allow different types of individuals and different levels of rationality and so on, economics just becomes so complicated that it becomes virtually impossible to make market predictions. The assumption of rationality is really central to economics. Even today, when behavioral economists make predictions, they still assume rationality, albeit with some exceptions. The way that theory is done is that you say that people are rational, except that they have too much faith in small numbers. People are rational, except that they are myopic. You make that assumption, and that assumption predicts some anomalies, but the basic mechanism of exchange still assumes people act in their own best interest.

Q. Your 2011 book Thinking, Fast and Slow brought your science to a wide and general audience. To what degree do you think understanding our flaws at the individual level helps us to live better lives?

A. I don’t think it has any significant influence at all. Thinking, Fast and Slow is not a self-help book for individuals. Where I think there is potential is for organizations to adopt procedures and processes that take into account human limitations among their employees. They already do that with respect to their clients, that is what advertising is, but internally they do not do this. I think of large organizations as decision factories. They produce decisions, but do they produce the best decisions that they are able to produce? My impression is that the answer is negative, and that organizations, because they do not try to optimize their decision-making at every level, leave a lot money on the table, for example.

Q. So how are the principles of behavioral economics applied in the real world?

A. The main impact of behavioral economics has been on policy, and it has been through the activities of Richard Thaler, and his book Nudge. That impact has been quite substantial, mainly through the whole movement of “nudges” it created, which can change the nature of the interaction between governments and citizens. The idea of “nudges” is to change the way that the choices that citizens face are structured, which Richard Thaler calls “choice architecture.” The idea is to present the choices in such a way that allows the individual freedom, but at the same time encourages people to make a decision that is actually fairly advantageous. Nudges have been quite popular and influential, and moderately useful. You have seen units devoted to this sprout up in governments.

Q. Can you give an example?

A. There are many laws that provide an individual with rights or entitlements that, if they reach a certain age, they are eligible for something. The take-up on these entitlements is very far from perfect because they are not communicated well. Or in the US, there are loans that are available to young people to go to college, but the forms that you have to fill out to get the loans are so complicated that there are thousands of people every year that do not go to college because they cannot fill out the forms. So part of it is simplifying the choices that individuals face.

On a different side of it, sometimes the challenge is to protect individuals from organizations because organizations deliberately present people with information that is very difficult to understand. This happens sometimes when you sign on to a new website: you have to scroll through a very long contract and at the end you have to say do you agree or disagree and of course you click “I agree,” and that establishes a relationship. Now, in the computing domain it is not very important. But when firms that issue mortgages, or firms that issue credit cards handle very long contracts that people do not understand, this is not to the individuals’ interest.

These ideas had some influence in the Obama White House, where they were introduced by law professor Cass Sunstein, who was Richard Thaler’s co-author on Nudge. What they were doing was to try to compel institutions that interact with individuals to simplify their communication, to reduce the ability that financial institutions have to mislead individuals. That was quite strongly resisted by the corporate world, I should add, and I am quite sure that any efforts will be reversed by the Trump administration.

Q. Some people find the idea of the government influencing people through nudges to be a bit unsettling, or “creepy” to use the popular word. What is your view on this reaction to nudges?

A. Nudges are explicitly paternalistic. I think clearly there is a danger of manipulation because the whole idea assumes that people can be moved, and it furthermore assumes that there are a lot of interested parties out there in the economy that want to manipulate people to their own ends. But now in the United States, this idea of “creepiness” is associated with a long-standing cultural tradition that emphasizes freedom and responsibility. And so you can expect that anything that allows bureaucrats, as they like to say, to do things that intentionally affect the behavior of people to sometimes have that connotation.

I think the answer to this controversy, which has been proposed by Richard Thaler, is easy. He points out that there always is a choice architecture. It is not as if the existing situation is neutral. The existing situation in many cases has been shaped either by people who did not care about the outcome, or by people with a self-interest. So the idea that you can have a system that is completely neutral and that behavioral economics is creepy because it intervenes is I think completely unrealistic. The field is not neutral.

Q. There seems to be a political dimension to the argument, at least the way it is framed in the United States.

A. Behavioral economists are, massively, I would guess, pro-Democrat. They very much preferred Hillary to Trump as compared to non-behavioral economists. So there is a political difference, and the “creepy” adjective I can almost guarantee you is probably used on the right of the political perspective.

It is unfortunate, but it is always true that policy applications involve political preferences and the whole idea that people need protection against their own mistakes is an idea that has been rejected by conservative economists. That has a long history. Milton Friedman, who was sort of a guru of conservative right-wing economics, although perhaps he was less extreme than some of his followers, emphasized personal responsibility in his book Free to Choose. It is a long story.

Rationality, the assumption that people are rational, means that they don’t need to be protected against their own mistakes. That’s the main issue that separates the people who believe in nudges from those who do not—it is whether the government has a responsibility to protect people from their own mistakes. Right-wing economists and conservatives in general in the United States were against social security, because of the idea that people are responsible for their own fate, and if they are going to be old and they will need money when they are old, well they are responsible for saving. And if not, well, poor them. The idea that people are myopic and therefore do not save enough is viewed by some as imposing a responsibility on the government to protect people by helping them save.

The liberal idea is to help various ministries in their interactions with citizens, to help citizens make good decisions, but I think that in the US this is already a thing of the past. I don’t believe the behavioral psychology unit will survive long in the Trump administration.