It is more the technologies underlying cryptocurrencies than the digital tokens themselves that are of interest to China

China and cryptocurrencies have had a turbulent relationship in recent years, but a recent event in Hong Kong seemed to suggest the opposite. In early 2023, investors and regulators rubbed shoulders to discuss a new version of the Web built on blockchain infrastructure—the same technology that underpins crypto transactions.

In attendance at the inaugural Web3 Festival were crypto exchange CEOs, representatives of major cryptocurrencies like the popular USDC stablecoin, and key local industry officials including Hong Kong’s financial secretary Paul Chan. “I will boldly say that now is a golden opportunity for the development of Web3, and also the most thrilling moment,” Chan told delegates.

Hong Kong’s bullish tone for the next stage of the decentralized internet known as Web3—and by extension cryptocurrencies—contrasts starkly with the outright hostility from Chinese regulators toward the crypto industry. Beijing first forbade local banks from handling Bitcoin (BTC) transactions in late 2013 and has turned the screws tighter over the past decade with a ban on initial coin offerings in 2017—the hottest component of the crypto industry at the time—and then full bans on crypto mining and trading in 2021.

“When you look at crypto, it does not solve many problems within the Chinese financial system—it only introduces risks,” says Zennon Kapron, managing director of fintech research firm and consultancy Kapronasia. “While China’s position has become more formalized over time, the authorities were saying pretty much from the start that they didn’t see the benefit in crypto so they didn’t want it.”

The restrictions have decimated the market for digital currencies in China, which once accounted for more than 90% of global BTC trading. But while the hard line on crypto appears to suggest that China does not care for digital assets—which remain risky, volatile and highly speculative—the ongoing development of a Chinese central bank digital currency (CBDC) indicates Beijing’s interest.

The digital yuan—now the most mature CBDC by far—is emblematic of how China has pooled resources and investment to spur innovation in blockchain, a peer-to-peer network made up of actors that can interact and exchange information without the involvement of a centralized entity. While this embrace of blockchain amid a crypto crackdown may seem inherently contradictory, it is important to note China’s interest is more in the technology itself than in its most popular application.

“This is a technological frontier so it makes sense that the government is emphasizing it,” says Zou Chuanwei, chief economist of Wanxiang Blockchain Labs, a research institution that cohosted the Web3 Festival in Hong Kong. But despite the government’s policy stance on cryptocurrency, it is clearly interested in the underlying blockchain technology, although with some restrictions.

“They have also made it very clear that only consortium blockchains developed by organizations are allowed. The development, promotion and use of public blockchains—which anyone on the internet can join and participate in—is tightly restricted in China,” says Zou.

Crypto’s China downfall

China’s crypto caution is perhaps understandable given its control-oriented governance system. Cryptocurrencies like BTC and Ethereum (ETH) are digital currencies that use cryptography—mathematical techniques for encoding and decoding information—to secure and verify transactions. Verification and record-keeping are done via blockchain, which allows the currency to operate as a decentralized system, theoretically beyond the control of any central government authority.

Transparency, decentralization, permanence and security are all hallmarks of crypto, which has the potential to simultaneously transform a variety of industries and blunt the power of authorities to impose strict social and financial controls.

Interestingly, in the early 2010s, China was the world’s biggest crypto mining hub, with local miners responsible for an estimated 95% of all newly minted BTC. And as recently as September 2019, the country made up 75.53% of the total ‘hash rate’ or processing power of the BTC network, dwarfing the 4.06% share of the US, according to research from the Cambridge Centre for Alternative Finance (CCAF). The Chinese share of global bitcoin mining capacity officially plummeted to zero in July 2021, weeks after the government called for the restriction of crypto mining and trading, for environmental reasons and over concerns that digital currencies could be used for fraud or money laundering.

But the extensive mining prior to the mid-2021 crackdown means China is a ‘whale’—crypto speak for a massive holder of digital currencies. Chinese authorities seized 194,775 BTC, 833,083 ETH and varying amounts of seven other coins from a massive crypto scam in 2020, with the BTC and ETH alone worth a combined $7.17 billion at the time of writing. China’s central government holds more than 1% of the 19.49 million BTC currently in existence.

China’s efforts to stamp out crypto mining didn’t completely quash activity in the country either. CCAF research showed China’s share of global BTC production had bounced back to 22.29% in September 2021, thanks to under-the-radar operations that were geographically scattered and small-scale, and has stayed steady at that level since.

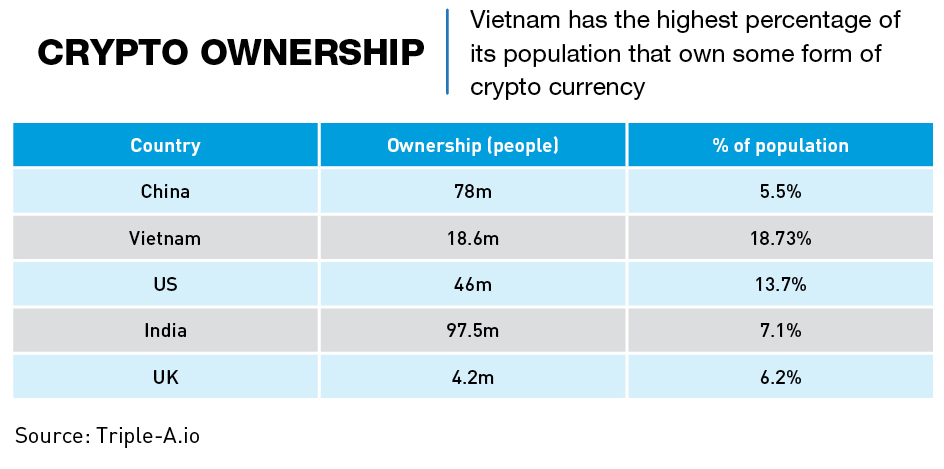

And despite Beijing’s anti-crypto stance, it remains technically legal for Chinese citizens to hold crypto. Some 78 million people in China—equivalent to 5.5% of the total population—still owned a cryptocurrency as of mid-May 2023, according to crypto payment gateway Triple-A. But this lags the 18.73% share in Vietnam, along with 13.7% in the US and 7.1% in India. These numbers can vary depending on the source, but the general distribution remains consistent across each outlet.

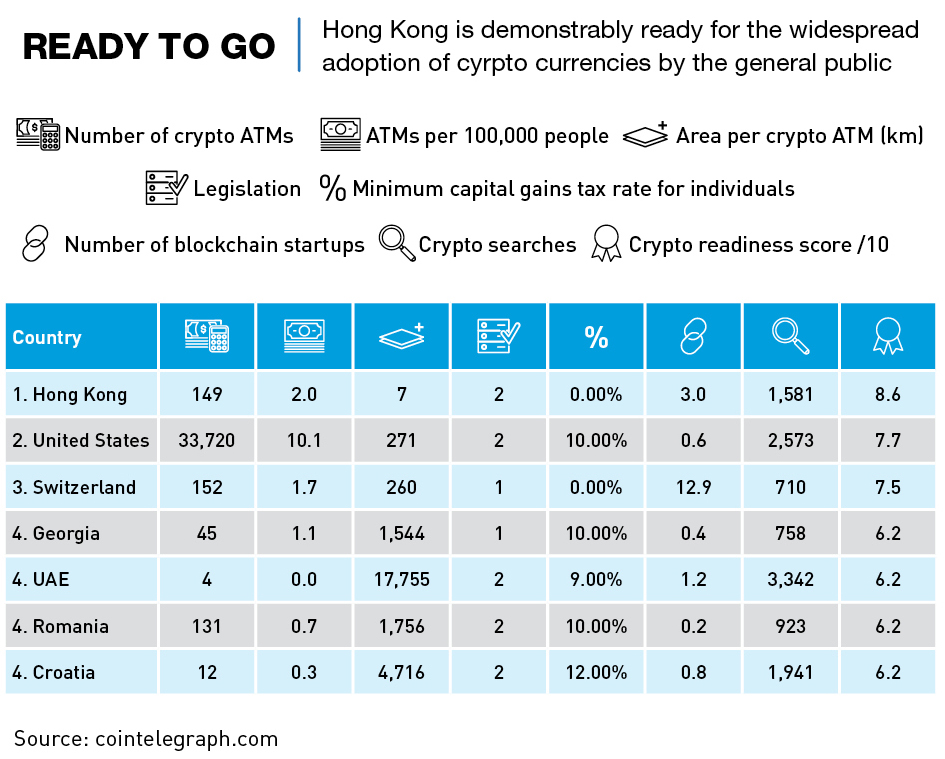

Hong Kong’s aim to be the world’s crypto hub is a more recent development, with the international financial center positioning itself in the same way Macau has done for gambling. As underlined by the Web3 Festival, the city has embarked on a charm offensive to attract crypto businesses, scrapping a yearslong ban on crypto trading by small investors and launching a new licensing regime for crypto exchanges. Crypto trading volume in Hong Kong stood at $74 billion between July 2021 to June 2022, compared with slightly more than $100 billion for Singapore, according to analytics firm Chainalysis.

The welcome mat for Web3 represents something of a pivot for Hong Kong as the Asian financial hub has not always been so open to crypto. In 2018, it introduced rules limiting crypto trading to institutional investors, sparking an exodus of digital startups to Singapore and other less strictly regulated jurisdictions.

“It’s a natural business for Hong Kong to get into ultimately,” says Wang Yikai, an associate professor in economics at the University of Essex in the UK. “It is a financial hub where institutions make money from international financial flows, so they could just as easily make money from cryptocurrency movements.”

Big on blockchain in Beijing

The transparency of blockchain creates a decentralized digital public record of transactions that is secure, anonymous, tamper-proof and unchangeable. Making use of this technology, a government could control all activities in the financial field. Blockchain technology can also be used in nearly every other industry. In addition, automation on the blockchain, widely referred to as “smart contracts,” could also appeal to Chinese authorities.

With an enthusiasm that comes from the top—Chinese leader Xi Jinping called for China to “seize the opportunities” presented by blockchain in a 2019 speech—Beijing is throwing considerable resources into this potentially disruptive technology.

China’s embrace of blockchain shows up most prominently through its development of a CBDC known as the e-CNY or digital RMB, a virtual version of the Chinese fiat currency and the first to be issued by a major economy. Cumulative transaction value of the digital RMB had topped ¥1.8 trillion by the end of June, compared with just ¥100 billion in August 2022, while ¥16.5 billion of the digital currency was in circulation, former People’s Bank of China (PBOC) governor Yi Gang said recently. This was up from the ¥13.61 billion in circulation at the end of 2022.

According to Yi, the amount of digital RMB in circulation represented just 0.16% of China’s currency in circulation, meaning there is plenty of room for its expansion.

“Mobile payments have already completely penetrated the daily lives of Chinese people, a shift that has made Alipay and TenPay important parts of China’s financial infrastructure,” says Zhang Xiaoxi, China financial analyst at Gavekal Research. “The PBOC does not want to be solely dependent on private-sector infrastructure, so they are creating a public-sector backup.”

“The digital RMB likely does not pose an immediate threat to other channels for private payments, but it does create competitive pressure that limits how much revenue the internet companies can extract from their users.”

Beijing is looking to cement its early leadership in blockchain with continued investment. In May, a national blockchain research center backed by the Ministry of Science and Technology launched in Beijing with the aim of training at least 500,000 blockchain professionals for China’s Web3 industry. It also aims to establish a national-level blockchain network that will connect existing blockchains in China and support other industries.

An additional arrow in Beijing’s quiver is the Blockchain Service Network (BSN), a major state-backed digital infrastructure company launched in 2020 with the support of the State Information Center, China Mobile, China UnionPay and Red Date Technology. The BSN oversees the development and operation of the national blockchain infrastructure.

“The BSN was meant to underpin many other blockchain services, but my anecdotal view is that the BSN hasn’t really met expectations in terms of what it could have been, so I think that’s limited the uptake of those services in mainland China,” says Kapron.

And while China has cooled toward crypto, some of the sector’s biggest global players have links to the country. Five out of the 10 most liquid crypto exchanges count Chinese nationals among their founders, a heritage that has occasionally complicated their operations—for instance OKX’s Xu Mingxing was detained by Chinese police for more than a month in 2020 to assist with an investigation.

The complicated relationship extends to Binance. Jiangsu province-born cofounder and CEO Changpeng Zhao launched the company in Shanghai in July 2017 before relocating it overseas weeks later as an official crackdown started to bite—although the claim that Binance completely exited China has been disputed. Even though Binance is inaccessible in China, the country reportedly remains the company’s top market with more than 900,000 active users who traded up to $90 billion of crypto assets in May 2023 alone.

Hong Kong’s cryptic role

Some have suggested that Hong Kong, through its recent pivot toward crypto, could be serving as a testbed for China to experiment and innovate on digital asset regulation. The city’s government recently introduced a HK$30 billion ($3.83 billion) mutual fund to boost the financial sector—including fintech, blockchain and digital assets—and aims to provide grants and funding opportunities to blockchain entrepreneurs.

“Hong Kong is an international financial center and is very open to financial innovations, including Web3 and cryptocurrencies,” says Zou. “Hong Kong’s financial regulators are very capable and experienced, so they know how to regulate this new market.”

Kapron believes Hong Kong’s motives for rolling out the red carpet could be more financially motivated given how the city was roiled by protests and then COVID-19 in the past four years. “Hong Kong did not fare well through the pandemic because of lockdowns and other recent challenges that it has faced. This is a much-needed opportunity to reset for Hong Kong because its role in Greater China has always been to be more innovative and one step ahead of mainland markets, to serve as the gateway into the wider country.”

A regulatory milestone took place in early August when the Hong Kong Securities and Exchange Commission permitted retail investors on HashKey Exchange and OSL—the only two crypto exchanges licensed by the commission—to trade BTC and ETH.

This extended the momentum of the crypto and blockchain space in Hong Kong, where new developments have come thick and fast. Recent milestones have included the establishment of the Institute of Web 3.0 in early 2023 to focus on the digitalization of traditional industries and the virtual asset economy that includes cryptocurrencies and non-fungible tokens. The institute is headed by a former leader of the Hong Kong central bank and counts China Mobile, Huawei and the Hong Kong University of Science and Technology among its founding members.

The end of 2022 and early 2023 saw the launch of three crypto-asset exchange-traded funds (ETFs) on the Hong Kong Stock Exchange, making the city the first in Asia to provide such access to crypto ETF products. Investor interest has been lukewarm though, as their daily turnover averaged just HKD 9.3 million ($1.19 million) from mid-December 2022 to early February 2023.

Not content with just hosting the Web3 Festival, Hong Kong plans to continue expanding access for crypto investors and entrepreneurs. More showcase events backed by the government are planned, including Hong Kong Fintech Week at the end of October.

Beijing’s quiet backing of Hong Kong’s push to become a crypto hub has generated excitement over the border, but Zou says the crypto community should be wary of great expectations. “Hong Kong is not a sandbox for mainland China regarding crypto markets,” he says. “What happens in Hong Kong is independent from the mainland, as the latter usually views Hong Kong as an overseas market.”

“Hong Kong has its own currency, its own financial regulator and set of laws. There is a clear firewall between the financial markets of the mainland and Hong Kong. I think the central government is confident that Hong Kong can develop a crypto market and regulate this market very well, with no risk of spillover to the mainland market.”

And far from a policy relaxation, there could be more headwinds incoming for crypto on the mainland given Beijing appointed prominent BTC skeptic Pan Gongsheng as PBOC governor in July. Six years ago, Pan commented that “if you sit by the river and watch, one day the corpse of Bitcoin will float in front of you.” At the time, he also defended regulatory action against crypto and admitted to being “a little scared” to consider what would have happened if China had not curbed digital assets.

Chinese blockchain

At first glance Hong Kong’s crypto-forward moves may be difficult to square with the anti-crypto actions of the Mainland. But continued Chinese investment in blockchain points to a recognition in Beijing that digital payments of all kinds—presumably including cryptocurrencies—will make up a major part of the cashless financial system of the future.

“It’s fair to say that the digitalization of money, payments and the financial system is a key motivation,” says Wang. “Digital payments are already super-important. Of course there is debate on how important cryptocurrency will be within digital payments, with some saying it could account for a large fraction and others saying it will always be small because of the instability of cryptocurrency values. But generally, digital currency and digital payments are critical, and cryptocurrency will be part of it.”

China’s harsh line on crypto also looks increasingly justified given how often the space is marred by corruption and fraudulent activity. In 2022 alone we saw the multibillion-dollar meltdown of crypto exchange FTX that marked the fall of former golden boy Sam Bankman-Fried, the collapse of stablecoin Terra and cryptocurrency Luna and the collapse of crypto lending platform Celsius.

The numerous scandals underline how crypto remains a relatively niche, highly volatile phenomenon that potentially poses a risk to financial stability and investor security.

“Crypto-assets have no intrinsic economic value and do not serve the needs of the real economy whatsoever, according to the Chinese government,” says Zou. “This is especially problematic given the country’s leaders believe serving the real economy is the single most important goal of the financial system.”

Some also view the development of digital RMB as an attempt to centralize the blockchain technology, which is ironically fundamentally about decentralization. China is now home to the world’s most centralized internet—again, a technology that many thought would enable more openness and independence from authorities—so perhaps it is no surprise that Beijing believes it can bend blockchain to its will. After all, shorn of their anonymity, distributed ledgers like blockchain can be a boon for regulators: they can provide visibility, for instance, on who owns what.

“Technology is neither good nor bad, it’s what you make of it,” says Kapron. “China fully understands the potential of blockchain to either reinforce government control or negate it, so it is perhaps no surprise that the authorities have chosen to embrace it as a tool as much as they have done.”

The acceleration of the digital RMB project also dovetails with Beijing’s deep concerns about the vulnerability of the Chinese economy to the US dollar’s supremacy and its desire to develop alternative systems to hedge against dollar risk. China’s dependence on the dollar has long been a source of frustration in Beijing as it not only cements the country’s vulnerability to sanctions, but also exposes China to America’s macroeconomic whims.

A digital RMB could be useful in helping China evade international sanctions should the US and its allies ever decide to impose financial restrictions, according to Wang. “It makes a lot of sense because at present, a Chinese company making payments to a company in Argentina would need to rely on US or Western institutions like SWIFT,” he says. “The money has to go through a system run by America or its allies. But now, with a CBDC, as long as the network is working, the money can go to Argentina directly.”

Crypto’s tip-toe to relevance

Once the promised land for cryptocurrencies, China has stamped out most activity in the space—although trading continues on the fringes. Mounting concerns about the health of China’s economy mean there is little possibility that policymakers will ease their position in the next five years at least, predicts Zou.

“Authorities want to manage risks to the financial market stemming from real estate and local government debt, and so while that is ongoing, there is no chance China will change its cryptocurrency policy.”

China’s experimentation with the digital RMB and blockchain suggest at least some recognition that cryptocurrencies are here to stay as the future of money becomes increasingly digital. The digital RMB may initially be a mere footnote in China’s financial system, but government backing could see it eventually become mainstream.