Chinese tourists are now flooding through Singapore’s Changi Airport in ever-greater numbers. The Southeast Asian nation now offers a whole host of activities that fit the changing tastes of Chinese travellers, as well as having a number of cultural and language alignments that help visitors easily acclimatize.

Chinese outbound tourist numbers peaked at 155 million in 2019, just before the pandemic struck, making them at the time the largest tourist demographic in the world. But border closures in 2020 reduced outbound travel to virtually zero. The pandemic officially ended for China in 2022, however recovery was slow, and although numbers are once again nearing pre-pandemic levels, destinations and desires have changed.

“While on the surface many statistics are returning to 2019 levels, there are major differences in how Chinese tourists choose to travel, what they want from their trips and how they decide on their itineraries,” says Subramania Bhatt, CEO of digital marketing and research firm China Trading Desk.

China’s international travel

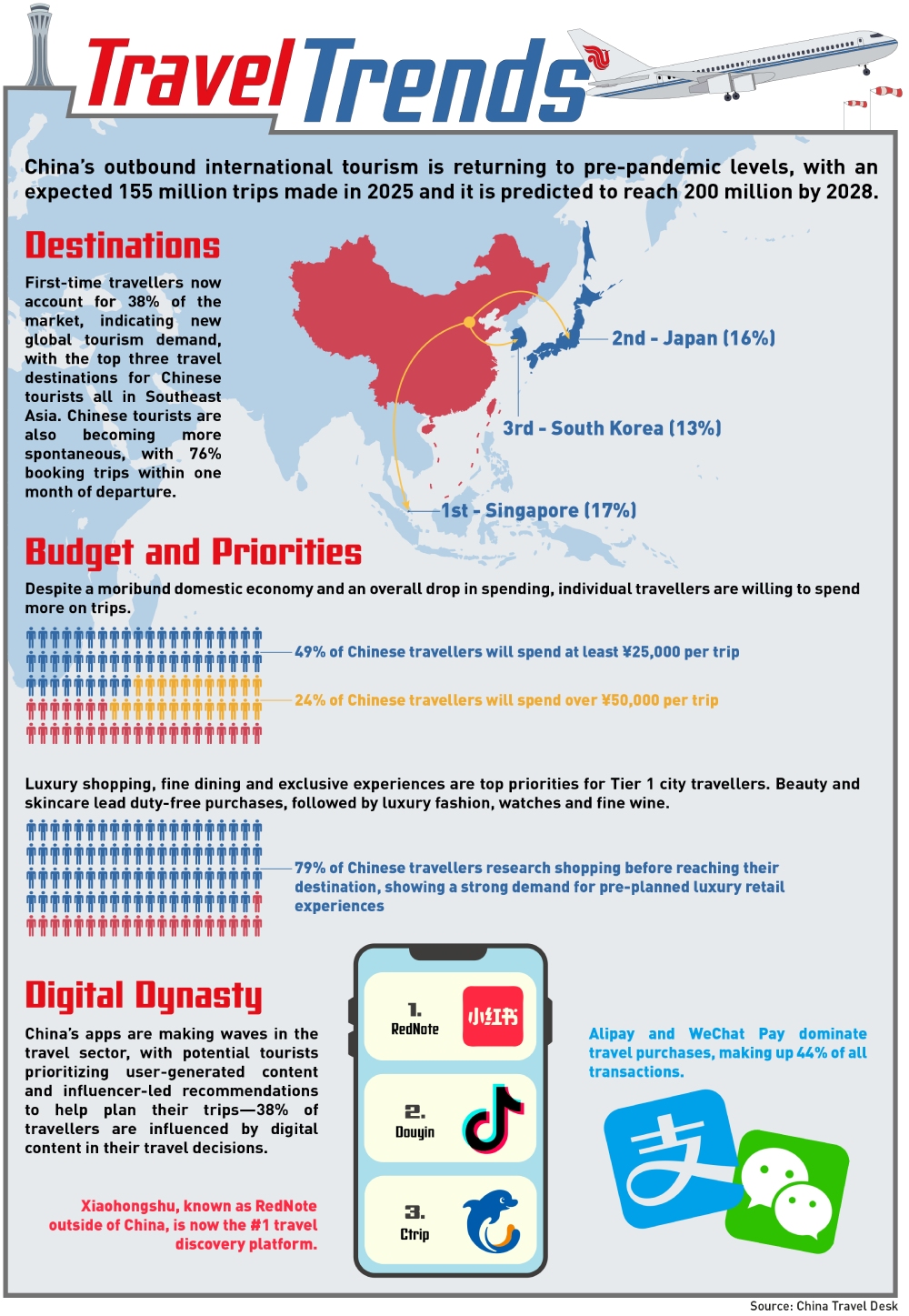

Chinese travellers made 145.9 million trips outside of the country in 2024. That number is expected to reach parity with 2019’s 155 million trips this year, according to China Trading Desk. And the growth is predicted to continue, with trips passing the 200 million mark by 2028.

“Although the overall number of trips made is recovering, it is drastically different from 2019 depending on which country you look at,” says Sienna Parulis-Cook, Director of Marketing and Communications at Dragon Tail International. “While many destinations have stayed reasonably even, some destinations have risen up the rankings while others, such as the US, have dropped significantly.”

Singapore now tops the list of preferred destinations for Chinese tourists, with 17% of travellers stating they would like to visit the city-state. Japan (16%) and South Korea (13%) are also popular thanks to their proximity and cost, particularly the weakening of the Japanese yen, which allows visitors to spend more.

Elsewhere in Asia, Thailand, although still a popular destination for Chinese tourists, has slipped to 7th place in the rankings, thanks, in part, to a recent spate of safety concerns after a high-profile kidnapping in the country. While safety concerns have always played a role in desire to travel to the US, currently, a lack of flight connections due to pandemic cancellations and the current geopolitical tensions are greater contributing factors.

“Safety has always been a top priority for the Chinese outbound market and right now it is having a huge impact on Southeast Asia,” says Parulis-Cook. “Prior to COVID Thailand and Japan were neck and neck, but Thailand’s recovery rate has been much lower compared to countries such as Singapore, Malaysia and Japan, which are perceived as much safer. The human trafficking issues in Thailand also came just before the New Year’s holiday, and resulted in a mass cancellation of bookings at a key time of year.”

The Middle East has also seen major incremental gains, although starting from a low base, particularly with high-net-worth Chinese. The UAE, and in particular Dubai, were seeing increases in tourists before the pandemic thanks to easy flight access and visa free status for travellers, but the region is increasingly interested in attracting Chinese tourists from around the region, with Oman launching its official marketing in China in March 2025.

While total tourist numbers have recovered, spending is another story, the average spend in foreign currencies is still 28.2% below 2019 levels in 2024, despite a 77.9% year-on-year surge, according to Pantheon Macroeconomics. But depending on destination, there have been rises and falls in duty-free spending, with GlobalBlue reporting that in January 2025 the EU saw Chinese duty-free spending at 82% of 2019 levels, while Asia Pacific was at 242% of pre-pandemic levels.

“Chinese households were hit by lost income during Covid lockdowns and the severe property market downturn. Many are worried about their job prospects amid the uncertain growth outlook, and consumer sentiment remains low,” says Duncan Wrigley, Chief China+ Economist at Pantheon Macroeconomics. “This has resulted in a preference for lower-cost regional destinations in Asia over long-haul travel to Europe and the US.”

China’s online travel agency (OTA) market is dominated by Trip.com Group, which accounts for around half of market share, but a number of other players are trying to take advantage of changing trends, the largest of which is Alibaba’s Fliggy.

“Trip.com Group is stronger when it comes to group travel, while Fliggy is the market leader for foreign independent travel,” says Wrigley. “Traditional travel agencies like China International Travel Services are playing a smaller role, though probably still serving older cohorts.”

The Chinese government has also implemented several reciprocal visa-free travel agreements with countries around the world, including Singapore, Thailand and Serbia, and extended public holidays by a day during the Lunar New Year and May Labor Day holidays, although the latter was initially implemented to help boost domestic consumption.

Tourist desires

The long-standing impression of Chinese travellers is one of large group tours, but there has been a growing shift towards fully independent travel. The trend away from group tourism was accelerated by the pandemic, but numbers were already dropping between 2015 and 2019. Since then, flight data from ForwardKeys shows that bookings of six or more to Asia have dropped 51% and for further afield they are down 55%. The opposite is true for individual or family bookings.

“There are still some destinations and demographics that lend themselves to group tourism,” says Parulis-Cook. “There is a preference for group tours to more niche destinations such as Latin America and Africa, where language and organization of activities can be more difficult. But the style is changing, they are moving away from the fast-paced, large group and cheap hotel model to smaller, more in-depth options.”

She adds that older and first-time travellers from lower-tier cities also provide a market for group tours, but are likely to shift over to more individual options once they have become more experienced with going overseas.

While overall spending is down, individual travellers often end up spending more on their trips. It is especially true that Gen Z tourists, who tend to value sustainability, culture and food, are very value conscious and if they are to look towards luxury, then it will be in the form of experiences rather than item purchases.

“Almost 50% of Chinese tourists state that they expect to spend more than ¥25,000 ($3402) on a trip, with around 25% likely to spend ¥50,000,” says Bhatt. “The majority of that is spent on food and sightseeing, rather than things that were more traditional in the past such as luxury goods.”

For older travellers, particularly high-net-worth individuals, there is increased interest in curated, personalized experiential travel and luxury experiences.

Spontaneity has also become more prevalent, with many travellers booking trips within one month of departure, and there has been an increase in flexible travel plans. This was evidenced by the mass cancellations of trips to Thailand in early 2025 and a spate of re-booking and shifting to other destinations.

Influencer-led travel

China’s tourism industry has enthusiastically participated in the inevitable shift towards digitalization, with massive social media coverage of destinations and recommendations used for travel inspiration.

“Digitalization ties neatly into the trend away from group tourism and towards independent travel,” says Parulis-Cook. “Digital resources make it easy to book and research, and user-generated content and travel influencer guides are encouraging people to travel and plan.”

The importance of user-generated content (UGC) to China’s travel market cannot be overstated, and social media app Xiaohongshu—known as RedNote elsewhere in the world—is now the key tool for Chinese travellers looking for inspiration and advice.

“UGC and influencers/Key Opinion Leaders (KOLs) are critical, and while family and friend recommendations still play a role, it is the third parties that have the most influence as they can often showcase the destination itself and the ‘hidden’ spots,” says Bhatt. “Some Chinese travellers have been so particular in their plans that hotels have reported them booking specific rooms that give them the right view at the right time, and that all comes from Xiaohongshu.”

Apart from Xiaohongshu, Chinese users are also turning to Douyin—TikTok’s Chinese sister app—and platforms such as WeChat, with each offering e-commerce options, as well as one-click buying and flash sales. Additionally, many global destinations are starting to accept the digital payment options that are so prevalent in China as a way to bring in more Chinese visitors.

The rise of UGC and influencer-led recommendations has led to a number of concerns over scams in China, and the government has taken steps to crackdown on app fraud and increase oversight of KOLs through content moderation due to the size of their influence.

Smart planning and AI-generated itineraries are also becoming more common with a greater digitalization of the industry, but so far, AI has not fully taken hold.

“Chinese travel companies are all investing a lot in AI, but at this point there aren’t that many tools that people are wanting to use,” says Parulis-Cook. “Users are still quite skeptical about the usefulness [of AI tools] and also prefer the personalized nature of UGC. But given the massive impact of Xiaohongshu on independent travel in the last few years, there is likely a major opportunity for AI tools to bridge gaps in the years to come.”

Ticket to ride

Although there are still some lasting effects of pandemic-related travel restrictions, China’s tourists are increasingly heading back out into the world, but with a very clear change in priorities, and the shifting geopolitical environment is also going to continue to impact choices.

“Regional preferences, for example, are still influenced by cost and convenience, but also by how welcoming they are to Chinese visitors,” says Wrigley. “This can be in terms of visa entry, but more subjectively depending on bilateral relations and media framing. For example, I would expect Europe to do better than the US in the coming years.”

As a result, according to Parulis-Cook, we are likely to see a growth in destinations tailoring their offerings to Chinese tourists and their demands. “The Middle East is a good example of a region with a good relationship with China that is investing money to attract more tourists,” she says. “It is also something that we should expect to see from other emerging destinations around the world in the future.”