Temu has grown rapidly but is still losing money on each transaction, so turning a profit is still a way off

The NFL’s Super Bowl is almost as well-known for its commercials as it is for its sporting entertainment, with many tuning in specifically to see how iconic American brands will wow them each year. But the 2023 Super Bowl featured a rather unusual spectacle—a commercial for a Chinese product, and one that was just five months old. Chinese e-commerce app Temu’s 30-second time slot cost the company $7 million, but that sort of spending seemed apt considering the “Shop like a billionaire” tagline that punctuated the commercial.

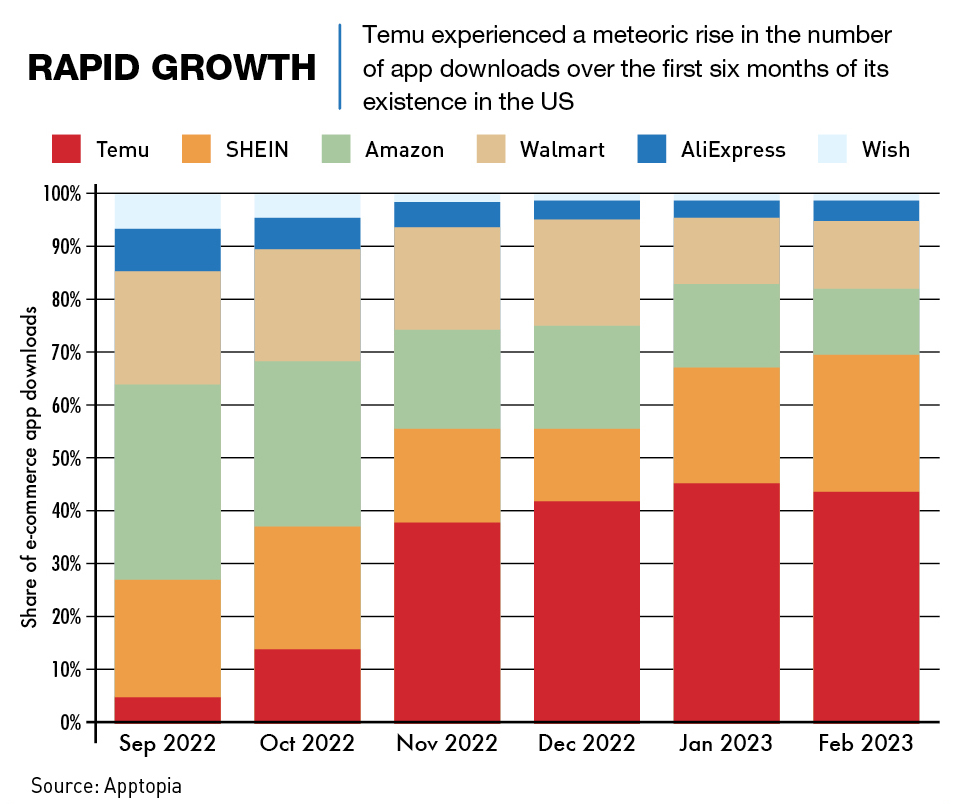

Launched in September 2022, Temu’s user numbers surged in the month following the Super Bowl and it only took the company a record-breaking seven months to achieve 50 million app downloads. The feat is even more impressive when compared to e-commerce giants Shein and Wish, both of which took nearly three years to reach the same milestone. But remarkably, this was only the beginning for Temu.

Temu, linked to Chinese e-commerce giant Pinduoduo under parent company PDD Holdings, is charting a fresh course for Chinese companies in Western markets, offering a wider range of products than the originally grocery-focused Pinduoduo. The unprecedented success of Temu in its initial months is in sharp contrast to the historical struggle faced by many Chinese companies in penetrating Western markets, but there are caveats.

“We’ve never seen such a rapid rise of an e-commerce app in terms of adoption and usage among US consumers,” says Sky Canaves, a senior retail and e-commerce analyst at Insider Intelligence. “However, the sustainability of its growth rate is still in question.”

New horizons

Temu is a cross-border e-commerce platform offering a wide range of products including clothing, home appliances, shoes, electronics and more. The company offers items at surprisingly low-price points—consumers can buy a wireless headset for $9, dresses for $2 or a digital camera for $12.

“Temu is really effective at conveying its message of low prices,” says Canaves. “This is particularly appealing in the current climate where inflation has pushed up prices and made consumers more value-conscious.”

The establishment of Temu was seen as a strategic move by Nasdaq-listed PDD to expand beyond China’s stagnating domestic economy and e-commerce market. According to China’s National Bureau of Statistics (NBS), online retail sales only grew by 4% year-on-year to ¥13.79 trillion in 2022, down from 14.1% in 2021 and 10.4% in 2020.

“This decline in growth signaled a need for Chinese companies to explore opportunities abroad,” says Kai Xie, a Beijing-based e-commerce analyst at a private equity fund specializing in Chinese internet giants. Xie adds that PDD also recognized the need for Chinese manufacturers to export goods overseas due to the escalating pressure on China’s exports and the severe surplus in China’s manufacturing industry. “Selling goods at low prices, or even at cost, can still yield minor profits,” says Xie.

Seizing this momentum, Temu has quickly carved out a unique place in the Western e-commerce landscape. The platform operates under the ethos of “Team Up, Price Down,” which mirrors the marketing strategy of Pinduoduo, PDD’s China app. This approach encourages users to invite others from their social circles to participate in deals, allowing them to gain discounts. But unlike Pinduoduo, which has a strong focus on agricultural products, Temu’s product range is broader, resembling global online retailers like Amazon.

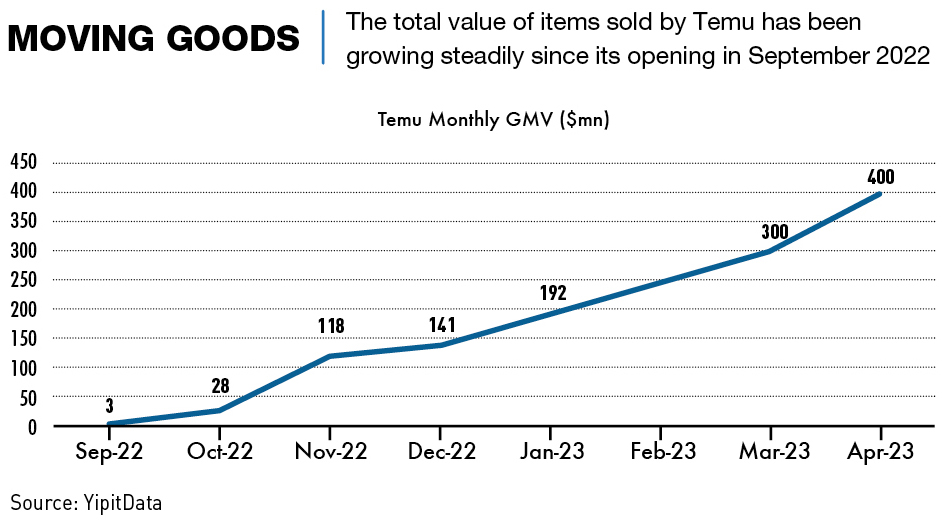

Currently, Temu operates primarily in the US market. The Boston-headquartered platform’s gross merchandise value, which is the total sales before expenses, grew quickly from $3 million in September 2022 to $192 million in January 2023 to $400 million in April. The company has not yet released any profit and loss numbers.

In the US, the company has been targeting young and price-conscious shoppers in search of discounts, with over 80% of users under the age of 44 and over 60% aged 34 or under, according to Daxue Consulting. The platform’s success in the US has encouraged its next move—expansion into Europe and the Middle East. Temu has now started selling to European markets including France, Germany, Italy, the Netherlands, Spain and the United Kingdom.

In terms of the operational strategy, Temu employs a direct-to-consumer model, which creates a direct link between Chinese manufacturers, where its warehouses are located, and the young and price-conscious consumers across the world, significantly streamlining the logistics process. By circumventing the conventional route that involves wholesalers, retailers, and multiple warehouses, Temu ensures a more efficient delivery processes.

“From zero to something is always the easy part,” says Mark Greeven, a professor of innovation and strategy at International Institute for Management Development (IMD), Switzerland. “It’s hard to call it a success yet. Such a short-term boost could have many reasons—not saying much about actual performance or sustainability.”

Speedy strategy

Temu’s rise in the US stems from an aggressive customer acquisition strategy primarily driven by heavy marketing investment. The firm intends to spend $1.4 billion on advertising campaigns in the US in 2023, and $4.3 billion the following year.

“Without the significant earnings from PDD’s stronghold in China to back it up, Temu wouldn’t be able to sustain such high losses to gain customers,” says analyst Xie. “This kind of aggressive approach is reminiscent of Pinduoduo’s early strategies in China, snatching a piece of the market from Alibaba, and focusing relentlessly on acquiring customers and increasing traffic.”

According to a WIRED analysis, Temu is losing an average of $30 per order as it tries to penetrate the US market, with PDD and suppliers subsidizing many of the costs in the hope of returns later on. So far, the company has avoided any scrutiny regarding anti-dumping laws in the US market, despite the impossible low prices.

Canaves says that there are plenty of e-commerce companies that have lost money for a long time as they grow and acquire customers, with Amazon as probably the best example. “But the strategy of selling low-cost goods—already a low-margin business—at a loss for a sustained period is definitely more risky,” she adds.

Still, utilizing PDD’s strong financial position, Temu employs various enticing marketing techniques, such as paid offers for site sign-ups, referral rewards and limited-time flash deals with discounts of up to 90%, all aimed at luring cost-conscious consumers into the app.

The firm’s approach has certainly garnered attention. “Temu ads were just all over the place —Instagram, Meta and even Chinese game platforms,” says Yi Liu, a Houston-based consumer. “But the whole shopping experience was fun and addictive, just like playing games.”

Liu’s feelings towards the app speak to the success of Temu’s gamification strategy. Gamified options include spinning wheels, growing virtual trees, a daily gift box and benefits for logging in multiple times and inviting friends—all measures meant to drive acquisition and consumer retention.

Temu’s connection to Pinduoduo’s robust supply chain also provides a significant competitive edge. “Temu benefits from the vast network of Chinese manufacturers it can access, which was utilized effectively,” says Canaves. “It offers an extensive range of products that can be sold and marketed not just to US consumers, but also globally.”

In terms of shipping and delivery, Temu operates a domestic and international joint transport model. Domestic sellers send their goods to Temu’s warehouse, from where Temu manages international shipping and last-mile delivery in the US. Standard delivery orders usually arrive within 7-15 days, whereas expedited orders usually arrive in 5-10 days. If the delivery is not there on time, then consumers get a cash benefit. The company manages this by subsidizing the expensive shipping, which makes up a major part of their losses on each transaction, as well as taking advantage of a duty-free shipping loophole that allows for tax-free shipping on $800 or less of goods.

Temu now also uses a “fully-managed” or “all-inclusive” marketplace approach. Manufacturers agree on a selling price to Temu and ship goods to its warehouse. Temu then handles everything else: sets the consumer price, marketing and shipments to consumers.

Competition

Temu has frequently been compared with Shein, the fast-fashion company known for its exponential growth rates. But despite their similarities, these two Chinese-born companies hold distinct positions in the market—Temu operates like an online mall, offering a wide variety of products from merchants and brands. On the other hand, Shein is primarily a fast fashion retailer.

In May, Temu achieved a notable milestone, surpassing Shein in US sales. According to Bloomberg Second Measure, which analyzes billions of credit and debit card transactions, spending on Temu was 20% higher than Shein.

“Temu may eventually adapt its strategy to sell more branded goods, seeking a slice of the higher-margin business,” Canaves says.

Both Temu and Shein’s meteoric rise demonstrates the potential they possess in reshaping the e-commerce landscape. However, despite Temu’s rapid ascent in the e-commerce space, it’s been a struggle to gain traction against the likes of Western competitors such as Amazon and Walmart. Currently, Amazon still holds a nearly 40% share of the US e-commerce market, followed by Walmart, with a 6% share.

“Temu can chip away at Amazon’s and Walmart’s revenues by competing on price, particularly for mass-market inexpensive goods,” Canaves says. This positioning has led to comparisons of Temu to the online equivalent of dollar stores, which currently have limited online presence, but “it’s still a long way off.”

US China tech analyst Rui Ma says that Temu is very likely to become a substantial competitor to established Western e-commerce brands like Amazon, adding that Temu could potentially replicate Amazon’s nearly infinite product selection and quick delivery times.

“Temu has proven its ability to utilize the existing, albeit imperfect, logistics system to deliver goods within about nine days, and the time will definitely reduce in the future,” says Ma. “With the right strategy and enough time, Temu could follow Amazon’s logistics playbook.”

Recognizing the threat, Amazon has recently excluded Temu from its price searching algorithm, which checks if products sold on its platform are competitive with rivals.

Canaves interprets Amazon’s move as an unwillingness to acknowledge Temu as a competitor and suggests that it could be due to Amazon’s inability to compete on price, given the numerous fees it charges sellers.

Overall, while Temu’s unique model and pricing strategy may pose a challenge to the likes of Amazon and Walmart, these Chinese upstarts still have a long way to go before they could substantially threaten the Western giants’ domination of the US e-commerce scene.

Challenges

Despite Temu’s growing gross merchandise value (GMV) and downloads, it is currently having trouble retaining customers. This struggle can be attributed to a myriad of reputational issues that have begun to tarnish the company’s image and dampen consumer trust.

For instance, Temu has been inundated with complaints about non-delivery of products, and reports of incorrect orders being dispatched. In addition, Temu has also been criticized for its poor customer service. The company has reportedly been unresponsive to customers’ grievances, further undermining its reputation.

Interestingly, another unexpected challenge that Temu is wrestling with stems from its ultra-competitive pricing strategy. While the intention was to attract customers with remarkably low prices, the strategy seems to have backfired. Many consumers are questioning the quality of the products due to their cheap price tag.

These issues have impacted the company’s ratings. With 520 complaints lodged to the Better Business Bureau, the company has been slapped with a subpar customer rating of 2.55 out of 5 and a C- for the BBB Rating and Accreditation.

Subpar product quality not only impacts the trust consumers place in Temu, but also hints at the broader challenges within the supply chain. Due to Temu’s aggressive pricing model, there’s an evident strain on the production side of things—the aggressive price competition is pressuring Chinese manufacturers to reduce their prices to unsustainable levels, posing an existential threat to these small businesses.

Many of these sellers, lured by the promise of accessing overseas customers, are being pressured into offering deep discounts and potentially sustaining losses. Canaves notes that the pressure on these smaller sellers could be significant, and that this is a “tough situation” for them, especially if they’ve come to only rely on Temu.

Xuan An, a clothing seller and factory owner in China’s southern Guangdong Province, expressed his concerns after losing money on 100 orders over two months. He says that he had little control over pricing as Temu frequently asked him to lower prices even to only 70% of the wholesale price. “Does Temu think us small businesses are running cross-border charities?”

But there are more difficulties waiting in the wings, especially related to Temu having a Chinese parent company. US officials worry that the consumer data collected by Temu could be accessed by Chinese authorities or used in ways detrimental to US interests. The difficulties faced by social media app TikTok in the country may be an example of what is to come.

“What happens to TikTok will have repercussion on every Chinese platform,” says Zhengyuan Bo, partner at Plenum Research, an independent policy consulting firm. “Sanctions won’t come right now. Political momentum is building, but it takes time.”

Bo opines that these issues could pose mid-term surprises, within two to five years, potentially becoming more tangible around 2024-2025, especially given the upcoming US presidential election in 2024.

Another challenge that looms over Temu is the potential closure of the $800 duty-free shipment loophole. By shipping small packages from its warehouse in Guangzhou, the company effectively operates in a duty-free manner within the US. However, small business lobbies are advocating for a reduction of the threshold to as low as $10, which would dramatically increase Temu’s operating costs.

Furthermore, another component that poses a challenge for Temu is its still-nascent logistics infrastructure, which heavily relies on a third-party logistics provider, J&T Express, also a company with a short track record in the US market.

Moreover, a US-China Economic and Security Review Commission report also flagged other concerns such as forced labor and violations of intellectual property rights. These issues not only present additional operational challenges for Temu, but also further complicate the company’s relationship with US regulatory bodies.

Besides the geopolitical issues, the recent fall in US consumer spending growth, as reported in March 2023, marked the weakest quarterly gain since the economic blow delivered by COVID-19 in 2020.

What’s Next?

In a recent strategic move, Temu’s parent company, PDD Holdings, shifted its headquarters from Shanghai to Dublin, Ireland. The decision, filed with the US Securities and Exchange Commission, indicated that its “principal executive offices” would henceforth be based in Dublin, Ireland.

The move mirrors a recent trend among Chinese-owned companies, seeking to alleviate Washington’s concerns about Chinese ownership of popular digital platforms. This follows in the footsteps of ByteDance, which relocated its TikTok operation to Singapore, and Shein, which also moved its headquarters to Singapore.

Relocating to Ireland offers various advantages for Temu, including tax benefits and a smoother path to a potential standalone listing of the business.

“PDD may be setting the stage for a separate overseas listing of Temu,” said Eugene Weng, a Shanghai-based attorney at Wintell & Co, who represents Chinese companies listed overseas.

Weng adds that Temu going public separately could not only allow it to serve as an independent entity to avoid geopolitical risks, but also Pinduoduo’s financing activities could be directly invested in the development of Temu itself.

However, the shift in corporate domicile to Europe introduces a new set of regulatory considerations. Europe’s stringent data regulations, particularly the General Data Protection Regulation (GDPR), present a potential hurdle for Chinese companies seeking to expand their operations in the region.

“The geopolitical issues Temu faces in the US will possibly be the same in Europe,” says policy analyst Bo. “However, while EU regulations often mirror US policies towards China, these either lack enforcement for existing rules or are yet to be enforced. What’s more, Europe’s segmented market and slower policy response make decision-making more complicated.”

This underscores the intricacies of global market navigation for Temu in its ambitious expansion.

“Temu’s competitors have started taking it to court, and I expect to see many more lawsuits in the US and elsewhere, though Temu may be able to brush many of these off as a cost of doing business,” says Canaves.

Despite the possible challenges, Temu has made a robust start in its global expansion efforts, targeting consumers in 27 European countries, including Italy, Greece, Finland, France, Germany and Spain.

In the European market, Temu is more inclined to cooperate with local logistics companies, with third-party logistics companies responsible for warehousing and distribution, as per Six Degrees Intelligence, a global qualitative research platform. Additionally, due to the more fragmented European market, Temu needs to do more localization work in Europe to adapt to the demands of different countries, while the US market is relatively uniform in comparison.

However, Six Degrees Intelligence predicted that in the long run, Temu may adjust its strategy in the European market and gradually move closer to the model of the US market.

On track

The company appears to be on track to rival established competitors like Shein in the US market. Nonetheless, the rapid pace of growth, fueled largely by inorganic means such as app downloads, raises questions about the long-term economic viability. The company’s trajectory in the coming months and years will be pivotal in determining the effectiveness in ability to secure a stable position in the global market.

“The deep pockets backing Temu will ensure that it continues to grow globally,” Canaves says. “But it will face an increasing number of challenges as it grows and attracts more scrutiny. Profitability will pose the bigger challenge, and that path isn’t entirely clear yet and may take years to realize.”