CATL dominates China’s electric vehicle battery market, and the company is setting its sights on greater international success

China’s top battery manufacturer CATL dominates due to R&D spending, but some of its competitors are catching up

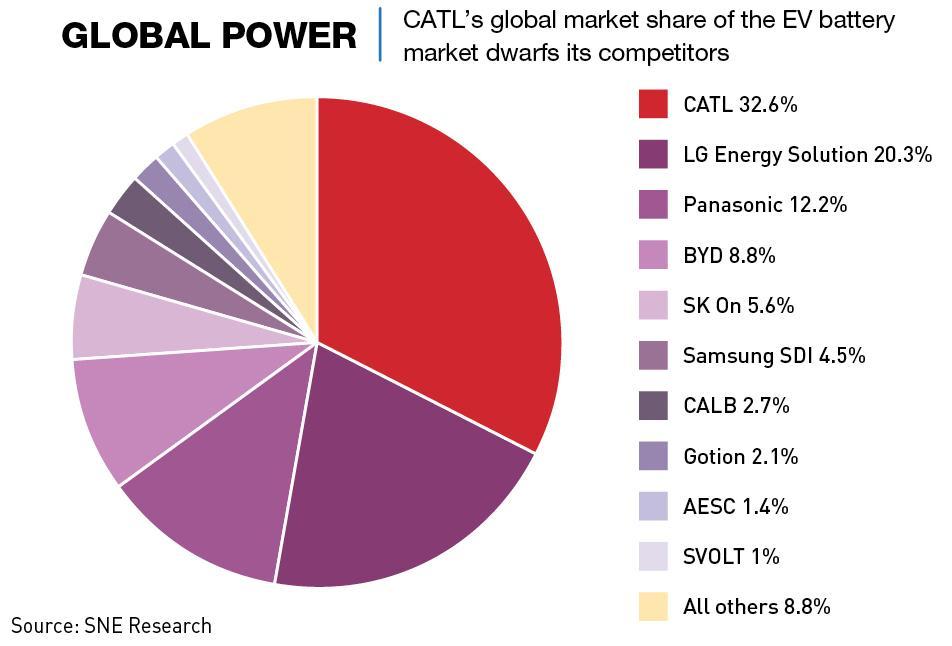

The driving force behind China’s massive shift to electric vehicles (EV) is a company that many outside the industry have never even heard of. Despite its muted reputation, Contemporary Amperex Technology (CATL) batteries power half of Chinese new energy vehicles (NEVs), of which there were 3.3 million in 2021 alone, and the company is by far the world’s largest EV battery manufacturer, with a massive 32.6% market share.

But more than that, the company is one of the biggest spenders on R&D in the industry and is at the cutting edge of new EV battery technologies, offering a wide range of batteries to a diverse range of customers, including Tesla, Kia and BMW.

“Currently, it’s the biggest, baddest, battery cell manufacturer on the block… and by a long way,” says Tu Le, Managing Director of Sino Auto Insights. “It’s also been able to sign up the ‘Who’s Who’ of customers which helps legitimize their technology and quality.”

At a time when the automotive industry is undergoing difficult supply chain issues and coping with soaring costs of raw materials, CATL is in an enviable position—the price of batteries reached $128 per kilowatt hour in May, compared to $105 in Q1 of 2021, and is expected to climb another 22% by 2026. But there is increasing unease among car producers around the world about CATL’s dominance in the market, and competitors are striving to challenge it.

Starting out

CATL was founded in 2011 by Chinese billionaire and entrepreneur Robin Zeng in the city of Ningde, located in the southeastern province of Fujian. Zeng originally founded Amperex Technology (ATL), a producer of lithium polymer batteries, in 1999, which was acquired by Japanese electronics firm TDK in 2005. After initially staying on as a manager at ATL, in 2012 Zeng and current CATL vice-chairman Huang Shilin spun the business back out of TDK and they took the company public in 2017.

CATL’s development benefited greatly from its years as part of TDK, but throughout the company has experienced exceptional growth thanks to protectionist government policies and provincial subsidies.

“The Chinese government for years had a white list policy to prevent OEMs from purchasing international players’ batteries,” says David Zhang, professor of Engineering at Huanghe S&T University. The list, consisting of 57 approved suppliers including CATL, was scrapped in 2019.

But government support didn’t stop there. “Since 2009, there has been an enormous amount of nationwide capital invested in the R&D of battery technology by the state,” says Le. “Localized support was given by the Ningde and Fujian provincial governments in the form of subsidies on land and tax abatements specifically favoring CATL that helped them build out their production capacity on the cheap.”

By 2021, the company had a 52% share of installed NEV batteries in China, up significantly from an already fairly impressive 15% in 2015. Largely due to the size of the China market, the company is also the largest global player, with a 32.6% share of NEV batteries worldwide. Its closest competitor is the Korean firm LG Energy Solutions which has a 20% global market share.

“A key part of its success was that CATL managed to establish itself as a reliable supplier of EV batteries early on,” says Klaus Paur, Managing Partner at MaLogic, a Shanghai-based professional services firm. “This not only refers to its high quality [lithium-ion] batteries, but also to a solid production capacity, which ensured stable supply.”

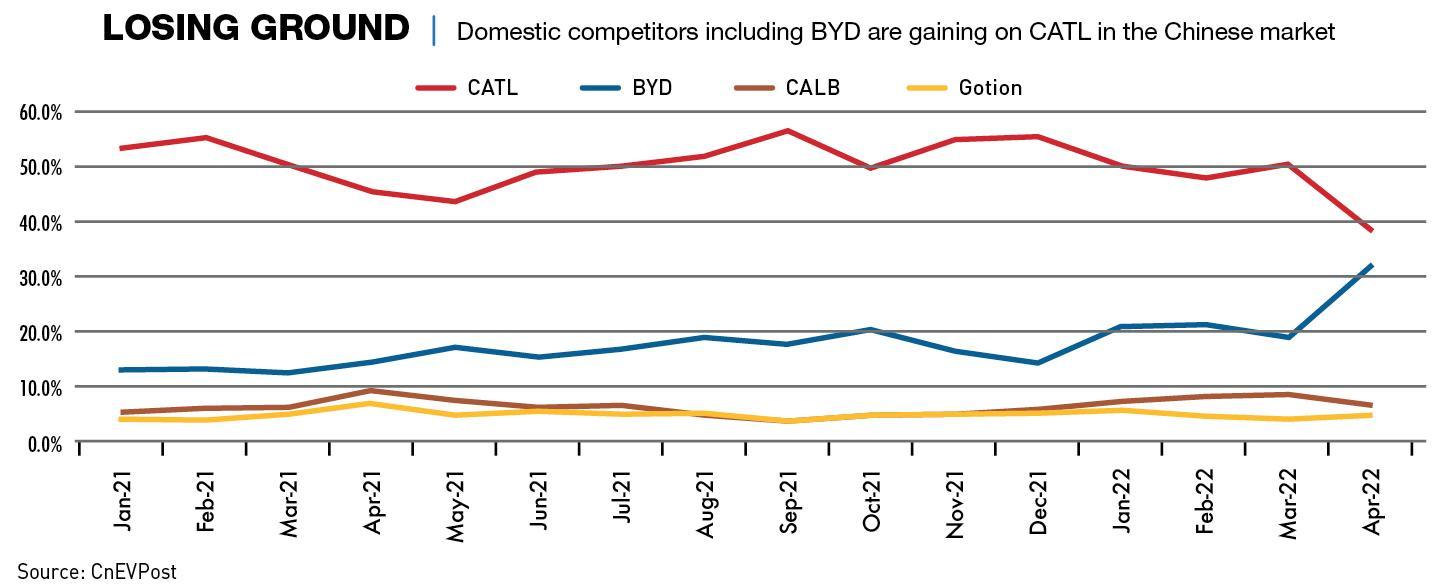

Despite its dominant position, CATL has several serious competitors in the domestic market, including Warren Buffet-backed BYD and rival battery maker CALB with market shares of around 21% and 8% respectively. CATL’s China market share also slipped below the 50% mark in early 2022, clocking in at around 48% in February 2022.

In terms of domestic rivals, BYD, the largest NEV manufacturer in the world, is a legitimate threat to CATL’s dominance thanks to the ability to supply itself—it sold around 641,000 NEVs in the first half of 2022, surpassing Tesla. In addition to this, since mid-2021, BYD has moved to increase the scale of its battery business by supplying other companies, and it has struck deals to supply automakers like FAW Group, BAIC Group, Toyota and Daimler.

Internationally, South Korean LG Energy Solutions, which went public in a $10 billion IPO in January 2022, is also confident it can catch up to CATL. The company already supplies Tesla, Hyundai and General Motors, among many others, and boasts a number of overseas production plants that it runs together with the clients. LG also has a massive cumulative order backlog worth $217 billion, which will allow it to overtake CATL in terms of market share.

CATL is also not yet the international powerhouse it could be. Around 80% of its revenue comes from the China market and currently it only has one production facility overseas in Germany, the opening of which has been delayed until the end of 2022, supposedly on security concerns. “Its international footprint is weaker compared to its major global competitor LG Energy Solutions, which has a stronger presence in Europe and the US,” says Paur.

Charging ahead

The backbone of the Shenzhen-listed company’s success is its dedication to research and development. In 2020, CATL’s R&D spend was just over 7% of its revenue and accounted for around a third of the company’s workforce. This is proportionally in line with the company’s competitors but CATL has a track record of pursuing technologies with the potential to change the market.

This R&D focus has manifested itself both in the breadth of the company’s product portfolio and its range of customers. “CATL’s batteries cover a wide range of segments, including passenger cars, buses, heavy trucks,” says Y.-C. Hsu, co-founder and CEO of Researcher and Research, a market and strategy research firm. “Its customers include startups, Chinese state-owned enterprises, and international companies from Europe, the US, Japan and South Korea. No battery manufacturer has such a diversified customer structure, which is the biggest opportunity for CATL.”

The company shifted earlier than its competitors from lithium-ion phosphate (LFP) batteries to a nickel-cobalt manganese (NCM) chemistry, which generally allows for greater energy storage density. Structure is a key challenge in the design of batteries and reducing the weight of the batteries relative to power output is of the utmost importance for any R&D team.

Interestingly, while LFP and NCM batteries have an almost 50/50 split in the China market, LFP batteries make up only 3% of EV batteries in the US and Canada, and 6% in Europe. The reason being that NEVs in the West tend to be higher-end models with a greater range than can be provided by an NCM battery, while in China many models are often cheaper and smaller, using LFP batteries.

CATL has an over 50% market share in NCM batteries in China and, as of February 2022 CALB, its closest competitor, only had a 15% share. For LFP batteries CATL’s lead is far smaller—46% versus BYD’s 37% share.

Both NCM and LFP batteries are based on lithium-ion technology and are thereby dependent on supplies of the element. Since 2020, commodity prices including lithium and nickel, have seen dramatic increases—lithium has risen by more than 400%. But CATL has managed to somewhat insulate itself from the increased costs by investing in sources of the minerals.

“CATL has focused on vertical integration,” says Paur. “It has invested in raw material and mining companies to ensure its own supply of minerals needed to manufacture batteries.”

As early as 2012, CATL started a subsidiary in China’s northwestern Qinghai Province, to extract lithium from dried-out salt lakes. In 2021, the company made a similar move to shore up cobalt supplies, buying a 25% share of the Kisanfu copper-cobalt mine in the Democratic Republic of Congo.

In 2020, BYD announced its new Blade battery, an improvement on the old LFP technology, which has raised questions about whether CATL was right in pursuing NCM technology so aggressively. Using the cheaper and reportedly more stable LFP chemistry, BYD restructured their battery by creating a new way of arranging cells that gives a higher energy density than early generations of LFP batteries.

“The biggest difference between CATL and its competitors is that it is more diversified than other battery manufacturers,” says Hsu. “Therefore, CATL can be competitive in the development of both battery materials, which Japanese and South Korean battery manufacturers are focused on, and also battery structure.”

CATL has also invested heavily in research on sodium-ion batteries, which swap out lithium compounds for easier-to-source sodium compounds, which is seen as the most likely contender to replace lithium at the heart of the batteries powering humankind longer term. The technology is the culmination of a Chinese government-led initiative into lithium alternatives, prompted by concerns over the country’s dependence on imports for 70% of its lithium needs. In July 2021, CATL commenced small-scale commercialization of the technology.

“Compared with other battery makers, CATL was very active in responding to this policy,” says Hsu. “They have made various developments in sodium-ion batteries, as well as creating a commercialization timeline and corresponding production plans. For a long time, the Chinese government and CATL have been in a state of mutual benefit.”

CATL has also introduced a new service called Evogo, which provides battery swapping provisions to consumers. One of the biggest challenges with EVs is the time they take to charge, an issue especially important for taxis and commercial vehicles. Battery swapping allows a vehicle to change a depleted pack for a fully charged one in a couple of minutes, versus half an hour or more for fast charging.

In China, EV startup NIO, car manufacturer Geely and dedicated battery swapping service Aulton are already present in this space. But CATL’s size already makes it stand out in the sector. Both NIO, which is already a CATL customer, and Geely’s swapping stations are limited by brand and model, whereas Evogo batteries will already fit 80% of existing battery electric vehicles and all of the vehicles slated to come out over the next three years, CATL claims.

If they are able to convince more of their customers to adopt the service, they stand a good chance of dominating the battery swapping market. “The key is for CATL to bully a few of their larger customers into implementing the service and continue working through them to standardize battery packs,” says Le.

Holding its charge

Despite being in a strong position compared to its competitors, CATL runs the risk of becoming a victim of its own success. Its commanding share of the domestic battery market gives it little room to grow, and car producers are becoming aware of the dangers of being too dependent on one supplier.

“CATL needs to address several critical issues,” says Paur. “Increasing local competition, a growing trend by automakers in China to diversify their battery sources, and CATL’s limited international scope.”

Currently, CATL is NIO’s sole battery supplier, but NIO CEO William Li has publicly stated that battery supply is one of the main factors limiting production capacity. Later this year, NIO will start selling cars with a battery pack supplied by Beijing-based WeLion and is also considering sourcing batteries from BYD.

BYD produces its own batteries for its cars. Tesla does the same, except for its cars produced in China, in which CATL batteries are used. And moving toward self-sufficiency is increasingly popular in the industry. “Currently, the clear trend is for EV automakers to build or invest in battery plants as a way to diversify risk,” says Hsu. “Likewise, battery makers want to share the risk of rising raw materials costs with EV automakers, so the trend for EV automakers to collaborate with battery makers will also gain momentum.”

Battery safety is another topic of concern. In 2020, BYD released a video of its Blade battery undergoing a “nail penetration test” versus an unnamed competitor’s NCM battery. In it, the competitor’s battery burst into flames whereas BYD’s battery did not. Two months later, Chinese regulators dropped the nail test as a way of grading battery safety and the new regulations that were put in place were drafted by CATL, potentially giving the company an unfair advantage over its competitors. “CATL has been instrumental in setting standards by joining the battery association and becoming the chairman,” says Zhang.

To ensure its long-term success, CATL is trying to further expand into international markets, but in the current climate, CATL’s strong links to the Chinese government could be a problem in terms of Western regulatory consideration. Its only major customer outside of China so far is BMW, which has four battery suppliers, of which CATL is one of the top two.

The various problems faced by CATL are also starting to affect the company’s valuation. Over the last year CATL’s share price has experienced extreme volatility and since December 2021 it has been declining steadily. Zhang attributes the stock market fluctuations to speculation and notes that Tesla has had similar problems. “The other reason is that OEMs don’t like that CATL is much bigger than other players. They want to have more bargaining power during business negotiations,” he says.

Accelerating away

Other than the sodium-ion system currently entering production, little is known about what other battery technologies the company is spending its large R&D budget on, but what is clear is that they are at the leading edge of battery technology. CATL has traditionally excelled with high energy-density technology, which is of utmost importance for electric cars—the higher the density, the larger the capacity. CATL’s forthcoming CTP3.0 Qilin battery reportedly has 13% higher capacity than Tesla’s 4680 model.

There is more transparency on CATL’s future production plans than on R&D. The company is investing $5 billion in a battery factory in Indonesia set to start production in 2024 and it is also eyeing investing a similar amount to create a plant in North America to service global clients.

But continued growth, especially internationally, will not necessarily be smooth sailing. CATL’s stock dropped in late 2021 after competitor BYD said it would supply batteries to Tesla “very soon.” A number of other significant potential clients are planning to go their own way on batteries. General Motors, already a CATL client, is planning a new US battery plant in partnership with South Korea’s LG Energy Solution, Toyota is planning to open its own battery plant in North Carolina, and Ford is building twin battery plants in Kentucky.

“There is already great local competition emerging with ample production capacity to scale up, but commodity prices such as that of lithium carbonate could remain volatile, hurting margins,” says Deutsche Bank analyst Edison Yu.

CATL is now facing the challenge of leveraging its production capability and big R&D budget to remain one step ahead of the competition.

“CATL quickly built a dominant global position in the EV battery sector and currently leads the space by a wide margin,” says Tu Le. “Now comes an even tougher mission, continuing that growth outside of the friendly confines of the China market. There’s no doubt that CATL has global ambitions but so do its competitors, as they all turn to focus on the EU and US markets.”