Alibaba vs JD.com: Products at your fingertips

By Li Wei, Professor of Economics, CKGSB and Chen Jian, Assistant Director of the Case Center, CKGSB

On Single’s Day 2021, China’s largest online shopping festival, e-commerce app Tmall’s gross transaction volume reached RMB 540 billion ($79 billion), a year-on-year increase of 8.5%, while rival JD.com grew even faster at 28.6% to reach RMB 349 billion ($51 billion). Competition this intense and long-lasting has both defined and stimulated the largest e-commerce market in the world.

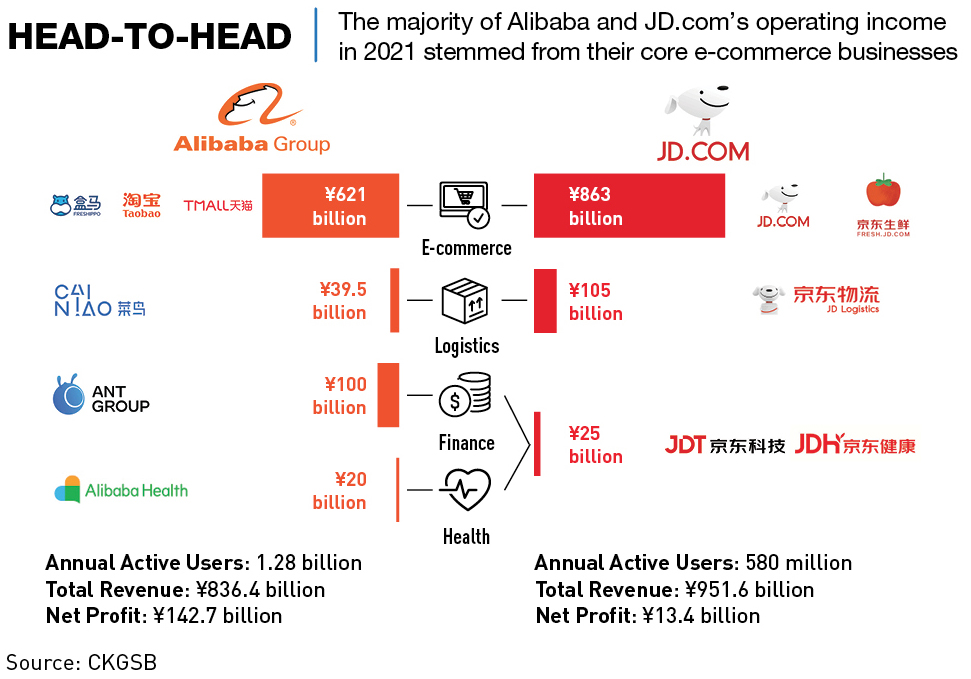

Interestingly, while the revenues of the two players are almost at the same level, with JD.com’s exceeding Alibaba’s by just over RMB 100 million in 2021, Alibaba made ten times the net profit of JD.com, with twice as many active users. This case study will look at how Alibaba and JD.com have carved out their successes over the last two decades, despite distinct differences in their models.

The “flywheel effect”

The “flywheel effect,” first coined by business author Jim Collins in his book Good to Great, provides a reference tool to understand the business models of Alibaba and JD.com. The effect refers to when a series of small successes build on each other over time, providing the momentum to grow a business, just as a flywheel provides momentum in an engine.

The rise of Taobao

Alibaba established its first consumer-to-consumer (C2C) e-commerce platform, Taobao, in 2003. The platform, which allows individuals and small business owners to sell their products by setting up their own stores on the platform, was the initial stimulus for Alibaba’s future “flywheel” expansion. The company subsequently launched Alipay later that year, which provided an efficient and safe method for individuals to send and receive payments. A year later, Alibaba also established the communication software Aliwangwang to enable users to communicate with Taobao sellers.

Taobao managed to carve out a unique space in the Chinese market by offering niche and personalized products on its platform. By 2005, Taobao’s annual turnover exceeded RMB 8 billion, surpassing that of Walmart China. Taobao also overtook Yahoo! Japan in terms of its number of transactions and the quantity of products on its platform, becoming Asia’s largest online shopping platform.

JD.com and SARS

In 2002, at a time when Alibaba occupied half of China’s e-commerce market, JD.com Multimedia (later to become JD.com) began to emerge in Zhongguancun, Beijing’s technology hub, as a dealer in tech products including hard drives. But just as JD.com’s founder and erstwhile CEO, Liu Qiangdong, was planning the company’s expansion, the SARS virus broke out in China.

Beijing was one of the hardest hit areas, with almost all stores in the city having to halt operations. In response, Liu moved his business online, and by the time the economy reopened, JD.com had established itself as an online brand that offered high quality, low prices and fast delivery. Liu then closed the company’s offline stores and placed his faith in the online business.

The C2C model, pioneered by Taobao, was becoming increasingly popular as it meant that intermediary platforms did not need to transport goods themselves nor build warehouses. As long as there is a protection guarantee on customers’ orders and the platform provides a relatively good user experience, the intermediary can earn commission without any operational or inventory risk.

Liu and his team at JD.com eschewed the C2C model, as its main products were computers, communications and consumer electronics equipment, which often required after-sales service. This meant that control of pricing, product quality and services were fundamental. For this reason, Liu chose to launch the platform with a business-to-consumer (B2C) model in 2004 under the name JD Multimedia. By June 2007, annual sales had reached RMB 360 million and since then JD.com has dominated the B2C e-commerce field.

Starting the wheel

Alibaba and JD.com took different approaches to getting the flywheel started.

Alibaba constructed a network of merchants and consumers but did not deal with or own the rights to any of the products on their platform. It acted as an “information intermediary” whereby the more information the platform obtains, the more successful the platform is.

The platform earns a profit from transaction commissions and advertising; as Alibaba’s user base grows, it was able to reduce the transaction fees it charges. Four years after its establishment, Taobao had expanded to an annual volume exceeding 16.9 billion transactions, its registered users had reached 30 million and the range of goods on offer had expanded to include digital products, cosmetics, virtual goods, jewelry and apparel.

JD.com, on the other hand, positioned itself as a “merchant intermediary,” where it profits from the price difference between product procurement and product sales. The company is more focused on the development of gross profit margins, asset turnover and product quality. The company also takes responsibility for inventory risks and costs.

In 2010, JD.com’s business model shifted from being the sole seller, to providing space on its platform for third-party sellers, and an expanded product range. It started with book sales which gradually branched out into other categories including apparel, daily necessities and luxury products. Since then, JD.com has developed online music, travel, grocery delivery and health platforms.

According to JD.com’s financial reports, in 2020 the platform had 5 million stock-keeping units (SKU), which are used by retailers to differentiate products and track inventory levels. In comparison, US retail giant Walmart, has less than 30,000 SKU and Costco only 4,000.

Alibaba’s revenue structure

Alibaba’s largest revenue generator is its advertising business, run by subsidiary Alimama. Launched in 2010, Alimama was an instant success, surpassing Baidu as China’s largest advertising platform after just a year.

In 2021, commercial transactions, including advertising, accounted for 87% of Alibaba’s total revenue. This includes its retail business (Tmall and Taobao), its international business, wholesale, its logistics business (Cainiao) and local services. The remaining revenue stems from cloud computing, media and entertainment and its digital business. Within commercial transactions, retail contributed 66% of the total revenue. Moreover, within retail itself, 30% of the revenue came from advertising and 12% from commissions.

JD.com’s revenue structure

According to JD.com’s financial reports, the company’s main sources of revenue are two-fold: first is the income from the products it sells on its platform; the second is the services it provides including fees from third-party merchants who use its platform, advertising and logistics services. Around 90% of JD.com’s revenue comes from its self-operated businesses, which is in stark contrast to Alibaba.

Alibaba’s traffic expansion

After Taobao’s success, Jack Ma decided to expand into the B2C market. In April 2008, he established Tmall, a platform for third-party brands and retailers, enabling them to sell their products either directly or indirectly through franchised stores.

With Tmall, Alibaba took greater responsibility for quality control of its products with the aim to address the authenticity issues often associated with Taobao. In comparison to Taobao, which profits from transaction fees and advertising, Tmall enables Alibaba to obtain revenue from a wider scope of channels, including set-up fees, sales commissions, warehousing, optional delivery services and online marketing services.

Then in April 2010, Alibaba started to expand overseas with the launch of AliExpress—an online platform which allows businesses in China to sell to international consumers.

Alibaba was also exploring internet finance, thanks to the popularity of Alipay as a payment method for Taobao. In March 2013, Alibaba announced the establishment of a microfinance service group, which would go on to become the Ant Group. Ant Group lowered the entry threshold and cost for consumers and small businesses, integrating them into a financial ecosystem which covers credit and insurance services.

To add to its e-commerce ecosystem, Alibaba launched Cainiao Smart Logistics Network in 2013 to integrate logistics with smart supply chain management. Cainiao allowed Taobao to increase the efficiency of its returns capabilities and operate a “seven day free return” policy. By 2020, Cainiao was providing warehouse storage, express delivery and smart supply chain solutions to Alibaba, shipping more than 4 million parcels daily to 200 million monthly users.

More recently, Alibaba has moved into lifestyle services, purchasing the food delivery company Ele.me, which it merged with its own brand Koubei in 2018.

JD.com’s traffic expansion

A big step in JD.com’s expansion was the development of its own logistics network. Logistical services in China were not well-developed prior to 2007, when JD.com was using relatively unreliable third-party companies to deliver its products. JD.com developed its own delivery network in July 2007 which stretched across Beijing, Shanghai and Guangzhou, covering an area of 50,000 square kilometers. It also developed its own warehouse management system in 2010.

After JD.com allowed third-party merchants on its platform and expanded its product range, both the number of brands and users on its platform increased significantly. Brands were drawn to the platform due to the flexibility it offered. They could either ask JD.com to operate their online store for them or they could operate the store themselves and use JD.com’s distribution network. Recently, JD.com has expanded its logistical services further, now offering warehousing, distribution and after-sales services. JD.com Logistics has become so successful that in May 2021 it was spun-off from JD.com, and went public with an IPO in Hong Kong.

Another important step for JD.com was the expansion of its financial services business. JD.com Finance, later renamed JD.com Digits, was established in 2013, offering financial services to consumers and small companies including loans, payment solutions, asset management and crowdfunding. JD.com Digits also assists self-operating suppliers and third-party merchants with purchasing, warehousing and processing settlement guarantee funds. Through supply-chain finance, JD.com Digits has mitigated the long-existing problem of financial risk in physical supply chains. Getting closer to suppliers has increased JD.com’s supply-chain efficiency.

JD.com has not relied on procuring products at low prices from suppliers to increase revenue. Instead, the company has created an integrated supply chain—reducing losses, increasing inventory turnover, and thereby reducing costs. According to JD.com’s financial reports, its fulfillment costs declined to approximately 6% in 2021. JD.com’s inventory turnover has also shrunk from 50 days in 2011 to 28 days in the first half of 2021.

The new era of retail

While both Alibaba and JD.com have enjoyed the huge profits of the e-commerce industry over the past two decades, they are now striving to veer away from their “e-commerce-dependent” growth models, and branch out into other areas.

In 2016, Jack Ma proposed the concept of “new retail”—the idea that the era of pure e-commerce was coming to an end. Within a year, JD.com had also proposed the idea of “borderless retail,” with Xu Lei, the company’s current CEO, saying in 2017 that everything from consumers to supply chains to marketing are all going through major transformations.

Thanks to this transition, the growth rate of pure e-commerce has decreased in recent years. In early 2019, Daniel Zhang, the current CEO of Alibaba, made it clear in a letter to stakeholders that the company would move into new areas such as international expansion, Big Data and cloud computing.

Liu Qiangdong from JD.com said, “the nature of retail has never changed—it has always been about costs, efficiency and user experience. But as technology develops and consumption upgrades, the type of value created changes. In the future, JD.com will focus on service infrastructure and will provide Retail as a Service (RaaS) solutions to the whole of society.”

The history of these two companies shows the ‘growth flywheel’ in operation. Alibaba essentially works as an “information intermediary,” whilst JD.com is more of a typical “merchant intermediary.” It is this fundamental difference in their e-commerce business models which gave birth to their individual distinctive flywheel structures, and which has led to the nearly two-decade-long rivalry between the two. Who will lose out, or can these two companies both continue their growth? Only time will tell.