Dr. Li Haitao – Dean’s Distinguished Chair Professor of Finance at Cheung Kong Graduate School of Business

China’s economy is facing many challenges from a number of factors including Federal Reserve interest rate hikes, the Russia-Ukraine war, Covid-19 restrictions, and rising inflation. Can China’s economy make a recovery? What are some of the problems with the way traditional policy has responded to crises like these? And how can China combine short-term and long-term policies to address these problems?

In the past six months, China’s economy has suffered from diminishing demand, supply shocks and weakening expectations. Traditionally, these problems would have been solved by the issuance of special bonds, reducing the reserve requirement ratio (RRR) for financial institutions, and introducing policies in the property market. However, the outbreak of the Russia-Ukraine war and strict lockdown measures in China have increased the severity of these issues, which raises doubts over whether China can respond in the same way as it has done previously.

Accelerating downward pressure began in April 2022. At this time the Price Manufacturing Index (PMI) was 47.4, unemployment 6.1% and annual retail sales were falling by -11%. Year-on-year (YoY) fixed asset investment only grew by 1.8%, exports 3.9% and social finance 10.2%, all below expectations.

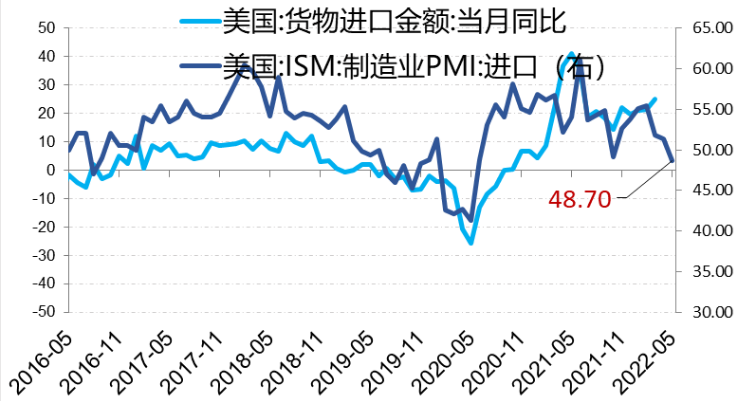

Due to Federal Reserve and European Central bank rate hikes, the Russia-Ukraine war, and declining business activity in the United States (the US ISM PMI fell to 48.7% in May from 51.4% prior), there has been less demand for Chinese goods overseas.

China’s May 2022 Economic data was not optimistic: the YoY growth rate of social financing (funds provided by the financial system to the real economy) was 10.5%, among which mortgages only rose by RMB 289 billion YoY (in previous quarters, mortgages rose by RMB 500 billion). This shows the lack of demand and confidence in household credit markets.

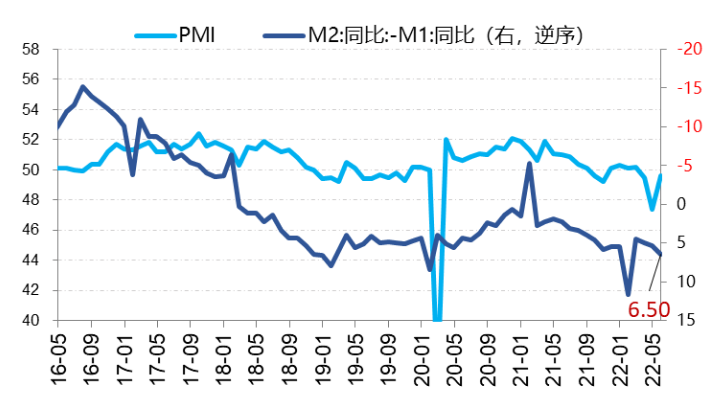

M2 money supply (M1+ time deposits + saving deposits + other deposits) and social financing are two measurements that reflect money flow in China’s economy. In May, M2 increased 11.1% YoY, and social financing fell -0.6% (falling from the previous -0.3%), thereby showing that more money was going into savings accounts rather than other entities. The difference between M2 YoY and M1 YoY was 6.5%, rising from 5.4% prior

Insufficient Demand in Real Estate Markets

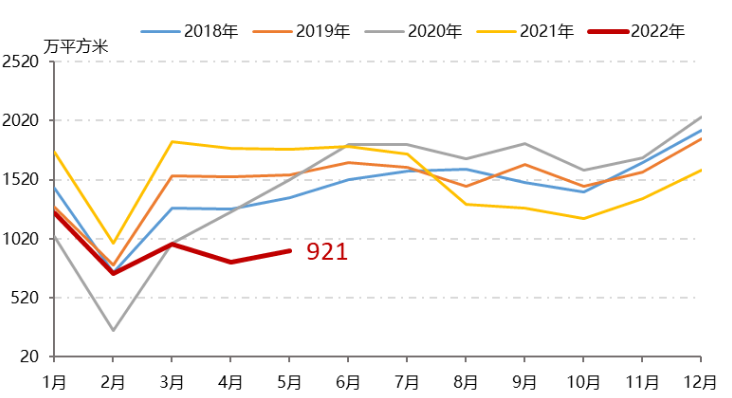

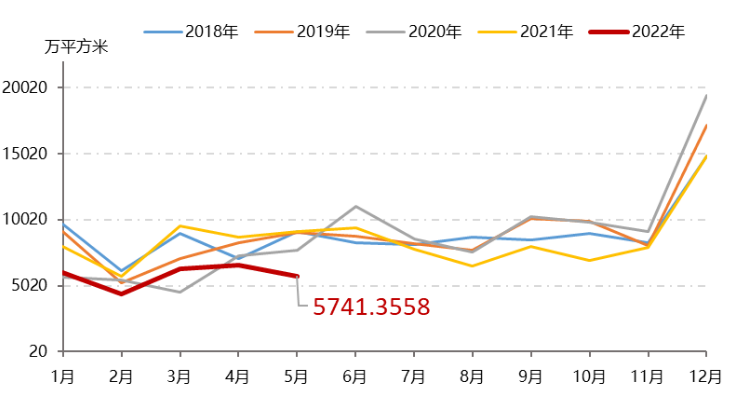

Commercial housing per square meter sold across 30 medium-to-large cities in China is still below both pre-pandemic levels and levels in the same period last year. Lack of demand for commercial housing is mainly due to higher interest rates, a slowdown in population growth, repressive policies and property companies buying up less land.

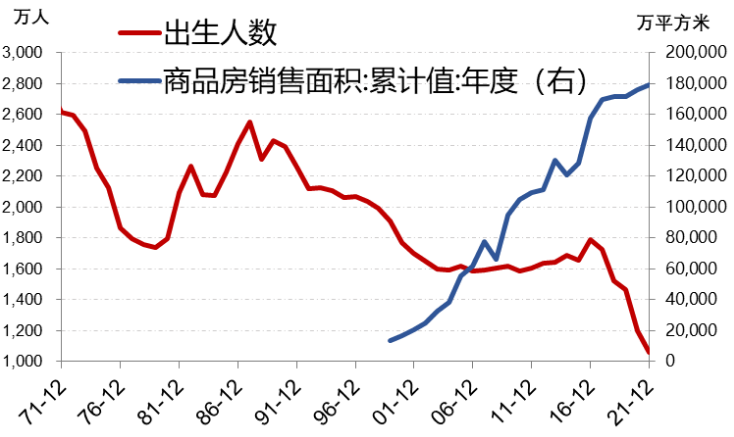

Consumer demand has not kept up with the large expansion of credit in the property sector. A risk is that once real estate becomes a reservoir for funds it poses the risk of less credit flowing into other industries, which in turn can impede innovation in other sectors. This occurred in in Japan in the early 1990s when the Bank of Japan poured vast amounts of credit into property, which lead to huge price inflation and eventually the asset price bubble.

A declining birth rate is another reason for a drop in demand for real estate. In 2021, China had 10.62 million births and sold 1.794 billion square meters of commercial housing. If each property is on average 100 square meters, then approximately 18 million properties were sold. The current birth rate is unable to sustain the large supply of 18 million homes per year. Furthermore from 1990-2000, the annual birth rate declined from approximately 25 million to 16 million. Demand has dropped significantly as younger generations had fewer first-time buyers.

Falling demand has also meant that property developers are less willing to acquire land, further increasing downward pressure on the economy. Only 57.41m square meters of land was sold in China’s 100 largest cities in May 2022 – a 37% decrease from May 2021. Sluggish land auctions have also left local governments short of funding sources and real estate companies with a lack of land reserves and ongoing projects.

Infrastructure is No Longer the Backbone of Employment

In April 2022, unemployment for 16-24-year-olds reached a record high of 18.2%. Results show that younger people in China are increasingly choosing to work in tertiary sectors and less willing to work in secondary industries such as infrastructure. Therefore, China can no longer rely on infrastructure to support employment.

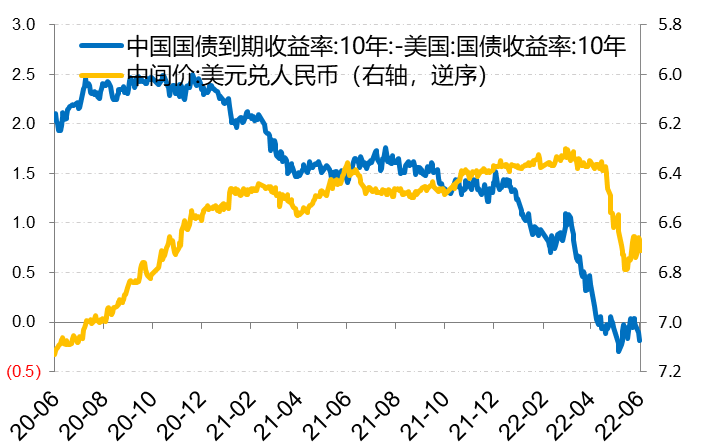

Further concerns are that if the Fed raises interest rates by 50 basis points in September and the dollar remains strong, there could be large-scale capital outflows from China. The performance of the 10-year US treasury bond yield compared to China’s 10-year bond yield has accentuated this risk, as well as putting pressure on renminbi depreciation and limiting the scope for the People’s Bank of China to cut interest rates.

Under Downward Pressure, How Should Policies be Implemented to Stabilize the Economy?

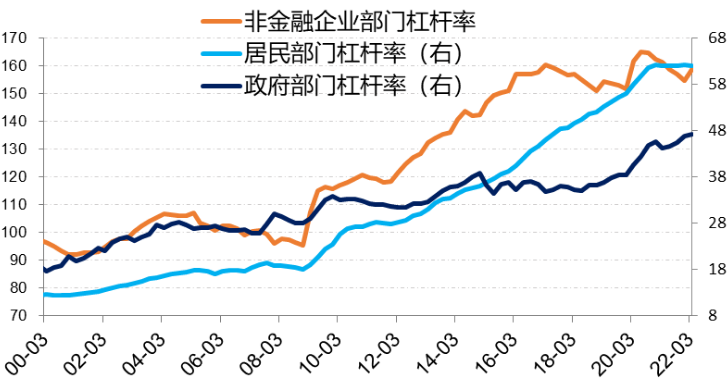

Firstly, China can increase government leverage in the short-term to deal with the economic downturn. In 2021 the leverage ratio in the real economy was 264%, down 6% from 2020, therefore China has the capacity to increase government spending. Furthermore, it should be considered that in comparison to the United States’ USD $5,200 billion Covid-19 economic relief package, China has remained relatively cautious in its fiscal response to the pandemic.

China should also cut interest rates to boost consumer demand. However, it should be noted that although China has the scope to cut interest rates and increase the fiscal deficit, these are only solutions in the short-term. Government spending is often inefficient and cannot address the structural issues in the economy. Therefore, in addition to introducing policy support it is fundamental to consider how to improve the way in which the economy operates.

In recent years, due to policy adjustments the technology, real estate, and education sectors have all suffered from large economic uncertainty. Further support needs to be provided to the private sector. Currently, there are about 150 million small, medium and micro enterprises in China; however, in April company registration fell by 13% and applications for cancellation rose by 23%. This has not only affected economic activity but has added pressure on employment.

China should also focus on stabilizing the foreign investment environment. The inflow of technology and capital has played a large role in China’s success over the past 40 years, and China should not lose confidence in its importance due to the pandemic.

Chinese companies are resilient and only need the support of a stable economic environment and long-term policies to promote their growth. It will not be long before China is able to overcome the middle-income trap and achieve long-term stable development.