Many indicators point to the inevitability of a recession in the United States, but to what extent is this true?

Ou-yang Hui, Deans Distinguished Chair, Professor of Finance, CKGSB

Cao Huining, Professor of Finance, CKGSB

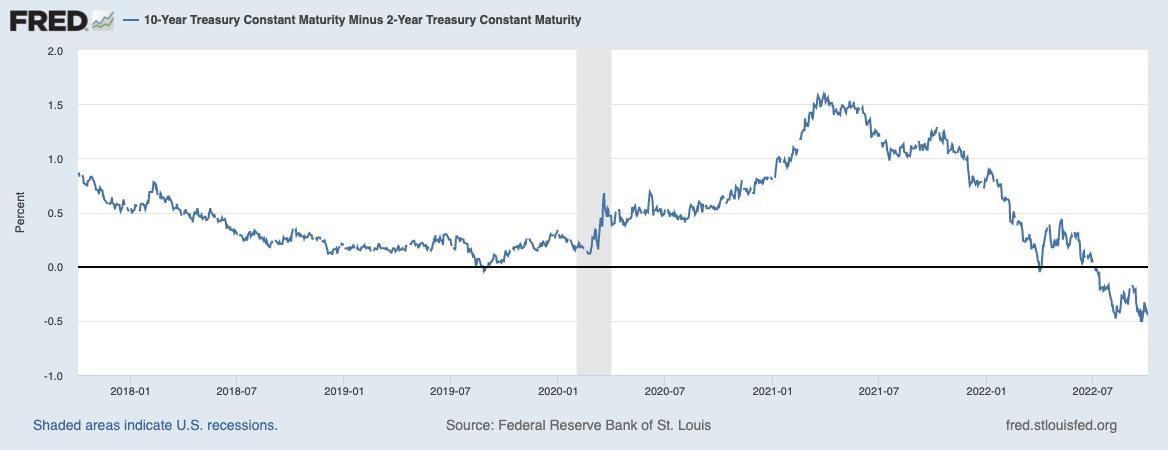

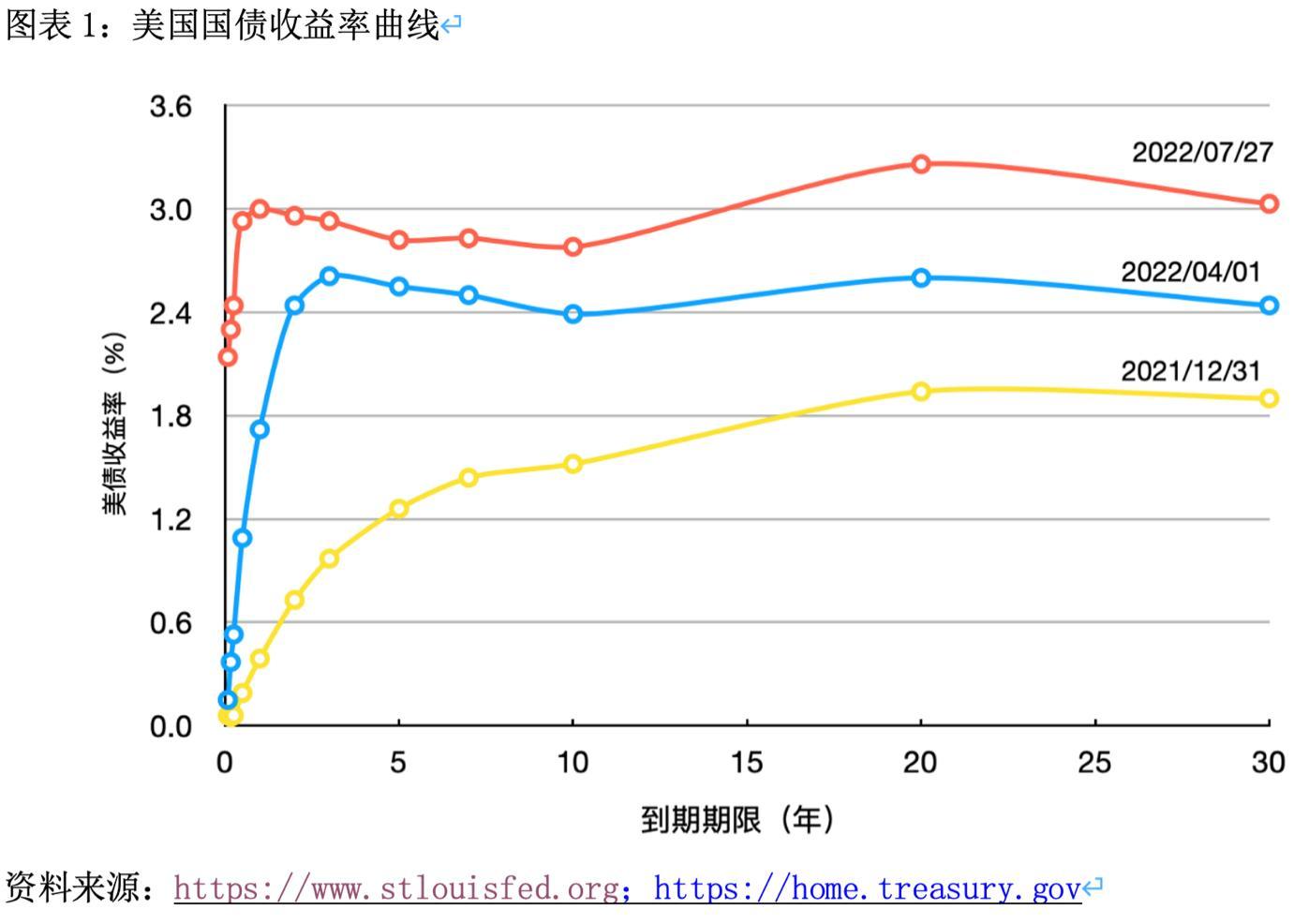

At the beginning of April 2022, the benchmark 10-year U.S. Treasury note yield briefly rose above the 2-year Treasury note. On July 6, the 2-year, 10-year (2s10s) Treasury spread inverted again. By July 27, after the Federal Reserve raised interest rates by 75 basis points, the 2-year Treasury bond yield closed in at 18 basis points higher the 10-year yield (2.96% vs 2.78%). Since July, this spread has remained inverted which is being closely watched by markets as an inverted yield curve is a key indicator of a recession.

Let’s look at the factors that could indicate a recession is coming.

Source: https://fred.stlouisfed.org/series/T10Y2Y

U.S. Treasury Bonds are issued by the U.S. federal government and their interest rates are usually fixed, with maturities ranging from 1 to 30 years. Other bond terms are 1,2,3,5 and 10 years. The 3-month and 2-year rates typically move in the same direction as the federal funds rate, while the 10-year Treasury Rate is regarded as a risk-free benchmark interest rate.

U.S. bond maturities and their corresponding yields

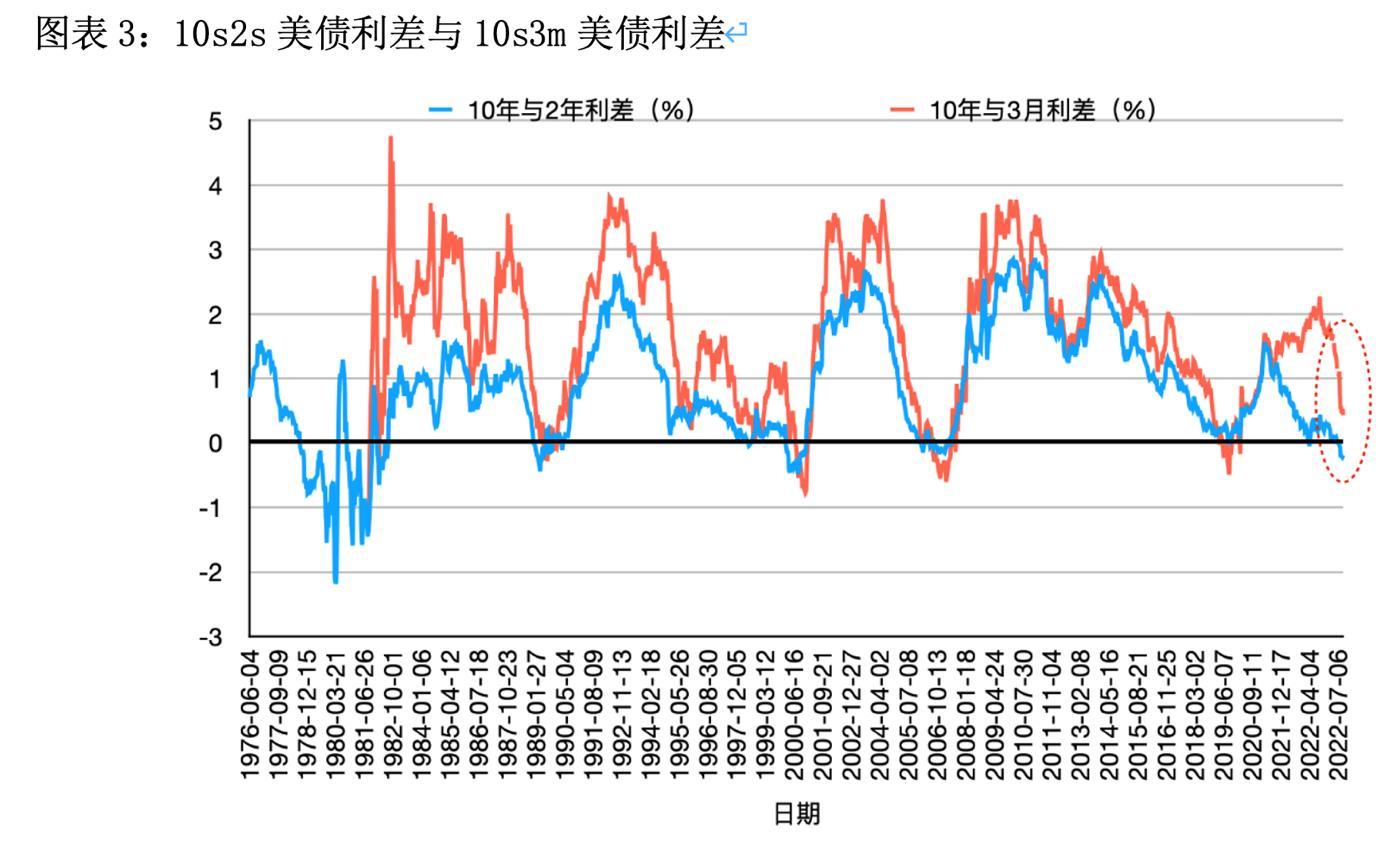

The two spreads that the market pays closest attention to are the 10 year-2year (2s10s) and the 10 year-3 month (3m10s). Since 1969, the 2s10s yield curve has inverted eight times and each time has been followed by a recession. The average time it takes to result in a recession is 13 months, with the shortest period being 7 months in 2019 and the longest being 22 months in 2006.

10s2s and 10s3m yield spreads since 1976

U.S. inflation has been climbing since the beginning of 2021. In June 2022, the U.S. consumer price index (CPI), a key measure of consumer price inflation, rose to 9.1% from the year before, reaching a 41-year high. To mitigate rising inflation the Federal Reserve has implemented an aggressive monetary tightening policy. After the Fed’s July meeting, the market expects the Fed to raise the federal funds rate to about 3.4% this year and 3.8% in 2023.

In general, the direction of the 2s10s and the 3m10s do not stray far from each other. In March 2022, the federal funds rate rose to the range of 0.25% – 0.5% (the first hike since 2018). Since the maturity on the 2-year and the 10-year Treasury note are greater than a year, 10 hikes are anticipated to occur within a year, so they usually lie within 2.4%-2.5%; but due to the shorter maturity of the 3-month Treasury Bill Rate, only 3 months of hikes can be factored in, so in March it stayed at 0.5%. That is why the 2s10s and the 3m10s yield spreads diverged in April and May.

But as the Fed gradually increased the federal funds rate, the U.S. 3 Month Treasury Bill has edged increasingly closer to the 2 Year Treasury Note, while at the same time the 3m10s has also narrowed significantly. On September 12, 2022, the U.S. 3 Month Treasury Bill was 3.035% and the 2 Year Bond Yield 3.53%. By the end of the year, it is expected that these curves will start to align.

As highlighted above the 2s10s Treasury Yield Spread has already been inverted since the end of July. If the Federal Reserve increases rates to around 3.3%-4.0% by the end of the year, then the 3m10s could invert as well. An inversion of both yield curves would likely result in a significant recession.

The Rate of Inflation

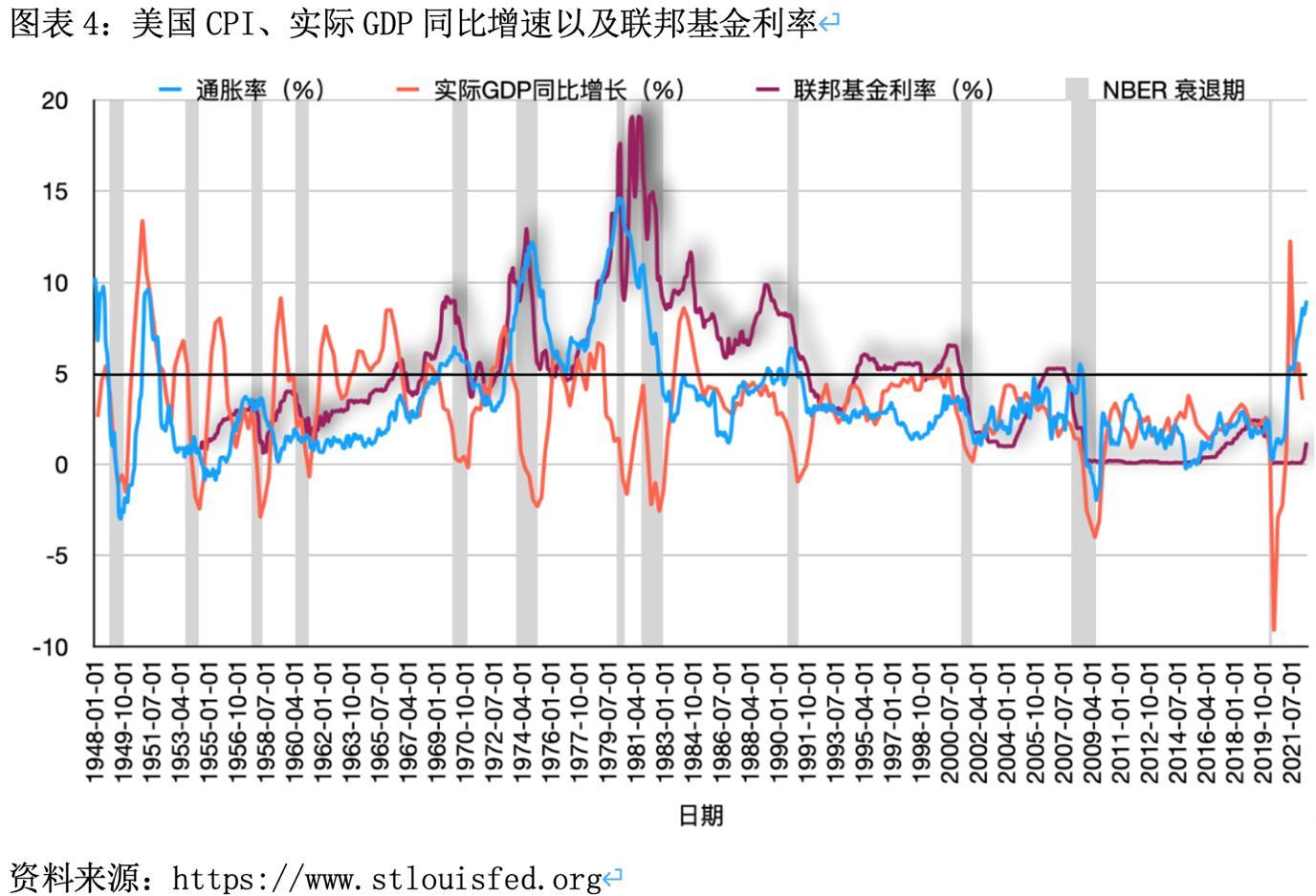

When inflation is high the Fed will raise interest rates to bring it down, therefore the inflation rate moves with the federal funds rate. A recession can often occur after rate hikes which are a response to rising inflation. Looking back on history, recessions have been accompanied by large falls in inflation – from a high percentage to around 5% or less.

For example, in the late 70s the Fed raised the federal funds rate in response to spiraling inflation to as high as 20%. Although this brought inflation down from 14.6% in April 1980 to less than 5% in November 1982, the United States went through two recessions between these years in 1980 and 1981-1982. Recessions in the 50s (1953-1954, 1957-1958) were also preceded by a sharp downturn in inflation before they started.

A comparison of the inflation rate (in blue), real GDP growth rate (in red), the federal funds rate (in purple) and the period of recession (in grey – determined by the National Bureau of Economic Research (NBER)).

Meanwhile, several inflection points have occurred in the middle of a recession, such as in 1970, 1973-1975, 1990-1991 and 2008-2009.

Consumer Confidence and Recession

Before each recession the Consumer Sentiment Index, which measures consumers’ optimism on their financial situation, falls sharply to around 20. For example, before the April-November 2001 recession, the University of Michigan Consumer Sentiment Index fell rapidly from 107.6 in November 2000 to 91.5 in March 2001. Moreover, the recession during the financial crash in 2008-2009 was preceded by a drop in the index from 96.9 in January 2007 to 75.5 in December that same year.

The Michigan Consumer Sentiment Index (in blue) and periods of recession (classified by NBER in grey)

The Consumer Sentiment index fell to a historic low of 50.0 in June 2022, falling by 38.4 points since April 2021 when it was at 88.4.

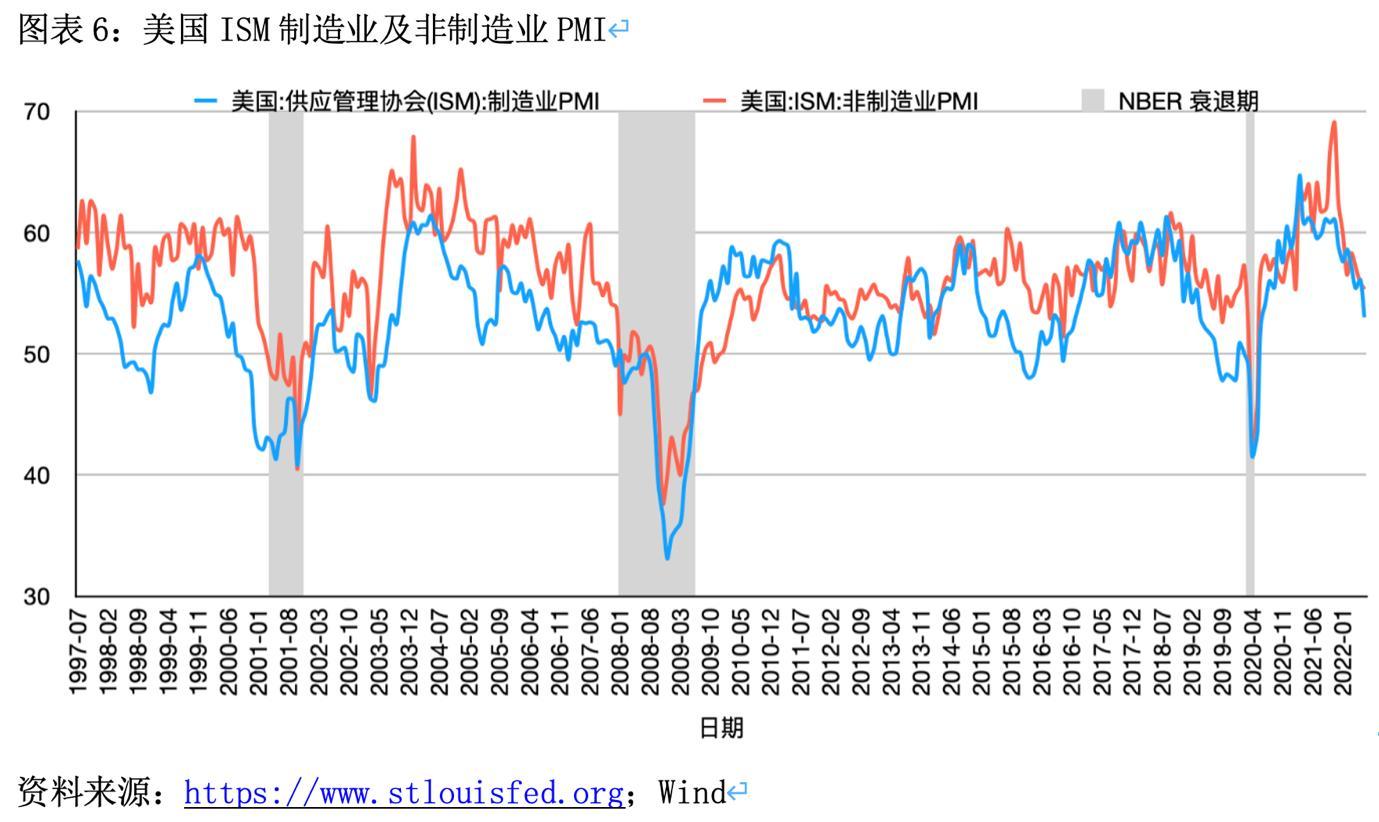

Purchasing Mangers’ Index (PMI)

For the three recessions that have occurred since 2001 in the United States, PMI – a measure of economic trends in the manufacturing and service sectors – has dropped below the line of prosperity (the dividing line marked at 50% which reflects confidence in the macroeconomy).

Before the recession in 2001, U.S. manufacturing PMI fell from 58.1 in November 1999 to below the line of prosperity in August 2000. (Six months before the recession began). In August 2022, the U.S. manufacturing PMI was at 51.3, down from 59.9 in August 2021: According to the PMI’s current trajectory, the probability of it falling below the prosperity line by the end of 2022 is not low.

U.S. ISM Manufacturing PMI (in blue), U.S. ISM Non-Manufacturing PMI (in red) and corresponding periods of recession

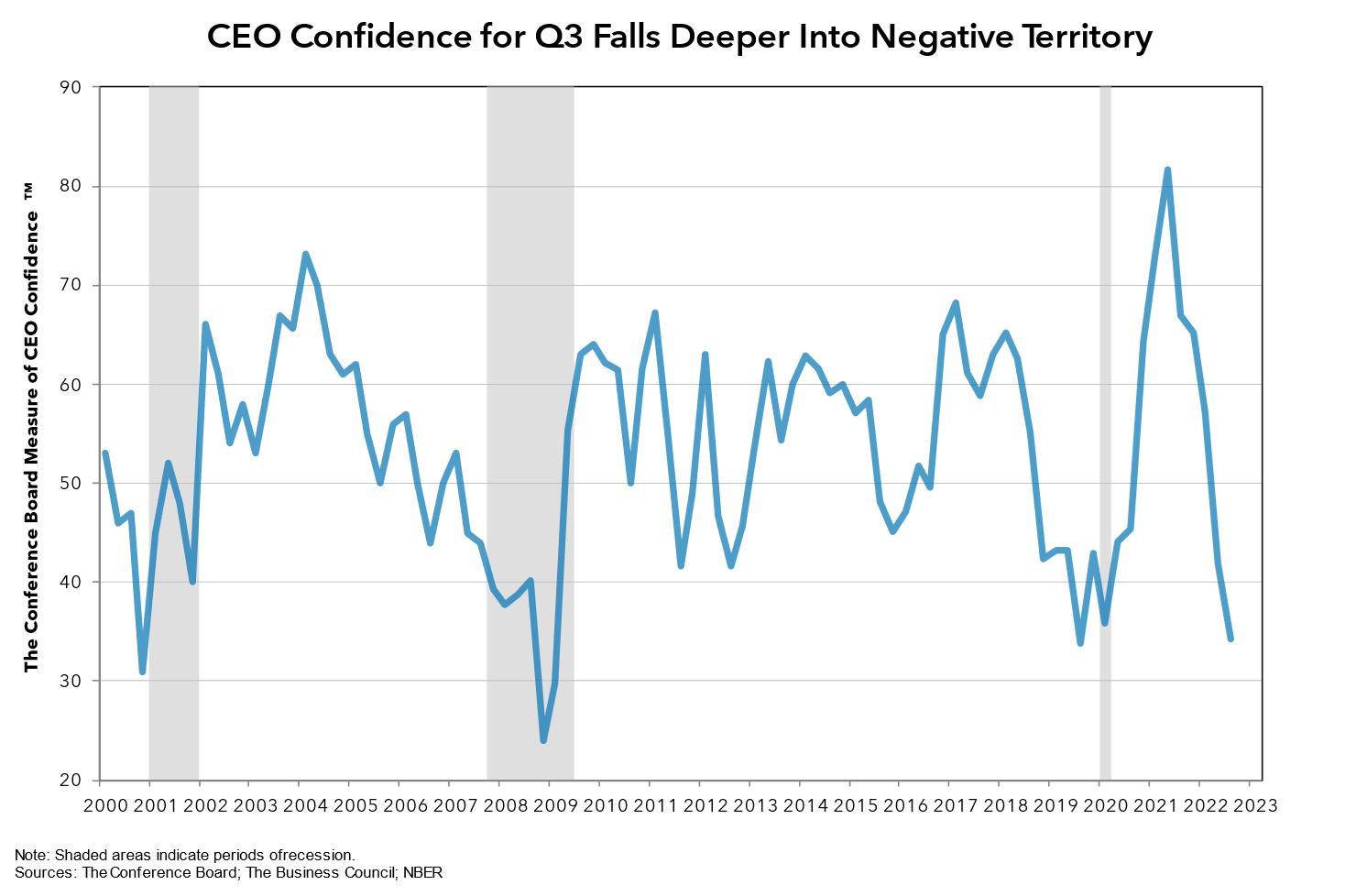

CEO Confidence Index

The recent drop in U.S. CEO Index is also noteworthy: this index usually dictates U.S. investment growth in advance by two quarters. Similar to the PMI, before each of the three recessions since 2000 the CEO Confidence Index has dropped below 40. For example, before the 2008-2009 financial crisis, the CEO Index fell from 53 in the first quarter of 2007 to 39 in the fourth quarter – after which the world fell into recession. Recently, the CEO index has dropped below 40 due to downward pressure on the U.S. economy triggered by interest rate hikes, inflation, and high oil prices.

Source: https://www.conference-board.org/topics/CEO-Confidence

Signs that the United States is not Falling into Recession

Although several indicators suggest that the United States is heading for a recession, there are some macroeconomic indicators that reflect the resilience of the U.S. economy with figures within normal ranges.

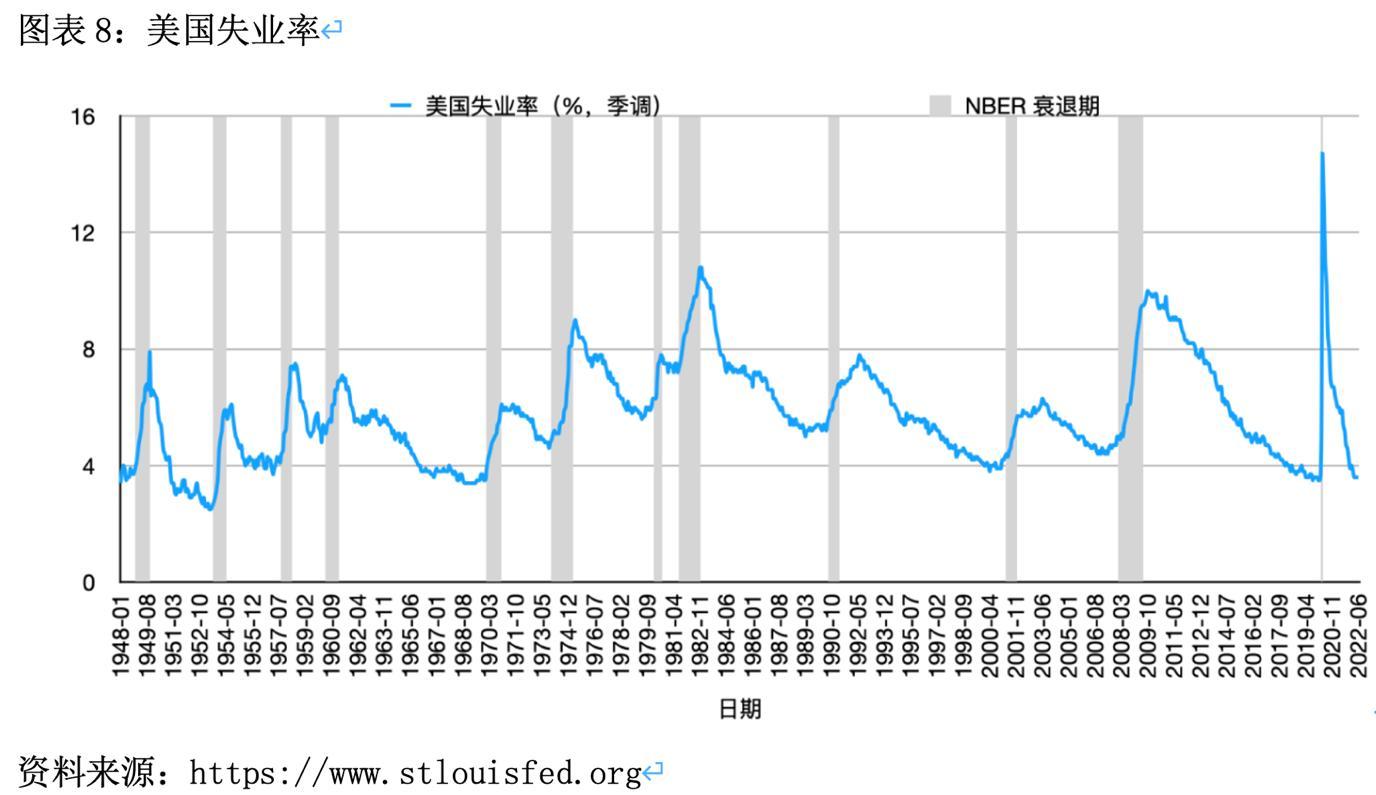

1.Employment

A key sign of the U.S. entering a recession in the past has been the rapid rise in the unemployment rate and a marked decline in the number of non-agricultural workers, with 200,000 to 400,000 people in non-agricultural sectors losing their jobs every month.

Presently, unemployment in the U.S. is at historic lows with 300,000 to 400,000 people being added to non-agricultural payrolls monthly. Only on three occasions since the 50s has unemployment in the United States fallen below 3.6%: February 1951-November 1953, April 1968 – December 1969 and September 2019-February 2020; and only once in the 50s did it fall below 3%.

U.S. unemployment and corresponding recessions since 1948

However, despite historic lows, unemployment rose from 3.5% to 3.6% in August 2022. Although a recession has not come about yet, many companies are starting to take precautions. If the economy does fall into a recession, it is likely that unemployment will rise rapidly.

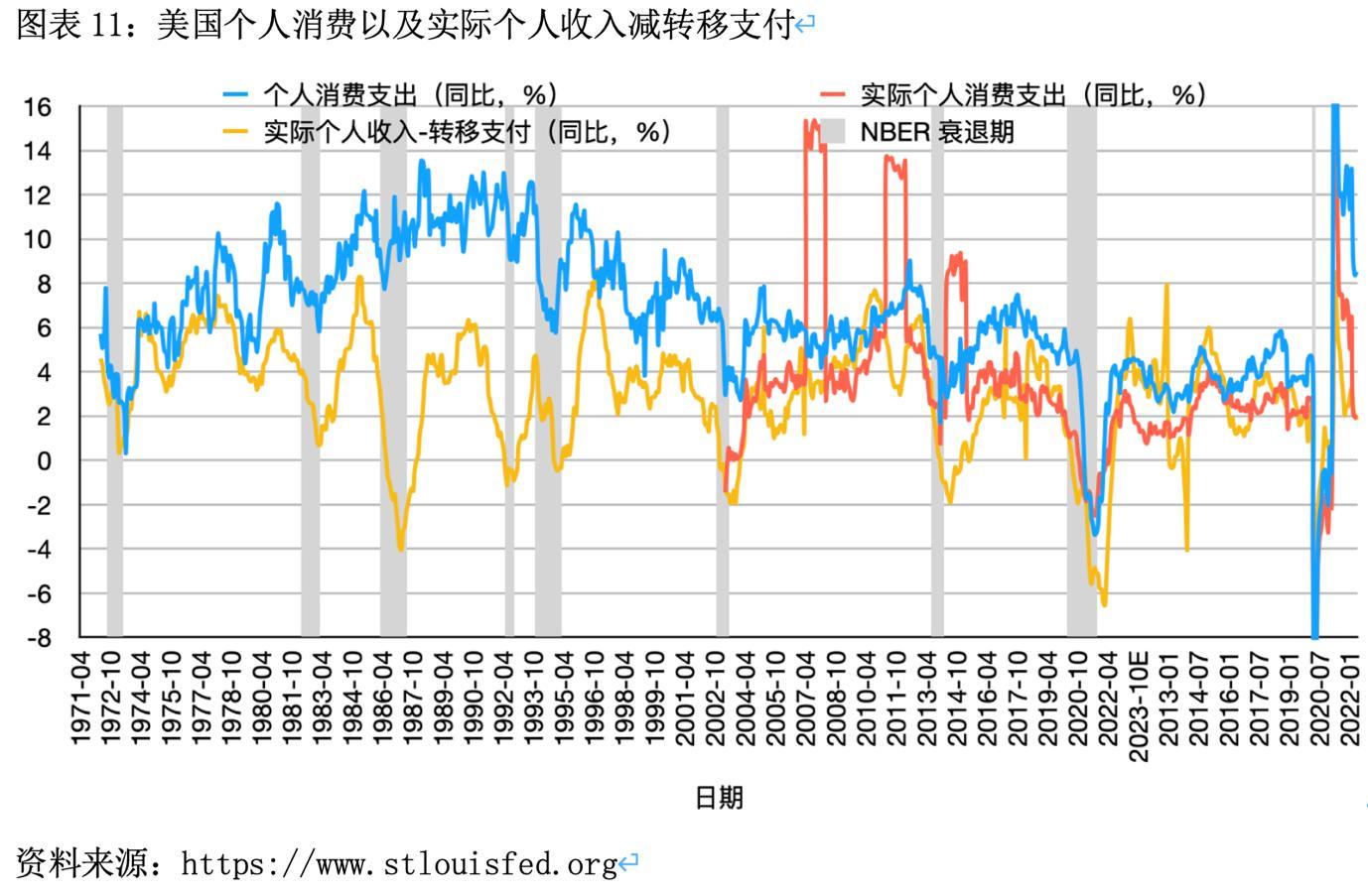

2.Consumption and Income

If you look at every recession since 1970, consumption and personal income have both declined slightly, with income dropping more than consumption. U.S. personal consumption expenditure has stayed strong – although it has dropped from 13% at the beginning of the year 8.5% in May, it is still above many other periods in history. Not accounting for inflation, the growth rate of personal consumption expenditure has stabilized at a normal level of around 2%.

Real income is defined as personal income after direct taxes and government charges have been paid. In general, real incomes in the United States have remained relatively strong. They have maintained a stable upward trend in 2022, and although not as strong as 2021, they are still higher than during the recession preceding 2020. If interest hikes continue and unemployment starts to rise, personal income, real income and consumption growth rates could decline and even turn negative.

YoY personal consumption expenditure (in blue), real personal consumption expenditures (in red), real income (in yellow) and periods of recession (in grey)

3.Retail

Retail sales rose by 3% in August month-on-month reaching USD $683.3 billion. Although retail sales are far off from the levels of 2021, they are still higher than average, thus suggesting that U.S. consumers are able to cope with higher prices.

Conclusion

The inversion of the 2-year and 10-year U.S. Treasury bond yields since late July is extremely important because every recession since 1969 has been preceded by an inverted yield curve. This is in addition to low optimism from the survey responses of consumers, companies, and CEOs. High oil prices, supply chain problems and the COVID-19 pandemic will also take their toll on the U.S. economy.

Although most indicators point to the inevitability of a U.S. recession, it does not mean that one is imminent. It usually takes more than 2 years from the start of interest rate hikes before the start of a recession, and 1-2 years after the inversion of bond rates spreads. Moreover, data on U.S. employment, industrial output personal income, income and retail sales are all within normal ranges, reflecting the resilience of the U.S. economy. Whilst the probability of a recession occurring in the next 1-2 years is high, it is unlikely that we will see a recession in 2022.