Dr. Li Haitao – Dean’s Distinguished Chair Professor of Finance at Cheung Kong Graduate School of Business

In the first quarter of 2022, due to the Russia-Ukraine war and lockdowns across many regions, China experienced a downturn in growth rates. The GDP growth rate was 4.8% year-on-year, industrial output 6.5%, retail consumer goods 3.3%, fixed asset investments 9.3%, exports 13.4%, and imports 7.5%. Consumption was the main drag on GDP growth.

With geopolitical tensions causing volatility in global financial markets, in addition to Federal Reserve interest rate hikes and Covid-19 outbreaks across China, A-shares (shares traded on the Shanghai and Shenzhen Stock Exchanges) fell.

On February 24, 2022, after Putin launched his “special military operation” in Ukraine, sanctions placed by the United States and Europe on Russia caused shocks to global markets: the Shanghai Composite index fell by 416 points (12.2%), the Hang Seng index in Hong Kong fell by 25%, oil prices rose to USD $139 a barrel and U.S. bond yields surged as high as 2.7%.

Due to these difficulties at home and overseas, China will implement a countercyclical policy. On March 16, 2022, Vice Premier Liu He chaired a meeting at the State Council’s Financial Stability and Development Committee, where he stressed that the government will “actively release policies favorable to markets and be cautious in introducing contractionary policies.”

On March 30, Premier Li Keqiang emphasized the severity of geopolitical affairs overseas: “With downward pressure on the Chinese economy, it is even more important to prioritize stable economic growth and to adopt policies as soon as possible to achieve this.” Later, on April 15, The People’s Bank of China announced a reduction of the reserve requirement ratio (RRR) – cutting the amount of cash banks need to hold in reserves by 25 basis points.

How can China achieve steady growth in the face of both internal and external pressures, and how will capital markets develop?

Inflation Caused by the Russia-Ukraine Conflict

The economic and geopolitical uncertainties brought on by the conflict include: 1) Sustained high inflation inhibiting global economic growth; 2) Rising sensitivity of relations between the United States and Russia, and Russia and the EU – with all parties increasing military spending; 3) The possibility of falling demand and a recession in Europe and the United States.

The disruption to supply chains due to the conflict is one of the main reasons for inflation. Russia and Ukraine accounted for 2.3% of global exports before the pandemic – principally oil, natural gas, aluminum, and gas. 40% of gas consumption in Europe was also sourced from the two countries.

The war will bring about a decline in global investment and a shift towards anti-globalization, a trend which has already been exacerbated by the withdrawal of U.S. troops from the Middle East in addition to tensions between China and the United States over trade and capital regulation. This has led to a decline in risk appetite and reversed the trend of economic growth and low inflation that were prevalent under a more globalized and integrated economy.

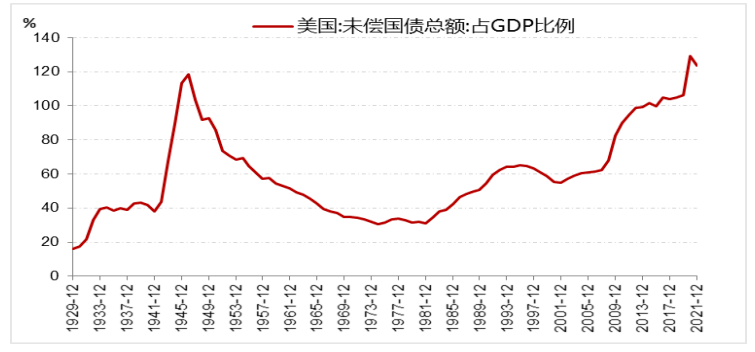

After the global financial crisis in 2008, the U.S’ debt-to-GDP ratio has been on the rise. This puts into question the ability of the United States to manage global tensions as it has done in the past, particularly considering its declining military influence overseas.

Rising Pressure on China’s Policy and Policies Required to Reach its 5.5% Growth Target

China’s economy is currently facing “triple pressure” – a collapse in demand, supply shock and weak expectations.

Due to a large trade surplus and high consumption, GDP growth in 2021 was 8.1%. Net exports rose 20.2% year-on year, retail sales 12.5% and fixed assets 4.9%. However, in March 2022, China’s retail growth was -3.5% year-on-year. This is due to declining exports and consumption, and lockdowns since March in many regions including Shanghai, Shenzhen, Hangzhou, and Taiyuan.

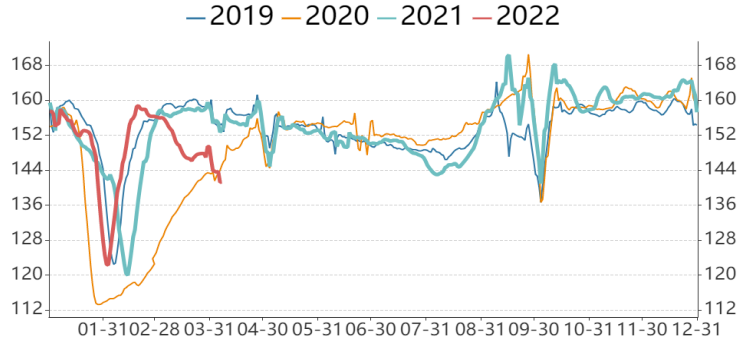

Furthermore, in March, China’s Manufacturing Purchasing Managers’ New Orders Index was 48.8% and New Orders Index 47.25% – both declining month-on-month. Many areas of consumption have also declined, such as catering, film, and the Traffic Congestion Index.

Investment in Fixed Assets

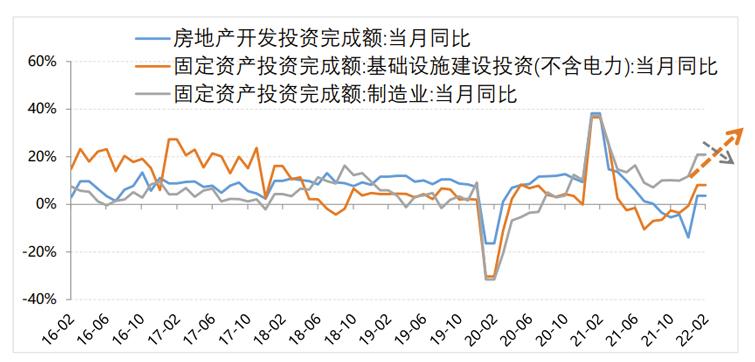

The impact of Covid-19 on consumption means that for China to achieve its 5.5% growth target, fixed asset investment will need to increase. In 2022, overall government spending will be higher with infrastructure playing an important role.

Cumulative investment in fixed assets in 2021 was RMB 54.5 trillion (USD $8.25 trillion). This included RMB 14.8 trillion (USD $2.24 trillion) in real estate, RMB 15.3 trillion (USD $2.32) in infrastructure and RMB 24.3 trillion (USD $3.68 trillion) in manufacturing. The cumulative year-on-year growth rates were 4.9%, 4.4%, 0.4% respectively.

Under the 2022 framework of “houses are for living in, not for speculation” (initially pledged by President Xi in 2019 to boost housing supply and increase affordability in the rental market), real estate investment is expected to rebound, with a year-on-year growth rate of 0-2%. However, investment in the manufacturing sector is likely to drop to 6%-8% year-on-year growth as a result of a decline in exports.

To develop stable economic growth, it is important that China adopts a countercyclical policy, ensuring that infrastructure investment increases from the present 0.4% growth to 10-13%.

Consumption

It may take until the second half of 2022 for consumption to gradually stabilize. It is expected that growth at the end of the year will be in the range of 4%-6.9%.

In 2021, the year-on-year consumer price index (CPI) rose 0.9%, far lower than the target of 3%. Total retail sales of consumer goods were RMB 44.1 trillion (USD $6.67 trillion), a year-on-year growth rate of 12.5%. The average year-on-year growth rate over two years is 4% which is lower than the GDP average growth rate of 5.1%. Moreover, due to the pandemic, consumption growth has not kept up with rising disposable income; however, once the pandemic is brought under control consumption is likely to rebound.

There is also more freedom for monetary policy and an expansion of credit after the People’s Bank of China cut the RRR by 25 basis points on April 15.

In 2022 the People’s Bank of China will focus on generating stable growth, stable employment, the expansion of credit, guiding interest rates down, and increase investment confidence within small and medium enterprises (SMEs).

The Importance of Infrastructure to Curb Inflation

With the impact of the Russia-Ukraine conflict and the Covid-19 pandemic, some of the certainties in China for the second quarter in 2022 include: 1) High inflation; 2) Weak stock markets; 3) Infrastructure as the preferred choice of investment; 4) A rise in RMB depreciation pressure; 5) Pressure threatening the survival of companies downstream

Inflation in the second quarter will trigger volatility in stock and bond markets. Some of the reasons why inflation has occurred in the United States are: 1) Wage increases (5.6% in March 2022), while job vacancies and labor shortages remain high; 2) Capacity utilization in extraction industries far below pre-pandemic levels, due to uncertainties surrounding Fed monetary tightening and the war in Ukraine; 3) Supply chain disruptions caused by the Russia-Ukraine war.

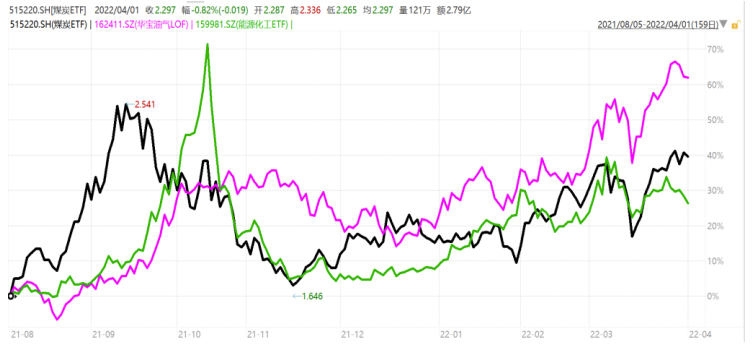

In terms of investment in the second quarter, it is important to allocate funds to energy ETFs which protect against inflation, such as the U.S SPDR S&P Oi & Gas Exploration and Production ETF (XOP), the SPDR S&P Metals & Mining ETF (XME), and the Huabao oil and gas fund.

Infrastructure Investment

In 2022, due to declining exports, a resurgence of Covid-19, and the pressure to contain housing prices under the “houses are for living in, not for speculation” initiative, infrastructure will bear the responsibility of promoting economic growth and employment.

To boost investment in infrastructure funds, local governments have been allocated RMB 5-6 trillion (USD $757-$908 billion) in special bonds. This includes RMB 3.65 trillion (USD $552 billion) for 2022, RMB 2 trillion (USD $303 billion) of unused debt from 2021, in addition to funds from a rise in land sales as a result of marginal easing; as well as various matching funds (funds provided by the central and provincial governments which city and township government match to support local projects).

It is expected that overall infrastructure investment in 2022 will reach RMB 16.8-17.3 trillion (USD $2.5-2.6 trillion), a year-on-year increase of 10-13%. Investment in infrastructure will be directed towards transportation, hydropower, and other energy projects – many of which were already underway in the second half of 2021. On March 30, Premier Li Keqiang announced that RMB 800 billion (USD $121 billion) would be invested in hydropower. Additionally, investment in wind power, solar power and energy storage will increase, as well as investment in underground pipe infrastructure, 5G networks and EV charging points. Investment in coal power transition will likely also increase.

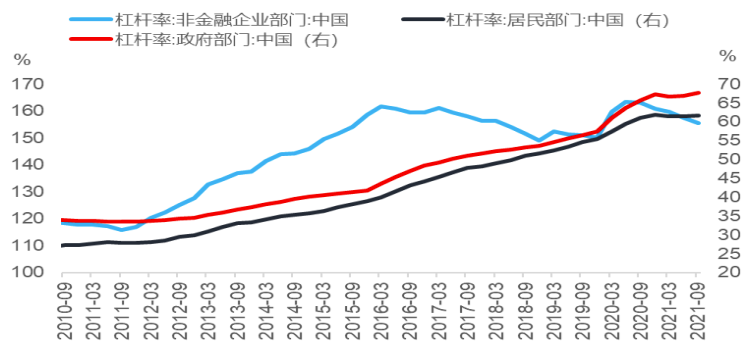

There is still a lot of scope for investment in energy on a per capita basis considering that China’s energy usage and travel distance per capita is below the level of developed countries. China’s 60% leverage (debt to equity) ratio is also below developed countries. Thus, infrastructure investment is an important starting point for China’s countercyclical adjustment.

Volatile A-shares and RMB Depreciation Pressure

In the second quarter, A-shares are expected to remain weak, the RMB exchange rate will experience a certain amount of depreciation pressure and treasury yields will bottom out.

Due to a lack of optimism in China as a result of pandemic prevention measures, external demand is under declining pressure; Unless policy measures are adopted that exceed expectations, China’s A-shares will remain volatile and the RMB will be at risk of depreciation – potentially to 6.4-6.5 to the dollar. However, if policies are introduced that promote stable growth the risk of a further decline in A-shares can be mitigated. Presently as a result of the low valuations of A-shares, buying the dip could be a good investment strategy.

The reasons for RMB depreciation include: 1) A narrowing of China’s trade surplus – with Fed interest rate hikes, consumption and imports in the United States and Europe are also expected to fall; 2) A narrowing of the China/United states 10 years government bond spread; 3) Rising inflation in China due to measures taken in the United States to counter inflation; 4) Rising interest rates in the United States which have driven up bond yields and reduced external demand (causing the U.S. stock bubble to burst). Capital moving out of growth stocks into mature markets has put pressure on both A-shares and the RMB exchange rate.

Finally, it should be mentioned that rising commodity prices and measures to combat Covid-19 in China have caused many problems for SMEs. Although China is gradually implementing policies to stabilize its economy, SMEs are going to encounter pressures in the short-term. It is important to adopt measures to ensure their survival – to take advantage of government policies that give them greater access to credit and reduce their taxes and fees in the hope that this crisis can be turned around.