In exposing the many vulnerabilities of our interconnected world, the COVID-19 pandemic has also brought to light the criticality of increasing the sustainability of development at a faster pace, as countries look to shore up resilience against future disruption and global risks events.

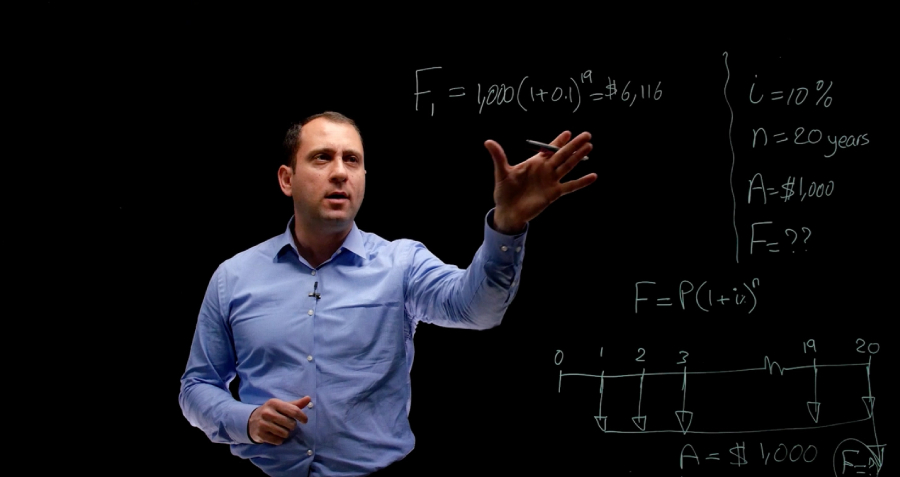

However, one of the main challenges towards building a more sustainable future is a growing investment gap. This challenge is especially acute for developing countries, which were estimated to require an additional USD $2.5 trillion in investment per year to achieve the SDGs. The impact of the pandemic has widened this gap, with the OECD estimating that in 2020 these economies faced an additional investment shortfall of USD $1.7 trillion. Considering the ongoing pressures on governments’ fiscal capacity, it has become imperative to attract more private capital into bridging this investment gap.

There are several reasons to be optimistic about the positive role that private capital can play. First is that there is a growing pool of capital available for investment: at the end of 2019, non-banking financial institutions and commercial banks respectively managed a total of USD $200.2 trillion and USD $155.4 trillion, up by 77.5% and 46.6% from 2010 levels. Some of this is in ‘dry powder,’ i.e. capital that while already committed by investors has still not been invested or allocated. It is estimated, for instance, that private equaity (PE) firms have a total of USD $1.9 trillion in dry powder globally.

Second is that sustainability considerations have become front of mind for investors in the search for alpha and risk-adjusted returns given: rising social pressures on companies to behave as ‘good citizens,’ and the risks of reputational damage and boycotting if they don’t; increasing risks to the long-term value of assets owing to climate change and natural disasters; tighter environmental regulations and emission standards; and the expected phasing out of carbon-intensive assets.

In fact, in a recent survey to 450 global institutional investors, over 70% said that their investments which integrated environmental, social and corporate governance (ESG) factors performed better financially than equivalent traditional investments in both 2020 and the three years prior. Also, 65% said that over the next 12 months they will use ESG factors in the investment process for at least 25% of assets under management (AUM), while 32% will do the same for at least 50% of AUM.

Data also show a rapid increase in the amount of private capital being deployed in sustainable assets. This includes USD $778 billion raised in sustainable bonds during the first nine months of 2021, which is more than ten times the amount raised in 2015 (USD $60.4 billion); and USD $448 billion in sustainable loans, up from USD $194 billion in 2019. Moreover, net inflows to sustainable funds globally are estimated to have surpassed USD $300 billion in 2020, up from USD $159 billion in 2019.

Having said this, the reality is that private capital will only be attracted to assets that are financially viable, with an acceptable risk profile, and which are structured appropriately so that risks are allocated to the parties best placed to manage them.

It is therefore not surprising that most of the capital is captured by developed countries. Besides their strong institutional and regulatory systems, they offer favorable business environments adapted to international best practices and standards, and mature financing systems. In comparison, developing countries carry higher risks and are thought of as lacking investable opportunities – a situation that has worsened due to the pandemic. No wonder then that they just accounted for 3% of sustainable fund investments in 2020.

Bridging the sustainable investment gap in developing countries requires promoting international cooperation among governments, multilateral organizations, companies and civil society across several dimensions. While it is not the purpose of this article to examine them at length, four stand out:

- Building institutional capacity. Governments can work with multilaterals and specialized consultancies to identify and address institutional weaknesses with the aim of providing regulatory certainty to international capital providers. Multilaterals can also help governments offer mechanisms to lower political risks (e.g. credit enhancement and sovereign guarantee products) to mobilize private capital.

- Developing common standards. Governments can work together to promote the harmonization of ESG standards and environmental regulations, thereby helping investors from different markets better identify opportunities and risks. One of the best examples is the ‘Common Ground Taxonomy’ for sustainable investments which is being developed by China and the EU.

- Adopting ESG best practices. Companies looking to attract sustainable investment can work together with NGOs, professional service firms and multilaterals to adopt best practices on ESG, including around data collection and disclosure so that potential investors can more easily evaluate performance and progress.

- Enhancing financing channels for nascent solutions. Governments can establish co-investment schemes to attract VC funds and philanthropists to invest in startups that are developing innovative solutions and technologies – and which are as of yet not commercially viable – to address climate change and environmental degradation.

One last thing to mention is that sustainability cannot be understood as only covering aspects related to climate change and the environment. It also covers societal issues such as income inequality and poverty; and social injustice and discrimination. Left unaddressed, these issues have been proven to fuel social discontent and feed into ‘us vs them’ narratives, driving protectionism, populism, xenophobia, and ideological extremism. They erode the potential for international cooperation and, in so doing, threaten global long-term prosperity. It is therefore necessary to think about solutions that can address the root causes of these issues, and about the potential role that private capital can play in this.

By Alfredo Montufar-Helu, Director, Economist Intelligence Corporate Network, Beijing, The Economist Group

Alfredo is the director of the Economist Intelligence Corporate Network, the C-suite briefing and networking arm of The Economist Group, and oversees its operations in Beijing. Based in China since 2013, Alfredo has focused on analyzing the business implications of policy, economic and political developments for companies investing and operating in China, and in the broader Asian region. This with the aim of distilling complex issues and conveying clear takeaways on how to capture business opportunities and respond to emerging challenges.