With China’s real estate industry continuing to be one of the hottest topics for discussion, CKGSB recently collaborated with KPMG to hold a breakfast seminar for senior executives of Japanese companies in Beijing. The purpose of this seminar was to explore the current state of the real estate market and offer an opportunity to discuss its prospects. Shedding light on this important topic were two distinguished speakers, CKGSB Professor of Economics Li Wei and Tomoyuki Fukumoto, GM, Bank of Japan. The highlights of their talks are summarized below.

Guest Speaker #1 – Dr. Li Wei (Professor of Economics, CKGSB) – Chinese Housing Market

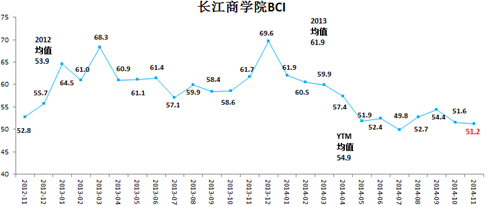

Prof Li Wei began by describing the current state of Chinese economic conditions, with CKGSB’s Business Conditions Index, or BCI, clearly showing a downward trend in recent months.

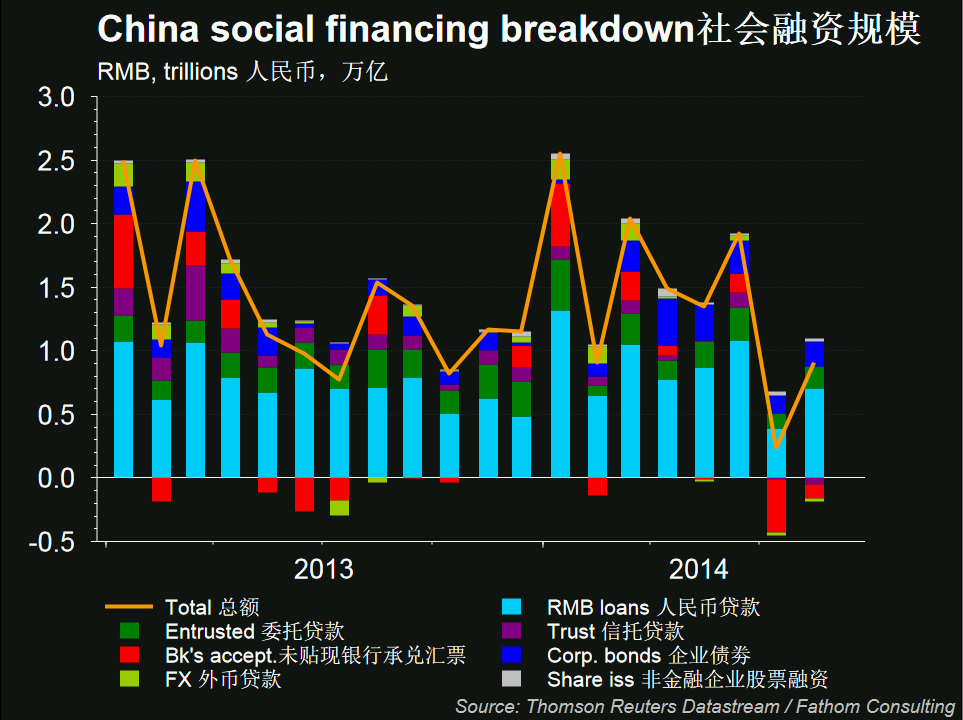

The breakdown of China’s social financing, which consists of bank loans and shadow banking activities, was also shown by Prof Li to be highly correlated with the BCI.

Prof Li then demonstrated the remarkable correlation of M2 growth, the Shanghai stock exchange and GDP, which, along with the BCI index, he said were useful China indicators and great predictors of the Chinese economy. However, Prof Li stressed that his BCI index was comprised by sampling some of the most competitive firms in industry, and, as a result, was not wholly representative, but added that if those companies were struggling, then others certainly would be too.

Next Prof Li discussed the issues of lower growth and structural weakness. On the issue of lower growth, Prof Li said too much investment has led to overcapacity, which is showing in a build-up of inventory, but he noted that their levels are going down. With regard to structural weakness, Prof Li said many firms’ costs are rising more than 10% per year, but that many of those same businesses found themselves unable to pass these costs downstream onto customers, taking an unavoidable hit themselves.

The forecast for inflation is modest, with consumer prices predicted to stay at 2-3%, or lower, but the main issue, Prof Li pointed out, is the drop off in investment, which has slowed substantially since 2004. A large part of China’s growth has been the housing sector – roughly half of China’s billionaires are in the housing sector – with many people continuing to buy houses even though prices were rising. But with prices now falling, people are holding off on making purchases, and inflation stands at a very modest level as a result of falling housing prices.

With more than 80% of the population living in their own homes, Prof Li said it is reasonable to conclude that China has built too much housing.

Prof Li then explained the background to this issue, touching on various aspects of land policy in China: how land policy is an implicit tax, not an explicit one; how China has been historically reliant on implicit taxes (eg the ‘hukou’ system and state ownership); and how China’s land policy has been transplanted from Hong Kong with its British-style leaseholds.

Finally, Prof Li discussed the prospects for future reforms in the sector, arguing that, with the Chinese government aware that it is running out of leaseholds, and the fact that there is no more land to sell, there is a very large chance that China will introduce a property tax, with this explicit tax replacing the current implicit one. But he warned that if housing prices continue to fall over the next one to six years, China could face a debt crisis, which would result in a whole new set of problems.

Guest Speaker #2 – Tomoyuki Fukumoto (GM, Bank of Japan) – Macroeconomic Analysis of China’s Real Estate Market

Bank of Japan’s Tomoyuki Fukumoto then gave a macroeconomic analysis of China’s real estate market and explored whether we are looking at a mere monetary adjustment or a more drastic economic impact.

Based on month-on-month data from China’s National Bureau of Statistics, Fukumoto said there has been a decrease in housing sales in first, second and third tier cities, though the decline did not exceed 20%, and the fluctuation was rather minor. Fukumoto pointed out that it is very important to determine whether China’s property market is facing a mid and long-term turning point, or whether it is simply experiencing short-term adjustments. He said he has the impression that this is only a short-term adjustment, though one which might be deeper and longer than previous adjustments have been. But he added he is not pessimistic about the current state of China’s real estate market, while warning that the period of rapid increases in real estate sales and prices may be over.

Two Major Factors of Monetary Adjustment

Fukumoto laid out two causes of the current adjustment: (i) softer -than-expected new real estate purchase regulations and (ii) the relatively tight monetary policy.

He argued the new real estate regulation published by the new administration in February 2013 turned out to be much softer than people had expected, sparking a rush of housing purchases in 2013. The subsequent decline in housing sales in 2014 was basically a natural reaction to the strong sales seen in 2013. The other area of focus was tighter monetary conditions. Though interbank rates have been dropping since the start of this year, mortgage rates have been going up because banks’ funding costs went up. Many young Chinese investors had been diverting their money into online payment funds such as Alibaba’s Yuebao product, which offered interest rates of 6-7%. That in turn, he said, had forced Chinese banks into following the trend of selling money market fund products or wealth management products. As a result, banks’ funding costs went up and banks started to raise mortgage rates.

Fukumoto also pointed out that the PBOC had issued guidelines in May 2014 to encourage mortgage loans for first time homebuyers, with banks introducing a relatively lower interest rate for mortgage loans three months later. Fukumoto said this could be favorable for homebuyers, but added that a total relaxing of interest rates may be needed in the future if China’s real estate market is to thrive.

Next, he discussed the question of when this period of real estate adjustment might end. Based on the last two adjustment periods (in 2008 and 2011), Fukumoto said he would expect the market to return to positive growth after three quarters of adjustment. Since the growth rate turned negative in May 2014, the expectation is that positive growth may return in the first quarter of 2015. But, without a reduction in interest rates, Fukumoto argued the current real estate adjustment may last longer than the previous periods.

Why the market is not collapsing

Fukumoto ended his presentation by summing up his thoughts on the real estate market in China, putting forward several reasons why he thinks the market is not collapsing and is instead going through a short-term adjustment. These include:

China’s current leverage, expressed in credit-to-GDP ratio, is standing at 207% of GDP. While it is increasing, it is still currently comparable with Japan’s leverage rate in the early 1970s (210%) when its economy was still developing relatively fast, rather than the rate experienced in the late 1980s (255%) shortly before Japan’s real estate price bubble started to burst.

China’s urbanization rate (54%) is similar to Japan’s rate in the 1950s. This tells us that China is still urbanizing. Meanwhile, the primary sector’s share of GDP is 10% in China, equal to that of Japan in the 1960s, during a period of economic growth.

China will most likely maintain the current level of its labor population throughout the 2020s (though it is forecast to decrease rapidly in the 2030s). Decline in labor force will not become a negative factor for GDP growth until 2030. For these reasons, Fukumoto argued that China’s economic stagnation will not occur drastically, but rather slowly.

Fukumoto concluded that 2020 could be a turning point for China’s real estate market because the population from age 25 to 34 – the majority of first-time homebuyers – will reach its peak then, saying that while the golden era of real estate is now over, the silver era is just beginning.

As a final point, Fukumoto noted that, in order to ensure the stability of the real estate market, the Chinese government has already carried out a stress test to simulate a collapse of the market. In the worst case scenario, the government would exercise three measures: a lowering of housing mortgage rates, tax exemptions for real estate transactions, and land supply restraint for municipalities, but he stated that the government thought these measures are not yet necessary in the current market.

References

Powerpoint slides by Professor Li Wei – ‘Chinese housing market’

This was the latest in a series of breakfast seminars co-hosted by CKGSB and KPMG. For the previous one on internet finance, click here.