Milan, 22 October 2025 – SDA Bocconi School of Management and Cheung Kong Graduate School of Business (CKGSB) are expanding their pioneering collaboration in art market research with the launch of the MM European Country Art Price & Sentiment Indices, a new set of tools designed to provide a more granular understanding of the European art market.

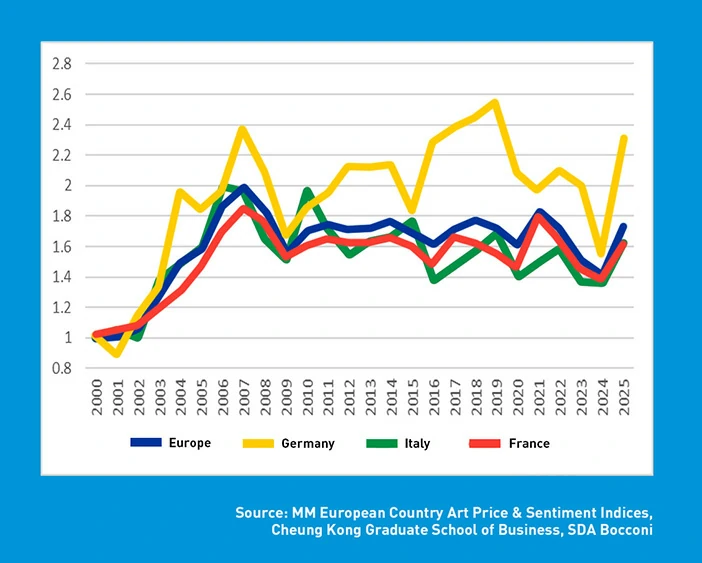

Following the July 2025 release of the MM Continental Art Indices, which for the first time offered a systematic, data-driven view of long-term price trends across Asia, Europe, and the Americas, this new release focuses on country-specific dynamics within Europe, capturing the unique trajectories of Italy, France, Germany, and the United Kingdom.

The presentation of the indices took place on October, 22, 2025 at SDA Bocconi School of Management in Milan, led by Professor Jianping Mei(CKGSB) , Professor Andrea Rurale, and Professor Brunella Bruno (SDA Bocconi).

This initiative is part of a research collaboration between SDA Bocconi and CKGSB, which brings together CKGSB’s pioneering econometric research—led by Professor Jianping Mei, co-developer of the Mei-Moses Art Indices—and SDA Bocconi’s academic leadership in cultural markets, represented by Professors Andrea Rurale and Brunella Bruno.

The two institutions have signed a Memorandum of Understanding to jointly develop the Art Market and Finance Monitor, a research platform hosted at SDA Bocconi. This platform aims to produce a comprehensive suite of indices to track price movements, sentiment, and liquidity across different geographies and artistic segments, providing reliable data for academics, collectors, institutions, and investors.

The indices are based on 19,258 repeat sales between 1873 and 2025, covering 3,821 artists born in Europe. The underlying data come from Sotheby’s, Christie’s, and Phillips auction results in major art hubs including London, Paris, Milan, Amsterdam, Cologne, New York, Hong Kong, and Dubai.

A turning point for the European art market

“The European art market has long been stable but slow-moving compared to other regions,” said Professor Jianping Mei during the presentation at SDA Bocconi. “These new indices allow us to understand the historical trajectory of each major European market and to identify where the opportunities may lie in the coming years.”

Professor Andrea Rurale added: “For the first time, we can look at Europe not just as a single bloc, but as a constellation of distinct markets with their own rhythms, collectors, and dynamics. This is a crucial step in building a more data-informed understanding of the art market.”

Professor Brunella Bruno highlighted the importance of comparing art to other asset classes: “The low correlation between art and financial markets, combined with renewed sentiment, suggests a unique moment for investors and collectors to reassess the role of art in their strategies.”

Sentiment indices: measuring market confidence

Beyond price trends, sentiment indices offer valuable insight into collectors’ behavior. Historically, periods of strong sentiment—such as 2000–2008—have been associated with competitive bidding and rapid price appreciation. Conversely, sentiment dropped sharply after the 2008 crisis, reaching historical lows in 2020 and 2024.

Spring 2025 data, however, suggests a “thawing” of market sentiment, particularly in Germany and France, where bidding activity has become more competitive again. This may signal the early stages of renewed confidence among European collectors and institutions.

Country-level indices allow for nuanced comparisons across European markets:

For each of these four countries, both price indices and sentiment indices were constructed. While price indices track long-term changes in auction prices using repeat-sales methodology, sentiment indices capture the intensity of bidding over time, measuring market enthusiasm.

-ENDS-

Notes to editors:

The analysis reveals that German art has outperformed the European average between 2000 and 2025, though with higher volatility. After a long period of stagnation following the 2008 financial crisis, the Spring 2025 data show a marked recovery, particularly in Germany.

This rebound follows over a decade of weak returns in the art market: between 2008 and 2024, the 10-year rolling annualized returns for art fell to -0.9% in 2023 and -1.4% in 2024, the lowest levels since 1954. This was a once-in-70-years downturn, unprecedented in the modern art market.

By contrast, Spring 2025 marks the strongest price increase in European art in over a decade, signaling a possible turning point. The German index showed the sharpest growth, followed by signs of recovery in the Italian and French markets.

The research also compares art market performance with major financial benchmarks, using dollar returns on:

Between 2000 and 2025:

In terms of risk, European art displayed the lowest volatility among these asset classes (standard deviation of 0.098, compared to over 0.20 for equities), and low correlation with financial assets (0.35 with equities and 0.33 with bonds). This highlights art’s potential role as a diversifying asset in investment portfolios, particularly during periods of financial uncertainty.

Over the last 87 years, art market returns have moved in cycles tied to major world events:

Today, structural changes suggest that the art market could be poised for a new cycle of growth. Since 1985, global stock market capitalization has grown from USD 4.5 trillion to USD 127 trillion, a 27-fold increase, while the world art market index has grown only 3.7 times. The number of billionaires worldwide has surged from 140 to 2,781 between 1987 and 2024 — a 19-fold increase — yet the world art index has risen only 2.2 times over the same period.

This massive accumulation of wealth, coupled with emerging trends such as the AI investment boom, changing working patterns, and longer productive lifespans, could create the conditions for a new wave of art collecting and investment.

The MM Art Indices are developed using repeat-sales methodology pioneered by Professors Mei Jiangping and Michael Moses, and later extended through this joint SDA Bocconi–CKGSB initiative. They are part of a long-term effort to bring more transparency, historical depth, and analytical rigor to the art market.

The indices are published under the umbrella of the Art Market and Finance Monitor, a new research platform at SDA Bocconi dedicated to studying the intersection between culture and finance.

Established in Beijing in November 2002, CKGSB is China’s first privately-funded and research-driven business school. With its MBA, Executive MBA and Executive Education programs, the school aims to cultivate transformative business leaders with a global vision, sense of social responsibility, innovative mindset, and ability to lead with empathy and compassion.

Today, CKGSB is the preferred choice in management education for business elites and future leaders to achieve exponential growth, as well as the leading choice for academics returning to China from top global schools. More than half of our 23,000 alumni are at the CEO or chairman level and, collectively, they lead one fifth of China’s 100 most valuable brands. Through our unique partnerships with leading schools and companies, we have nurtured 1,188 founders of companies with at least Series A funding, including the founders of 151 unicorn companies.

SDA Bocconi School of Management is the international school leading the transformation of individuals to improve the future of people, organizations, and society. Alongside its urban campus in Milan, renowned as the most sustainable in the world, the school also has a location in Rome and a pan-Asian hub in Mumbai. SDA Bocconi’s programs are built on rigorous and original research activities, offering MBAs, Specialized Master, and Executive Master programs, as well as open and custom executive education.

According to the Bloomberg Businessweek ranking, SDA Bocconi is the third best business school in Europe. The most recent Financial Times rankings place it third in the world for custom executive education, fourth globally for the Full-Time MBA, and sixth in Europe among business schools.