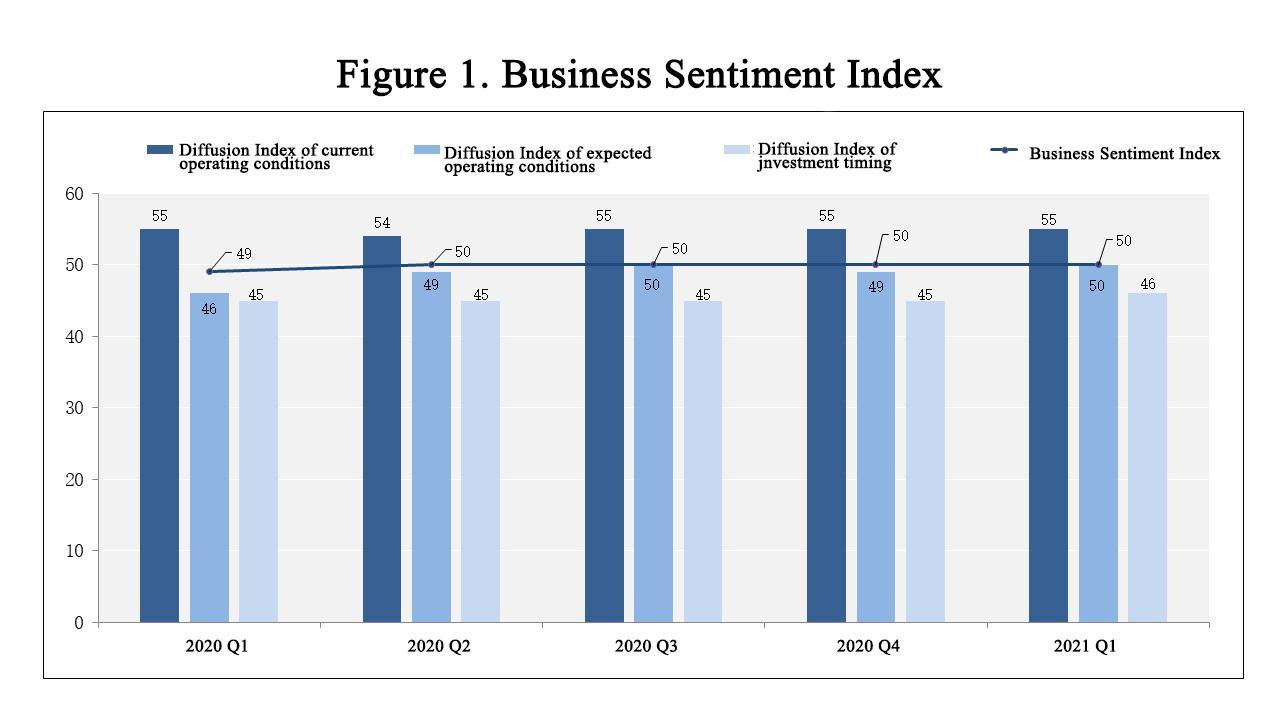

Cheung Kong Graduate School of Business’ Center on Finance and Economic Growth released results of its 2021 Q1 Business Sentiment Index, a survey of more than 2,000 Chinese companies from within the industrial sector to provide the most comprehensive set of independent data currently available. The overall sentiment remained flat at 50. The diffusion indices reflecting real output, including production, electricity consumption and domestic orders all indicate a slight expansion. However, low demands in the domestic and international markets and rising cost of raw materials hinder the full recovery of the sector. The companies surveyed are still cautious about the future, with only 1% of them making expansionary investment.

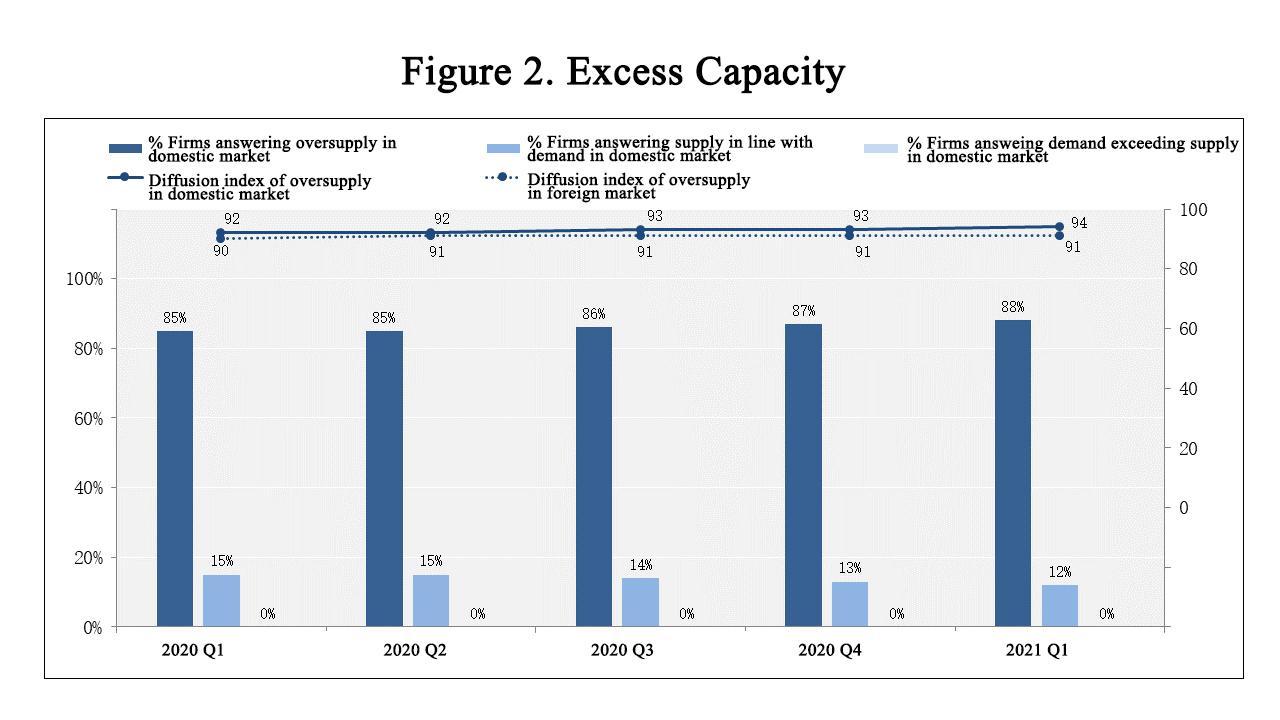

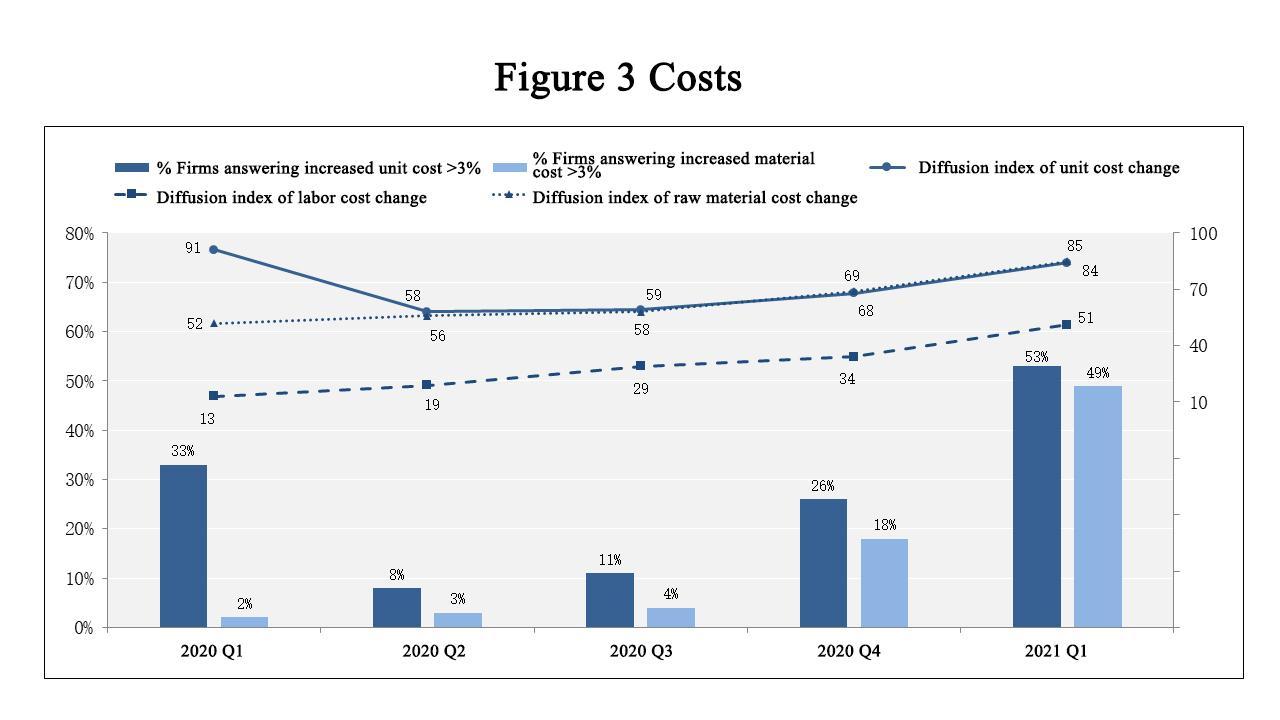

Products in 88% of surveyed companies were oversupplied in the domestic market. Correspondingly the overcapacity diffusion index reflecting insufficient domestic demand rose by one point to 94, hitting a record high. The cost of raw material have risen across the board, with a diffusion index of 85, an increase of 16 points from the previous quarter, also the highest in history. This has led to a significant increase in unit costs, with a diffusion index of 84. Against the context of overcapacity, companies lack pricing power, reflected in the price index rising to 58. Rising costs mean that profits are squeezed, and the proportion of companies with a gross profit margin of more than 15% fell by 5 points to 30%. Inflation risk looms.

Led by CKGSB Professor of Finance Gan Jie and described as the first of its kind, this large-scale, micro-level quarterly company survey on China’s industrial economy, is based on a stratified random sampling by industry, region and size from the National Bureau of Statistics’ (NBS) population of industrial firms that have sales of over twenty million RMB. The 2021 Q1 survey sample covers 41 industries in 31 provinces and municipalities in China.

For full report, visit the Business Sentiment Index page HERE.