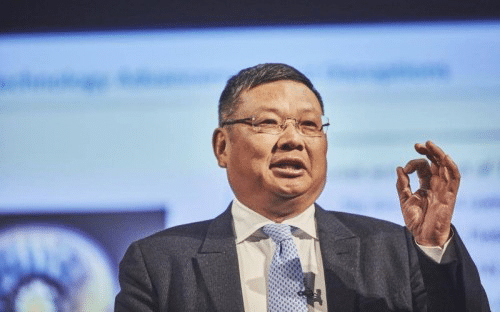

Cheung Kong Graduate School of Business (CKGSB) Founding Dean and Professor of China Business and Globalization Xiang Bing, shares key insights on how foreign companies can survive in the Chinese market amid the current global environment, in a recent interview with South Korean media, E-Daily, China correspondent Shin Jung Eun. In discussing the pertinent topic, Dean Xiang examines the importance of adopting sustainable social responsibility, China’s role in the global economy, the US-China trade dispute and its impact, and how best to develop the global economy moving forward.

Below is an English summary of the article. To read the full article, originally published in Korean on E-Daily, please visit: https://www.edaily.co.kr/news/read?newsId=01364486628914440&mediaCodeNo=257&OutLnkChk=Y

“Since the global financial crisis, China’s contribution to the global economy has been huge. Post-COVID19, China’s role in stabilizing the global economy will once again be significant. This will be an important safeguard for countries with a high trade dependence, such as Korea and Japan,” said Dean Xiang. In emphasizing the synergizing effect of regional cooperation for economic growth, he noted that “Korea, China and Japan should be accelerating cooperation.”

Dean Xiang pointed to China’s internal and external “dual circulation” economic strategy as the most noteworthy part of the Chinese economy this year. This is a strategy in which “internal circulation”—incorporating development brought by the domestic cycle of production, distribution and consumption with innovation and upgrades in the economy—will be supported by “external circulation.” He explained that the strategy is not simply a preparation for decoupling with the US, but a strategic choice to maintain China’s sustainable growth. In particular, Dean Xiang emphasized that accordingly, approaches to the Chinese market should be updated as China is now a major consumer market.

Whilst a lot has happened to the Chinese economy in this past year, what are some significant events?

The “dual circulation” strategy announced by the Chinese government is of most importance. China has so far effectively controlled the COVID-19 pandemic, which has been favorable for economic growth. I have reason to be even more confident. China is firmly committed to opening up to the global economy and to foreign investment, examples would include the Shanghai Trade Fair and the Hainan Special Economic Zone. Unlike the US, China has accelerated globalization. Neighboring countries such as Japan, Korea and ASEAN member states have also done so. In fact, in the first quarter, ASEAN overtook the European Union to become China’s leading trading partner. The synergizing effects of regional cooperation are enormous. In this respect, I think we need to accelerate cooperation among the Korean, Chinese and Japanese markets in the future. The Regional Comprehensive Economic Partnership Agreement (RCEP) is also noteworthy. The RCEP is the most significant regional move in recent history and signals a massive geopolitical shift. Today, as reverse globalization is taking place, this new regional cooperation has become even more important.

As China moves away from being a low-cost country, the “dual circulation” strategy announced by the Chinese government is the correct market approach to adopt. It is becoming increasingly difficult for an economy as large as China to solely rely on trade; hence, it is important that the domestic economy be simultaneously developed.

With the problematic US-China relationship, do you see US-China relations improving in the Biden era?

Even in the Biden era, I do not foresee significant changes in US-China relations. I do, however, expect more emphasis on multilateralism and rejoining international treaties, such as the Paris Climate Convention. The Democratic Party will place greater importance on the difference in ideological values, with the US trying to return to its role as a global leader. However, overall, it is unlikely that US-China relations will return to what they were four years ago.

Do you see a possibility for trade negotiations between the US and China to proceed again?

Biden’s government is more likely than Trump to sit at the negotiating table. In a survey by the American Trade Association, US firms’ investments in China are still increasing amid the decoupling occurring between the US and China. Although political relations are important, economic relations are still strengthening. While Chinese companies are increasing investments in the US, US companies are also continuing to invest heavily in China.

It seems increasingly difficult for foreign companies to survive in China, what advice can you give?

In order to achieve success in China, we must consider our responsibility to society. CKGSB emphasizes social innovation and the need for governments, businesses, NGOs, civil society, and international organizations to collectively address humanity’s common challenges of income inequality, immobility and sustainability. As times change, so do society’s issues. Therefore, corporate social responsibility must be redefined in today’s era.

With the US-China conflict, Korea is at a crossroads, what do you foresee in the future?

First, the US will try to return to its leadership role, as it is very important for the global economy and global governance. Second, China and the US must cooperate. A US-China conflict is a disaster for the world. Climate change, which threatens human survival, cannot be resolved without the cooperation of the US and China. The same goes for WTO reform and the COVID-19 pandemic. If the US and China did decouple, many countries around the world, including Korea, Japan, the European Union, and Australia, would face a difficult situation. In particular, China is highly likely to maintain its top spot in global economic growth contribution. If global companies do not capture this market, it will be difficult to survive. Can you do business only in the US and not in China? I don’t see this as an option.