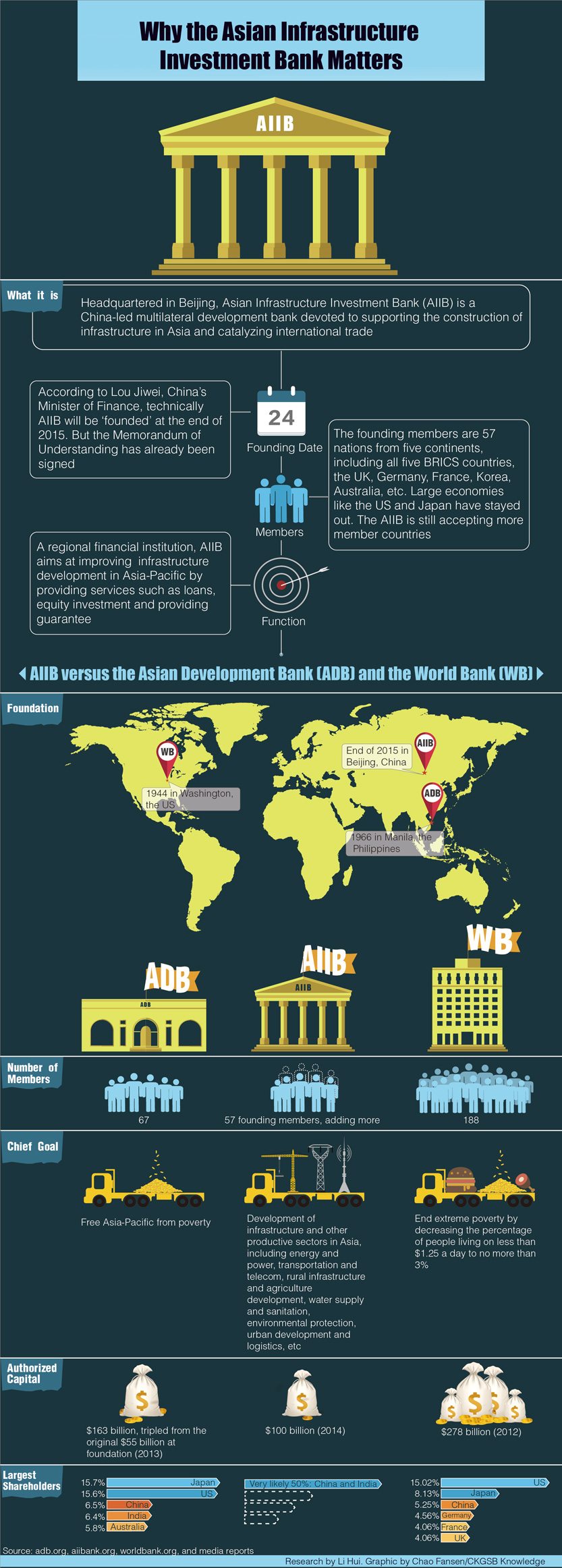

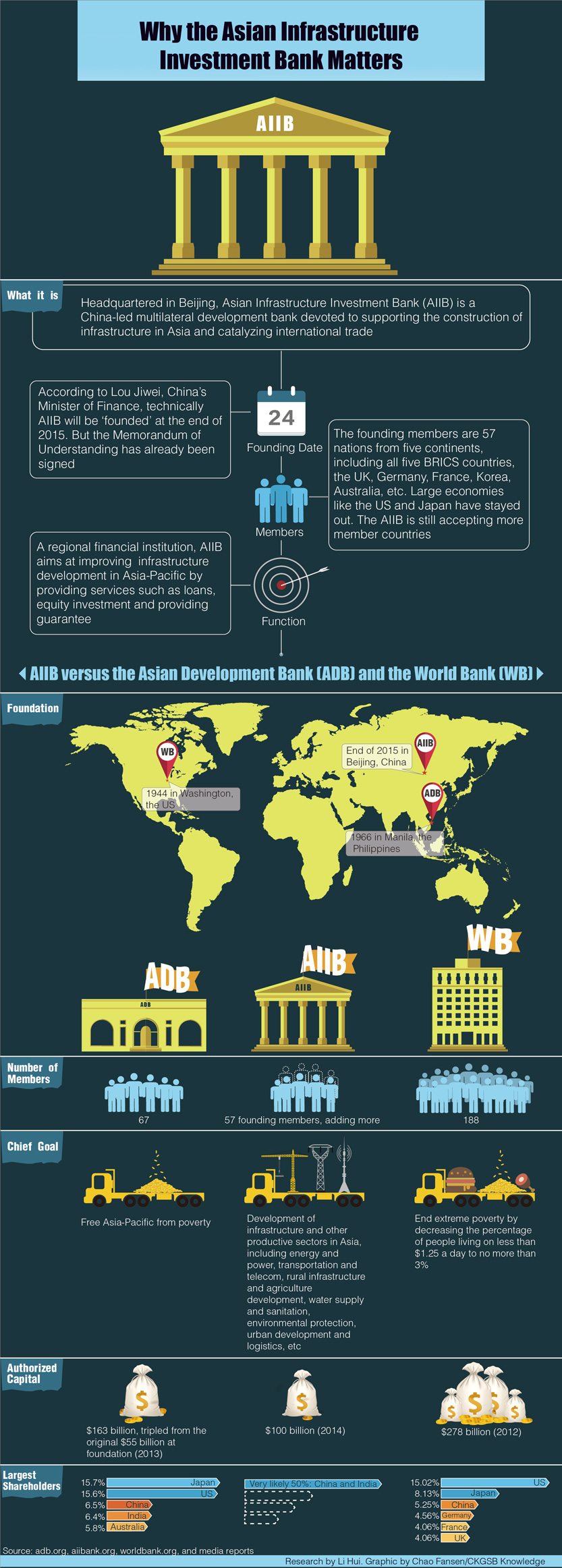

The Asian Infrastructure Investment Bank has ruffled many feathers even before its formal launch. We bring you the lowdown on what it is and how it compares with the World Bank and the Asian Development Bank.

The China-led Asian Infrastructure Investment Bank, or AIIB, has created a lot of buzz in the past few months although it hasn’t officially launched yet. Headquartered in Beijing, the bank, which is often depicted as a World Bank rival, will function as a multilateral development bank that aims to cement Asia’s infrastructure and international trade ties.

In March 2015, the UK became the first Western power that applied to join the AIIB. Later many other European economies such as Germany, France and Italy followed. Afraid that its international dominance would diminish, the US government started to put strong political pressure on its allies, such as Japan, South Korea and Australia, to prevent them from joining. But disappointingly for the US, only Japan chose not to join the AIIB.

On 15th April 2015, the AIIB officially unveiled the list of its founding members: 57 countries from five continents appeared on that list. This includes all five BRICS countries and 14 out of the G20 members. As a new regional multilateral development bank, the AIIB has an authorized capital of $100 billion and is welcoming more members onboard.

According to some experts, the concerns that the US has expressed are not justified. “The AIIB will, in a way, complement the Asian Development Bank and the World Bank because it will not be doing certain kinds of projects the others are doing, and they will not duplicate certain things that the other banks are doing,” says Yukon Huang, Senior Associate at the Carnegie Endowment. (To read our interview with Yukon Huang on the AIIB, please click here.)

So will the emergence of the AIIB reshape the world’s economic structure? What will the AIIB represent in the global sphere? This explainer will tell you what the AIIB is all about and how it compares with the World Bank and the Asian Development Bank.

(Click on the infographic below to enlarge)