China’s stock market regulator is finally cracking down on umbrella trusts in a bid to defuse a potentially dangerous situation.

Late last month, China’s stock market watchdog—China Securities Regulatory Commission (CSRC)—launched a crackdown on unauthorized margin lending, ordering brokers to halt off-the-books operations and investigate existing accounts that use a structure called the “umbrella trust”.

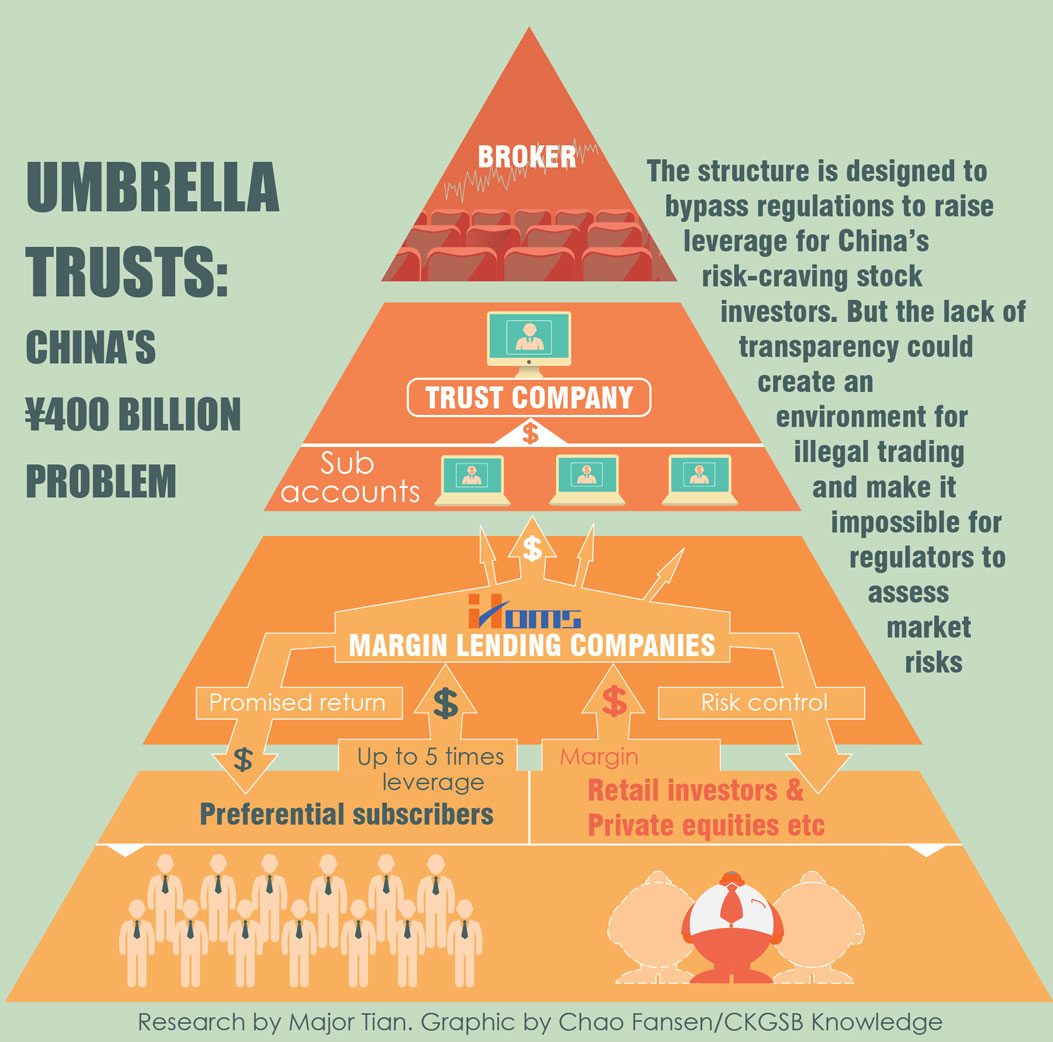

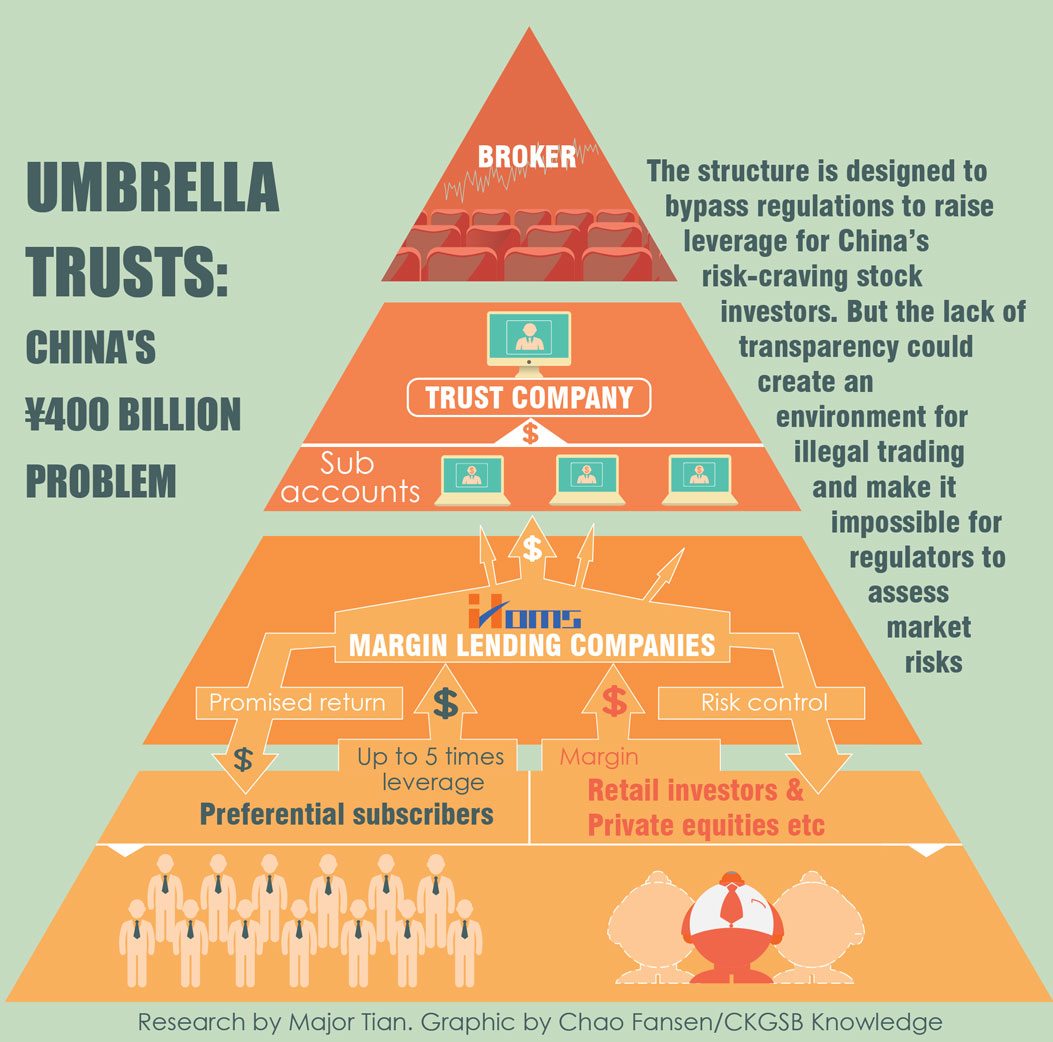

Technically speaking, an “umbrella trust” is a trust plan designed to provide high leverage for bold investors. Under current rules, the minimum margin rate at brokerage firms is 50%, which means that investors, once deemed qualified according to a set of criteria, can only borrow twice the amount of their margin; borrowers are also subject to a number of limitations on what stocks they can buy.

However, those risk managing protocols become useless when investors borrow money from other channels rather than the brokers. One popular way to raise significant money is to set up a trust plan and a securities account for that plan, under which investors can raise as much as five times their margin. To make fund-raising even more convenient, trust companies can open many sub-accounts under one single securities account, so more pairs of lenders and borrowers can share the same trust plan without having to register new securities accounts.

The structure of the trust plan resembles that of an umbrella, as numerous sub-accounts all trade through the same main account.

The most widely used IT platform to split and manage all the sub-accounts is called HOMS developed by Hundsun Technologies Inc, a Hangzhou-based financial software firm. The platform is open to all kinds of small financing institutions and will synchronize their clients’ account data with the systems of trust companies and brokerage firms. Therefore essentially, an investor can open up a securities account through the internet and trade with very high leverage without registering with China Securities Depository and Clearing Corporation (CSDC), the designated clearing house for Chinese securities.

The elephant in the room is, of course, the lack of transparency—regulators can’t trace the account activities back to each investor, potentially creating a hotbed for illegal practices such as ‘rat trading’ (or fund managers buying shares via their personal trading accounts just before large purchases of the same shares by their fund companies) and insider trading. It also makes it very difficult for regulators to assess and control the leverage level of the market, which is already at the highest in history.

There are no statistics on the size of umbrella trusts, but back-of-the-envelope calculations by some analysts estimate that the sector had grown to about RMB 400 billion.

While the number is tiny compared to the size of the Chinese stock market (less than 1%), it could be dangerous if it keeps growing in the shadows. In the ongoing clampdown, CSRC is asking brokerage firms to document and regulate all the existing sub-accounts and stop accepting new funds into their systems. But it remains unclear as to what would happen to the existing trust products or whether umbrella trusts will stage a comeback once CSRC loses its grip—because China’s A-share market is, at the end of the day, full of people who love risk.

To understand how umbrella trusts work, please look at the infographic below: