The world’s tourism industry has become addicted to big-spending Chinese travellers, but events seem to be conspiring to disrupt the trend, at least temporarily

Mandarin is the dominant language as the crowd murmurs and shuffles past the fair maiden, smartphones held aloft for a snapshot. But this is not a red-carpet event for China’s latest starlet, it is Paris’ Louvre Museum, specifically the Mona Lisa exhibit. At least that was a typical scene in the summer of 2019, and at top tourist attractions around the world. But when the museum reopened in July 2020 after France’s COVID-19 outbreak had peaked, there were three notable differences: mandatory face masks, designated visiting time slots to reduce crowding and a distinct lack of Chinese tourists.

As the pandemic took hold in the first half of 2020, people around the world were confined to their homes and the global travel industry ground to a halt. But while domestic tourism is recovering strongly as China emerges earlier than others from the virus, the lack of Chinese tourists visiting the rest of the world has had a huge impact on the countries and sectors that have come to rely upon them. Chinese people, like people all over the world, are spending less, waiting for an end of the virus or the arrival of a vaccine. But they are also wary of what they see as undisciplined health policies in many countries and discouraged by the fear of possible discrimination.

The rise of Chinese tourism

Chinese people are relatively new to the wonders of foreign travel. As the country’s middle class has grown in terms of affluence and size in the past two decades, so too has their taste for exotic experiences. From Bangkok to Belgium, Sydney to Stockholm, flocks of Chinese tourists have become an ever-present aspect. Chinese residents took 116 million overseas trips in 2019, marking an annual increase of 11%, and they stand miles clear at the top of the leader board for worldwide spending—$277 billion compared to second-place US at $144 billion.

Chinese people are relatively new to the wonders of foreign travel. As the country’s middle class has grown in terms of affluence and size in the past two decades, so too has their taste for exotic experiences. From Bangkok to Belgium, Sydney to Stockholm, flocks of Chinese tourists have become an ever-present aspect. Chinese residents took 116 million overseas trips in 2019, marking an annual increase of 11%, and they stand miles clear at the top of the leader board for worldwide spending—$277 billion compared to second-place US at $144 billion.

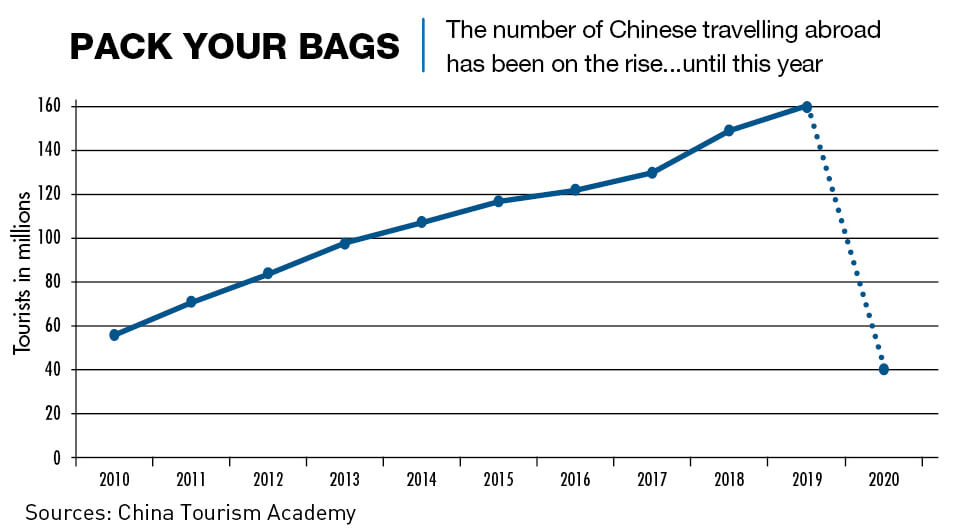

Up until the start of 2020, China’s thirst for outbound travel seemed impossible to quench. Records were broken at Chinese New Year in 2019 as outbound tourism numbers reached 6.3 million, up by more than 12% on the year before. According to the National Migration Administration, international trips were expected to reach 178.4 million a year by 2022, amounting to a total expenditure of RMB 1.2 trillion ($171 million).

Such a huge movement of people with money in their pockets—Chinese travelers typically spend twice as much abroad as they do when they vacation at home—has an obviously positive effect on the economies of the countries they favor. Chinese tourists have become the main revenue source for hotels, restaurants, and attractions all over the world, which bend to their wants and whims.

Cihan Cobanoglu, Professor of Hospitality Technology at the University of South Florida, says tourism-related industries have been drastically reconfigured over the past decade to accommodate Chinese visitors. Hotels have added dumplings and noodles to their breakfast buffets, attractions are allowing for payment via Chinese digital money QR codes and Chinese-speaking personnel are in high demand.

“The tour operators who serve the market always employ Chinese speaking tour guides,” says Cobanoglu. “In addition, shops and other businesses, especially high-end product stores, employ Chinese speaking staff.”

But according to a March report by the University of Thessaly in Greece, the pandemic could lead to 25 million fewer outbound trips by Chinese travelers in 2020, wiping out $73 billion in global tourist spending.

Feeling the loss

Thailand is the foreign country most favored by the Chinese, with the Southeast Asian nation welcoming 11 million last year, an increase of 4.4% on 2018 and amounting to more than 27% of all overseas tourism arrivals. The Tourism Authority of Thailand has predicted that the number of Chinese tourists will drop by 2 million this year, however, resulting in a 50 billion-baht ($1.6 billion) loss, around 0.3% of gross domestic product (GDP).

“Thailand has developed a considerable reliance on inbound tourism from China,” says Stuart McDonald, co-founder of Thailand-founded website Travelfish. “When Thailand turned off traffic from China [in March] it effectively wrote off almost a third of their inbound numbers,” he added. “This was catastrophic.”

Australia’s Gold Coast is another hard hit destination, with visitor numbers down by 90%, largely due to a reliance on tourists from China. Hotels have slashed rates by as much as half in a bid to attract domestic tourists, but those in more remote areas have been less able to pivot to the home crowd. Cairns on the far north-eastern Australian coast, for example, lost $200 million in bookings by February as the Chinese government urged citizens not to travel.

Ariela Kiradjian, co-founder, partner and COO the Boutique Lifestyle Leaders Association, an official organization for the world’s leading boutique hotel and travel brands, says Chinese tourists are now “undoubtedly a force” in her sector.

“Chinese tourism is vital to our industry and a drop would affect properties over the next few years,” she says, adding that her partners are striving to lure back Chinese travelers for future bookings. “We’re seeing boutique hotels adapt their strategies to accommodate and grow with this sector. For example, how accessible is your website? How active is your social media?”

Global travel website booking.com confirmed to CKGSB Knowledge that many of their partners have taken a hit. “China continues to be one of our most important markets and the lack of Chinese international travel did have an impact,” said a representative.

Better safe than sorry

People around the world are wary about travel. Indeed, according to a study by South Florida University, 63% of people across 28 countries say they will reduce their travel plans over the next 12 months, resulting in a predicted 50% contraction for the global travel industry. But with their country currently locked down against almost all foreign tourists, a mandatory 14-day quarantine on their return if they do vacation abroad and the possibility of encountering COVID-19 related xenophobia overseas, the Chinese have more reason to stay put than most.

People around the world are wary about travel. Indeed, according to a study by South Florida University, 63% of people across 28 countries say they will reduce their travel plans over the next 12 months, resulting in a predicted 50% contraction for the global travel industry. But with their country currently locked down against almost all foreign tourists, a mandatory 14-day quarantine on their return if they do vacation abroad and the possibility of encountering COVID-19 related xenophobia overseas, the Chinese have more reason to stay put than most.

Yang Huaping, a mother-of-two from Sichuan province, says she now only feels safe traveling to destinations within driving distance of her home. “I don’t want to go to airports or train stations as I have children,” says the 29-year-old. “China has more or less got the virus under control, but things can change quickly and I don’t want to risk it.”

Wendy Min, Director of International Affairs at Trip.com Group, the largest online travel agency in China, says that while many customers are eager to travel abroad again, few are willing to deal with the hassle. “They prefer to remain within China,” says Min. “Some have thought about making trips within Asia but only if they can cross with ease and don’t have to go through quarantine.”

Lydia Zhang, a 35-year-old freelance teacher from Hubei, traveled abroad regularly before the pandemic and is keen to get back out into the world. While she says some of her friends living abroad have reported discrimination, as China experiences its most severe economic downturn since the 1970s, money issues are what’s stopping her. “At the moment I am busy working,” she says. “My work really dried up at the start of the outbreak, so I am making the most of being busy now. Busy is good. I’m lucky.”

Bouncing back

If you think the Chinese travel a lot abroad, international travel figures are dwarfed by travel numbers at home. The national holidays usually bring about the biggest annual human migrations in the world, with train and plane tickets selling out months in advance. In 2019 alone, Chinese citizens took more than 6 trillion domestic trips, an increase of 9.5% from 2018. The domestic tourism industry accounts for 11% of the country’s GDP and employs more than 100 million people. In February, however, the China Tourism Academy predicted that domestic visits would decline by 15.5% and revenue by 20.6% in 2020.

Focusing on domestic air travel, the industry all but ground to a halt by mid-February as people across the country were told to stay home. Ticket sales slowly picked up in March and April as seat capacity was increased and the economy began to reopen, but it wasn’t until the Labor Day holiday in May that a significant bump was seen with rates hitting 50% of the same time last year. Encouragingly, the domestic travel industry has recovered even more rapidly away from air travel. Car rental, for example, rebounded to the same level as last year in May and some hotels were already seeing occupancy rates above 70%.

“Toward the end of April we saw early indications that domestic travel was starting to return in certain markets where shelter-in-place rules were relaxed, including Greater China,” says the booking.com representative.

As to inbound tourism into mainland China, it has also been growing in recent years, with the first three quarters of last year seeing 108 million visitors, up 4.7% on the same period in 2018. But foreign arrivals halted almost completely when the government closed its borders towards the end of March. Foreign tourists represent only 2.5% of the country’s total tourism-generated revenue, so it was a hit the government was seemingly willing to take.

Green shoots at home

Companies across the spectrum of the Chinese travel industry have been dealing with the virus fallout in different ways. Niccolo Hotel in Chengdu was expecting 100% occupancy at Chinese New Year, only to see business become “basically non-existent.” The hotel, however, managed to keep all staff employed and busy with training, deep cleaning and preventative maintenance, and even resisted engaging in a price war with other five-star hotels, offering guests value-added extras instead. The group has employed several new safety protocols, such as the regular changing of air con filters and extra cleaning of rooms, all of which are advertised front-and-center on its website. Thanks to a guest profile that was already 90% domestic, occupancy increased to 60% by April and hit 100% in July as locals enjoyed “staycations” and visitors from neighboring cities and provinces resumed short-haul trips.

Companies across the spectrum of the Chinese travel industry have been dealing with the virus fallout in different ways. Niccolo Hotel in Chengdu was expecting 100% occupancy at Chinese New Year, only to see business become “basically non-existent.” The hotel, however, managed to keep all staff employed and busy with training, deep cleaning and preventative maintenance, and even resisted engaging in a price war with other five-star hotels, offering guests value-added extras instead. The group has employed several new safety protocols, such as the regular changing of air con filters and extra cleaning of rooms, all of which are advertised front-and-center on its website. Thanks to a guest profile that was already 90% domestic, occupancy increased to 60% by April and hit 100% in July as locals enjoyed “staycations” and visitors from neighboring cities and provinces resumed short-haul trips.

“I feel local travelers are confident to start China-wide travel again,” says General Manager Michael Ganster. “At the moment, in Chengdu it feels like nothing happened.”

By the summer, top resorts and hotels were reporting nearly capacity business, largely because Chinese people decided to stay at home this year.

Things have not been so plain sailing for the Bespoke Travel Company, which typically targets inbound foreign tourists. Founder Sarah Keenlyside scrambled to cut costs immediately, downsizing the company’s shared office space, laying off some staff and putting those remaining on minimum wage. The team has, however, since repositioned itself toward a new segment of business—expats currently stuck in China and unable to travel abroad. They are offering city-based scavenger hunts, an online speaker series and off-the-beaten-track domestic itineraries.

“We just don’t want the company to close so we’re using our creativeness to our advantage,” says Keenlyside. “But it takes an awful lot of effort for very little return.”

Meanwhile, Trip.com Group is betting big that its more than 400 million worldwide users will return to international travel soon. After providing refunds to 10 million customers at the peak of the outbreak, they are now offering flexible reservations with discounts of up to 60% in more than 180 countries. Focusing first on the Asia-Pacific region where domestic travel is showing signs of recovery, they have also launched in-destination livestreams with further exclusive discounts, achieving $70 million in sales by July.

Looking to the future

According to research by Cobanoglu and his team, travelers’ priorities have changed. Where online reviews, security and price were previously the most important factors in travel decisions, a destination’s COVID-19 situation, cleanliness and health service now come out top. This could be good news for the domestic rebound, as while the research found the country’s image had deteriorated severely in the eyes of international travelers at the start of the outbreak, it’s likely to bounce back quickly thanks to its strict virus prevention measures.

In terms of Chinese people traveling abroad, booking.com predicts that global tourism may take years, and not quarters, to rebound to previous levels, but that ultimately Chinese people will want to return to international travel.

“Even though COVID-19 has restricted our ability to travel around the globe, as we move beyond this pandemic we know that people will again want to experience the world, perhaps in a more meaningful way than ever before,” says the company representative.

“For the next several years, I believe that domestic tourism will be the main driver for tourism activities until travelers gain back their travel confidence,” says Cobanoglu. “Chinese tourists are no exception, but I do believe that as soon as the current situation relaxes and traveling goes back to somewhat normal, they will start going abroad again.”