Founded in 2008, SHEIN has quickly become the go-to source of cheap, custom-designed clothing for women in the 18 to 35-year-old age bracket. Its meteoric rise to prominence has seen it compete with big brands like ZARA and H&M that have dominated the space over the past two decades. Although it is a Chinese company, SHEIN ships to over 220 countries but operates mostly in the US and Europe, and is now the most popular shopping app in Apple’s US iOS App Store, having overtaken Amazon’s app.

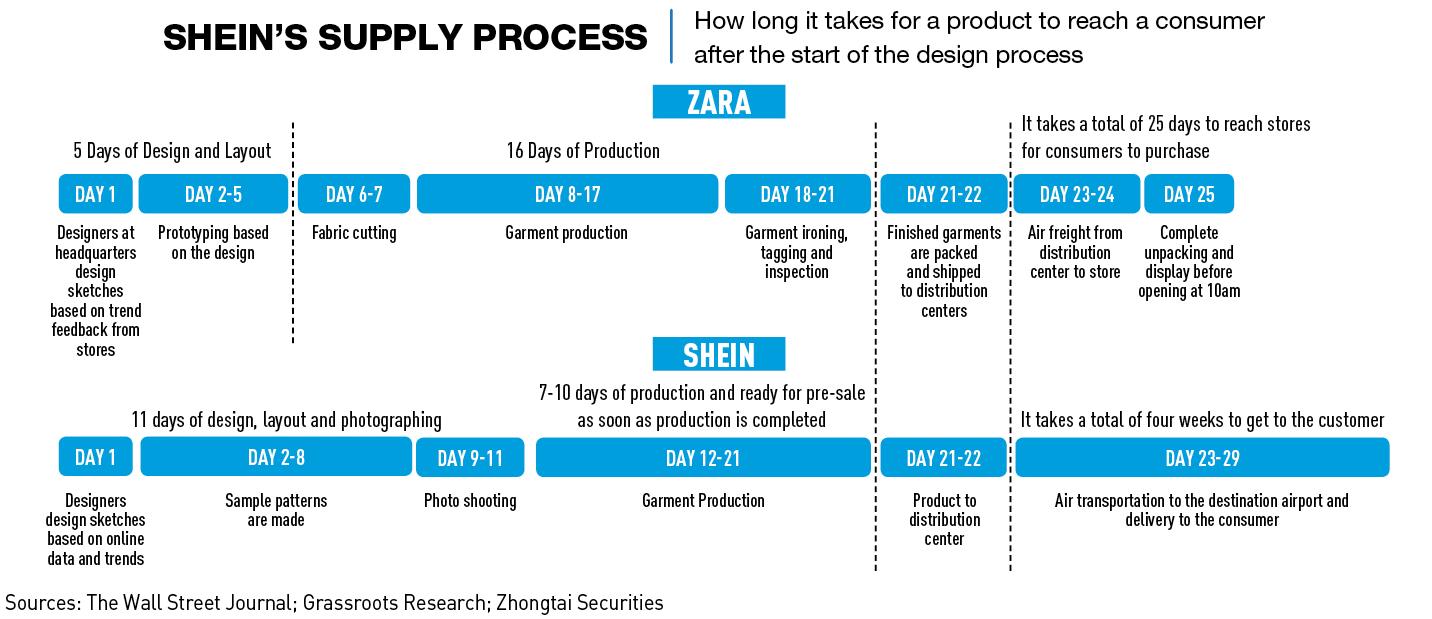

SHEIN has a unique business model that allows consumers to receive newly-designed goods in times unmatched by fashion incumbents such as Zara and H&M. Trend-based designs are sent out to its vast network of small Chinese manufacturers in an Uber-like bidding system and then shipped across the world within a 25 day timeframe, and all at a more-than-competitive price. From where things stand today, SHEIN looks to be the future of fast fashion.

The company generated approximately RMB 70 billion ($10.8 billion) in revenue during 2020, up from RMB 3.98 billion ($617 million) in 2016. This case study presents a comprehensive picture of SHEIN’s influence and marketing characteristics as well as digital supply chain operations based upon the collation of information from various sources.

Marketing strategies

As SHEIN is not a listed company, information on its operations and business model are not publicly accessible and one needs to extrapolate backward using externalized performance information.

The company was launched at a time when online marketing did not require a product label to correspond to a key opinion consumer (KOC)—customers that are experts in testing and reviewing products—and there was no cost for influencer marketing. Capitalizing on the KOC and influencer channels through the use of digital technology, SHEIN generated high levels of traffic from global social media at a low cost, which helped to support a large user-generated content (UGC) marketing effort.

In the early days of SHEIN, prior to Instagram becoming mainstream, Facebook was the dominant social media outlet around the world. But Facebook then and now was more about people sharing information on their everyday lives, with fewer content creators sharing purely fashion and outfit-based content. SHEIN saw the opportunity to promote its products in collaboration with online celebrities, taking advantage of low traffic costs and successfully creating effective low-cost campaigns.

Moreover, the company encourages customers to share its products via “buyers’ stories,” utilizing the users themselves to share information on its products and guide the direction of product development. Early on, the company attached great importance to “user sharing,” inviting customers to upload photos of products on its Facebook photo wall, in exchange for coupons and discounts. It became a vehicle for sharing content and fashion and at the same time, it was able to tap into new fashion elements and develop new products based on the styles uploaded by consumers.

Further, SHEIN stressed women’s dresses as a way to reduce the effort required to launch new products, due to the ease of utilizing different prints on the same pattern. The company has maintained a very high rate of launching new dress options, close to 3,000 a week, since its establishment.

With its in-house approach to marketing, SHEIN can consistently guarantee new and interesting promotional pictures in their online stores. They had no shortage of competitors in the early days, but while most of these chose to upload images of their products for sale on fashion e-commerce websites, such as 1688.com, directly from overseas, SHEIN insisted on using in-house models and photographers; these better-looking and higher quality images allowed SHEIN to generate higher click-through and conversion rates.

Overseas consumers were also receptive to SHEIN’s comparatively quick delivery times. Although initial turnaround times were not at the same level as today, due to the immature global e-commerce infrastructure in place at that time, consumers generally accepted a 10-20 day wait for receipt of goods, giving SHEIN long enough to complete orders.

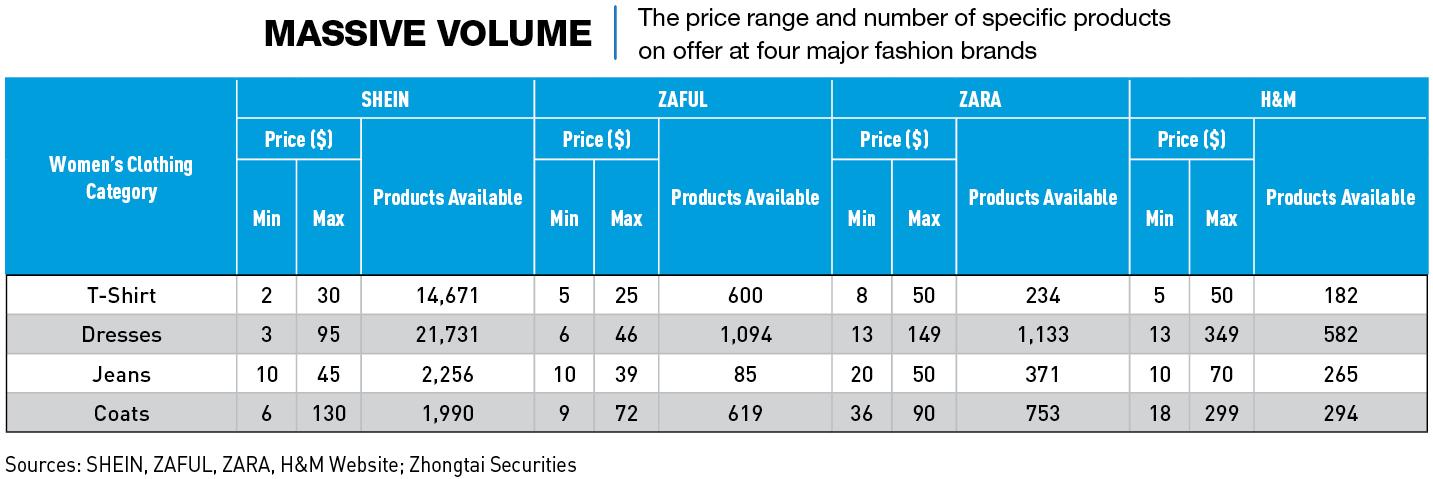

Compared to other top fast fashion platforms, SHEIN has a clear competitive advantage in terms of price and number of new product arrivals. For the US market, women’s products, SHEIN’s mainstay, are priced at a minimum of $9, with the best-selling items in each category priced between $9-24. This is equivalent to the lowest price points at ZARA ($8-36) and H&M ($5-18). In terms of the number of available styles and designs, SHEIN is head-and-shoulders above both global fast fashion headliners and its online competitors, with tens of thousands of items on sale to meet the needs of a vast range of consumers.

A unique supply chain

Having collated available data on SHEIN’s supply chain structure, we found that the digital organization of the supply chain is one of the company’s core strengths. For this study, we split SHEIN’s supply chain into four distinct sections: materials, design, production and warehouse logistics.

SHEIN is not involved in the manufacturing of the base materials used in its products, which is highly standardized and involves high costs of research and development. Instead, the company prefers to focus on cooperation with manufacturers and has built its own exclusive online B2B supplier platform, taoliaowang.com, to meet its supply chain needs.

The motivation behind the consumption of fast fashion is similar to that in the cultural and creative sectors. For example, if the content of a book is exciting enough, it seems unnecessary to be overly concerned about the quality of the paper. In the same way, if a piece of clothing is visually desirable enough, the buyer will likely be less concerned about where a piece of clothing comes from and how it was made.

In a sector where teams of designers are often difficult to manage, making it harder to standardize and achieve economies of scale and rapid response, SHEIN has created an effective system of control for the design process. SHEIN’s intelligence-gathering system makes full use of Google Trends and web crawler tools to keep up with emerging trends and new product launches from competitors. SHEIN’s design assistance system is an online Software as a Service (SaaS) system that allows designers to develop products online within a framework that has been defined by the company, which may include fabrics, accessories, and pre-made patterns. SHEIN’s design process follows a similar logic to an industrial assembly line, thus significantly reducing the skill demands on designers.

Production is mostly handled by small workshops across China, adding flexibility to the supply chain. But on the flipside this also presents many obstacles that prevent it from scaling. Firstly, small workshops are unstable and can close down at any time, affecting the stability of the supply chain itself. Secondly, the management costs of scaling up small workshops are high and management itself can serve to increase overheads. Thirdly, there are still fixed per-order transaction costs between small workshops and brands‡business, purchasing, underwriting, order-following, etc. The more frequent the transactions, the more losses are incurred. SHEIN has made its billing period the shortest in the industry, and the company also supports its small workshops, even funding them to buy equipment and open new production facilities in order to address the instability of small workshops.

This is not only an issue of funding, but also one of changing the values and ethics that have always been part of the industry. In order to solve the problem of management efficiency, SHEIN has curated a group of local suppliers which are now highly dependent on SHEIN and, therefore, easier to manage. In addition, geographical proximity and the maturity of its IT infrastructure, which determines the efficiency and transparency of information transfer, have enabled SHEIN to effectively locate itself between its many affiliated small workshops. This in turn has boosted its management efficiency.

Another of SHEIN’s software systems, Manufacturing Execution System (MES), has been developed as a tool for their partner garment workshops. With it, they can directly help the production department export management processes, rules and concepts directly to the garment factories. In addition, employees who are responsible for following up on orders at SHEIN also tutor suppliers in the use of the operating platform and encourage them to be deeply involved in the operational management of the company.

In order to solve the problem of revenue per order not covering transaction costs, the calculated geographical positioning of SHEIN’s offices reduces the cost of sending samples, following up orders, quality control, and a range of other costs that depend on physical factors. On the other hand, for parts that do not rely on physical entities, SHEIN goes directly online. For example, traditionally, the decision of which supplier will produce which order is made by the buyer, which can be inefficient. SHEIN’s alternative is to ‘Uberize’ the process of allocating orders through a bidding system. After an order is placed, the platform will automatically suggest it to the best suited workshops and suppliers can accept the orders online. The whole process is decided by algorithms, thereby reducing transaction costs to almost zero.

SHEIN has re-invented the idea of the traditional small workshops that were born and bred in China. It takes full advantage of the inherent flexibility of small workshops and addresses their shortcomings by utilizing information technology instead. At the same time, the advantages of the highly-dispersed production approach are utilized to the fullest and the extremely low tolerance rate for faulty work has, in effect, created a new model for flexible supply chains of fashion goods.

In terms of warehouse logistics, overseas warehouses generally have two uses. One is as a return facility and the other is for stock preparation. The return rate in apparel, especially the fast fashion industry, can be as high as 20-25%. The returned goods can be sold again after disinfection, pressing, a packaging change and some other preparation. SHEIN’s overseas warehouses are mainly used as return warehouses and stock is generally available for delivery in 7-14 days through the Universal Postal Union (UPU) agreement.

In the US, shipping on orders of $49 or more is free and users can return items for free within 30 days. The generous return terms increase consumers’ willingness to buy multiple pieces at once, increasing the customer unit price. SHEIN’s average unit price is currently close to $100 and even exceeds $150 in regions such as the Middle East.

Logistics costs are generally kept at around 20% of the product price, and with high unit prices, SHEIN’s logistics options are more varied, giving greater flexibility to the entire supply chain. Due to customs duties and the UPU “terminal fee” SHEIN’s delivery costs are well below 20% of the product price, allowing it to achieve an affordable price positioning.

The overseas warehouses allow SHEIN to accept and redistribute returns, the relaxed return conditions increase SHEIN’s unit price, which in turn allows SHEIN to further reduce logistics costs. These various points of interest are interlocked, creating a positive and progressive framework.

FMCG industry models

For the fast-moving consumer goods (FMCG) industry, the media believes that the business logic followed by the average brand is to anticipate the needs of the consumer and find the intersection of where companies develop their products according to their predictions of the market. The typical brand makes money where these intersect and loses money where they do not. The logic of SHEIN and ZARA, on the other hand, is not to look for intersections but to cover all trends.

If you visualize the fast fashion industry’s model as a triangle, rapid and massive numbers of new arrivals at a low cost form the first corner, while a high price-performance ratio, and high turnover and low inventory form the second and third corners, respectively. With high investment and low gross margins, if a company wants to make profit, it must be highly efficient and have a low inventory backlog.

In China, many brands have been built on the first two corners of the model because it has been proven, time and again, that newer and more interesting styles, plus a high level of cost effectiveness are very attractive to consumers. Such brands easily take off, but because they do not address the “third corner,” they quickly find themselves grappling with inventory issues. The real success of SHEIN lies in the organization of their supply chain, a process which it has developed over many years. Having found a way to create the “third corner” SHEIN has gained the ability to make a profit whilst maintaining incredible levels of adaptability.

SHEIN has created and demonstrated some unique business features and appears likely to continue to define fast fashion in the years ahead, increasingly encroaching on the market share of established brands.