Buffeted by economic forces, does China’s economy still have the wherewithal to face strong winds or is structural reform needed?

Concealed behind a still impressive official growth rate, China’s economy is in danger of stalling. Doubts are multiplying over whether outward appearances tell the whole story. Slow growth around the world, little progress fostering domestic demand, and a change in the direction of China’s capital flow are beginning to invite questions over China’s long-term prospects. Add to this increasing skepticism about the official statistics, continuing disappointment over the results of the 2008/9 stimulus program and an overcapacity problem that raises the prospect of protectionism around the world, and China’s reform path looks in need of a rethink.

Perhaps the most important change between China’s robust response to the financial crisis in 2008 and the present uncertainty is that the problems China now faces are not seen as merely cyclical, but structural, and stimulus is not the obvious answer. Different analysts have different explanations, but most agree that China is at a turning point, where easy catch-up growth is exhausted, and difficult choices are multiplying.

Whether China’s leaders take the hard decisions over structural reform, or continue to stimulate their way along the path of least resistance, building up bigger problems in the future, remains uncertain. According to Andrew Collier, Managing Director of Orient Capital Research in Hong Kong, “China has to make an adjustment at a time when the stimulus package has created a worse bubble than normal.”

Structural Reform Challenges

Structural shifts come in many forms: demographic, technological or simply in terms of resource constraints. For example, a recent reportage film published online by the Financial Times placed great emphasis on what is known as the ‘Lewis Turning Point’, where the growth benefits of rural-to-urban migration dry up and wage costs start to escalate. Some economists believe China reached this point around 2010. But there is no consensus about this, and others identify different structural challenges.

Salvatore Babones, Associate Professor of Sociology and China specialist at University of Sydney, offers an alternative structural critique: “China has reached what I call the ‘fiscal crisis of the state’. At low income levels, government revenues tend to grow in line with GDP growth and government expenses don’t.” He goes on to explain that “so far, no developing country has voluntarily increased revenues in line with expenses…. They all end up hitting a fiscal wall, [and] China is hitting that brick wall now.”

While these are two of many possible explanations for what is often referred to as the ‘middle income trap’ where an economy’s growth is restrained by the exhaustion of its particular competitive advantage—in China’s case, labor—it nevertheless neatly reflects wider concerns about China’s ballooning deficit and the solvency of its state-run banks.

Similarly, Arthur Kroeber, Head of Research at Gavekal Dragonomics, describes in his recently-published book China’s Economy: What Everyone Needs to Know, how China must now move from a model where growth comes from ‘resource mobilization’ to one where growth accompanies the maximization of ‘resource efficiency’, which is an altogether more difficult proposition.

But none of this is unexpected. All economic textbooks acknowledge different phases of growth in developing and transitioning economies, even if they differ in their precise explanations. So it has long been understood that China would arrive at this juncture, and amazingly some people even managed to get the date right. Collier makes this point plainly: “China has come to the end of the period of easy gains in GDP.” He adds for emphasis: “People were predicting in 2004 that the movement of labor to more productive uses with capital… meant that [high growth] cannot be sustained past 2016. At that point the growth rate would be 6-8% maximum… [which was] absolutely right.”

Simply put, China faces a choice that would be recognized by the humblest Buddhist pilgrim when faced with two paths ahead: the hard road—of structural reform and painful consolidation—and the easy road—of fiscal and monetary stimulus, leading inevitably to further problems along the way.

What’s in the Toolbox?

Li Keqiang, China’s Premier, has made few speeches so far this year. But when he spoke at a press conference on March 16th, he said two interesting things while discussing China’s declining growth rate. First, he said of China that “we still have tools in the toolbox” while prefacing this with the assertion that “in the past couple of years we did not resort to massive stimulus measures for economic growth.”

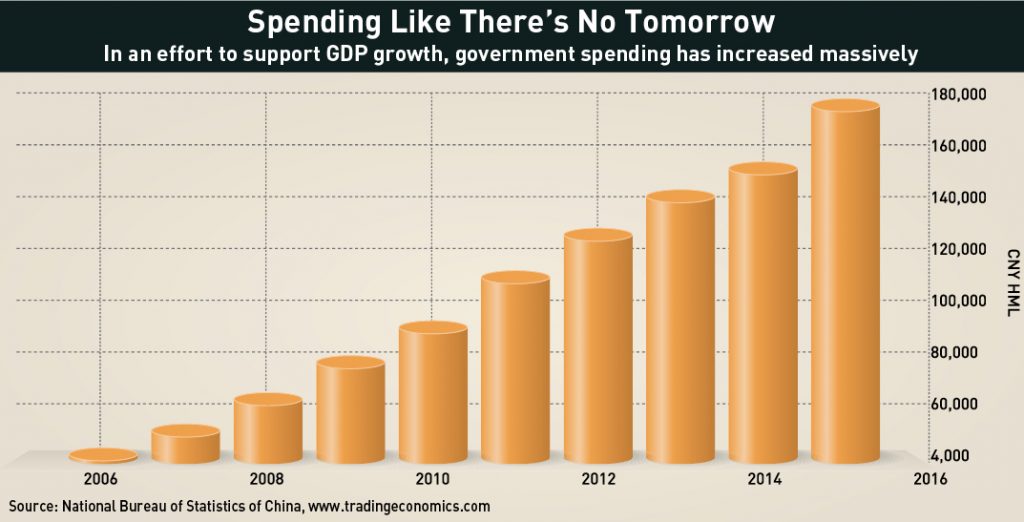

A quick glance at the China headlines for the last year, however, suggests that such assertions should be treated with caution. Early 2015 saw talk of $1.1 trillion in accelerated infrastructure investment, and in September a further $188 billion was earmarked as the fiscal component of what was called ‘growth stabilization’ efforts by the China International Capital Corp (CICC)—a leading Chinese investment firm.

This partly reveals a definitional quandary concerning what counts as ‘stimulus’ in China, with an economy with such a high degree of state direction. This is particularly the case as capital investment is a key component of China’s Five Year Planning (FYP) cycle and not something that simply happens spontaneously, to be augmented by occasional government adjustments as might be the case in a Western economy.

As Collier says, “There is a widespread misbelief that China has been withdrawing stimulus and is [now] ready to inject more money into the economy, and that’s not true.” He goes on “there has been quite a bit of stimulus since the RMB 4 trillion in 2009, through the banking system.”

When it comes to structural reform, Collier says that those that “they have announced are quite significant.” This may be necessary and long-heralded, but it has yet to really arrive. Indeed, “reforms at the margin are going to be difficult because you’ve got a lot of political battles between provincial governors and the state council,” and when growth begins to slow, what appetite does China really have to shut down factories?

Old Tricks

One widespread concern is that when it comes to sustaining growth, China keeps doing more of the same thing.

“What started as stimulus spending in 2008 was a Keynesian response to a crisis, which was entirely appropriate,” says Salvatore Babones. “[But] what we’re talking about now is not a temporary economic downturn, we’re talking about a structural deficit.” And for all Li Keqiang’s disavowals of fiscal stimulus “the current FYP assumes that it’s going to go on forever,” which is “clearly not sustainable.”

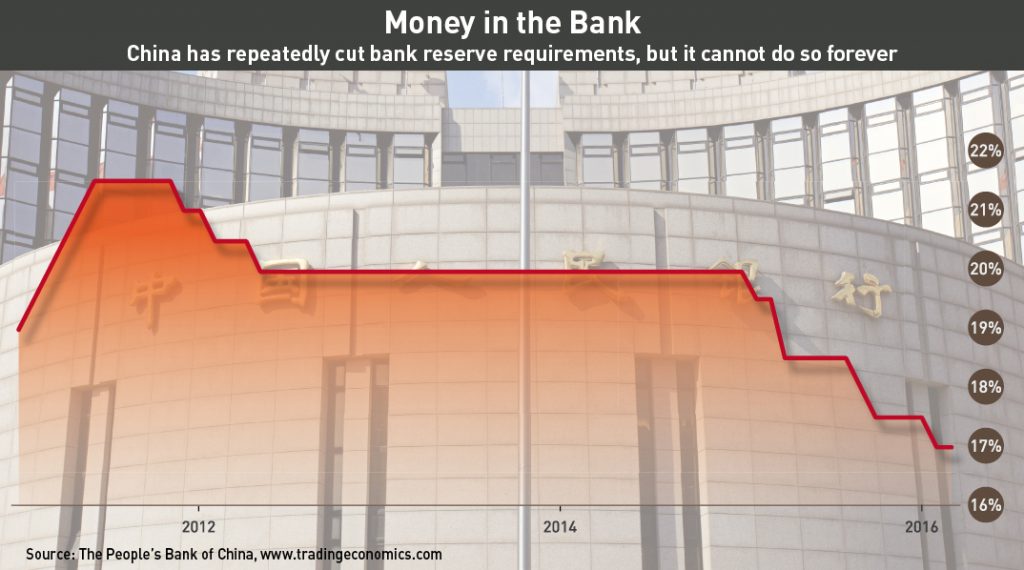

Equally, on the monetary stimulus front, the habit of adjusting interest rates and the ‘reserve rate requirement’—the so-called ‘Triple-R’—is generating diminishing returns. “There is a lot of evidence now that credit is less effective. We’ve certainly seen that in the declining GDP but the figures for return on equity (ROE) [are also] declining,” says Collier.

Collier goes on to say “it’s not clear how much more they can do. The main area that people are expecting is cuts in the ‘Triple R’… now that’s a huge pool of money, but that’s basically their last big basket of money.”

Song Gao, Managing Partner at PRC Macro Advisors in Beijing, cautions against viewing changes in the ‘Triple R’ as monetary stimulus at all. “Triple R cuts at this point are not a stimulus tool,” he says. “It is more about liquidity withdrawal from China’s domestic market due to capital outflows.” Meaning that the Triple R works like an emergency stabilizer during periods of capital withdrawal.

“There’s a real concern about balancing the need to stimulate the economy and just throwing the money overseas,” says Collier, adding that Chinese policymakers are “stuck between a rock and a hard place.”

All of which neatly clarifies the policy trade-offs at stake. “The biggest limit… from the monetary policy side is the exchange rate. If there is more easing by the PBOC, that should lead to more depreciative pressure on the RMB,” says Song, and “at this point the PBOC’s policy priority is to stabilize the exchange rate.”

New Tricks?

With fiscal stimulus pinched by rising deficits and corporate debts, and monetary stimulus undermined by diminishing returns and downward pressure on the exchange rate, what’s left?

Setting aside Keynesian stimulus, China’s growth has been driven for decades by massive infrastructure investment, and this shows no sign of slowing under the latest FYP. Babones, however, remains optimistic about the detail. “The 13th FYP has absolutely the right priorities for China… [which] has to build the infrastructure for its tomorrow economy.” He picks out details for specific praise: “Expanding high speed rail by 50%, building 50 new civilian airports, building expressways, building mass transits, connecting rural villages.”

“I strongly endorse the 13th FYP,” he adds. “I think China has the most ambitious and positive social policy agenda of any developing country and maybe of any country in the world.” The only drawback being “if they can fund it.”

Capital expenditure is coming under greater scrutiny. Enthusiasm for overseas investments on the “One Belt One Road” initiative, for example, has cooled, resulting in “the pace of lending overseas… [being] substantially slower than people previously thought, including policy makers,” says Song. And when even Zhou Xiaochuan, Governor of the PBOC, publicly warns about rising corporate indebtedness, then something surely has to give.

On the domestic level, however, “the central government still considers infrastructure investment as a major policy tool to prevent the economy from a hard-landing scenario,” says Song.

Andrew Collier raises the prospect of stalled SOE reforms in this capital-constrained context, adding that, “there’s going to be de-facto restructuring of industry in China because of a shortage of capital, and a lot of this is going to happen at a local level.” Indeed, he also believes that the recent announcement of up to six million redundancies across the state sector was really a form of signaling, or “the center telling the provinces ‘well, we’re willing to take the pain, so we think you should be too.’”

The difficulties of SOE reforms are hard to overstate. For Song, “SOEs are central to the power structure of the Communist Party, so any missteps or radical reforms of the SOEs will have a lot of political consequences,” adding that “naturally… they will… be cautious.”

Finally, it should be noted that none of these are really ‘new tricks’, so much as long-awaited structural adjustments aimed at limiting China’s enormous overcapacity problems and generating growth through greater efficiency.

Failure of Expectations

When faced with all the constraints and difficult choices China has to make, it is tempting to ask whether the most difficult adjustment does not involve policy. Having moved from a period of high growth, where superlatives bred overconfidence, to a period of slower growth which obliges recognition of limits, could growth targets themselves be part of the problem?

The official growth target for 2016 to 2020 is now set at between 6.5% and 7% and the number for 2015 came in slightly below expectations at 6.9%. But there is tremendous skepticism concerning both of these numbers. On the one hand, the target implies that the government will always step in to make up any shortfall, regardless of its impact on aggregate leverage, and on the other hand, the reported figure for last year is not widely believed, not least because the Ministry of Finance does not reveal its methodology.

On the first issue, Collier says, “there is a lot of evidence that rising debt levels can lead to crises. Everyone tries to argue that China is immune to that, but there’s really no reason why China should be,” thus implying that it may be counterproductive to prioritize a growth target over long-term progress towards efficiency gains.

Babones believes that “the growth rate in the taxable portion of the economy is zero. All the growth is coming from the government spending and you can’t tax government spending.” That is a problem which exacerbates the growing government deficits, and reinforces the negative impact of excessive leverage.

Song considers that one answer to this problem is simply to “tolerate slower growth and more credit defaults in the near term, which… will pay off in the long run.” In advocating this he acknowledges that the more important objective would be long-term economic growth rather than the short-term fix of hitting a target. But ultimately, “because of the constraint of growth, the government has to pay more attention to short-term stimulus.”

Babones, on the other hand, believes that the gains from efficiency are still a long way off, and the answer is to keep infrastructure investment high but to raise taxes to cover the deficit. “The only place where I seriously disagree with the 13th FYP is that they plan to cut taxes.” He adds that “funding [infrastructure expenditure] will require somebody to start paying something. And that somebody is China’s wealthy and profitable corporations.”

In contrast, Song outlines a continuing role for fiscal measures. “According to international norms, the sovereign debt over GDP ratio can be raised to 50% of GDP, so there is room for another RMB 10 trillion fiscal borrowing by the central government.” He adds that “China is shifting leverage from private corporations to central government and household leverage,” and that therefore “this stimulus can last a little bit longer and will probably impose less financial risk to the over-leveraged, over-burdened banking sector.”

But Collier has a more pessimistic view, suggesting that much of the recent funds made available for infrastructure investment have ended up servicing existing property development debt. He also doubts “that money is going to create a very significant source of new demand, particularly as there is already a huge property bubble in the tier-3 and 4 cities.”

“I’m not optimistic,” he adds.

All Hat – No Rabbit

As might be expected, discussing China’s next steps provokes many different responses. Both Collier and Song believe China needs to accept a period of lower growth, but the political atmosphere makes such an adjustment complicated. In any event, the transition from ‘resource mobilization’ to ‘resource efficiency’ will be difficult. Aside from fiscal and monetary measures, which have become almost knee-jerk responses despite growing doubts over their effectiveness, and supply-side reform now deferred in search of short-term growth, other measures are conceivable.

For example, the Lewis Turning Point, if it is not already upon China, might be deferred or ameliorated by advancing China’s proposed rural reforms and extending the gains from rural to urban labor mobility. An ambition that would complement SOE reforms towards the “[privatization of] all of these provincial state-owned firms… because… provincial governments are running out of revenue from land sales,” according to Babones. But this involves a complicated, multi-year reform agenda.

Equally, improving transparency, as recently called for by Ben Bernanke, Former Chairman of the Federal Reserve, should improve the reliability of the published statistics, which would in turn increase confidence in investment in China, provided the more-true numbers are not too far from market expectations.

But again, it may all come down to attitude. “The government keeps thinking it can use these [policy tricks] to jump start economic growth and that’s really not the way to do it,” says Collier. “You’ve got to restructure the banks so capital is allocated according to returns. For a lot of very complicated reasons, there is a huge reluctance to do that.”

Then Babones hints at the wider difficulties of improving efficiencies. “We all talk about China becoming more efficient, but nobody has any concrete advice about how to become more efficient.” On the other hand, “they do know how to make a road, and that’s at least at start.”

Lastly, Song Gao reasserts that “what the Chinese government is doing is not innovative… China is just late to the game.”

For all the current anxiety over falling long-term growth rate expectations, China has not yet run out of options. But it has still to convincingly demonstrate the ability and/or willingness to carry out necessary reforms. This coincides with the long-anticipated structural shift away from easier ‘resource mobilization’ growth to ‘resource efficiency’ growth, which makes for pretty bad timing.

What is clear is that China’s path ahead is no longer an easy one, and will involve painful reforms more than clever tricks. As Andrew Collier says, China faces a “tsunami of negative events,” leaving them “in a difficult place.”

For Buddhist pilgrims, the choice is forever a simple one: ‘If there are two ways before you, always choose the harder way.’