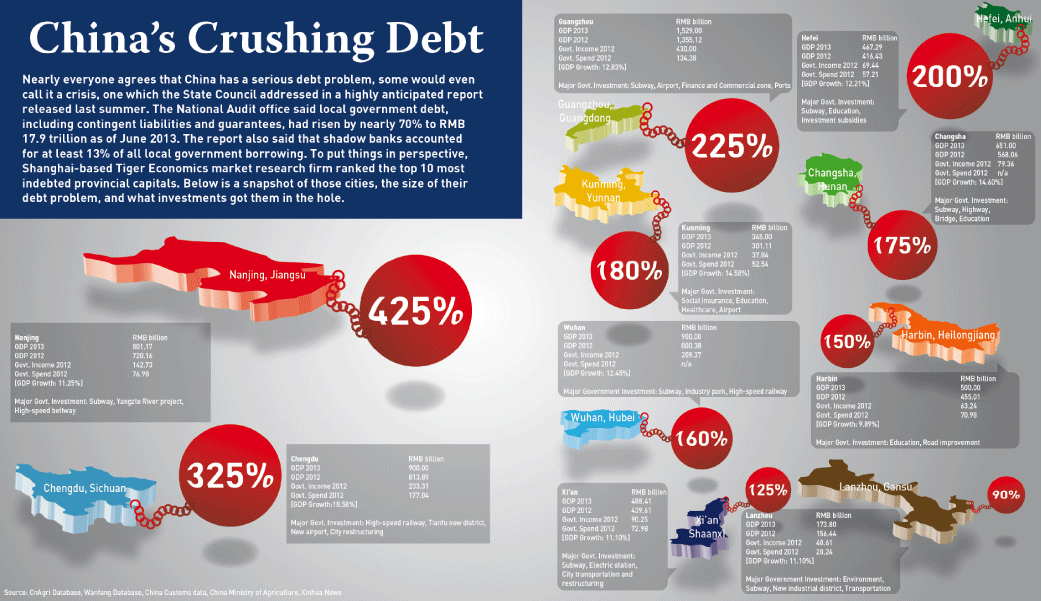

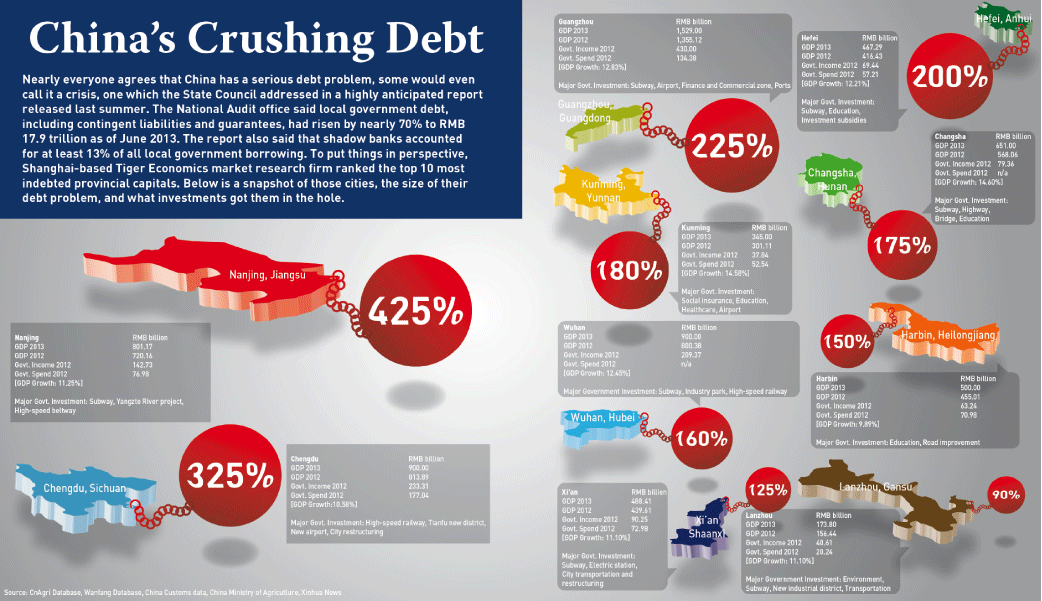

Local government debt in China is spinning out of control. A look at the most indebted cities in China and the size of their debts.

Nearly everyone agrees that China has a serious local debt problem, some would even call it a crisis, one which the State Council addressed in a highly anticipated report released last summer. The National Audit office said local government debt, including contingent liabilities and guarantees, had risen by nearly 70% to RMB 17.9 trillion as of June 2013. The report also said that shadow banks accounted for at least 13% of all local government borrowing. To put things in perspective, Shanghai-based Tiger economics market research firm ranked the top 10 most indebted provincial capitals. Above is a snapshot of those cities, the size of their debt problem, and what investments got them in the hole.