Pinduoduo’s unique business model allowed it to carve out a top spot in the ultra-competitive e-commerce landscape.

Pinduoduo’s unique business model allowed it to carve out a top spot in the ultra-competitive e-commerce landscape.

Shanghai businessman Ni Tao loves rice wine, and in recent months, he’s been buying his favorite brand from Pinduoduo, an ultra-cheap bargain app. A relatively new player in China’s dog-eat-dog e-commerce world, Pinduoduo has enjoyed dizzying growth due to a unique business model and is now challenging the reigning kings, the Alibaba platforms Taobao and Tmall.

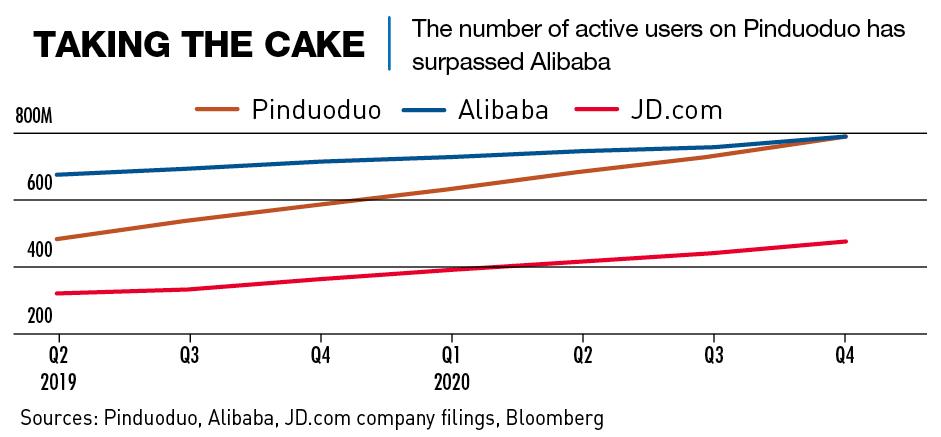

“The same products on Pinduoduo can be bought at a fraction of [the price on] Taobao. With coupons, I can get the rice wine I like at half the price,” says Ni. The online purchasing and payment experience, and the delivery times are effectively identical to Taobao. The result is that with its cheap prices, Pinduoduo has stormed in and done the seemingly impossible—carved out a new space in the hugely competitive e-commerce sector that international heavyweights such as Amazon and eBay had given up on. Today Pinduoduo has more active users than the Alibaba platforms.

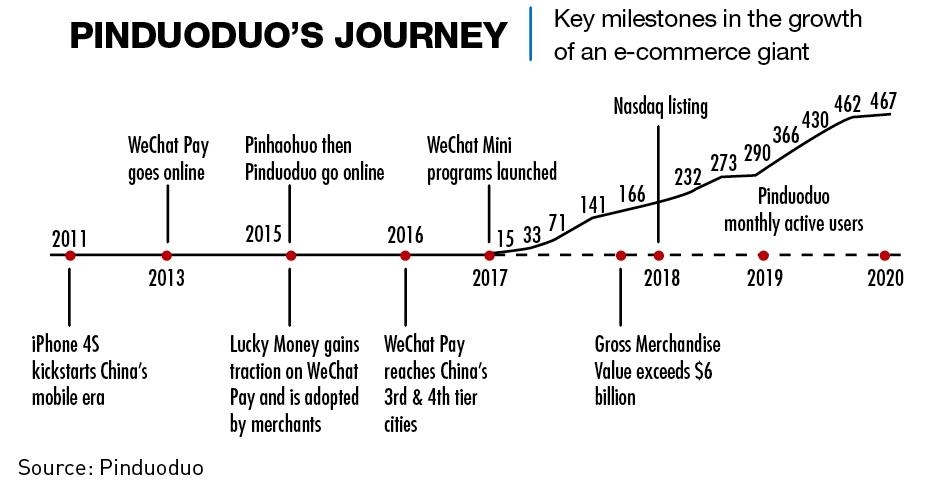

Founded in 2015 by young entrepreneur Colin Huang using a concept like that of the group-buying marketplace Groupon, Pinduoduo started with an app which allowed consumers to buy vegetables and other farm products collectively and hence at a lower price. The company now offers just about everything, including clothing, cosmetics, electronics and household goods on the same basis.

A unique model

The sudden emergence of Pinduoduo, the characters for which (拼多多) translate as “piecing many things together,” is based on a simple principle—the same product for much less money. “I’m ditching Taobao because everything available there can be found on Pinduoduo and for less,” says Ni.

“The key reason for Pinduoduo’s success is that it has firmly occupied the ‘lowest price’ position among major e-commerce platforms,” says Bing Jing, Associate Professor of Marketing at CKGSB. “For products of similar quality, Pinduoduo is perceived to have a lower price than Taobao and JD.com.”

In 2019, Alibaba still dominated e-commerce with a 55.9% share, with JD.com number two at 16.7% and Pinduoduo a distant third at 7.3%. Since then, Pinduoduo has dramatically outperformed Alibaba in terms of growth of both revenue and user numbers. Its 2020 fourth quarter results released in March 2021 showed Pinduoduo topping Alibaba’s number of buyers for the first time, 788 million to 779 million. Total revenues for the company in the quarter were also up 146% compared to 37% for Alibaba.

Interestingly, Pinduoduo founder Colin Huang, a former Google engineer, chose that celebratory moment to retire as chairperson, having already stepped down from the CEO post in mid-2020. But in a statement he sent to shareholders, he indicated he was planning to continue focusing on the next steps for Pinduoduo.

“Although Pinduoduo is still a young company with a long runway for growth, it is about the right time to explore what’s next if we want the same quality and pace of growth in 10 years,” Huang wrote. “As the founder of this company, I am probably the most suitable person to take on this task by stepping out of the business and the comfort zone to embark on a journey of exploration.”

Alibaba’s main rival, Tencent, has a 16.5% stake in Pinduoduo, and a key game-changing move for Pinduoduo was integration with Tencent’s WeChat, a messaging platform as well as super-app. Overnight, it gave Pinduoduo access to a massive user base. Pinduoduo’s ability to operate in the WeChat environment has been a major factor in its success: it makes full use of WeChat’s linkage capabilities, aggregating buying requests from consumers in WeChat groups.

“While it might not seem like much, the ability to complete transactions in WeChat was important for new or unsophisticated e-commerce users to form online shopping habits,” says Michael Norris, Strategy and Research Manager at AgencyChina, a market intelligence firm.

Also, by focusing on mobile internet only, Pinduoduo managed to avoid many of the legacy issues from the PC era. “The internet has changed,” says a Pinduoduo staffer who asked not to be named. “With the creation of WeChat, the way people communicate and interact is fundamentally different now.” Such changes to user behavior further translate into other activities, such as how they shop.

“Alibaba, Amazon and JD.com were founded on the PC-based internet,” CKGSB’s Jing adds. “But Pinduoduo was born on the mobile internet and has been the leading model of social e-commerce.”

From the start, Pinduoduo has pitched itself simply as the bargain platform for the masses, and around 58% of Pinduoduo’s users come from tier-3 regions or below. “Success has been driven by targeting customers who are more price sensitive and less brand conscious in lower-tier cities,” says Barron Zhang, a strategist at digital design and communications agency Akqa, which builds innovative business models for clients.

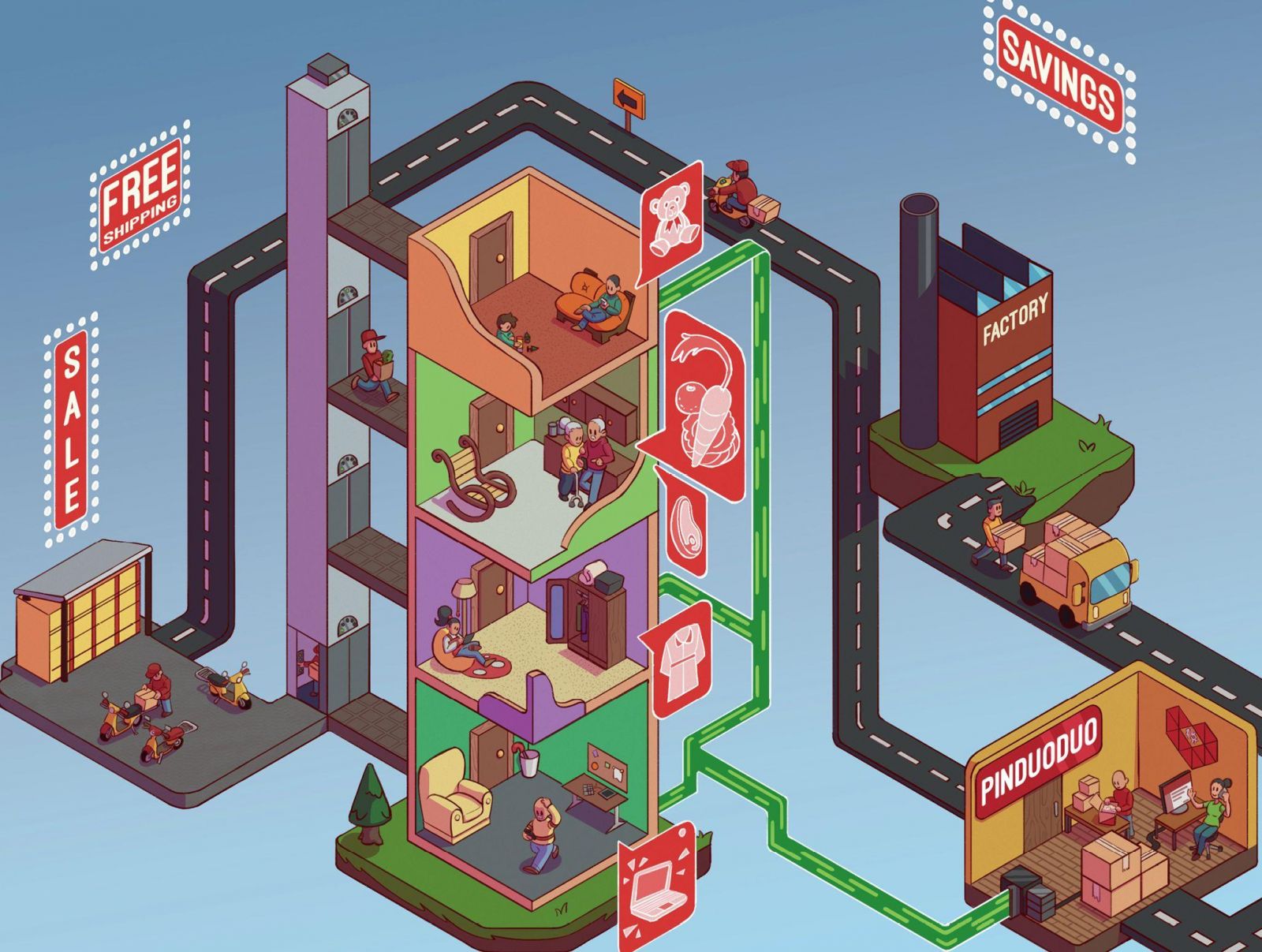

Another factor in the app’s success has been its radical shrinkage of supply chains, putting producers in direct contact with groups of consumers. “Pinduoduo disrupts the supply chain by aggregating the demand and supply side to remove the middlemen, which drives a virtuous circle of cost savings leading to lower prices, more demand and economies of scale,” Zhang says.

A fundamental difference between e-commerce platforms like Taobao and Pinduoduo is that the former is intent-based—that is, the user searches for items that they want and then buys them. But consumers in the new style of e-commerce increasingly combine shopping with interactive sharing, chatting and discovery. Pinduoduo monitors the actions of consumers on its platform, and leverages AI to suggest new products. Many users share product details and comments in their social media circles, generating more demand.

Social elements, such as games, encourage users to spend more time on the app. There are also live streams featuring products mostly from amateur presenters, and shoppers are encouraged to interact and ask questions. Lucky money envelopes (“red packets”) are also widely used.

Bargain-basement prices

However, the main attraction of Pinduoduo is simply lower prices. Each product is offered with two prices, one for immediate purchase as a standalone item, and a cheaper second one for a group purchase. Users can bring a group together themselves or wait for a group to form. “Baked into the business model is the reliance on users to recruit friends and family to drive prices lower and lower, resulting in the business having a natural exponential spread,” says Akqa’s Zhang.

The groups tend to come together extremely fast, and customers usually go for the cheaper group price. “As for the shopping experience, I don’t feel there is much of a difference,” says Ni. “It’s just that bulk buying brings prices down and passes on savings to customers.”

Customer Amy Yu agrees: “I share with my friends all the time because I know if I like it, most people will like it too.”

But Pinduoduo, the online equivalent of a super-cheap discount store, is not something everyone feels comfortable using. “I only share my purchase on Pinduoduo with my family and a few close friends via WeChat,” says 50-something user David Chen. “I think that most of my friends will look down on me when they know my favorite app is Pinduoduo, [simply] because Pinduoduo is synonymous with cheap goods.”

Delivering the goods

The biggest outstanding problem for Pinduoduo, which charges sellers much lower fees than other platforms, is that it is still making losses, despite its fast growth and the fact that its shares trade on NASDAQ at a market value of around $144.4 billion. The company announced an operating loss of RMB 9.4 billion ($1.44 billion) in the fourth quarter of 2020, bigger than its operating loss of RMB 8.5 billion in the same quarter of 2019.

Furthermore, it has few income sources. “One hundred percent of Pinduoduo’s revenue comes from ‘online marketplace services’ including commissions and advertising revenue,” says Barron Zhang. “Compared with Alibaba and JD.com, which diversify their revenue streams via cloud computing products amongst others, Pinduoduo’s current revenue stream is relatively limited.”

Another enduring problem is the size of orders. In 2017, Goldman Sachs calculated that Pinduoduo’s average order value was RMB 33 ($5) compared with RMB 120 on Taobao and RMB 600 on JD.com. This is related to the types of products consumers are buying on the different platforms.

“Each individual is likely to have a ‘go to’ e-commerce app for a good chunk of their shopping needs, supplemented by another app for certain product categories or need states,” says Norris. Consumer feedback reinforces this idea. “I buy computers, mobile phones and books from JD.com,” says online shopper David Zhang in Shanghai. “I buy most well-known brand goods from Tmall, small cheap things from Taobao and food for everyday cooking from Pinduoduo.”

Pinduoduo’s public image took a hit in January with the deaths, within a space of days, of two employees from overwork highlighting a problem with the company’s “996” work culture, endemic to many Chinese tech companies. The number refers to employees working from 9 a.m. to 9 p.m. six days a week to compete in the cut-throat online retail world. Pinduoduo was apologetic in a statement following the deaths and said that they were introducing psychological counseling for employees.

Customers tend to be pragmatic, however. “I do not like the way Pinduoduo treats its employees, but that doesn’t affect my interest in looking for bargains,” says Ni.

Keeping shoppers happy

With the number of active buyers on Pinduoduo now exceeding Taobao’s, some say the days of breakneck expansion are over. Akqa’s Zhang disagrees, citing WeChat’s 1.2 billion user base to indicate that there’s still room for Pinduoduo to grow. But he thinks the company’s profitability needs to be addressed. “Pinduoduo should think about pivoting their business model. They could, for example, look into using the data they’ve gathered, and the network they’ve garnered, to unlock new revenue streams for sustainable business growth.”

Competition in the bargain online space is certainly going to grow and rivals are creating group buying platforms targeting the same type of consumers who flocked to Pinduoduo—Taobao’s Tejiaban, launched in March 2018, is just one example.

One of the ways Pinduoduo plans to compete is by going back to its farm-product roots. “We realize that people are going online more to get groceries than during the pre-pandemic times, so we are going to invest more in logistics and agricultural tech,” says the Pinduoduo employee.

Going global

Pinduoduo’s success is based on a number of elements coming together at the right time in the right market, but that doesn’t mean it is impossible for the company to maintain its winning streak.

“While grafting group-buying onto e-commerce may be hit-and-miss in some markets, the rapid success of bargain-basement online retailers like Wish and SHEIN overseas, there’s ample opportunity for discounted non-branded items sold online,” says Norris.

With China still the “factory of the world,” Pinduoduo has been able to take advantage of its proximity to the world’s highest-volume manufacturers, thereby offering base product pricing and minimal logistics costs.

But while Pinduoduo may have limited ability to move up the value chain to handle more sales of higher-priced branded goods, its model is well supported by demographics and average incomes. “We anticipate Pinduoduo will continue to eat into Taobao’s share of e-commerce gross merchandise value (GMV),” says Norris.

In 2018, around 40% of China internet users were estimated to earn less than RMB 2,000 per month, providing a ready market for the Pinduoduo model, and the company has a first-mover advantage in the bargain e-commerce niche amongst under-served customers. That may well be Pinduoduo’s winning card.

“In 2020, Pinduoduo again achieved rapid growth in terms of both GMV and annual active users, although it was still not profitable,” says CKGSB’s Bing. “At least for the next three to five years, I expect Pinduoduo to continue to grow at a much faster rate than Taobao and JD.com.”

For Pinduoduo, clearly there’s strength in numbers.