International investors in China’s private equity are finding it increasingly difficult to get their money out

The China market can no longer offer the vast returns that used to offset the risks of investing in the country

In late 2021, one of the world’s 10 largest private equity firms invested $156 million in a relatively unknown Chinese cosmetics startup called moody, which specializes in colored contact lenses that change the look of a user’s eyes. It was a huge but outlying investment by private equity (PE) into the China market, which overall is facing significant headwinds.

Twenty years ago, international PE also used to dominate the China market, but the moody deal is increasingly an exception in a market now dominated by state-backed equity firms, not least because international PE firms are facing difficulties in getting the money out once a deal is done.

One of the fundamental parts of the PE play in China over the last two decades has been taking companies public on US stock exchanges to provide an exit for investors. But this route may no longer be an option for many, thanks to the decoupling of the financial markets in China and the US. There are always exceptions, however, and moody’s business model and very fast growth rate—its sales value jumped from RMB 200 million in 2020 to RMB 800 million in 2021—proved too tempting to pass up for US investment firm KKR & Co.

In the past two decades, international PE investors have been an active part in China’s so-called “consumption upgrade,” as the country’s booming economy helped it become one of the world’s most profitable PE markets, valued at $1.3 trillion.

“Foreign private equity is now in a difficult position in China,” says Shen Meng, director at Chanson & Co, a boutique investment bank in Beijing. “On the one hand, Beijing needs international private equity players to showcase its openness to the outside world, but on the other hand, the government does not want foreign private equity firms to really become predators that harvest high-quality local projects.”

Home or away?

Private equity funds are pools of capital used to invest in non-listed companies, usually aimed at companies with the potential for fast growth and a high rate of return. PE funds tend to have a fixed investment horizon, typically ranging from four to seven years, at which point the firm hopes to profitably exit the investment. The exit for investors is usually an IPO or the sale of the business to another private equity firm or strategic buyer.

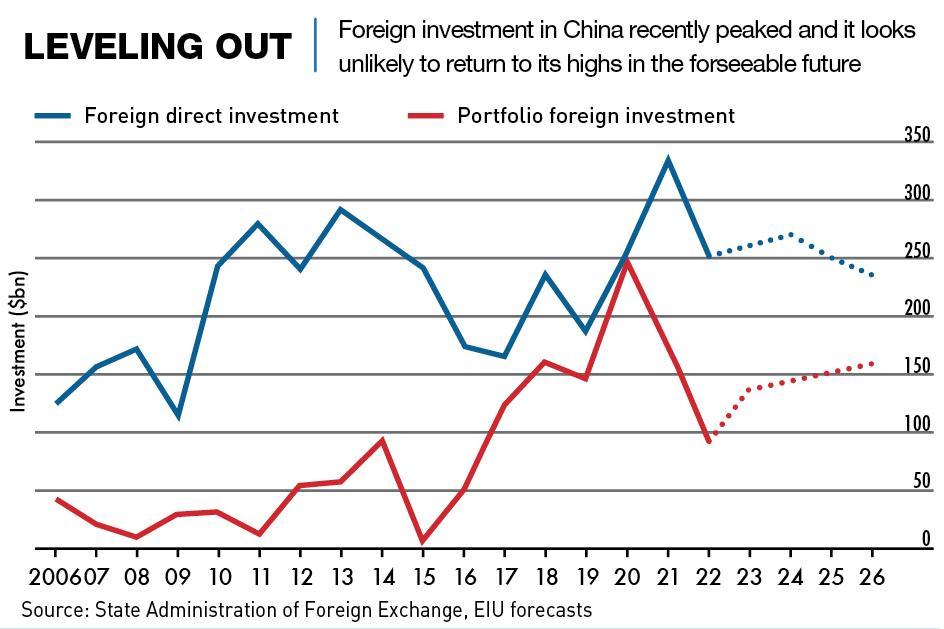

Deployment of PE funds in the China market surpassed $100 billion for the first time in 2017 and today, according to McKinsey estimates, China is the third-largest private equity market in the world, behind the US and the UK. According to China Bridge Group, an information service provider in China’s PE investment market, more than 60% of funds raised in China’s PE market are now from state-owned capital, a jump from 40% in 2018 and a massive leap from less than 4% in 2007.

“The private equity industry in China has expanded significantly in the past decade thanks to underlying economic growth in the country,” says Ivo Naumann, Partner at McKinsey & Company based in Shanghai. “It has also seen increased complexity and size of typical PE transactions and an increasing share of buyouts.”

Investing in private equity in China differs depending on whether the PE fund is an offshore fund or an onshore fund. Offshore holding companies, also known as “red chip” companies, hold assets indirectly or directly in China through a Special Purpose Vehicle (SPV), which acquires or invests in the stocks of the target company’s offshore holding company. Generally, the offshore holding company is intended to be a listing vehicle in an overseas IPO in the future.

On the other hand, onshore PE funds invest in domestic, PRC corporate entities through an offshore SPV. The private equity company thus becomes a shareholder in the onshore corporate entity.

International investments in PE funds have grown significantly in value since China joined the WTO in 2001 when it opened up the finance sector to global investors.

Upon entering the Chinese market, foreign PE investors played a non-negligible role in China’s economic growth. “The most straightforward advantage they have brought was the inflow of capital,” says Liu Lei, Partner at Shanghai-based StratePower Consulting Group. “Back then China used to be poor and something of a blank canvas, and foreign investors’ money definitely helped the growth and development of many industries in China, especially in high-tech industries that are highly reliant on investments.”

According to David San Roman, Founder of ANKEN Group, a Shanghai-based real estate developer, the small- and mid-sized investors proved to be those most interested in China in the past. “Because they’re the ones that were willing to take risks,” he adds.

And this brought about another benefit to the developing Chinese PE sector, which is that international firms imported expertise from operations in already established markets. “International private equity players can apply their decades of experience in Europe and the US to the Chinese market,” says Franklin Fu, head of M&A advisory at consultancy Roland Berger. “They can make proactive strategic adjustments and accelerate the transformation of the invested companies.”

First movers

To begin with, the private equity industry as a whole somewhat flew under the radar for many years without much intervention from Beijing. “From the government standpoint, it is a new thing,” according to San Roman. “They do put a lot of attention on the financial industry as they want JP Morgan and the bigger guys to come in here from the investment and the banking point of view, but private equity is still fairly unknown terrain.”

In the past decade or so, officials from China’s Central Bank have clearly stated its mission to promote local PE funds and the State Council has also repeatedly pointed out that PE funds were the “weak links” in China’s capital market. To facilitate this change, regulators and lawmakers in Beijing have introduced several laws in order to support the development of domestic RMB-dominated private equity funds.

And it has worked. “In the past few years, the previously wide gap between global firms and local private equity players has been drastically decreasing,” says Liu Lei.

Boyu Capital, Legend Capital, CITIC PE, Hony Capital and a number of other Chinese PE players have stood out among the domestic and international competition, each with billions of RMB under management and successful exits from the likes of Alibaba, JD Logistics and Suning.

The success of domestic businesses is not likely to be limited to China. “Inevitably, over time some of these newly emerging local PE players will also be players on a global scale,” says Naumann.

But this has also led to a significant drop in the proportion of international money in the China PE market. According to the Asset Management Association of China, the country’s self-regulatory association of fund management companies, by 2020, international PE investment accounted for only 3.6% of the private equity market in China—a massive drop from 96% in 2007. There were a total of 302 foreign-controlled or equity-involved institutions in the PE, venture capital, and private securities investment fund management market in China at the beginning of 2020, with a total of $69.5 billion under management.

“Now with more domestic capital in China flowing to the local PEs, combined with the prosperity of the A-share IPO market, international PEs are more and more limited by their foreign funding source,” says Shen Meng.

Money block

In the past, many global PE players entered the Chinese market through investment vehicles such as Hong Kong intermediary companies, which are eligible to take 100% interest or a majority stake in a Mainland China-based subsidiary. These offshore holding companies were intended to be the listing vehicle for a future overseas IPO. However, with the recent regulatory crackdowns on Chinese tech companies, issues arising with overseas listings for Chinese companies, and travel restrictions due to the COVID-19 pandemic, foreign private equity firms have found themselves facing new challenges.

“Many global private equity people based in Hong Kong, and elsewhere in the world, have been for the most part unable to make it to the mainland,” says Roman. “For example, from a real estate standpoint, it has been very difficult for private equity investors to come in [to the mainland] and see on-site what kind of asset they’re going to be investing in.”

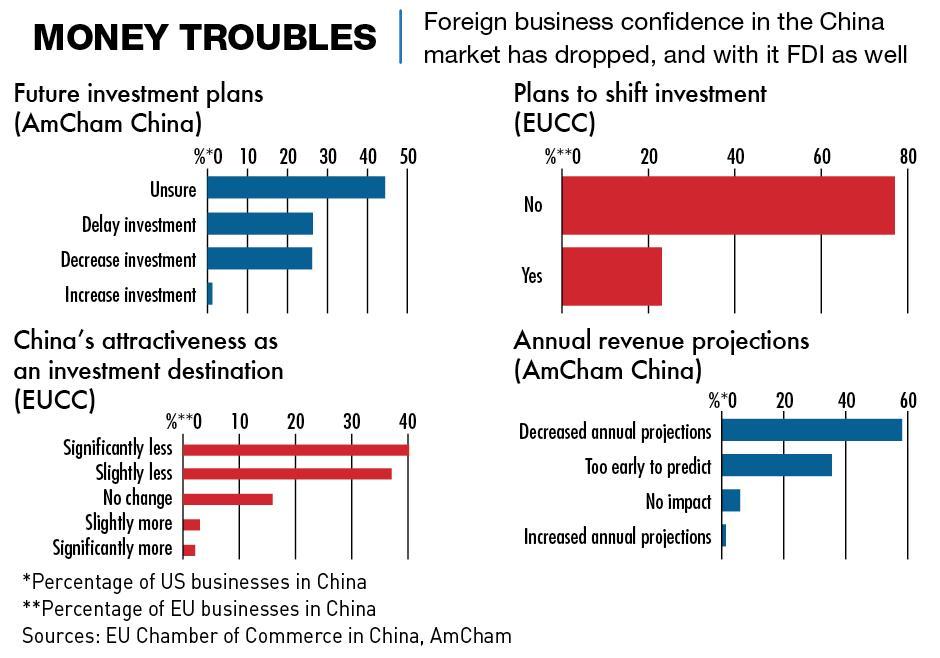

Beyond pandemic-related travel restrictions, for many investors with millions of dollars invested in the Chinese market, the volatile regulatory environment and recent government crackdowns in China’s highly profitable property sector, technology and online education industries have left many foreign investors wondering if they would still be able to successfully execute their investment exit strategy if current policies or regulations change. Global investors betting on the country’s tech companies from fintech, ride-hailing apps, e-commerce delivery apps and the wider tech industry have incurred hundreds of billions of dollars in losses since 2021.

“Top foreign PE investors that have done well in China have actually made the majority of their investments in consumer goods and the tech industry, which have been a free and open market for foreign investors,” says Liu of StratePower. “Now everyone knows that there are basically no more investment opportunities in these two industries thanks to regulatory crackdowns, they would have to start looking for something new.”

With Beijing’s tightening foreign exchange controls and restrictions on foreign investment in sensitive areas, analysts point out that the scope left for foreign PE investment is now heavily restricted.

“In particular, China’s loose monetary policy and the transfer of medium and long-term funds from social financing scale to short-term funds will significantly increase the inflow of local PE funds,” says Shen Meng of Chanson & Co. “These potential PE fund bubbles are not conducive to professional global PE investors.”

Last December, the Chinese securities regulator proposed its plan to tighten restrictions for Chinese companies that want to list overseas. While Beijing did not say it wishes to ban domestic companies from trading abroad altogether, this could still lead to increasing difficulties for non-Chinese private equity investors to exit their investment by listing the companies on US stock markets.

Listings of China-based companies on US exchanges are becoming increasingly precarious because the US Securities and Exchange Commission (SEC) has mandated that Chinese companies must disclose whether they are owned or controlled by a government entity, and provide evidence of their auditing inspections.

Under the rule, more than 200 companies, including Weibo, Alibaba and Baidu, face being delisted unless they comply by the start of 2023. A deal has been reached between the two sides, but it is still not clear how it will play out once the auditng process is underway.

For foreign investors, the option of a listing on the Hong Kong Stock Exchange is still available, but the bourse is less active and has a lower value estimation benchmark, which makes it a less attractive option. This means that if US listings are no longer possible, a successful investment exit for a PE firm will be even harder to achieve.

The road ahead

Despite potential regulatory risks and increasing competition from local players, many global PE funds are continuing to increase their asset allocation to the Asian and Chinese markets. In March, European buyout giant EQT AB struck a $7.5 billion deal to acquire private equity firm Baring Private Equity Asia (BPEA), strengthening its presence and engagement in China and other Asian countries. Only five days after the BPEA acquisition, EQT Private Equity Asia announced that it has taken a majority investment in Guardian, China’s largest domestic pest control operator.

Similarly, Kewsong Lee, CEO of private equity giant Carlyle Group said in an interview with Nikkei Asia last May that the group sees “massive opportunities” in the Chinese market despite trade frictions and geopolitical tensions. According to Carlyle, opportunities are being created in China because of the digitization of its economy, the demographics of its population, the use of mobile, its fintech payment systems and its ability as a country to potentially leapfrog in certain areas like climate and health care.

“In a large economy with a population of 1.5 billion, there have been ongoing mega trends attracting investors’ interests,” says Franklin Fu. “Electric vehicles, healthcare, consumer and e-commerce have been the center of attention for both local and international investors in the past decade.”

But however attractive these options may be, the difficulty and cost of a successful exit are greater than ever before. “For investment project exits in an overseas market, foreign PE firms are now restricted by regulatory policies, and for project exits in the local market, they are subject to China’s foreign exchange control policies limits,” says Shen of Chanson & Co. “Either way, the cost of exits for foreign private equity players is getting higher.”