China’s healthcare sector is dogged by several challenges. Can tech companies and digital healthcare ease out the situation?

In late January, a video clip shot at Beijing’s Guang’anmen Hospital went viral on Chinese social media. In the video, a girl accused scalpers of charging RMB 4,500 to get her an appointment with a specialist, 15 times the actual fee for consulting that doctor. The girl had come to Beijing all the way from northern China just to meet a reputed doctor face-to-face. But getting a consultation was impossible. She was furious at how hospital scalpers, guards and counter staff were all bullying hapless patients into coughing up large sums of money.

The video sullied Guang’anmen Hospital’s name to the degree that the National Health and Family Planning Commission of China was forced to take action. The Commission tracked down the scalpers and arrested seven. The hospital, on its part, gave the girl an appointment.

What happened at Guang’anmen is, unfortunately, the reality in many hospitals in China. Go to any reputed public hospital in Beijing and you’ll see people lining up at the crack of dawn or even a day in advance to get an appointment. China’s public health infrastructure is bursting at the seams: it is clearly not equipped to meet the growing demands of 1.35 billion people and an aging society.

Too Big Yet Too Little

China’s healthcare sector is huge. According to a Deloitte report, the estimated expenditure on healthcare in China was about $511.3 billion in 2013 (about 5.4% of China’s GDP then). The same report said that healthcare expenditure “is projected to grow at an average rate of 11.8 percent a year in 2014-2018, reaching $892 billion by 2018.”

But huge spending on healthcare doesn’t mean that people are getting the service they need. The problem in China’s healthcare sector is two-dimensional: it involves both shortages and skewed market dynamics. According to a PwC healthcare report, China has 1.8 physicians and 1.7 nurses per 1,000 people. That’s hardly adequate. In comparison, the US has an average of 2.4 physicians and 10.8 nurses per 1,000 people. The report goes on to say that the average qualifications of China’s medical staff are not that high.

There is also an imbalance in terms of where patients prefer to go and which hospitals have the capacity. Citing a report from China’s National Health and Family Planning Commission, iResearch analyst Qin Zexi says that 7.6% of public hospitals are full-service tertiary hospitals, but they are handling 47% of the patients; primary hospitals or community healthcare centers with limited equipment and staff are treating only 6.2% patients while they account for 27.1% of public hospitals. So the shortage of healthcare infrastructure is actually a structural problem.

Also, healthcare resources are distributed unevenly across different parts of China. According to a 2012 Annual Report on China’s Pharmaceutical Market brought out by the Social Science Academic Press (China), people living in big cities enjoy 2.5 times more healthcare resources than rural area residents.

Bring Out the BandAid

China’s healthcare delivery systems are full of big gaps that need to be bridged quickly. Given the importance of the healthcare industry, it is obvious that the Chinese government will play a dominant role. A 2013 report from PwC points out that the government plans to train 150,000 general practitioners by 2015 and at the same time establish a primary care system with two components: community health centers in urban areas and small hospitals with higher standards in rural areas.

But this will not happen overnight.

To an extent, private hospitals can fill the gaps. Although they have been permitted in China for more than 20 years, the role of private hospitals is still limited. They account for 45.7% of China’s hospitals but only 15% of China’s hospital beds, and do a mere 10.6% of healthcare work, according to China Hospital Association. They also tend to be much more expensive.

Not ones to be left behind, China’s big three internet giants—Baidu, Alibaba and Tencent (BAT)—and several tech start-ups are getting involved in healthcare in different ways. Given the penetration of mobile phones and the internet, digital healthcare is becoming big in China. According to the Boston Consulting Group, “In 2014, approximately $700 million in venture funding poured into digital healthcare in China, with investors supporting all things digital, from e-commerce to online physician-and-patient communication services to disease management apps. This is just the beginning.”

The health services being launched by tech companies range from simple support services that take some of the pressure off the existing healthcare services to actual brick and mortar hospitals. There are social networks for medical practitioners such as DXY (DingXiangYuan) and Medlinker; online patient-doctor consulting services like Chunyu; doctor appointment, online diagnosis and payments apps like Quyiyuan; and ‘internet hospitals’ such as Guahao. There are even niche services such as SoS919.com, which provides first aid at racing events.

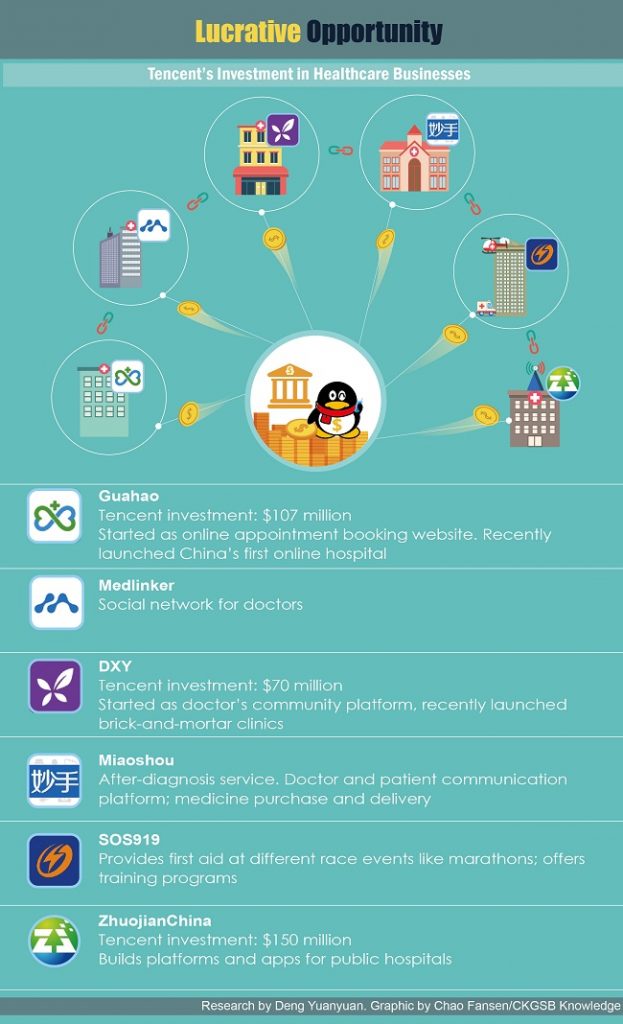

The bigger players offer multiple services. For example, Alibaba’s Ali Health has an online pharmacy, appointment booking service, medication information, a drug selling and delivery business and it also sells health insurance. Tencent, another big player, has invested in a wide range of healthcare businesses.

Some are venturing beyond support services and getting into the business of healthcare delivery itself. In recent months, both DXY and Chunyu have launched brick-and-mortar clinics in Hangzhou and Wuhan. These clinics aim to provide a better experience for patients and their families.

Through these services tech companies are releasing some of the pressure on China’s creaking healthcare system. Patients, for instance, can use the online diagnosis service to deal with minor problems instead of adding to the throngs in already overburdened hospitals. In some cases, they can skip going to a hospital altogether with services like Guahao which has grown from an appointment booking website to China’s first ‘internet hospital’ which specializes in remote online diagnosis. Online appointment booking apps are convenient as they cut out the need to physically queue up at insane hours and deal with touts.

But operating in China’s healthcare sector can be tricky because of government regulation. Ali Health, for instance, ran a PIATS (Product Identification, Authentication and Tracking System) for China Food and Drug Administration (CFDA), which does authentication of drugs. But the monitoring system was suspended by CFDA on 20th February. Ali Health’s rivals—a group of pharmacy chains put pressure on CFDA questioning why Ali Health, a for-profit company, was getting involved in regulation of pharmaceutical information. Not everyone thinks this is fair. Says Will Tao, an internet industry expert, “In the long run it is unfair that in a game someone is a player and a judge at the same time.”

Healthcare is a sensitive field and at the end of the day, these are people’s lives at stake. Search engine giant Baidu learnt this the hard way when an unverified sponsored ad ranked high in searches and ended up directing a cancer patient to a certain hospital. The 21-year old Wei Zexi passed away after one year of treatment at a tertiary hospital that topped his Baidu search results. Later it turned out that the treatment he opted for under the public hospital’s aegis was actually outsourced to a private clinic. Before he passed away, Wei criticized the hospital for misleading him and also Baidu for promoting the hospital’s claims. This incident kicked up a social media storm for Baidu in China and dragged down Baidu’s stock price by 7.29% on 2nd May.

There are limits to how much tech companies can do. “The core problem of China’s healthcare reform is the lack of doctors and nurses, not hospital buildings. And in terms of human resources there isn’t much BAT can do,” says Will Tao. “If anything, it would just be remote healthcare service, technology support, doctors and nurses’ training…. [The human resource shortage] situation won’t change a lot in the short term, so for BAT the opportunity lies in re-distributing resources effectively,” he adds.

Adds Qin Zexi, “Private companies can, of course, participate. But healthcare is different, it can’t be too market-driven otherwise it ceases to be fair.”