China recently joined an elite group by launching its own global navigation system, BeiDou. But how does it stack up against the other major systems of Galileo, GLONASS and GPS?

On 23 June 2020, China completed a decades-long project to build a global navigation satellite system by launching yet another satellite into outer space. It was the final piece in the jigsaw of satellites needed to provide global coverage for a navigation system to rival the more famous, US-owned Global Position System (GPS). China’s network of satellites is BeiDou, which means “Big Dipper,” a natural constellation stars long used for navigation.

On 23 June 2020, China completed a decades-long project to build a global navigation satellite system by launching yet another satellite into outer space. It was the final piece in the jigsaw of satellites needed to provide global coverage for a navigation system to rival the more famous, US-owned Global Position System (GPS). China’s network of satellites is BeiDou, which means “Big Dipper,” a natural constellation stars long used for navigation.

After the launch of the final satellite, BeiDou went fully live. Less than six months later, state-owned media China Daily reported that the system was used in more than 120 countries and regions globally. Some 70% of mobile phones in the country now use the system, along with 6.2 million taxis, buses and trucks throughout the country, according to statistics from the China Satellite Navigation Office.

However, the system’s key strategic importance is national security—China has for years been uncomfortable about being locked into the use of the GPS developed by and still controlled by the US military.

The big question is how does the BeiDou system compare with GPS and other navigation systems? The answer appears to be that it is a strong contender and might end up making more money than any of the others.

Empty space

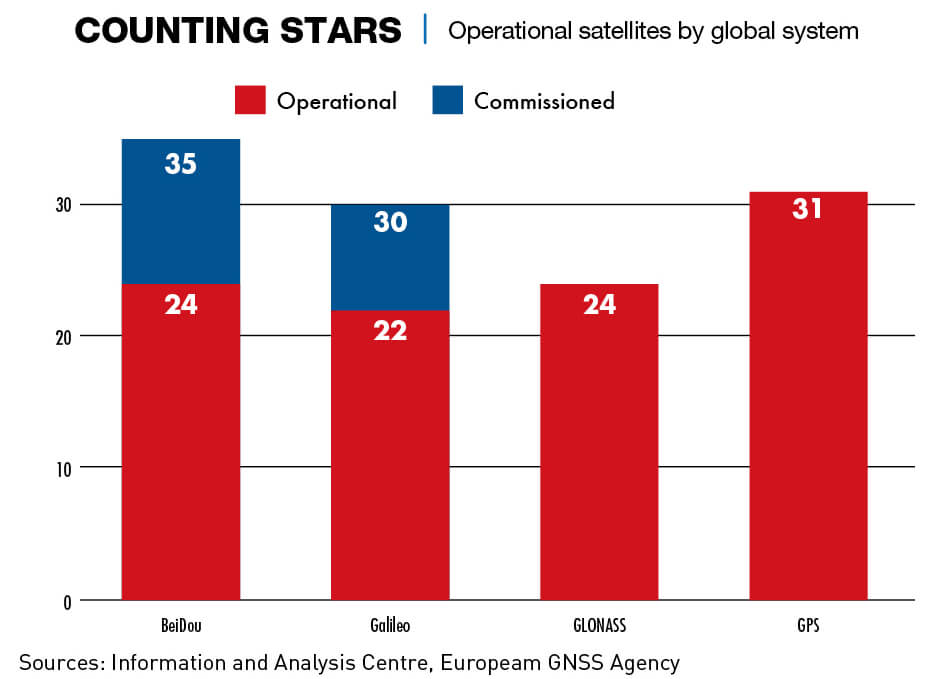

BeiDou is the latest of several Global Navigation Satellite Systems (GNSS) used to supply positioning, navigation and timing (PNT) information. The first system, the Global Positioning System (GPS) from the United States, was initiated in 1978, and achieved global coverage by 1995. Russia’s Global Navigation Satellite System (GLONASS) followed in 1982 and achieved global coverage in 1996. Galileo from the European Space Agency started in 2005 and achieved full operational capabilities in 2019, although not all the projected 30 satellites have yet been launched. India and Japan also have systems although they both only have regional coverage.

The systems all work by beaming radio signals to devices on the ground. Signals from at least four satellites are used to calculate the receiver’s location, direction and velocity.

“There are several key differences between BeiDou and Galileo, GLONASS and GPS, including the number of satellites, functionality, accuracy and orbital period,” says Heath Sloane, Yenching Scholar at Peking University.

Lift off

Plans for a Chinese GNSS system were conceived in the 1980s. Impetus came from an alleged incident in 1996 when China fired three missiles in the ocean near Taiwan but lost contact with two of them. China believes the US cut the GPS signal that the missiles were dependent upon.

“Keep in mind that signals can be jammed, cutting off access to PNT, or spoofed, sending a false location or direction,” says Larry Wortzel, commissioner on the US-China Economic and Security Review Commission. “Having the capability to receive a variety of PNT signals and process them provides alternatives in the event one country’s system is jammed, spoofed or taken offline for any reason.”

As with GPS, the original goal behind BeiDou was military support and to close a loophole exposed by the lost missiles. “In 1996, China decided to build its own navigation system, to be completed within 25 years, to establish truly independent military command and control, and precision missile guidance and tracking,” says Namrata Goswami, an independent analyst and author specializing in space policy.

BeiDou is now in its third phase. BeiDou 1 consisted of four satellites launched between 2000 and 2003 and only covered China and parts of Asia. BeiDou 2, consisting of 14 satellites launched from 2004 to 2012, completely superseded the original system with coverage extending over the whole Asia-Pacific region. BeiDou 3 (BDS3) created a constellation of satellites providing global coverage. Goswami says Beijing invested about $9 billion in setting up the system and that BeiDou is now the largest of the four global navigation systems.

“BeiDou comprises the largest constellation, totaling 35 operational satellites,” says Sloane. “This outnumbers other systems by at least four satellites. Notwithstanding the truism that positional accuracy depends on the number of satellites, it isn’t the only metric that counts.”

According to Goswami, open-source data shows BeiDou’s signal accuracy to be better than GPS—0.41-meter versus a 0.5-meter average for GPS. The accuracy of the network in China is enhanced by 155 framework reference stations and over 2,200 regional stations across the country, which take accuracy to the centimeter level. A 2014 article in the China Daily stated that Beijing planned to build a network of similar ground stations in other parts of Asia, including 1,000 in Southeast Asia alone.

“Both [systems] provide positioning services globally using broadly similar technology and for broadly similar purposes, both military and commercial,” says Blaine Curcio, a space and satcom industry consultant. “But BeiDou has certain features that GPS does not, such as a short messaging system.”

BeiDou is unique amongst satellite navigation systems in having a two-way function where a receiving device can send a 1,200-character message. The French SPOT system, another smaller player, stresses imaging rather than PNT functionality, but does offer a similar messaging service.

“In the event of an emergency, I can generate an emergency locator signal that will allow the Coast Guard or marine rescue to come to my aid,” says Wortzel about the system on his boat, which uses SPOT. “The SMS text system will allow me to send pre-programmed, very short, text messages to a specific number.”

A mission

For China, having its own GNSS system is an essential part of power projection and security in the Asia-Pacific region. “Global navigation systems have become the essential condition of modern armed forces,” says Sloane. “In addition to its explicit role in enabling accurate navigation, GPS technology allows accurate communications, mapping and targeting, among other applications.”

Without a domestic GPS alternative, any modern armed force has little choice but to rely on foreign systems. Outsourcing these capabilities leaves the People’s Liberation Army (PLA) vulnerable to jamming or spoofing in the event of war, effectively rendering GPS-dependent weaponry and communications systems inoperable.

But as the US discovered with GPS, the commercial advantages might be even greater than the military imperative. PNT services, usually offered for free, are an enabler for an increasing array of technologies in an ever-more connected world—autonomous driving cars being one example. “To that extent, China now has a lot more control over the foundation of these services,” says Curcio.

Developing home-grown cutting-edge technology is one key aim. BeiDou was one of 16 science and technology megaprojects under China’s 2006-2020 medium-long term plan. It directly challenges the dominance of the US in satellite navigation and gives China a more prominent place at the table.

“An independent BeiDou offers a strong hold on global infrastructure and rulemaking,” says Goswami. “This enables China to challenge the centrality of the United States to form partnerships and alliances and to control the standards for 5G, information technology, mobile devices, self-driving cars and drones, and the broader Internet of Things (IoT).”

Pay back

GPS was only opened to civilian use after Soviet fighter planes shot down a Korean Airlines plane—flight 007—in 1983 when the plane strayed into Soviet airspace due to a navigation error. All 269 people on board were killed. In comparison, BeiDou 3 was developed very much with an eye on commercialization.

Like GPS, the basic positioning services of BeiDou are free, but it is estimated that the return on investment will amount to $59 billion in 2019 alone. “This would include selling its satellite services in an ecosphere were satellite-based communications is critical for an entire economy of a country to work,” says Goswami, who adds that the global navigation market is forecast to grow to $146 billion by 2025.

While Curcio does not believe BeiDou has enough differentiating advantages over Galileo of GPS for users in other parts of the world to switch on technical grounds, he says he believes there may be ways to successfully market the system internationally.

“I could imagine two ways: One by subsidizing BeiDou-related equipment, which could allow customers to justify switching from GPS to BeiDou to save money. Two, which is more likely, to market BeiDou as part of a suite of services,” Curcio says. “For example, if we think about a world 10-15 years down the road, we could imagine China having fleets of autonomous vehicles using the BeiDou satnav standard for location tracking.”

Pakistan and Thailand are already important customers. Pakistan was the first country outside China to use BeiDou for their military. Thailand has said it aims to integrate the system with its public sector. All countries involved in the Belt and Road Initiative are key target markets.

“BeiDou is intrinsically linked to 5G and IoT, as they collectively comprise a major component of China’s ‘Digital Silk Road’,” explains Sloan. “In addition to the Belt and Road Initiative, the Digital Silk Road is a blueprint to become a global leader in advanced technologies, including artificial intelligence, satellites, smart cities and telecommunications, among others.”

Domestically, thanks to government guidance, uptake has been fast. Along with smartphones now having BeiDou compatibility, most fishing boats used the system by as early as 2012. By the end of 2019, there were also over 6.5 million commercial vehicles in China deploying the system.

“BeiDou has brought down costs for farming, logistics, robotics and support to domestic aviation in PNT critical for the local industrial and economic production base,” says Goswami. But the critical factor for BeiDou versus GPS internationally is whether it can deliver 100 times more accuracy at a lower cost, as claimed. “We will have to wait and see if that will be the reality,” she adds. “But like in other sectors, including 5G, ground solar and rare earth minerals, China could take the lead.”

Space alone

BeiDou is also viewed by observers as an example of what President Xi Jinping means by his “Dual Circulation” growth strategy (see “The Infinity Loop”), which puts an emphasis on developing homegrown technology.

“While discourse around ‘decoupling’ tends to focus on US efforts to reduce its reliance on China, the case of BeiDou shows China’s technological disengagement with the USA,” says Sloane. It harks back to one of the long-term guiding principles of China since 1949—self-sufficiency.

Curcio says, the development of BeiDou is not something that can be solely attributed to the deterioration of China-US relations in recent years, but it makes decoupling easier.

“China’s aim to establish an independent navigation system is about decoupling from dependence on foreign navigation systems,” says Goswami. “The need for it arises even further with protectionist measures and the penchant to cut communication signals in times of conflict.” She adds that Chinese companies targeted by US sanctions can now easily switch to BeiDou without fearing losing business.

Shooting for the stars

There is little doubt that souring relations with the US has enhanced China’s desire to be more self-sufficient in the tech sphere. Beijing considers BeiDou to be one of “The Two Pillars of a Great Power,” the other being 5G telecommunications capability.

In 2018, China accounted for 23% of global research and development (R&D) spending versus 25% for the US. “Learning a lesson by getting key technologies cut off due to US national security concerns, China will make self-reliance in core technologies a priority, and as in other sectors including 5G, space navigation and telecoms, will work toward self-reliance,” says Goswami. “This will become the top policy focus given China is the world’s largest consumer of computer chips. Such efforts are visible with increased funding in semiconductor research, increasing job opportunities and high salaries drawing outside talent, all with an aim to develop 70% of chips within the country by 2025.”

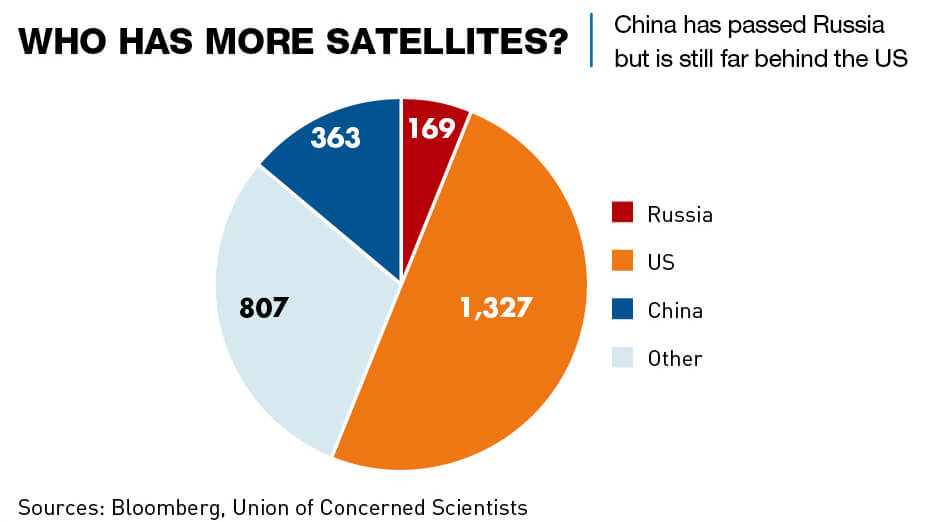

But despite the apparent success with BeiDou, China still lags Western nations in satellite technology. “The Chinese space industry can produce most of the same types of satellites that the West can produce, but at a somewhat lower level of technological sophistication,” says Curcio. “The most advanced Western-made communications satellites offer hundreds of Gbps [in signal speed]. The most advanced Chinese communications satellites are around 30-50 Gbps. This puts them probably 7-10 years behind where the West is right now in communications satellites, for example.”

Ultimately, China’s GNSS candidate has provided a huge advantage domestically and a potential win in many other parts of the world. “If BeiDou can provide a highly accurate and cost-competitive alternative to other GNSS systems, it may present an enticing option irrespective of any shortcomings,” says Sloane.