Bruno Roche, chief economist and Catalyst managing director for global food producer Mars, explains how the “Economics of Mutuality” can benefit businesses all over the world

For more than five decades, Mars Incorporated—a multinational family-owned company, makers of iconic brands like M&Ms, Mars, Snickers, Dove, Uncle Ben’s, Pedigree, Royal Canin, Wrigley’s and more—has invested in Catalyst, its internal think tank which provides insights on leadership capabilities and develops business solutions to ensure Mars is always at the forefront of what it calls “the thought leadership space.”

Bruno Roche has led Mars Catalyst globally from Brussels since 2006. Under his leadership, Catalyst has developed ground-breaking methodologies in the areas of marketing effectiveness and M&A integration. It has also expanded geographically from its United States and European bases to become truly global by covering Asia and Africa.

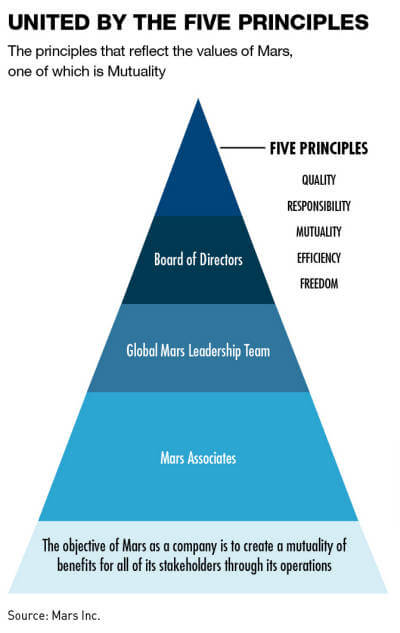

Spurred by a question posed in 2007 by the leadership of Mars Incorporated—”What is the right level of profit for a corporation?”—Catalyst developed the Economics of Mutuality (EoM) program which has matured into a breakthrough management innovation and disruptive model for inclusive growth. EoM aims to empower businesses to adopt a more complete and mutual form of capitalism that is fairer and more efficient than the dominant profit-maximising business models.

Bruno Roche also co-created the Mutuality in Business Lab at Oxford University in 2014, joined the World Economic Forum in 2015 and co-authored Completing Capitalism in 2017. In this interview, Roche walks us through how EoM encompasses the world’s fourth economic cycle—the digital age—and how it developed.

Q: How does the Economics of Mutuality fit into our current climate of rapid technological change?

Over the past 150 years the world has gone through three economic cycles. We are now about to start the fourth one. The first was the agricultural economy where land was considered an asset. The second was the industrial economy where underlying assets were in the means of production. The third wave, which started in the early 1970s and is now coming to an end, is what is known as the service economy, where financial capital are the underlying assets. We are now moving into a new economic cycle, known as the knowledge economy or the digital age. This is where underlying assets are essentially human and social capital, powered by digital technology.

Our argument in the EoM is that there are two forces actioning the drift away from financial capital. The first one is based on the definition that economics is a “science which deals with the social management of scarcities.” Fifty years ago, financial capital was scarce, while natural capital and social capital were overly abundant. Today, financial capital is overly abundant, so it doesn’t make any sense at all to create more financial capital. Therefore a new economic model is required to deal with this new form of scarcity. This alone justifies the shift in economic models, from a pure financial capital-based model to a social capital-based model. The second is based on the fact that, in the knowledge economy or digital economy, for companies to be successful, they don’t need a lot of cash but rather a lot of other forms of capital, essentially the relationship between individuals.

Even large companies like Facebook, Google and WeChat are companies that are based on the production and commercialisation of social connections. So the EoM is a good fit to actually appreciate and frame these new norms of value creation, which is based on human and social capital.

Q: How does the Economics of Mutuality and the concept of “reciprocity” play into the US-China trade war?

Over the last 12 years, EoM has been tested at a business-unit level across a wide range of business situations and locations. What we have demonstrated supports the idea—both academically and in practice—that companies which include EoM in their decision-making not only become more responsible and have a bigger positive impact on society and the environment, but are also more performant financially. Part of their decisions should involve setting up a purpose as a strategy (i.e., solving people and/or planet problems profitably and at scale, not profiting from creating problems for the planet and/or its people), enlarging the ecosystem in which they operate, managing business performance using financial and non-financial capital metrics and new modes of profit construction while making the strategic decision to develop a reciprocal relationship with their key stakeholders, instead of just focusing on transactional relationships.

This is actually a real breakthrough innovation because it shows that a business model that is based on mutuality, when others prosper around you, is more performant than a model which is based purely on profit maximisation.

We have not tested this hypothesis yet on the relationship between nations. But my intuition tells me that it is also a principle that would be applicable to trade relationships between countries. As long as reciprocity is maintained, shared benefit will endure. So if there is a lack of equilibrium in a relationship between two parties, then there is less mutuality and reciprocity. This usually leads to tensions.

Q: EoM started with the question ‘what is the right level of profit?’ Why is that such an important question to ask?

For the last 50 years, the response to this question has been based on Milton Friedman’s view that “there is one and only one social responsibility of business (…) to increase its profits”. That economic model has worked very well, primarily for financial capital holders, but increasingly at the expense of the environment and many other stakeholders. I can understand why it was such an important and relevant concept in the 1970s due to the lack of financial capital in the West—as the system, globally, needed more cash to increase liquidity and in turn to facilitate exchange. But today, with financial capital being overly abundant (with negative interest rates becoming the norm) and the emergence of other forms of scarcities (in social, human and natural capital), that economic model has become unsuitable, increasingly dysfunctional and even destructive.

I would say that the crises we had in 1987, 1994 and 2001 were early alarm bells, while the 2008 crisis was truly a wake-up call. Ever since then, alas, the system has continued to focus on creating financial capital for capital holders, with the consequence that only a small portion of the world truly benefited from the system, and with a visible negative impact on the environment.

Therefore the question of the right level of profit is, in my view, the core question as it goes straight to the core of the purpose of the company—which is to create profitable solutions to the problems of people and planet.

Q: How does the answer to that question compare to the kind of profit that corporations are seeing today, particularly Chinese corporations?

At the moment there is an increase of profits not only in China, but also across the world. And while this race is not necessarily bad, the only purpose that companies have is to make more money just for the sake of making more money. This is not a healthy or sustainable game.

In the EoM, when profit-making has a purpose which goes beyond just making a profit, there is a possibility of even increasing a company’s bottom line. I am not challenging the level of profit in any economy, I’m challenging the purpose of profit-making. If profit-making doesn’t have a purpose, it will lead to predatory behaviour and eventually will not last. Once profit-making has a purpose, including solving problems that we’re seeing on the planet and with people, then that’s how a business can re-connect with new growth levers and can become, in turn, truly sustainable.

Q: You’ve spoken about the role of business in society. What in your opinion, are the pros and cons of the current business-society relationship in China?

I was amazed to see dragonflies a couple of weeks ago on Fudan University’s campus in Shanghai. It really revealed the power of the government in China and how they have managed to drastically reduce levels of pollution. It’s interesting, because the West doesn’t have the same level of power in involvement.

It’s clear that the relationship between business and society in China needs to take place in the context of the government’s vision and planning. This could to some extent be a catalyst to improve or enhance the value of business in society. But this actually requires an alignment of business, society and government behind the pain point that needs to be addressed in society.

As China becomes an incredibly rich and increasingly sophisticated economy, I would be very interested to see how the commission of business, government and society will address this phase of prosperity in society, with their own values in mind.

Q: What are the biggest economic challenges that China’s leaders are currently facing?

The challenges that we face globally are in fact very similar, whether you are in the East, the West or in Africa. Climate change and the rise of inequality are challenges that the world will have to face as a whole.

And while these challenges are global, there are going to be, in my view, two broad ways to approach them. One system will be based on Western values while the Chinese system will be based on their own Confucian culture and statist approach.

And the two are facing the same challenges, with similar levels of resources, but two very different ways in approaching the problems.

One of the greatest challenges for the Chinese economy will be to organize the second system to address global challenges in a way that will also act in harmony with the Western system, so that both systems would be able to benefit from one another.

Perhaps the constitutional principle “one country, two systems” formulated by President Deng Xiaoping for the reunification of China during the early 1990s will be a source of insights to organize the global economy of the 21st century along the principle “one global economy, two systems”.

Q: Mars’ products are generally aimed at the middle class and their disposable income. How do your company’s products and their sales reflect changes within Chinese society? What is the difference between the middle class in China and elsewhere?

We have been in China since 1989, so for a total of 30 years now, and China is really an important market for Mars. We have many factories and associates based in China.

My view is there are in fact many similarities between the middle class in China and middle classes in the rest of the world. Just like how there are a lot of similarities between the ultra-rich, no matter where they come from. Human beings just tend to have very similar needs around the world. And to an extent, I think that the middle class in Europe and the US are actually under economic pressure, what with the concept of how the rich become richer and the poor become poorer. It is to the benefit of Mars that the middle class in the countries we are operating in continue to grow, which is something that is still happening in China.

The real wealth of a country doesn’t comes from the elite. It comes from the prosperity of its middle class. So I firmly believe that the protection of the middle class is the key to ensuring prosperity in our nations.

Q: There’s been a great deal of talk about China’s economic slowdown recently. What impact do you see the slowdown having within the near future?

I think because China’s economy is so integrated with the rest of the world, any challenges occurring in China would have major repercussions for countries globally.

You could argue that there is a lot of anxiety at the moment and there is a fear of there being another economic crisis. And I think that the slowdown of the Chinese economy in that context could trigger such an event from happening because of its high level of involvement with the rest of the world.

The economic slowdown, as well as the US-China trade war, are conducive to even more conditions of protectionism. We are at a time where the limits of economic liberalism have become very clear and there are many voices around the world that goes against the doctrine. The trade war between China and the US is an expression of this change in philosophy.