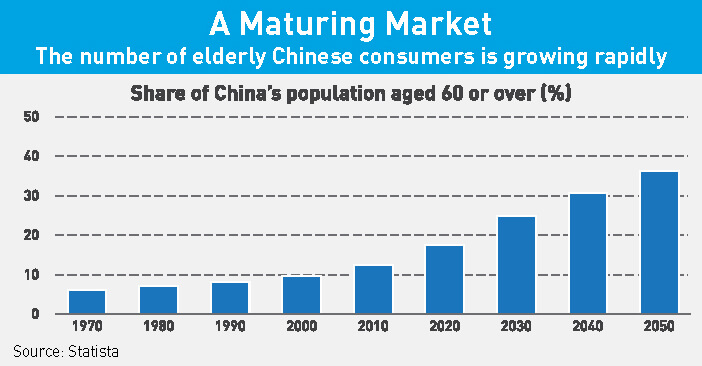

By 2045, there will be nearly 350 million people in China aged over 65. Forward-thinking companies across the Chinese economy are already preparing for a future dominated by silver consumers

Wang Jianmei never thought she would own a smartphone: the 68-year-old retiree always believed they were just for the young. But one day, she noticed a group of her elderly neighbors in her village in southern Hunan Province all messaging on their phones, and she decided to ask her son to buy one for her too.

A few days later, a big pink Huawei smartphone arrived at her doorstep and Wang could not be happier. “I like the size, the color and the way it lets me keep in touch,” she enthuses. “I can send voice messages over WeChat and, now that we’ve had Wi-Fi installed, it’s so convenient. I feel very modern.”

Slowly but surely, digitally-savvy seniors like Wang are changing the game for brands in China. There are already 131 million people over the age of 65, and the United Nations projects that this number will exceed 348 million by 2045.

China’s rapidly aging society is the legacy of a huge baby boom that was abruptly halted by the introduction of the one-child policy in 1979. Over the long term, this trend threatens to drag on economic growth. There were five Chinese taxpayers for every senior citizen in 2010; by 2030, there will be just two.

But for businesses that stay ahead of the demographic curve, there will be big opportunities. They are about to gain 200 million new customers.

Old Folks at Home

The most dramatic growth is likely to come in the senior care sector as demand for care homes increases exponentially. Elderly care is predicted to become a $280 billion market in China by 2020, according to research by consultancy Dezan Shira & Associates, and could even surpass real estate as the country’s largest industry within 15 years.

Traditionally, Chinese children would take care of their parents in their old age, but social changes are making this Confucian ideal increasingly unrealistic for many families. Whereas children in the past usually had siblings with which to share the burden, couples from the one-child generation often have four parents and eight grandparents to take care of all by themselves.

The upshot of this is a huge shortage of care homes. State institutions currently care for just 2% of the elderly population and there are only around 42,000 private facilities in the entire country. Official estimates say an additional 3.4 million nursing homes will be needed within the next five years.

Chinese developers including Fosun, Greenland, Sino-Ocean and Vanke are already piling into this space and many are keen to partner with international care providers in order to tap their experience.

New York-based Fortress Investment Group, for example, launched a chain of Chinese care facilities called Starcastle Elderly Service in partnership with Fosun. Starcastle’s flagship community opened in the suburbs of Shanghai in 2013. Residents pay up to $4,700 per month to stay at the luxury facility, where they can enjoy access to a fitness center, art room, library, teahouse, computer room and Western and Chinese medical treatment.

French nursing home operator ORPEA has also opened a premium nursing home charging between $3,100 and $7,800 per month in the eastern city of Nanjing. According to Nayoung Mathiesen, an analyst at Dezan Shira & Associates, the best opportunities in China’s care industry are likely to remain at the top end of the market for the near future.

“A large number of middle-class seniors still live at home, but their children, who are often active professionals and have their own children, are the primary customer group for professional senior care services,” Mathiesen tells CKGSB Knowledge.

“This group will demand more specialized care services. Many of them will be willing to pay for the services, whether at the home or institutional level. A bigger chunk of demand is likely to come from the private domestic market.”

Businesses also need to be aware that the opportunities come with major risk, according to a recent report by investment management group PGIM entitled, A Silver Lining: The Investment Implications of an Ageing World.

“While there is a nascent and growing private-sector senior housing market, it may take some time for this demographic opportunity to translate into a viable investment opportunity,” the report warns.

“This is due both to cultural expectations that elder care will be provided primarily by adult children and relatives, and to the legal and political risks that the government may make sweeping policy changes that could hamper a newly forming market.”

Companies in other areas of the health care sector are likely to encounter less friction as the country’s demand for care skyrockets. China’s health care spending will hit $890 billion in 2018, Chinese professional services firm Daxue Consulting estimates. By 2030, the Chinese government predicts that this figure will reach $2.3 trillion. Health technology companies that help patients manage chronic diseases from home are likely to find the best opportunities, according to Peter Hubbell, CEO of agency BoomAgers.

“Think of all the smart technology opportunities for assisting the living of people of age,” he says. “It’s no longer a beeper for if grandma falls over; these are sophisticated technologies, smartphone-based apps, which can remind you to do just about anything, or give warnings when critical functions aren’t done.”

British companies are already helping China build a Sino-UK Health Big Data Park in Guiyang, a city in southwest China, to roll out digital health tech solutions. They are also bringing the technology to a local senior care “village,” which houses 170,000 people.

Maturing Markets

The changes taking place in society are also creating new opportunities in a range of consumer markets as older Chinese loosen their purse strings, explains Hubbell.

“Because of filial piety in China, you had youths caring for adults for years and years, and those adults preserved their wealth and passed it along to the children,” he says. “But now, you are seeing older people in China with a propensity to spend their money on themselves, rather than saving it for the next generation.”

Older people already account for 8% of total spending on products and services in China, a market worth $680 billion, according to a government report published in September. And where previous generations of older people in China were poor, in the future senior citizens will have much more disposable cash. Standard Chartered forecasts that total consumption by the 65+ will increase to $2.8 trillion by 2030.

So far, most businesses have failed to appreciate the economic potential of older consumers, says Florian Kohlbacher, Director of the Economist Corporate Network in North Asia and a specialist in population aging in China.

“When you look at the figures, it should be a no-brainer to be in this market and be targeting senior consumers,” says Kohlbacher. “But demographic change and aging populations are quite complicated. There are a lot of factors to consider as well as it being a slow process. Not many companies plan for 2050.”

But to glimpse what China’s future may look like, head to IKEA in downtown Shanghai. The Swedish furniture retailer has carved out a large social space in the middle of its cavernous shop floor, which has become a gathering place for hundreds of local seniors. Alina Ma, an analyst at market research firm Mintel, explains that retailers could learn a huge amount from how IKEA has optimized its stores for older customers.

“Friendly salespeople and guides are necessary because many seniors view shopping as a social activity,” says Ma. “They also prefer stores with simple layouts, labels with a simple design and bigger fonts, close proximity to their homes, products specifically catering to older consumers and in-store dining options.”

Another early mover is Reebok, which made headlines last year when it appointed 80-year-old actor Wang Deshun as its brand ambassador in China. According to the sports giant, Wang only got into sport in his 60s and is an example that people are never too old to pursue their goals.

And as more sixtysomethings like Wang Jianmei acquire fancy new smartphones, China’s e-commerce giants are beginning to target older shoppers. Alibaba has released a new channel on Taobao that caters to senior users and their families, including a peer-to-peer chat function that allows family members to share products and consult each other.

There are around 30 million users of Taobao aged over 50, and 20% of these are 60+, according to Alibaba. But the next generation of retirees will be far more tech-savvy. In its 2016 Consumer Barometer report, Google found that while just 51% of over-55s in China owned a smartphone, 86% of Chinese consumers aged 45-54 used smartphones for mobile commerce.

“The new older generations will be very different from the ones before,” says Kohlbacher. “They will still be consuming and they grew up using smartphones, so they’ll still be using them when they are older.”

Migratory Birds

There is already a clear generational change taking place among China’s elderly. Today’s over-60s often have much more money than 20 years ago due to rising income levels. Many are also sitting on property that has skyrocketed in value.

These wealthier pensioners have markedly different attitudes and lifestyles to their peers. According to Mintel’s research, over 40% of Chinese seniors say they want to make efforts to limit the effects of aging, whereas traditionally aging was considered a natural process. This group is also more likely to be well-educated, technologically-savvy and willing to spend money on entertaining themselves.

“This group is happy to learn new things, rather than being scared,” says Ma. “Elderly care to them is more individual and involves fun, entertainment and self-development.”

Many youthful retirees are embracing opportunities they missed in the past by learning a new skill. China has around 60,000 elderly education institutions with more than 7 million students, according to the China Association of Universities for the Aged, offering elderly citizens everything from Latin dance classes to literature seminars.

They are also eager to discover new places. According to Mintel, 28% of Chinese between 55 and 74 want to travel in the next year. Online travel company Ctrip is betting on silver tourism in a big way. The company estimates the current value of the senior travel market at more than RMB 100 billion ($15.6 billion), growing in value by approximately 30% each year.

The firm has formed 33 product service lines that focus on senior travelers, including special itineraries for “China aunties”: modern women aged over 45 who enjoy traveling in a group but put priority on quality travel.

“We have developed specialized services to meet the needs of elderly consumers, including restaurants, hotel locations and itineraries,” says Zhang Qi, Director of Travel for Beijing, Tianjin and Hebei at Ctrip. “Ctrip has also standardized our services to sell travel to older consumers, and in the future, there will be special after-sales services for the elderly to resolve any anxieties before they travel.”

Ctrip has found that tours for older Chinese people must allow time for shopping and taking photos, provide hot water and Wi-Fi when traveling, and the chance to try local delicacies. Their research also suggests that more travelers over 45 are female, and so the company offers targeted deals around Mother’s Day.

Cruise companies have also been successful at targeting older age groups in China. Mintel found 61% of 40-49-year-olds have been on a domestic cruise line, and 42% on an overseas cruise line.

Many well-off retirees—especially those from colder northern provinces—are choosing to move and spend winters somewhere warmer. The most popular destination is the subtropical island of Hainan, which has been dubbed “China’s Florida” due to the massive number of elderly “migratory birds” that flock there each year. More than a million migrants arrive in Hainan every winter, according to the Hainan Provincial Committee, a high percentage of whom are seniors from the Northeast.

Local Hainanese often resent the strain this huge influx puts on public services, but others have been quick to cash in. Total spending by older people in Hainan last year reached $2.2 billion, according to the state-run Xinhua News Agency. Pharmacies have learned to stock up on medicine commonly needed by older people, while local real estate companies are building special “senior-citizen apartments.”

A Silver Future

As China continues to age, opportunities in China’s “silver economy” for foreign companies will grow. According to Standard Chartered’s Ageing: Passing the Baton to Asia report, the elderly consumers of tomorrow—the generation aged between 35 and 54—are “open to Western brands, strongly invest in their only child and are more educated than their predecessors.”

But businesses will need to pay attention to their customers to take advantage of these opportunities, predicts Zhang from Ctrip. “The older age group is very complicated and cannot be generalized,” says Zhang. “As China’s population ages, there will be a richness of targeted products, services and quality.”

For many brands, this kind of focus on older consumers does not come naturally, according to Kohlbacher. “Planning for an aging population always gets put off to a later date,” he says. “Most executives just can’t make sense of it, so they keep deferring on the opportunity.”

But those who overcome this mind-set will benefit. In the US, retirees already spend more than the much-targeted millennial generation. It will only be a matter of time before the same is true in China.